Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is a possibility that Edward can invest in another set of equipment which costs $70,000 less but which will generate revenues of only

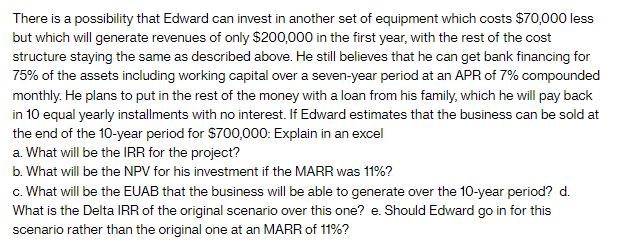

There is a possibility that Edward can invest in another set of equipment which costs $70,000 less but which will generate revenues of only $200,000 in the first year, with the rest of the cost structure staying the same as described above. He still believes that he can get bank financing for 75% of the assets including working capital over a seven-year period at an APR of 7% compounded monthly. He plans to put in the rest of the money with a loan from his family, which he will pay back in 10 equal yearly installments with no interest. If Edward estimates that the business can be sold at the end of the 10-year period for $700,000: Explain in an excel a. What will be the IRR for the project? b. What will be the NPV for his investment if the MARR was 11%? c. What will be the EUAB that the business will be able to generate over the 10-year period? d. What is the Delta IRR of the original scenario over this one? e. Should Edward go in for this scenario rather than the original one at an MARR of 11%?

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the financial metrics for the two investment scenarios we need to set up a cash flow an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started