Answered step by step

Verified Expert Solution

Question

1 Approved Answer

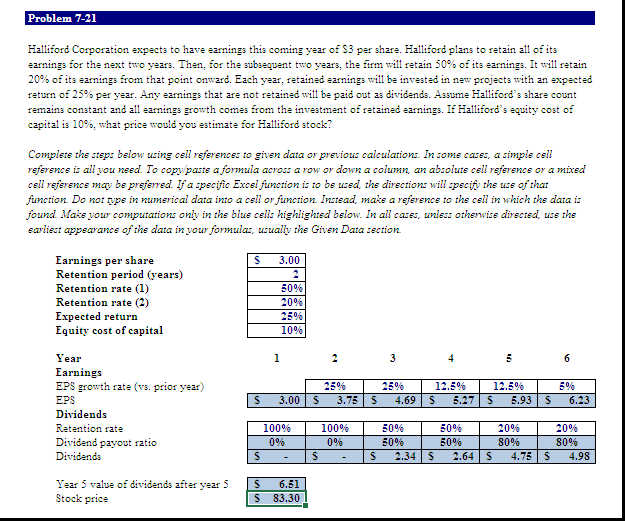

There is a small error inside. I am unable to recognising it. Can u help? Problem 7-21 Halliford Corporation expects to have earnings this coming

There is a small error inside. I am unable to recognising it. Can u help?

Problem 7-21 Halliford Corporation expects to have earnings this coming year of $3 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm will retain 50% of its earnings. It will retain 20% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 25% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 10%, what price would you estimate for Halliford stock? Complete the steps below using cell references to given data or previous calculations. In some cares, a simple cell reference is all you need to copy paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of that function Do not type in numerical data into a cell or function Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the sarliest appearance of the data in your formulas, usually the Given Data section S 3.00 Earnings per share Retention period (years) Retention rate (1) Retention rate (2) Expected return Equity cost of capital 50% 20% 25% 10% 1 2 3 4 5 6 25% 3.755 4.69 12.5% 12.5% S 5.27S 5.93 S 5% 6.23 S Year Earnings EPS growth rate (vs. prior year) EPS Dividends Retention rate Dividend payout ratio Dividends 3.00 S 20% 100% 0% 100% 0% 50% 5006 2.34 | S 50% 50% 2.64 | 20% 80% 4.75 S 8006 4.98 S S S Year 5 valve of dividends after years Stock price S S 6.51 83.30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started