Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is three questions please solve it fast with all requirements and working second question three question The market value balance sheet for Bobaflex Manufacturing

there is three questions please solve it fast with all requirements and working

second question

three question

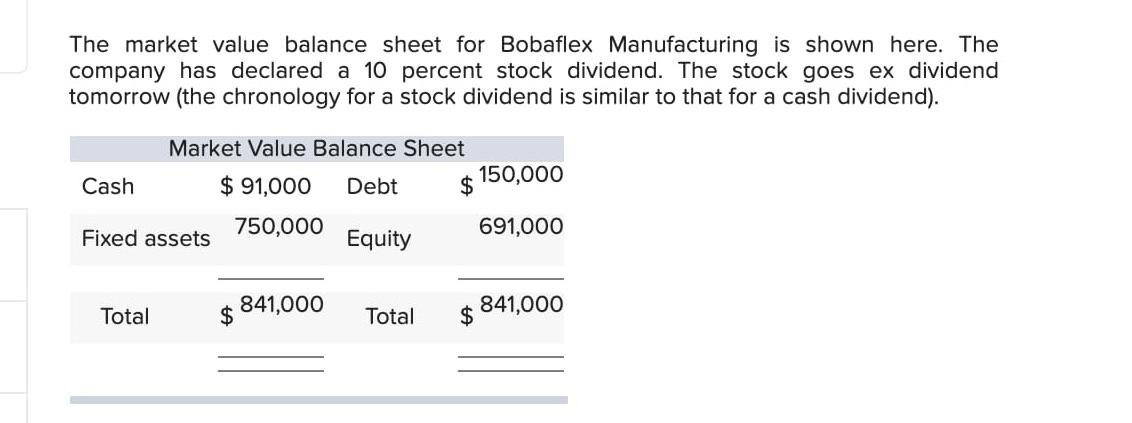

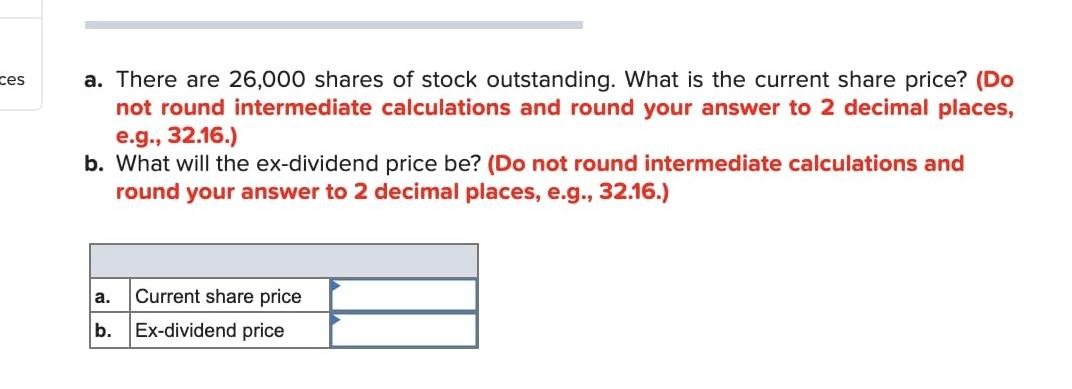

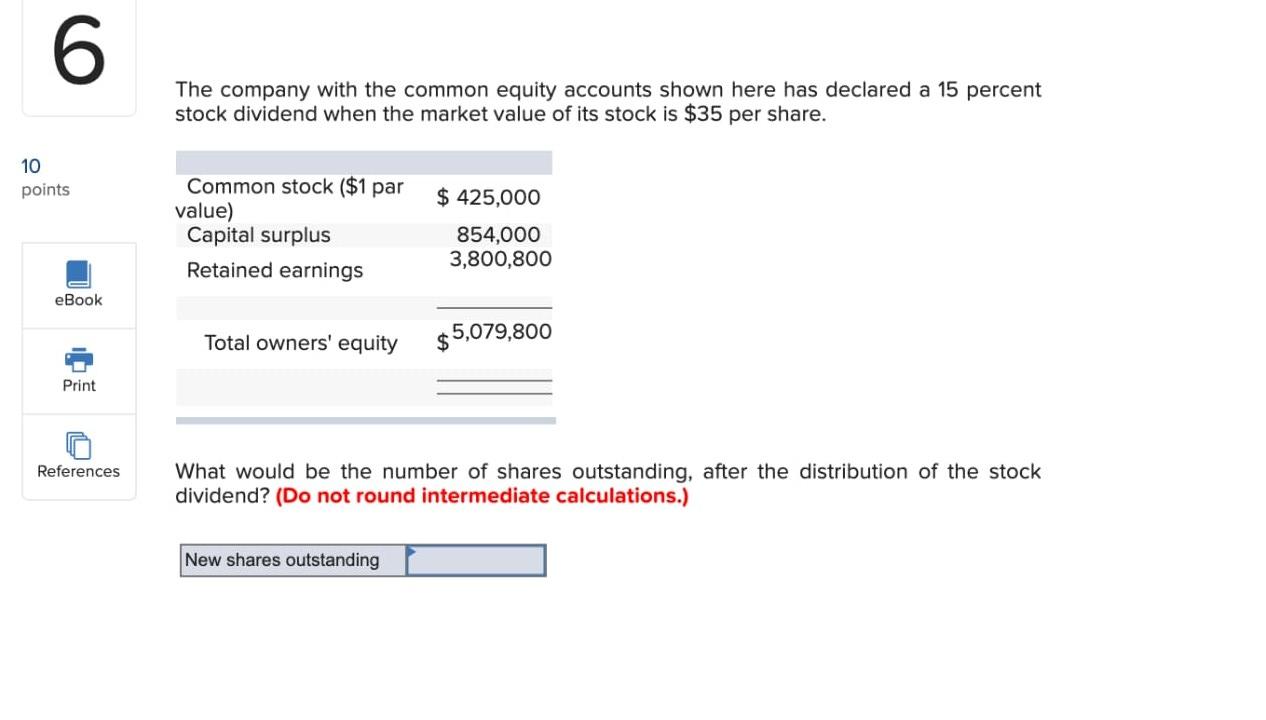

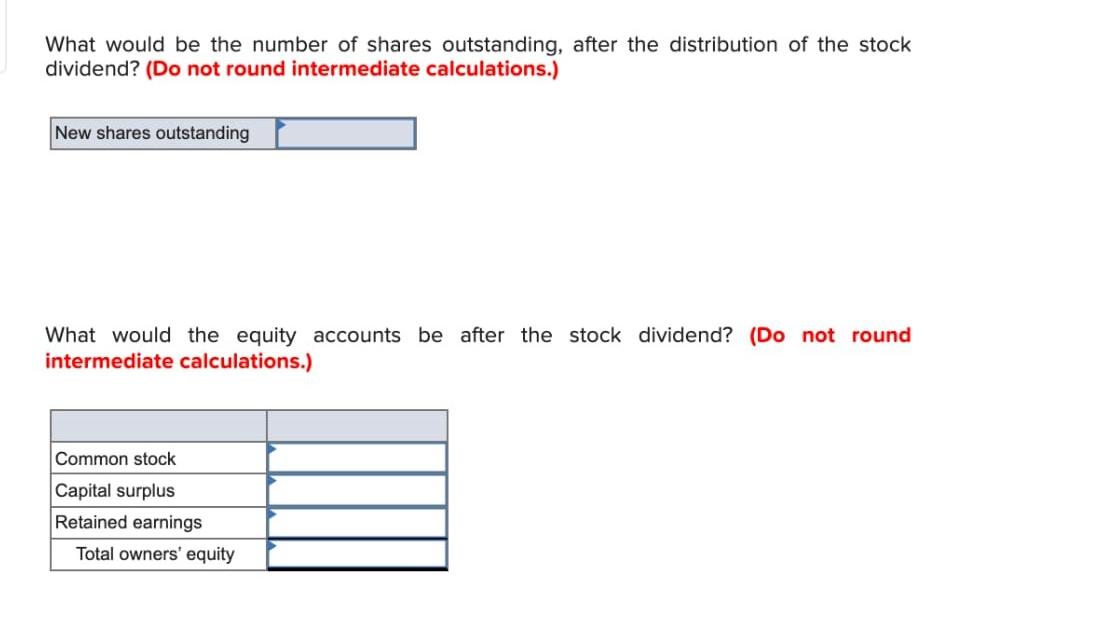

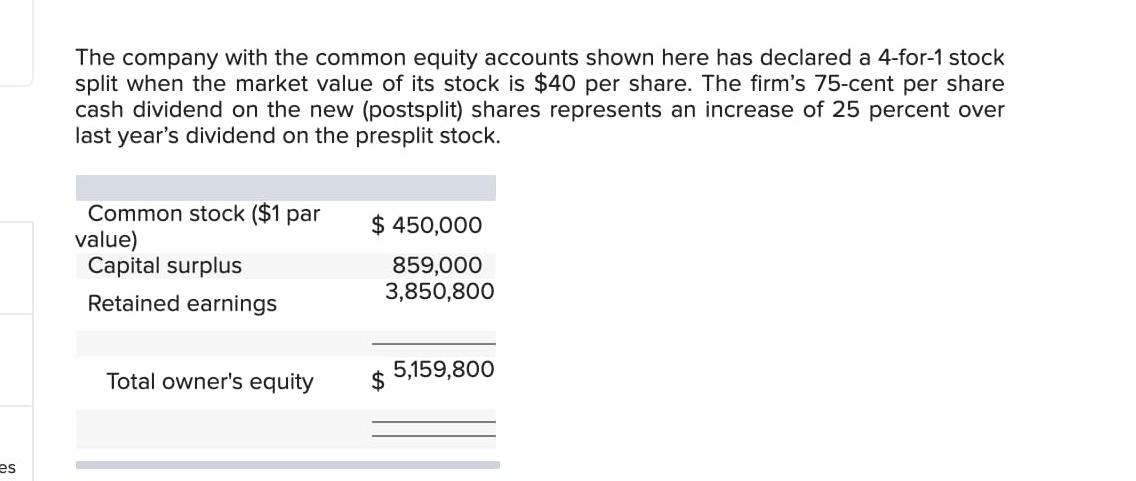

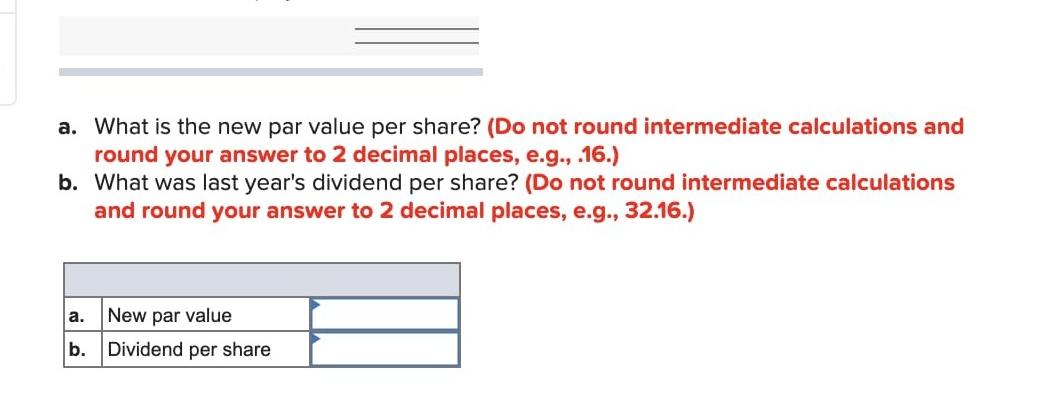

The market value balance sheet for Bobaflex Manufacturing is shown here. The company has declared a 10 percent stock dividend. The stock goes ex dividend tomorrow (the chronology for a stock dividend is similar to that for a cash dividend). Market Value Balance Sheet $ 91,000 Debt 150,000 $ Cash Fixed assets 750,000 691,000 Equity Total 841,000 $ Total 841,000 $ ces a. There are 26,000 shares of stock outstanding. What is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the ex-dividend price be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current share price Ex-dividend price b. 6 The company with the common equity accounts shown here has declared a 15 percent stock dividend when the market value of its stock is $35 per share. 10 points $ 425,000 Common stock ($1 par value) Capital surplus Retained earnings 854,000 3,800,800 eBook Total owners' equity $5,079,800 Print References What would be the number of shares outstanding, after the distribution of the stock dividend? (Do not round intermediate calculations.) New shares outstanding What would be the number of shares outstanding, after the distribution of the stock dividend? (Do not round intermediate calculations.) New shares outstanding What would the equity accounts be after the stock dividend? (Do not round intermediate calculations.) Common stock Capital surplus Retained earnings Total owners' equity The company with the common equity accounts shown here has declared a 4-for-1 stock split when the market value of its stock is $40 per share. The firm's 75-cent per share cash dividend on the new (postsplit) shares represents an increase of 25 percent over last year's dividend on the presplit stock. Common stock ($1 par value) Capital surplus Retained earnings $ 450,000 859,000 3,850,800 Total owner's equity 5,159,800 $ es a. What is the new par value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., .16.) b. What was last year's dividend per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. New par value Dividend per share b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started