Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is no addition information for this question b. Sales declined over the 3-year hiscal period, 2016-2020. DUS necessarily also declined? Explain, computing the gross

there is no addition information for this question

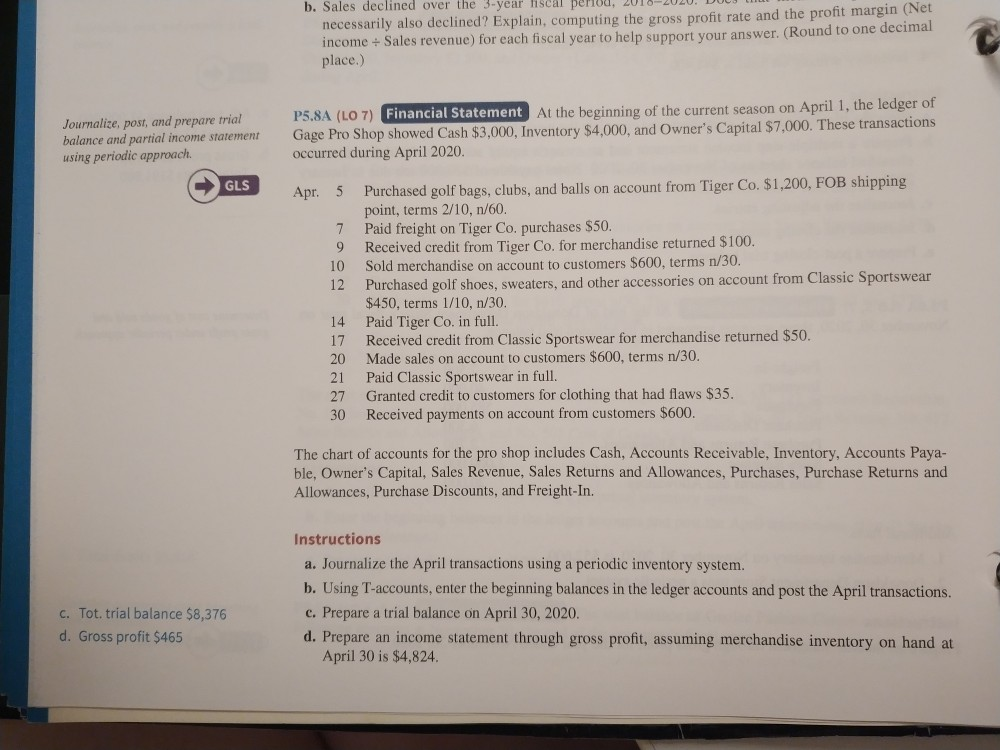

b. Sales declined over the 3-year hiscal period, 2016-2020. DUS necessarily also declined? Explain, computing the gross profit rate and the profit margin (Net income + Sales revenue) for each fiscal year to help support your answer. (Round to one decimal place.) Journalize, post, and prepare trial balance and partial income statement using periodic approach. P5.8A (LO7) Financial Statement At the beginning of the current season on April 1, the ledger of Gage Pro Shop showed Cash $3,000, Inventory $4,000, and Owner's Capital $7,000. These transactions occurred during April 2020. GLS Apr. 5 7 10 12 Purchased golf bags, clubs, and balls on account from Tiger Co. $1,200, FOB shipping point, terms 2/10, n/60. Paid freight on Tiger Co. purchases $50. Received credit from Tiger Co. for merchandise returned $100. Sold merchandise on account to customers $600, terms n/30. Purchased golf shoes, sweaters, and other accessories on account from Classic Sportswear $450, terms 1/10, 1/30. Paid Tiger Co. in full. Received credit from Classic Sportswear for merchandise returned $50. Made sales on account to customers $600, terms n/30. Paid Classic Sportswear in full. Granted credit to customers for clothing that had flaws $35. Received payments on account from customers $600. 14 17 20 21 27 30 The chart of accounts for the pro shop includes Cash, Accounts Receivable, Inventory, Accounts Paya- ble, Owner's Capital, Sales Revenue, Sales Returns and Allowances, Purchases, Purchase Returns and Allowances, Purchase Discounts, and Freight-In. Instructions a. Journalize the April transactions using a periodic inventory system. b. Using T-accounts, enter the beginning balances in the ledger accounts and post the April transactions. c. Prepare a trial balance on April 30, 2020. d. Prepare an income statement through gross profit, assuming merchandise inventory on hand at April 30 is $4,824. C. Tot. trial balance $8,376 d. Gross profit $465

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started