Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Accrued liabilities. Accrued liabilities arise from ordinary operations and provide interest-free financing. Are operating liabilities large for the companies? Compare common-size amounts. What

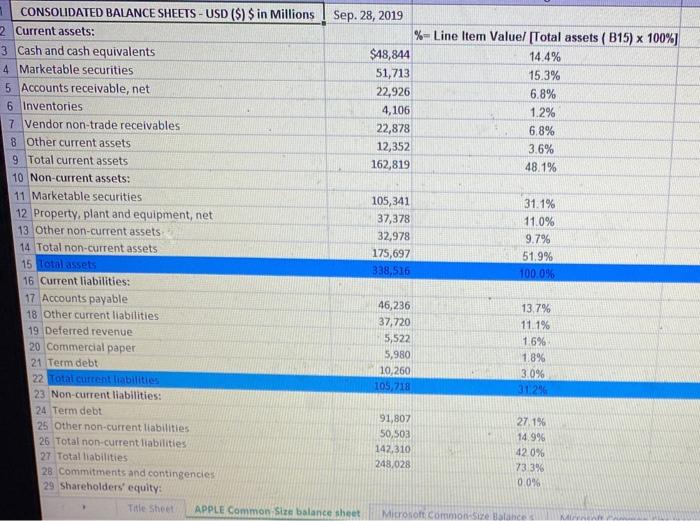

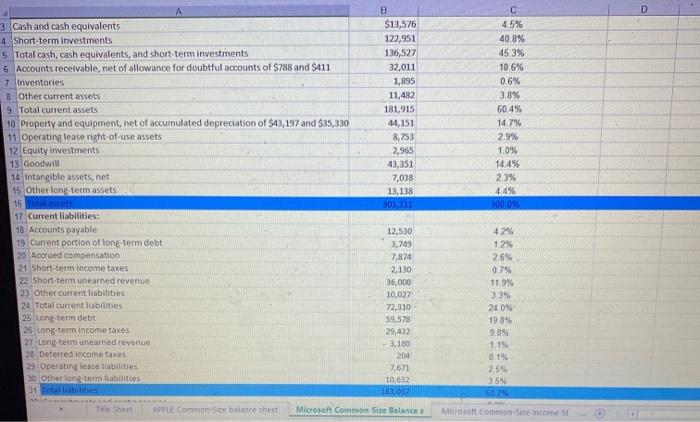

1. Accrued liabilities. Accrued liabilities arise from ordinary operations and provide interest-free financing. Are operating liabilities large for the companies? Compare common-size amounts. What proportion of total liabilities are operating? . 3 What are the companies' main operating liabilities? Are there substantial contingencies? What gives rise to these? Read the footnote and determine whether the company has recorded a liability on its balance sheet for these contingencies. . Shaut JE 1 CONSOLIDATED BALANCE SHEETS- USD ($) $ in Millions 2 Current assets: 3 Cash and cash equivalents 4 Marketable securities 5 Accounts receivable, net 6 Inventories 7 Vendor non-trade receivables 8 Other current assets 9 Total current assets 10 Non-current assets: 11 Marketable securities 12 Property, plant and equipment, net 13 Other non-c rent assets. 14 Total non-current assets 15 Total assets 16 Current liabilities: 17 Accounts payable 18 Other current liabilities 19 Deferred revenue 20 Commercial paper 21 Term debt 22 Total current liabilities 23 Non-current liabilities: 24 Term debt. 25 Other non-current liabilities 26 Total non-current liabilities 27 Total liabilities. 28 Commitments and contingencies 29 Shareholders' equity: Sep. 28, 2019 Title Sheet APPLE Common Size balance sheet $48,844 51,713 22,926 4,106 22,878 12,352 162,819 105,341 37,378 32,978 175,697 338,516 46,236 37,720 5,522 5,980 10,260 105,718 91,807 50,503 142,310 248,028 %-Line Item Value/ [Total assets (B15) x 100%] 14.4% 15.3% 6.8% 1.2% 6.8% 3.6% 48.1% 31.1% 11.0% 9.7% 51.9% 100.0% 13,7% 11.1% 1.6% 1.8% 3.0% 31:2% 27.1% 14.9% 42.0% 73.3% 0.0% Microsoft Common-Size Balance 3 Cash and cash equivalents 4 Short-term investments 5 Total cash, cash equivalents, and short-term investments 6 Accounts receivable, net of allowance for doubtful accounts of $788 and $411 7 Inventories 8 Other current assets 9 Total current assets. 10 Property and equipment, net of accumulated depreciation of $43,197 and $35,330 11 Operating lease right-of-use assets 12 Equity investments 13 Goodwill 14 Intangible assets, net 15 Other long-term assets 16 Total mets 17 Current liabilities: 18 Accounts payable 19 Current portion of long-term debt 20 Accrued compensation 21 Short-term income taxes 22 Short-term unearned revenue 23 Other current liabilities 24 Total current liabilities 25 Long-term debt 26 Long-term income taxes 27 Long-term unearned revenue 28 Deferred income taxes 29 Operating lease liabilities 30 Other long-term liabilities 31 Total liabilities A Tale Sheet B $13,576 122,951 136,527 32,011 1,895 11,482 181,915 44,151 8,753 2,965 43,351 7,038 13,138 301,311 12,530 3,749 7,874 2,130 36,000 10,027 72,310 59,578 29,432 - 3,180 204 7,671 10,632 183,007 APPLE Common Size balance sheet Microsoft Common Size Balance s C 4.5% 40.8% 45.3% 10.6% 0.6% 3.8% 60.4% 14.7% 2.9% 1.0% 14.4% 2.3% 4.4% 100.0% 4.29% 1.2% 2.6% 0.7% 11,9% 3.3% 24.0% 19.8% 9.8% 1.1% 0.1% 2.5% 3.5% 60.7% A Microsoft Common-Sire income St D

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Operating liabilities are those liabilities wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started