Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There has been much recent volatility within a specific highly technical sector of the electronic components industry. This industry sector comprises specialist businesses delivering

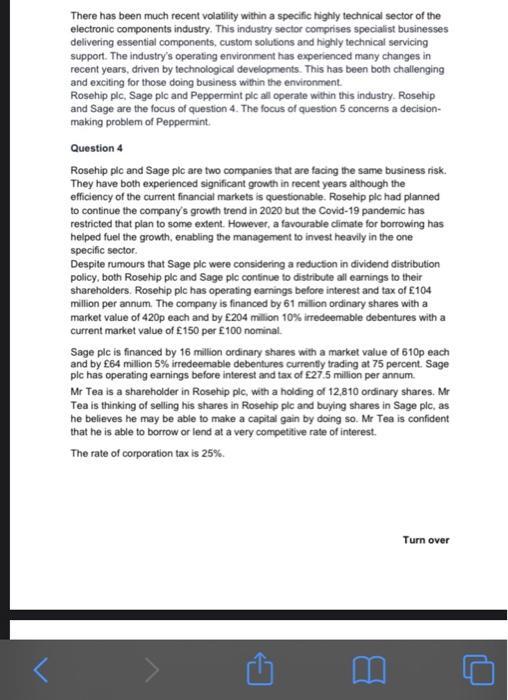

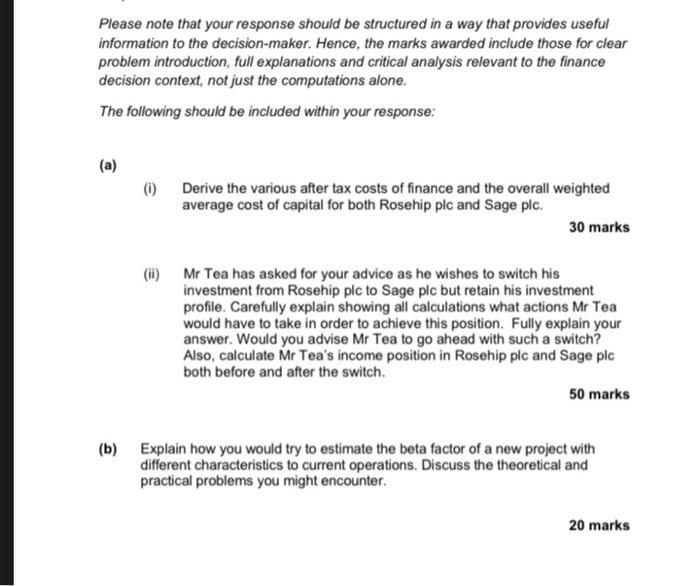

There has been much recent volatility within a specific highly technical sector of the electronic components industry. This industry sector comprises specialist businesses delivering essential components, custom solutions and highly technical servicing support. The industry's operating environment has experienced many changes in recent years, driven by technological developments. This has been both challenging and exciting for those doing business within the environment. Rosehip plc, Sage plc and Peppermint plc all operate within this industry. Rosehip and Sage are the focus of question 4. The focus of question 5 concerns a decision- making problem of Peppermint. Question 4 Rosehip plc and Sage plc are two companies that are facing the same business risk. They have both experienced significant growth in recent years although the efficiency of the current financial markets is questionable. Rosehip plc had planned to continue the company's growth trend in 2020 but the Covid-19 pandemic has restricted that plan to some extent. However, a favourable climate for borrowing has helped fuel the growth, enabling the management to invest heavily in the one specific sector. Despite rumours that Sage plc were considering a reduction in dividend distribution policy, both Rosehip plc and Sage plc continue to distribute all earnings to their shareholders. Rosehip plc has operating earnings before interest and tax of 104 million per annum. The company is financed by 61 million ordinary shares with a market value of 420p each and by 204 million 10% irredeemable debentures with a current market value of 150 per 100 nominal. Sage plc is financed by 16 million ordinary shares with a market value of 610p each and by 64 million 5% irredeemable debentures currently trading at 75 percent. Sage plc has operating earnings before interest and tax of 27.5 million per annum. Mr Tea is a shareholder in Rosehip plc, with a holding of 12,810 ordinary shares. Mr Tea is thinking of selling his shares in Rosehip plc and buying shares in Sage plc, as he believes he may be able to make a capital gain by doing so. Mr Tea is confident that he is able to borrow or lend at a very competitive rate of interest. The rate of corporation tax is 25%. Turn over Please note that your response should be structured in a way that provides useful information to the decision-maker. Hence, the marks awarded include those for clear problem introduction, full explanations and critical analysis relevant to the finance decision context, not just the computations alone. The following should be included within your response: (a) (b) (i) Derive the various after tax costs of finance and the overall weighted average cost of capital for both Rosehip plc and Sage plc. 30 marks (ii) Mr Tea has asked for your advice as he wishes to switch his investment from Rosehip plc to Sage plc but retain his investment profile. Carefully explain showing all calculations what actions Mr Tea would have to take in order to achieve this position. Fully explain your answer. Would you advise Mr Tea to go ahead with such a switch? Also, calculate Mr Tea's income position in Rosehip plc and Sage plc both before and after the switch. 50 marks Explain how you would try to estimate the beta factor of a new project with different characteristics to current operations. Discuss the theoretical and practical problems you might encounter. 20 marks

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A 1 To calculate the aftertax cost of finance for Rosehip plc Cost of equity Dividend per share Market value per shareAssuming a dividend of 22p per shareCost of equity 22p 420p 00524 or 524 Cost of d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started