Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is no additional information provided, the is the whole question You will prepare a static master budget, pro-forma financial statements and a flexible budget/variance

There is no additional information provided, the is the whole question

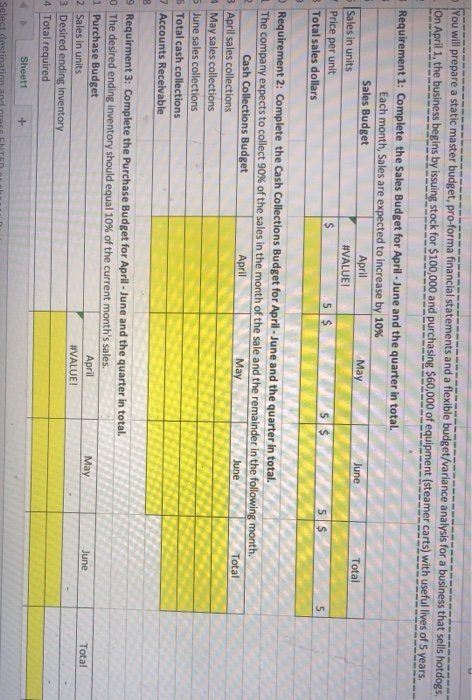

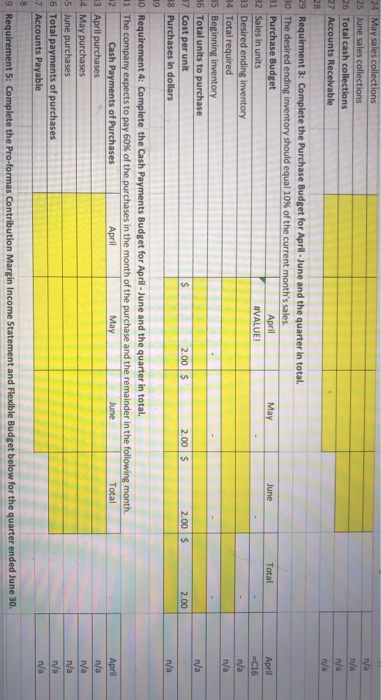

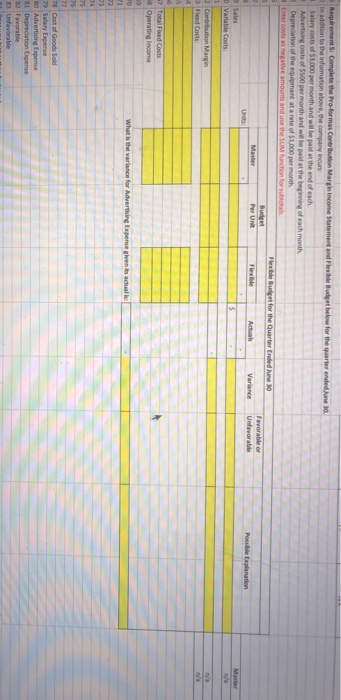

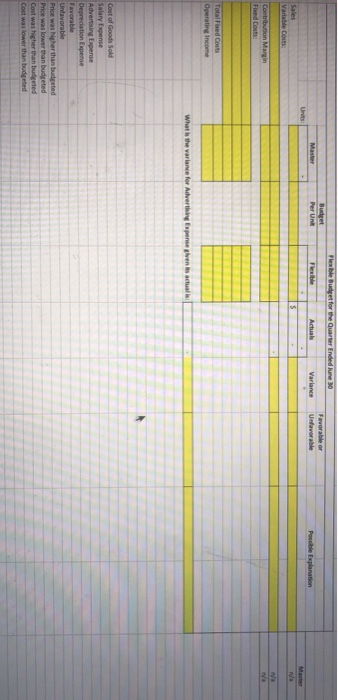

You will prepare a static master budget, pro-forma financial statements and a flexible budget/variance analysis for a business that sells hotdogs. On April 1, the business begins by issuing stock for $100,000 and purchasing $60,000 of equipment (steamer carts) with useful lives of 5 years. Requirement 1: Complete the Sales Budget for April - June and the quarter in total. Each month, Sales are expected to increase by 10% Sales Budget April May Sales in units #VALUE! - Price per unit $ 5 $ Total sales dollars June Total 5 Requirement 2: Complete the Cash Collections Budget for April - June and the quarter in total. The company expects to collect 90% of the sales in the month of the sale and the remainder in the following month. Cash Collections Budget April May June Total April sales collections May sales collections 5 June sales collections 5 Total cash collections 7 Accounts Recelvable 8 9 Requirment 3: Complete the Purchase Budget for April - June and the quarter in total. o The desired ending inventory should equal 10% of the current month's sales. 1 Purchase Budget April May June 2 Sales in units #VALUE! 3 Desired ending inventory 4 Total required Total Sheet1 + Select desti n/a nya n/a n/a May April =C16 n/a n/a n/a 24 May sales collections 25 June sales collections 26 Total cash collections 27 Accounts Receivable 28 29 Requirment 3: Complete the Purchase Budget for April - June and the quarter in total. 30 The desired ending Inventory should equal 10% of the current month's sales. 31 Purchase Budget April June Total 32 Sales in units #VALUE! 33 Desired ending inventory 84 Total required 35 Beginning inventory 36 Total units to purchase 37 Cost per unit $ 2.00 $ 2.00 $ 2.00 $ 2.00 38 Purchases in dollars 19 0 Requirement 4: Complete the Cash Payments Budget for April - June and the quarter in total. 11 The company expects to pay 60% of the purchases in the month of the purchase and the remainder in the following month 12 Cash Payments of Purchases April May June Total 13 April purchases 4 May purchases -5 June purchases 6 Total payments of purchases -7 Accounts Payable 8 -9 Requirement 5: Complete the Pro-formas Contribution Margin Income Statement and Flexible Budget below for the quarter ended June 30. n/a April n/a n/a n/a va n/a Requirements: Complete the reformas Contribution Margin income Statement and Flexible Buget below for the quarter ended June 10, In addition to the information above, the company incur Salary costs of $3.000 per month and will be paid at the end of each Advertising costs of $500 per month and will be paid at the beginning of each month Depreciation of the equipment at a rate of $1.000 per month Entercosts assive amounts and use the SUM function for subtotal Flexible Budget for the Quarter Ended June 30 Budget Favorable or Master Per Unt Actual Variance Unfavorable Units Sales 5 0 Variable costs Possible Explanation Master 2 Cortsbution Margin 3 Fed Costs Iva 26 7 TotalFeed costs - Operating income 9 TO 21 22 33 What is the variance for Advertising Expense given its actual 75 76 27 T8 Cost of Goods Sold 79 Salary Expense 80 Advertising Expense 81 Depreciation Expense 82 Favorable 83 Unfavorable Flexible Budget for the Quarter Ended lunes Budget Per Un Master Favorable or Unfavorable Artuals Variance Posible Explanation Units Sales Varie $ Contribson Margin Fed Costs Total Fixed Costs Operating income What is the variance for Advertising Experieglven is actuals Cost of Goods Sold Salary Expense Advertising Expense Depreciation Expense Favorable Untavorable Price was higher than budgeted Price was lower than budgeted Cost was higher than budgeted Cost was lower than budgeted You will prepare a static master budget, pro-forma financial statements and a flexible budget/variance analysis for a business that sells hotdogs. On April 1, the business begins by issuing stock for $100,000 and purchasing $60,000 of equipment (steamer carts) with useful lives of 5 years. Requirement 1: Complete the Sales Budget for April - June and the quarter in total. Each month, Sales are expected to increase by 10% Sales Budget April May Sales in units #VALUE! - Price per unit $ 5 $ Total sales dollars June Total 5 Requirement 2: Complete the Cash Collections Budget for April - June and the quarter in total. The company expects to collect 90% of the sales in the month of the sale and the remainder in the following month. Cash Collections Budget April May June Total April sales collections May sales collections 5 June sales collections 5 Total cash collections 7 Accounts Recelvable 8 9 Requirment 3: Complete the Purchase Budget for April - June and the quarter in total. o The desired ending inventory should equal 10% of the current month's sales. 1 Purchase Budget April May June 2 Sales in units #VALUE! 3 Desired ending inventory 4 Total required Total Sheet1 + Select desti n/a nya n/a n/a May April =C16 n/a n/a n/a 24 May sales collections 25 June sales collections 26 Total cash collections 27 Accounts Receivable 28 29 Requirment 3: Complete the Purchase Budget for April - June and the quarter in total. 30 The desired ending Inventory should equal 10% of the current month's sales. 31 Purchase Budget April June Total 32 Sales in units #VALUE! 33 Desired ending inventory 84 Total required 35 Beginning inventory 36 Total units to purchase 37 Cost per unit $ 2.00 $ 2.00 $ 2.00 $ 2.00 38 Purchases in dollars 19 0 Requirement 4: Complete the Cash Payments Budget for April - June and the quarter in total. 11 The company expects to pay 60% of the purchases in the month of the purchase and the remainder in the following month 12 Cash Payments of Purchases April May June Total 13 April purchases 4 May purchases -5 June purchases 6 Total payments of purchases -7 Accounts Payable 8 -9 Requirement 5: Complete the Pro-formas Contribution Margin Income Statement and Flexible Budget below for the quarter ended June 30. n/a April n/a n/a n/a va n/a Requirements: Complete the reformas Contribution Margin income Statement and Flexible Buget below for the quarter ended June 10, In addition to the information above, the company incur Salary costs of $3.000 per month and will be paid at the end of each Advertising costs of $500 per month and will be paid at the beginning of each month Depreciation of the equipment at a rate of $1.000 per month Entercosts assive amounts and use the SUM function for subtotal Flexible Budget for the Quarter Ended June 30 Budget Favorable or Master Per Unt Actual Variance Unfavorable Units Sales 5 0 Variable costs Possible Explanation Master 2 Cortsbution Margin 3 Fed Costs Iva 26 7 TotalFeed costs - Operating income 9 TO 21 22 33 What is the variance for Advertising Expense given its actual 75 76 27 T8 Cost of Goods Sold 79 Salary Expense 80 Advertising Expense 81 Depreciation Expense 82 Favorable 83 Unfavorable Flexible Budget for the Quarter Ended lunes Budget Per Un Master Favorable or Unfavorable Artuals Variance Posible Explanation Units Sales Varie $ Contribson Margin Fed Costs Total Fixed Costs Operating income What is the variance for Advertising Experieglven is actuals Cost of Goods Sold Salary Expense Advertising Expense Depreciation Expense Favorable Untavorable Price was higher than budgeted Price was lower than budgeted Cost was higher than budgeted Cost was lower than budgeted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started