Question: There is no reason to expect a change in either prices of interest rates. Question 1 0 1 pts Assume that in recent years, both

There is no reason to expect a change in either prices of interest rates.

Question

pts

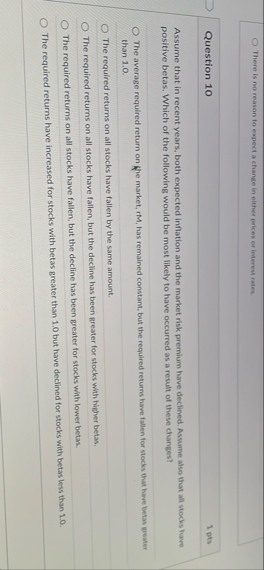

Assume that in recent years, both expected inflation and the market risk premium have declined. Assume also that all stocks have positive betas. Which of the following would be most likely to have occurred as a result of these changes?

The average required return on the market, rM has remained constanh, but the required returns have faltentor stocksithat have betas weater than

The required returns on all stocks have fallen by the same amount.

The required returns on all stocks have fallen, but the decline has been greater for stocks with bighver betas.

The required returns on all stocks have fallen, but the decline has been greater for stocks with lower betas.

The required returns have increased for stocks with betas greater than but have declined for stocks with betas lers than

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock