Answered step by step

Verified Expert Solution

Question

1 Approved Answer

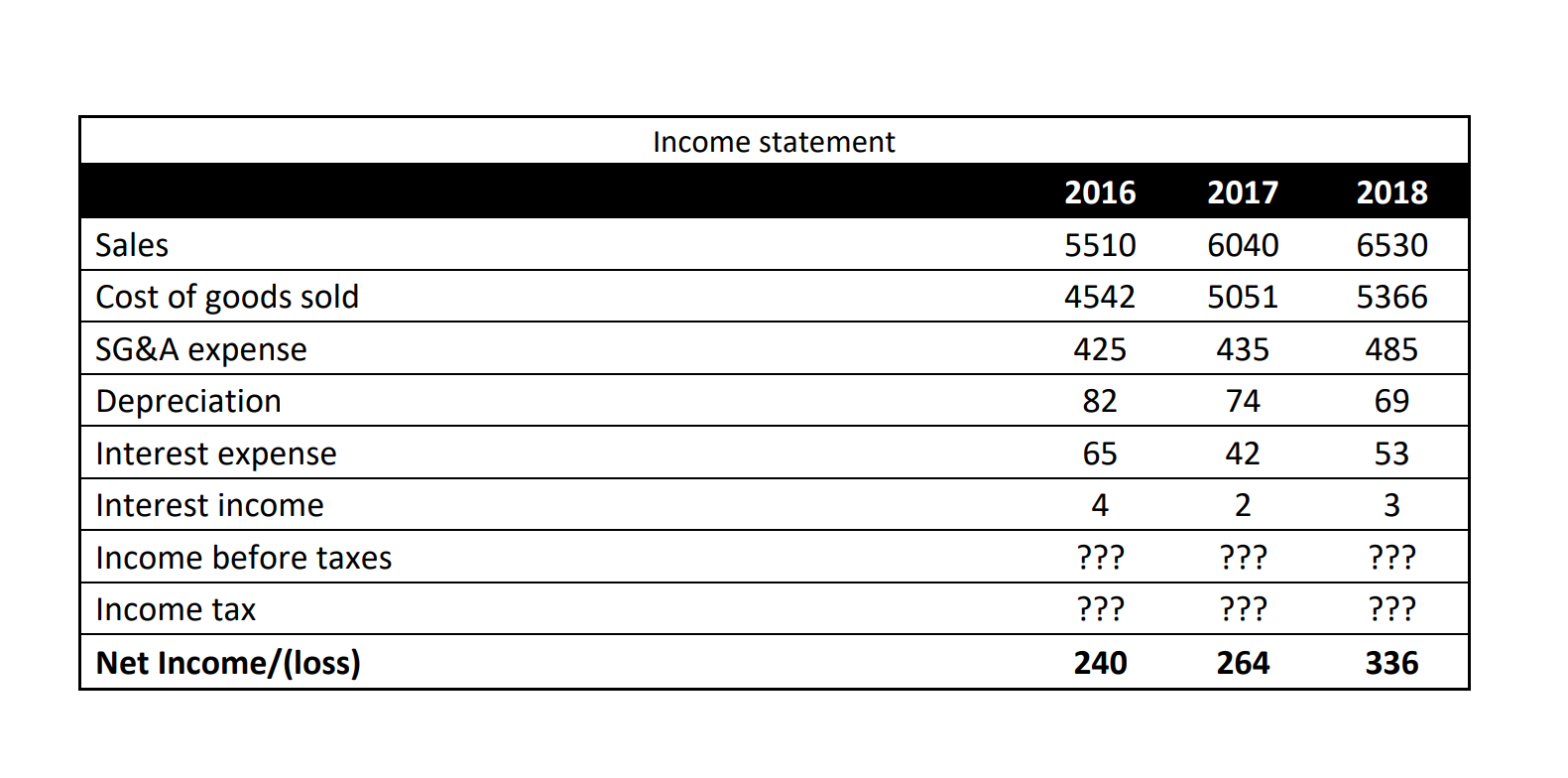

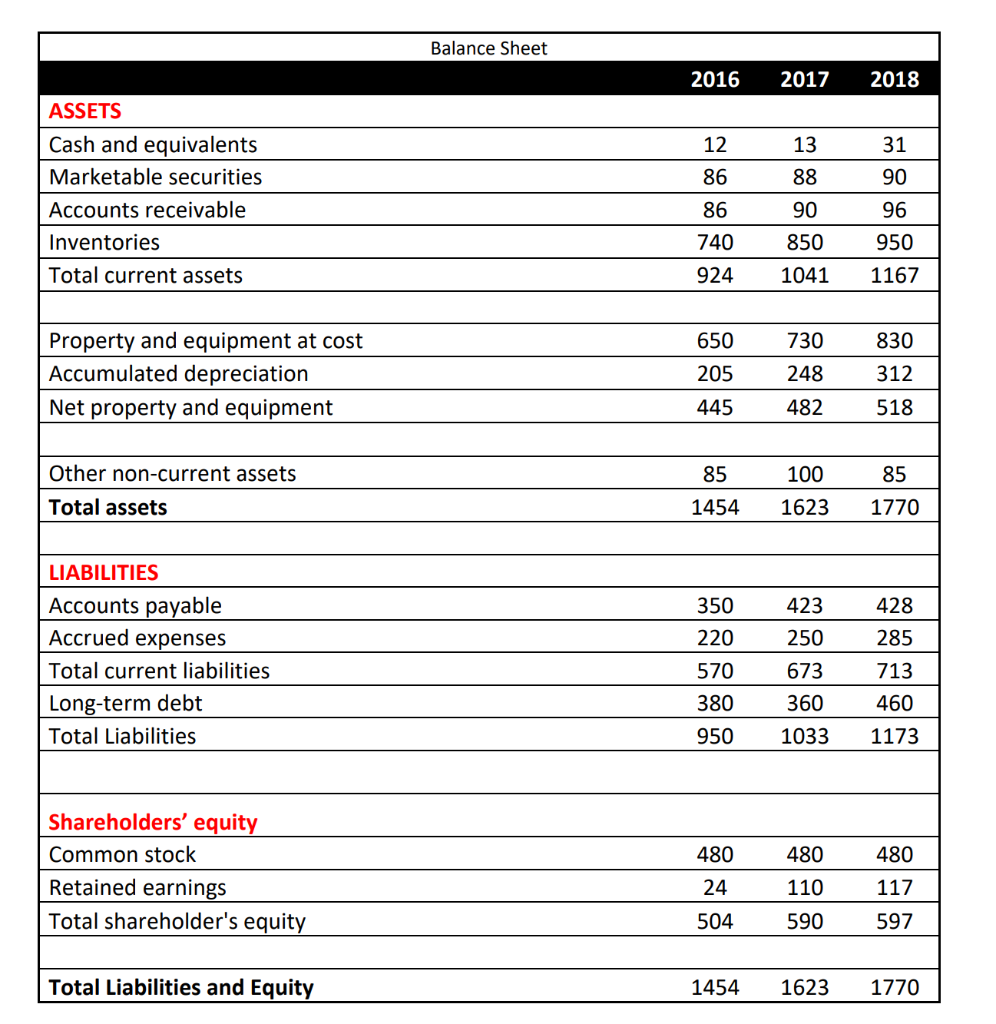

There is a set of 35 questions, I have 3 questions (31 + 32 + 33) in this post. Thank you! begin{tabular}{|lcccc|} hline & &

There is a set of 35 questions, I have 3 questions (31 + 32 + 33) in this post. Thank you!

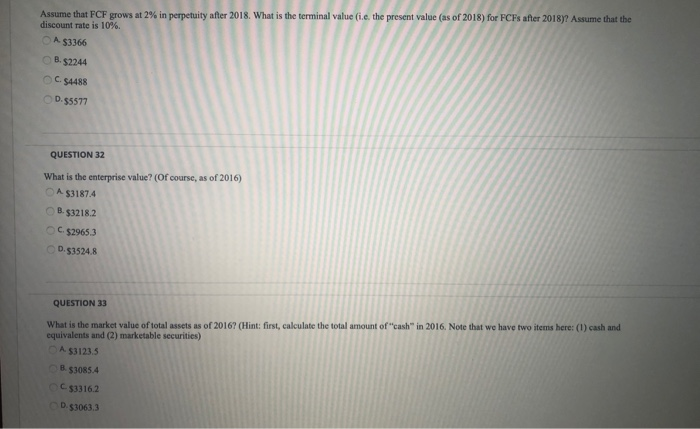

\begin{tabular}{|lcccc|} \hline & & & & \\ & Income statement & 2016 & 2017 & 2018 \\ \hline Sales & 5510 & 6040 & 6530 \\ \hline Cost of goods sold & 4542 & 5051 & 5366 \\ \hline SG\&A expense & 425 & 435 & 485 \\ \hline Depreciation & 82 & 74 & 69 \\ \hline Interest expense & 65 & 42 & 53 \\ \hline Interest income & ??? & ??? & ??? \\ \hline Income before taxes & ??? & ??? & ??? \\ \hline Income tax & 240 & 264 & 336 \\ \hline Net Income/(loss) & 4 & 3 \\ \hline \end{tabular} Assume that FCF grows at 2% in perpetuity after 2018. What is the terminal value (i.e. the present value (as of 2018) for FCFs after 2018)? Assume that the discount rate is 10%. A. $3366 B. $2244 c. $4488 D. $5577 QUESTION 32 What is the enterprise value? (Of course, as of 2016) A $3187.4 B. $3218.2 C. $2965.3 b. $3524.8 QUESTION 33 What is the market value of total assets as of 2016 ? (Hint: first, calculate the total amount of "cash" in 2016. Note that we have two items here: (1) cash and equivalents and (2) marketable securities) h. $3123.5 8. $3085.4 $3316.2 D. $3063.3 \begin{tabular}{|lcccc|} \hline & & & & \\ & Income statement & 2016 & 2017 & 2018 \\ \hline Sales & 5510 & 6040 & 6530 \\ \hline Cost of goods sold & 4542 & 5051 & 5366 \\ \hline SG\&A expense & 425 & 435 & 485 \\ \hline Depreciation & 82 & 74 & 69 \\ \hline Interest expense & 65 & 42 & 53 \\ \hline Interest income & ??? & ??? & ??? \\ \hline Income before taxes & ??? & ??? & ??? \\ \hline Income tax & 240 & 264 & 336 \\ \hline Net Income/(loss) & 4 & 3 \\ \hline \end{tabular} Assume that FCF grows at 2% in perpetuity after 2018. What is the terminal value (i.e. the present value (as of 2018) for FCFs after 2018)? Assume that the discount rate is 10%. A. $3366 B. $2244 c. $4488 D. $5577 QUESTION 32 What is the enterprise value? (Of course, as of 2016) A $3187.4 B. $3218.2 C. $2965.3 b. $3524.8 QUESTION 33 What is the market value of total assets as of 2016 ? (Hint: first, calculate the total amount of "cash" in 2016. Note that we have two items here: (1) cash and equivalents and (2) marketable securities) h. $3123.5 8. $3085.4 $3316.2 D. $3063.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started