Answered step by step

Verified Expert Solution

Question

1 Approved Answer

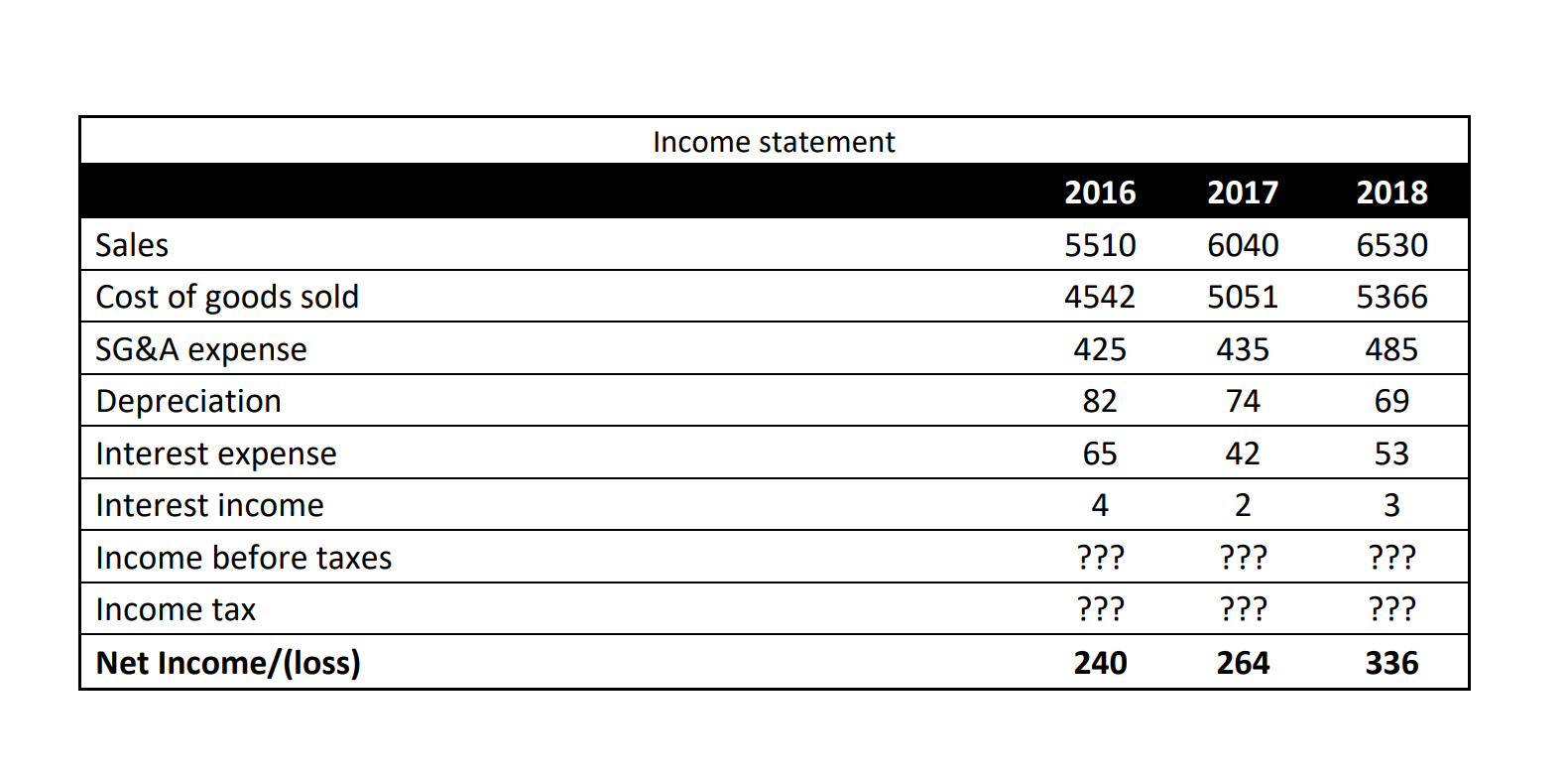

There is a set of 35 questions, I have 2 final questions (34 + 35) in this post. Thank you! begin{tabular}{|lcccc|} hline & & &

There is a set of 35 questions, I have 2 final questions (34 + 35) in this post. Thank you!

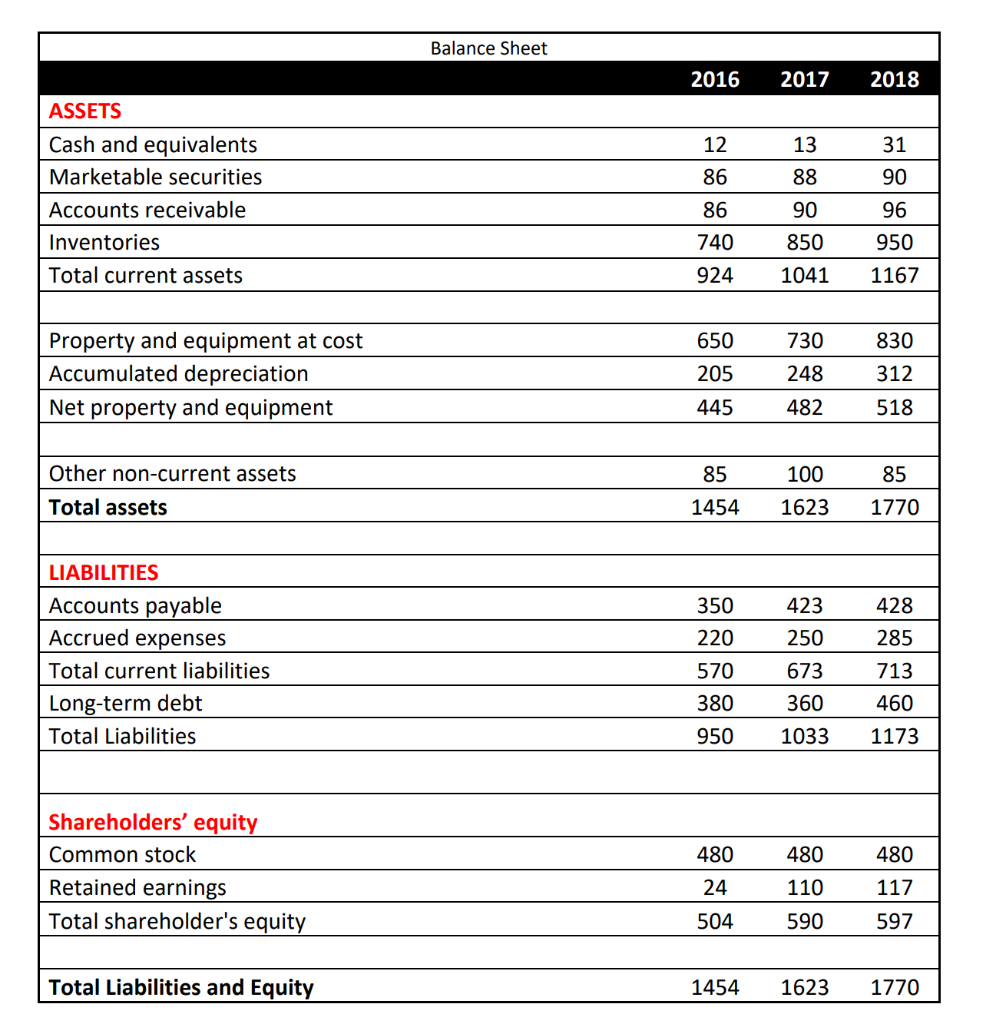

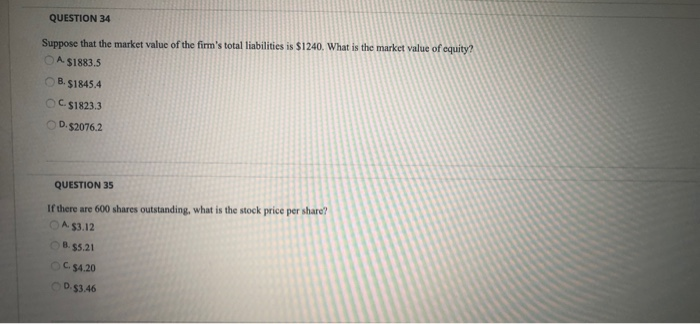

\begin{tabular}{|lcccc|} \hline & & & & \\ & Income statement & 2016 & 2017 & 2018 \\ \hline Sales & 5510 & 6040 & 6530 \\ \hline Cost of goods sold & 4542 & 5051 & 5366 \\ \hline SG\&A expense & 425 & 435 & 485 \\ \hline Depreciation & 82 & 74 & 69 \\ \hline Interest expense & 65 & 42 & 53 \\ \hline Interest income & ??? & ??? & ??? \\ \hline Income before taxes & ??? & ??? & ??? \\ \hline Income tax & 240 & 264 & 336 \\ \hline Net Income/(loss) & 4 & 3 \\ \hline \end{tabular} Suppose that the market value of the firm's total liabilities is $1240. What is the market value of equity? A. $1883.5 B. $1845.4 C. $1823.3 D. $2076.2 QUESTION 35 If there are 600 shares outstanding, what is the stock price per share? A. $3.12 8. $5.21 C. $4.20 D. $3.46 \begin{tabular}{|lcccc|} \hline & & & & \\ & Income statement & 2016 & 2017 & 2018 \\ \hline Sales & 5510 & 6040 & 6530 \\ \hline Cost of goods sold & 4542 & 5051 & 5366 \\ \hline SG\&A expense & 425 & 435 & 485 \\ \hline Depreciation & 82 & 74 & 69 \\ \hline Interest expense & 65 & 42 & 53 \\ \hline Interest income & ??? & ??? & ??? \\ \hline Income before taxes & ??? & ??? & ??? \\ \hline Income tax & 240 & 264 & 336 \\ \hline Net Income/(loss) & 4 & 3 \\ \hline \end{tabular} Suppose that the market value of the firm's total liabilities is $1240. What is the market value of equity? A. $1883.5 B. $1845.4 C. $1823.3 D. $2076.2 QUESTION 35 If there are 600 shares outstanding, what is the stock price per share? A. $3.12 8. $5.21 C. $4.20 D. $3.46Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started