Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How much money do you need to deposit in a bank each month if you are planning to have $5000 in four years

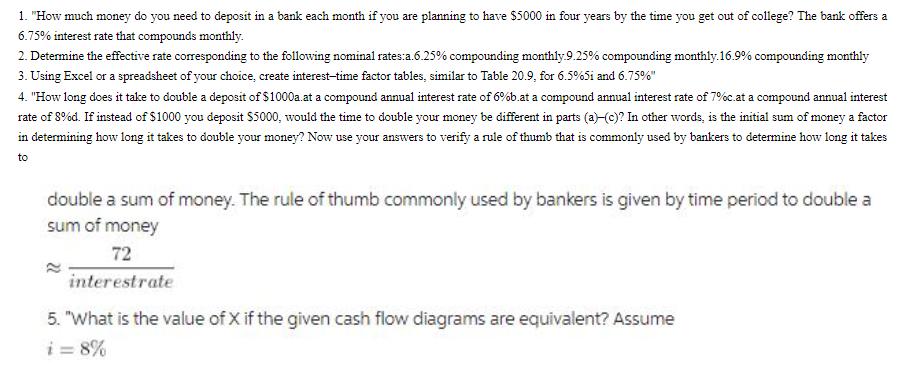

1. "How much money do you need to deposit in a bank each month if you are planning to have $5000 in four years by the time you get out of college? The bank offers a 6.75% interest rate that compounds monthly. 2. Determine the effective rate corresponding to the following nominal rates:a.6.25% compounding monthly.9.25% compounding monthly.16.9% compounding monthly 3. Using Excel or a spreadsheet of your choice, create interest-time factor tables, similar to Table 20.9, for 6.5%5i and 6.75%" 4. "How long does it take to double a deposit of $1000a.at a compound annual interest rate of 6%b.at a compound annual interest rate of 7%c.at a compound annual interest rate of 8%d. If instead of $1000 you deposit $5000, would the time to double your money be different in parts (a)-(c)? In other words, is the initial sum of money a factor in determining how long it takes to double your money? Now use your answers to verify a rule of thumb that is commonly used by bankers to determine how long it takes to double a sum of money. The rule of thumb commonly used by bankers is given by time period to double a sum of money 72 interestrate 5. "What is the value of X if the given cash flow diagrams are equivalent? Assume i = 8%

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 To calculate the monthly deposit needed to have 5000 in four years with a 675 interest rate compounded monthly we can use the formula for compound interest A P1 rnnt where A is the future val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started