Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is no more information Problem 7,8 (Page 230) - Takeshi Kamada UIA Japan: Takeshi Kamada, Credit Suisse (Tokyo), observes that the V/S spot rate

there is no more information

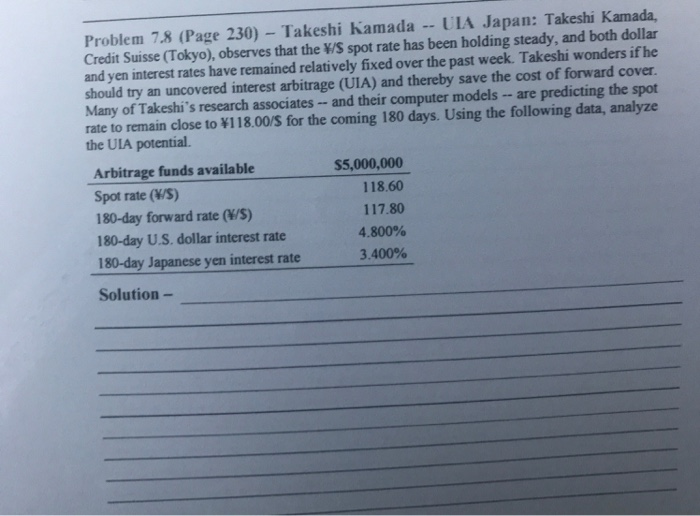

Problem 7,8 (Page 230) - Takeshi Kamada UIA Japan: Takeshi Kamada, Credit Suisse (Tokyo), observes that the V/S spot rate has been holding steady, and both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associates -- and their computer models -- are predicting the spot rate to remain close to 118.00/S for the coming 180 days. Using the following data, analyze the UIA potential. Arbitrage funds available $5,000,000 Spot rate (W/S) 118.60 180-day forward rate (/5) 117.80 180-day U.S. dollar interest rate 4.800% 180-day Japanese yen interest rate 3.400% Solution Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started