Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is something wrong with the chegg app. When I take pictures with the chegg app it becomes unclear. If I upload the pictures to

There is something wrong with the chegg app. When I take pictures with the chegg app it becomes unclear. If I upload the pictures to the chegg app from the gallery, it becomes unclear.

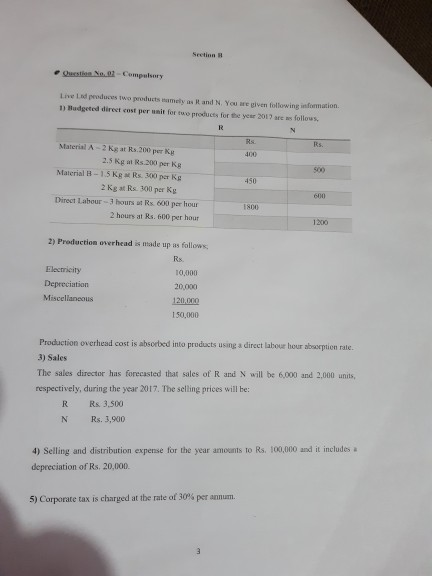

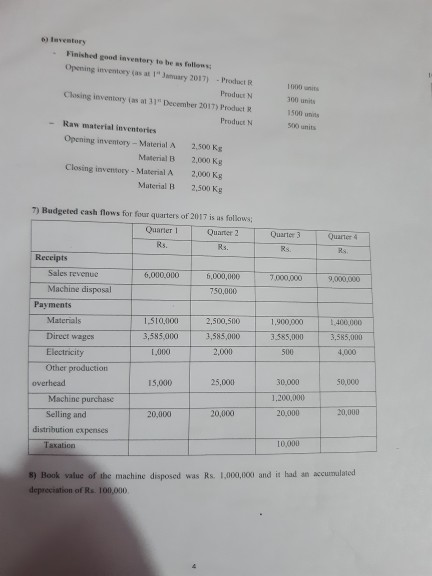

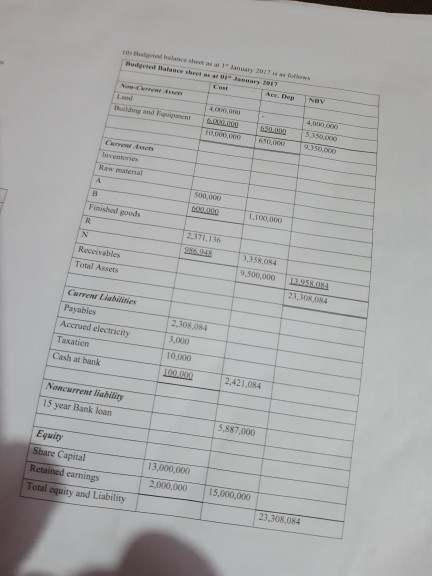

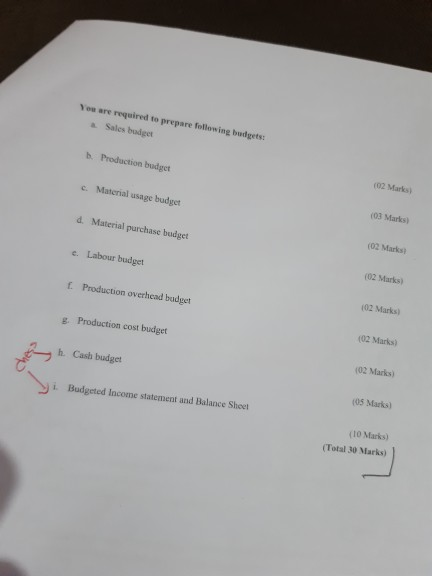

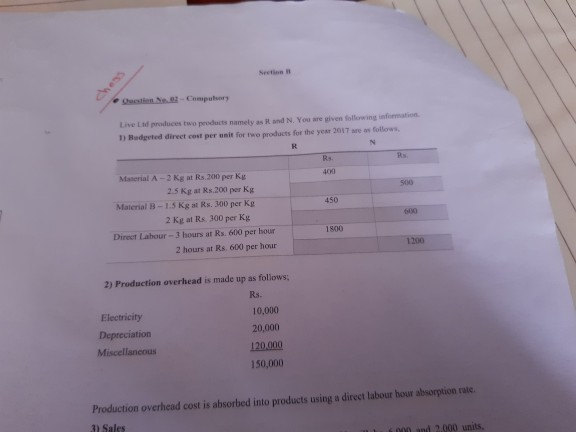

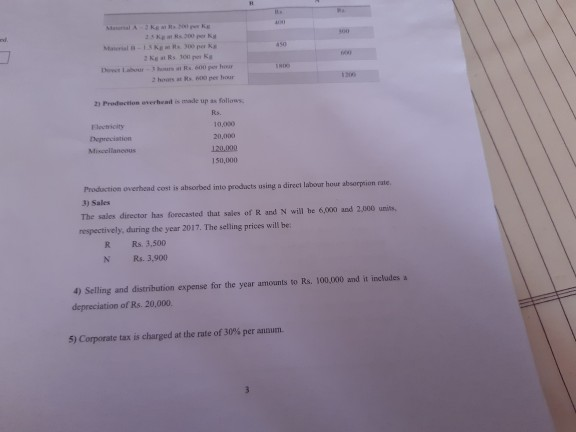

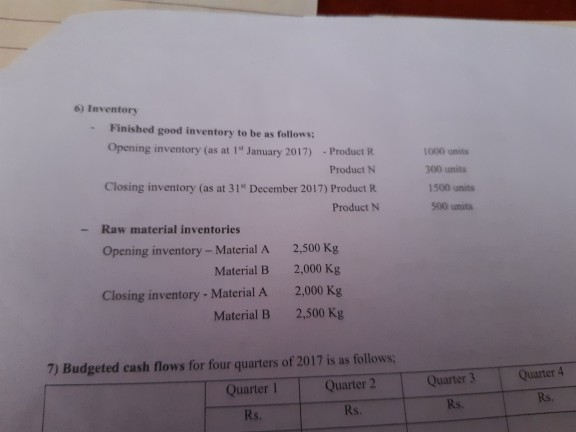

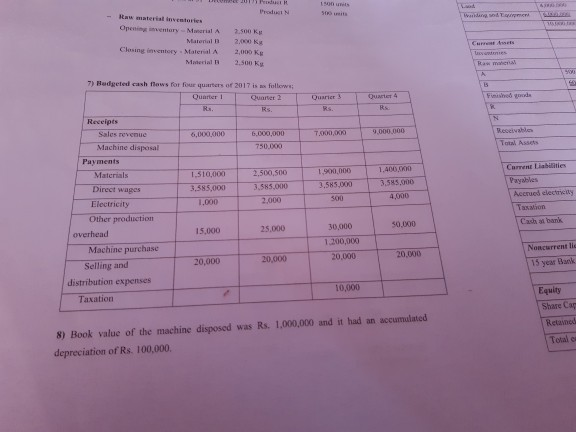

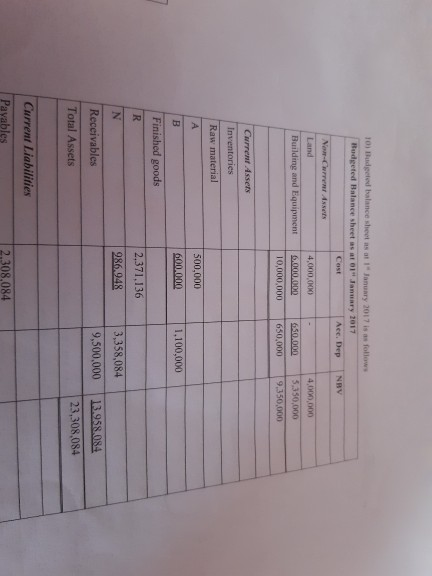

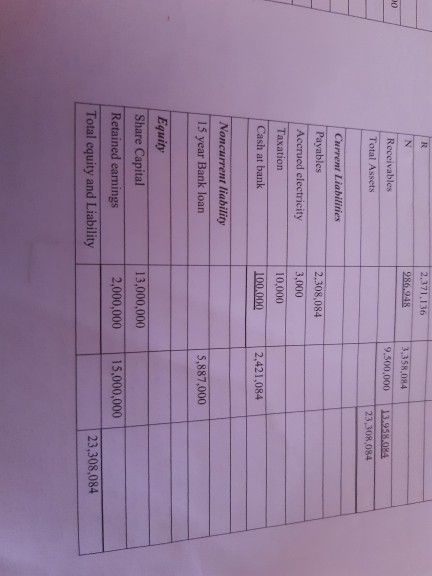

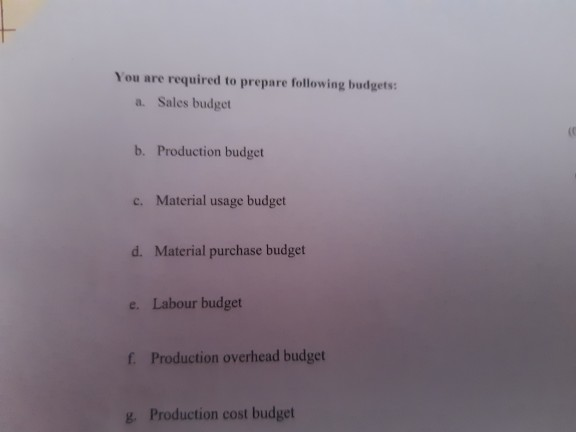

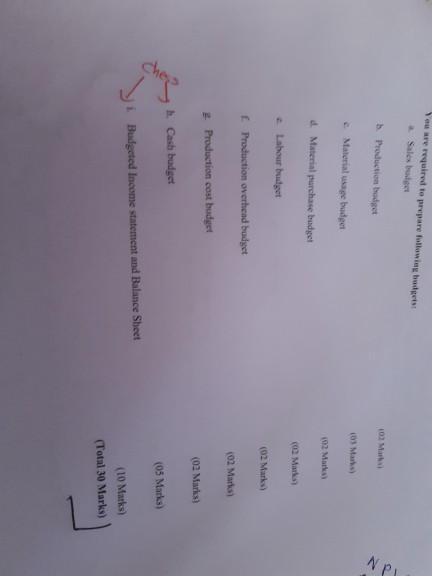

No. of Compulsory LiveLnd produces two products may it and N You wegen e 1) Budgeted direct cost per unit for products for the year 2017 w ingsomation as follows 500 Material A-2 kg at Rs.200 per kg 2.5 K R 200 per kg Material 1-1.5 Kg - Rs. 300 per kg 2 kg at Rs 100 per kg Direct Labour - 3 hours at Rs 600 per hour 2 hours at Rs. 600 per hour 450 600 TO 1200 2) Production overhead is made up as follows Electricity Depreciation Miscellaneous 10,000 20.000 120.000 150.000 Production overhead cost is absorbed into products using a direct labour hour absorption rate. 3) Sales The sales director has forecasted that sales of R and N will be 6.000 and 2.000 units, respectively, during the year 2017. The selling prices will be: R Rs. 3.500 N Rs. 3,900 4) Selling and distribution expense for the year amounts to Rs. 100,000 and it includes depreciation of Rs. 20,000 5) Corporate tax is charged at the rate of 30% per annum. Finished god inventory to be as follons Opening inventory at 1 may 2017) Products Product N Closing inventory ( 31 December 2017) Product Product N Ras material inventories Opening inventory - Material A 2.500 kg Material B 2.000 kg Closing inventory - Material A 2,000 Ks Material B 2.500 kg 7) Budgeted cash flows for four quarters of 2017 is as follows Quarter Quarter 2 Rs. Quarter 3 Quarter 4 Rs. Rs RS Receipts Sales revenue 6,000,000 T000,000 9,000,000 Machine disposal 6,000,000 750,000 Payments 1.510,00 1.000.000 1.400.000 3. 55,000 3,585,000 2.500.500 3.585,000 2.000 Materials Direct was Electricity Other production overhead 3.585.000 1.000 500 4.000 15.000 25,000 50.000 30,000 1.200.000 Machine purchase Selling and 20,000 20,000 20.000 20,000 distribution expenses Taxation 10000 8) Book value of the machine disposed was Rs. 1,000,000 and it had an accumulated depreciation of Rs. 100,000 Budged Halance sheet mary 101 ng and Funct 500.000 A RILE Finished goods 1,100 000 2.371.136 Receivables 285048 Total Assets 3.358.084 9.500.000 13.258.04 23,308,086 Current Liabilities Payables Accrued electricity Taxation Cash at bank 2.308.084 3,000 10.000 L .IO 2,421,084 Noncurrent liability 15 year Bank loan 5,887,000 Equity Share Capital Retained earnings Total equity and Liability 13,000,000 2.000.000 15,000,000 23.308.084 You are required to prepare following budgets: Sales budget b. Production budget c. Material usage budget 02 Marks d. Material purchase budget 103 Marks e Labour budget (02 Marks (02 Marks E Production overhead budget 102 Marks 8 Production cost budget 02 Marks Cash budget 102 Marks) i Budgeted Income statement and Balance Sheet 105 Marks) (10 Marks) (Total 30 Marks) O SO - Computery Live Ltd produces we products namely as it and N. You are given following information 1) Budgeted direct cost per unit for the products for the year 2017 me follows Rs. Rs 500 450 Material A-2 Kg at Rs 200 per ku 2.5 Kg at Rs.200 per kg Material B - 1.5 kg at Rs. 300 per kg 2 kg at Rs 300 per kg Direct Labour - 3 hours at Rs. 600 per hour 2 hours at Rs 600 per hour 1800 1200 2) Production overhead is made up as follows: Rs. Electricity 10,000 20,000 Depreciation Miscellaneous 120.000 150,000 Production overhead cost is absorbed into products using a direct labour hour absorption rate. 31 Sales 000 and 2.000 units. Rs 10 2 ourth 600 per her 2 Production area is made up as follows: Precision Miscellaneous 10.000 20,000 120,000 150,000 Production overhead cost is absorbed into products using a direct labor hour absorpion rate The sales director has forecasted that sales of Rand N will be 6,000 and 2.000 units respectively, during the year 2017. The selling prices will be R Rs 3.500 N Rs. 3.900 Selling and distribution expense for the year amounts to Rs. 100,000 and it includes depreciation of Rs. 20,000 5) Corporate tax is charged at the rate of 30% per annum 6) Inventory - Finished good inventory to be as follows: Opening inventory (as at 1 January 2017) - Product R Product N Closing inventory (as at 31 December 2017) Product R Product N 1000 units 300 units 1500 units 500 units Raw material inventories Opening inventory - Material A Material B Closing inventory - Material A Material B 2,500 Kg 2,000 Kg 2,000 Kg 2,500 Kg Quarter 3 7) Budgeted cash flows for four quarters of 2017 is as follows: Quarter Quarter 2 Rs. Quarter 4 Rs. Rs. Rs. Raw material investories Opening i ntery-Morial A Material n Closing i ntory Material A Material B 2.500 kg 2.000 KM 2,000 kg 2.500 kg 7) Budgeted cash flows for four quarters of 2017 is follows: Quarter 1 Quarter 2 Quarter 4 Receipts Sales revenue Machine disposal 6.000.000 0.000.000 6.000.000 T.200,000 750.000 1.400 1.510,000 3.5 SOKI 3.585.000 Payments Materials Direct wages Electricity Other production overhead 1.900,000 3.585.000 500 2.500.500 3.585.000 2.000 Accrued key 4.000 1.000 Cash albania 50,000 25.000 15.000 30,000 1.200,000 Machine purchase 20.000 20.000 20,000 Noncurrently 15 year Bank 20,000 Selling and distribution expenses Taxation 10,000 Equity Share Retained N Book value of the machine dinosed was Rs. 1,000,000 and it had an accumulated depreciation of Rs. 100,000. Budgeted Balance sheet sa a nuary 1817 Aee. Dep NRV Land 4.000 Building and Equipment 4,000,000 5,350,000 9.350.000 10.000.000 650.000 CAMERA Inventories Raw material 500,000 600.000 1.100,000 Finished goods 2.371,136 986.948 Receivables Total Assets 3,358,084 9,500,000 13.958.084 23,308,084 Current Liabilities Pavables 12.308.084 2,371,136 986,948 Receivables Total Assets 3.358.04 9.500,000 23.958.084 23,308,084 Current Liabilities Payables Accrued electricity Taxation Cash at bank 2,308,084 3,000 10,000 100.000 2,421,084 Noncurrent liability 15 year Bank loan 5,887,000 Equity Share Capital Retained earnings Total equity and Liability 13,000,000 2,000,000 15,000,000 23,308,084 You are required to prepare following budgets: a. Sales budget b. Production budget c. Material usage budget d. Material purchase budget e. Labour budget f. Production overhead budget 8. Production cost budget You are required to prepare following budgets Sales budget NPL b Production budget (02 Marks) (03 Marks) Material usage budget 102 Marks d. Material purchase budget (02 Marks) e Labour budget (02 Marks) f. Production overhead budget (02 Marks) Production cost budget (02 Marks) h. Cash budget (05 Marks) i Budgeted Income statement and Balance Sheet (10 Marks) (Total 30 Marks) No. of Compulsory LiveLnd produces two products may it and N You wegen e 1) Budgeted direct cost per unit for products for the year 2017 w ingsomation as follows 500 Material A-2 kg at Rs.200 per kg 2.5 K R 200 per kg Material 1-1.5 Kg - Rs. 300 per kg 2 kg at Rs 100 per kg Direct Labour - 3 hours at Rs 600 per hour 2 hours at Rs. 600 per hour 450 600 TO 1200 2) Production overhead is made up as follows Electricity Depreciation Miscellaneous 10,000 20.000 120.000 150.000 Production overhead cost is absorbed into products using a direct labour hour absorption rate. 3) Sales The sales director has forecasted that sales of R and N will be 6.000 and 2.000 units, respectively, during the year 2017. The selling prices will be: R Rs. 3.500 N Rs. 3,900 4) Selling and distribution expense for the year amounts to Rs. 100,000 and it includes depreciation of Rs. 20,000 5) Corporate tax is charged at the rate of 30% per annum. Finished god inventory to be as follons Opening inventory at 1 may 2017) Products Product N Closing inventory ( 31 December 2017) Product Product N Ras material inventories Opening inventory - Material A 2.500 kg Material B 2.000 kg Closing inventory - Material A 2,000 Ks Material B 2.500 kg 7) Budgeted cash flows for four quarters of 2017 is as follows Quarter Quarter 2 Rs. Quarter 3 Quarter 4 Rs. Rs RS Receipts Sales revenue 6,000,000 T000,000 9,000,000 Machine disposal 6,000,000 750,000 Payments 1.510,00 1.000.000 1.400.000 3. 55,000 3,585,000 2.500.500 3.585,000 2.000 Materials Direct was Electricity Other production overhead 3.585.000 1.000 500 4.000 15.000 25,000 50.000 30,000 1.200.000 Machine purchase Selling and 20,000 20,000 20.000 20,000 distribution expenses Taxation 10000 8) Book value of the machine disposed was Rs. 1,000,000 and it had an accumulated depreciation of Rs. 100,000 Budged Halance sheet mary 101 ng and Funct 500.000 A RILE Finished goods 1,100 000 2.371.136 Receivables 285048 Total Assets 3.358.084 9.500.000 13.258.04 23,308,086 Current Liabilities Payables Accrued electricity Taxation Cash at bank 2.308.084 3,000 10.000 L .IO 2,421,084 Noncurrent liability 15 year Bank loan 5,887,000 Equity Share Capital Retained earnings Total equity and Liability 13,000,000 2.000.000 15,000,000 23.308.084 You are required to prepare following budgets: Sales budget b. Production budget c. Material usage budget 02 Marks d. Material purchase budget 103 Marks e Labour budget (02 Marks (02 Marks E Production overhead budget 102 Marks 8 Production cost budget 02 Marks Cash budget 102 Marks) i Budgeted Income statement and Balance Sheet 105 Marks) (10 Marks) (Total 30 Marks) O SO - Computery Live Ltd produces we products namely as it and N. You are given following information 1) Budgeted direct cost per unit for the products for the year 2017 me follows Rs. Rs 500 450 Material A-2 Kg at Rs 200 per ku 2.5 Kg at Rs.200 per kg Material B - 1.5 kg at Rs. 300 per kg 2 kg at Rs 300 per kg Direct Labour - 3 hours at Rs. 600 per hour 2 hours at Rs 600 per hour 1800 1200 2) Production overhead is made up as follows: Rs. Electricity 10,000 20,000 Depreciation Miscellaneous 120.000 150,000 Production overhead cost is absorbed into products using a direct labour hour absorption rate. 31 Sales 000 and 2.000 units. Rs 10 2 ourth 600 per her 2 Production area is made up as follows: Precision Miscellaneous 10.000 20,000 120,000 150,000 Production overhead cost is absorbed into products using a direct labor hour absorpion rate The sales director has forecasted that sales of Rand N will be 6,000 and 2.000 units respectively, during the year 2017. The selling prices will be R Rs 3.500 N Rs. 3.900 Selling and distribution expense for the year amounts to Rs. 100,000 and it includes depreciation of Rs. 20,000 5) Corporate tax is charged at the rate of 30% per annum 6) Inventory - Finished good inventory to be as follows: Opening inventory (as at 1 January 2017) - Product R Product N Closing inventory (as at 31 December 2017) Product R Product N 1000 units 300 units 1500 units 500 units Raw material inventories Opening inventory - Material A Material B Closing inventory - Material A Material B 2,500 Kg 2,000 Kg 2,000 Kg 2,500 Kg Quarter 3 7) Budgeted cash flows for four quarters of 2017 is as follows: Quarter Quarter 2 Rs. Quarter 4 Rs. Rs. Rs. Raw material investories Opening i ntery-Morial A Material n Closing i ntory Material A Material B 2.500 kg 2.000 KM 2,000 kg 2.500 kg 7) Budgeted cash flows for four quarters of 2017 is follows: Quarter 1 Quarter 2 Quarter 4 Receipts Sales revenue Machine disposal 6.000.000 0.000.000 6.000.000 T.200,000 750.000 1.400 1.510,000 3.5 SOKI 3.585.000 Payments Materials Direct wages Electricity Other production overhead 1.900,000 3.585.000 500 2.500.500 3.585.000 2.000 Accrued key 4.000 1.000 Cash albania 50,000 25.000 15.000 30,000 1.200,000 Machine purchase 20.000 20.000 20,000 Noncurrently 15 year Bank 20,000 Selling and distribution expenses Taxation 10,000 Equity Share Retained N Book value of the machine dinosed was Rs. 1,000,000 and it had an accumulated depreciation of Rs. 100,000. Budgeted Balance sheet sa a nuary 1817 Aee. Dep NRV Land 4.000 Building and Equipment 4,000,000 5,350,000 9.350.000 10.000.000 650.000 CAMERA Inventories Raw material 500,000 600.000 1.100,000 Finished goods 2.371,136 986.948 Receivables Total Assets 3,358,084 9,500,000 13.958.084 23,308,084 Current Liabilities Pavables 12.308.084 2,371,136 986,948 Receivables Total Assets 3.358.04 9.500,000 23.958.084 23,308,084 Current Liabilities Payables Accrued electricity Taxation Cash at bank 2,308,084 3,000 10,000 100.000 2,421,084 Noncurrent liability 15 year Bank loan 5,887,000 Equity Share Capital Retained earnings Total equity and Liability 13,000,000 2,000,000 15,000,000 23,308,084 You are required to prepare following budgets: a. Sales budget b. Production budget c. Material usage budget d. Material purchase budget e. Labour budget f. Production overhead budget 8. Production cost budget You are required to prepare following budgets Sales budget NPL b Production budget (02 Marks) (03 Marks) Material usage budget 102 Marks d. Material purchase budget (02 Marks) e Labour budget (02 Marks) f. Production overhead budget (02 Marks) Production cost budget (02 Marks) h. Cash budget (05 Marks) i Budgeted Income statement and Balance Sheet (10 Marks) (Total 30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started