There is two images attached with all the necessary information.

it says it needs more info, what information is missing?

these images are perfectly clear. can you please show the T-Accounts for cost of control, non controlling interests, and consolidated reserves as asked. thannk you.

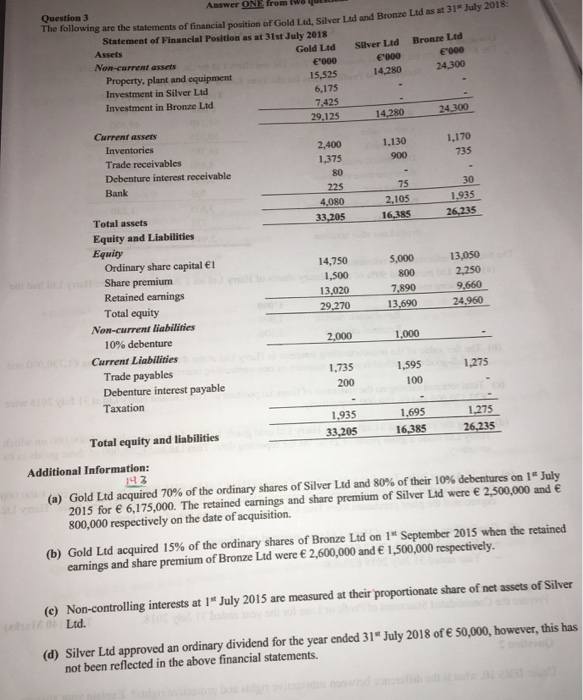

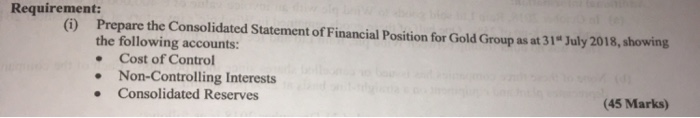

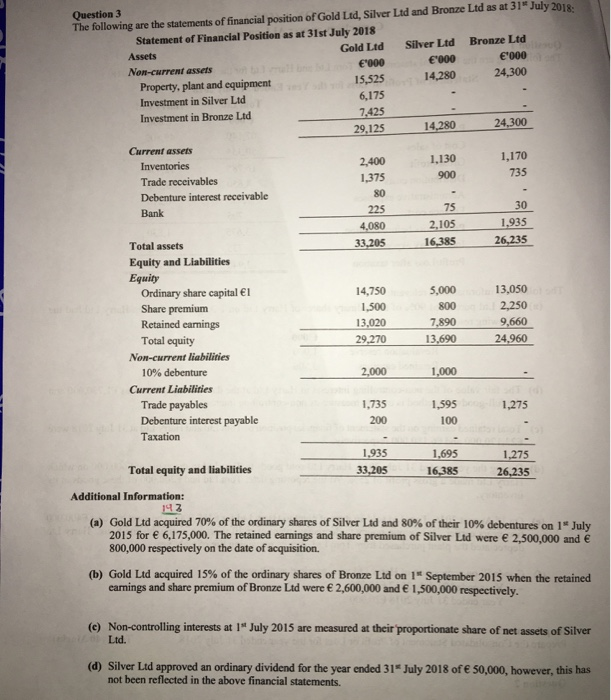

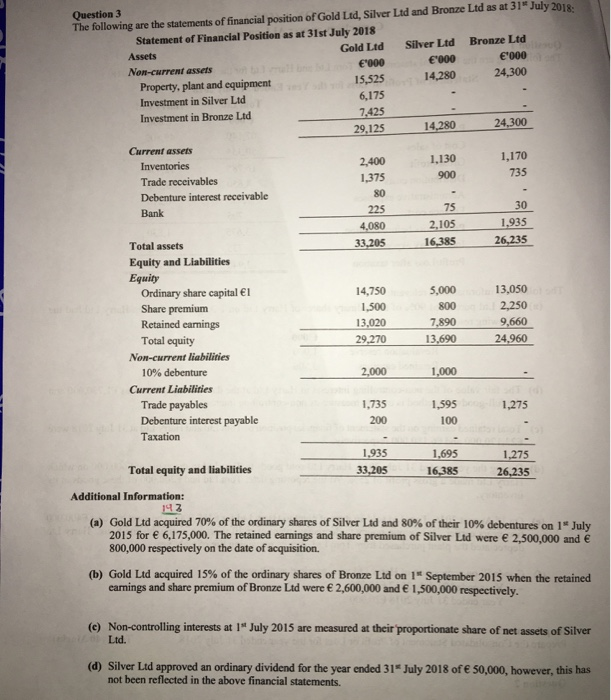

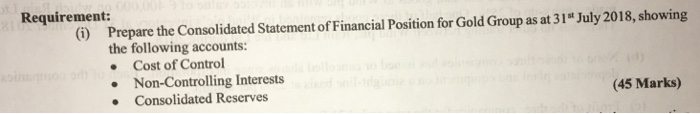

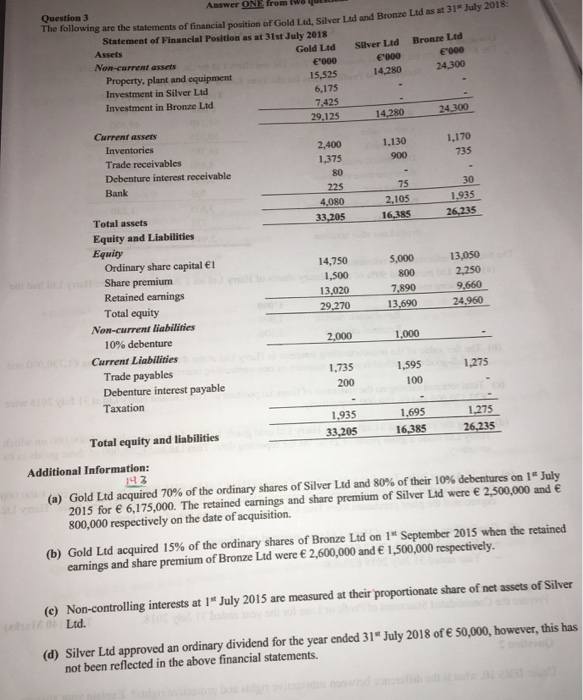

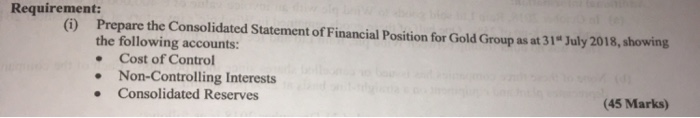

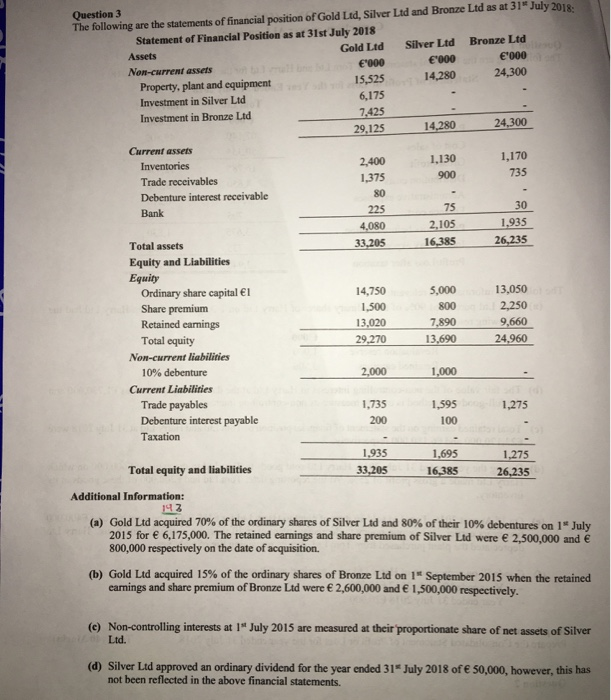

Question 3 Answer ONE from Iwo The following are the statements of financial position of Gold Lad, Silver Lad and Bronze Ltd as at 31* July 2018: Statement of Financial Position as at 31st July 2018 Assets Gold Ltd Silver Ltd Bronze Ltd Non-current assets E000 "000 '000 Property, plant and equipment 15,525 14,280 24,300 Investment in Silver Lid 6,175 Investment in Bronze Ltd 7,425 29,125 14.280 24,300 Current assets Inventories 2,400 1.130 1,170 Trade receivables 1,375 900 735 Debenture interest receivable 80 Bank 225 75 30 4,080 2,105 1.935 Total assets 33,205 16.385 26,235 Equity and Liabilities Equity Ordinary share capital el 14,750 5.000 13.050 Share premium 1,500 800 2,250 Retained earnings 13,020 7,890 9,660 Total equity 29,270 13,690 24,960 Non-current liabilities 10% debenture 2,000 1.000 Current Liabilities Trade payables 1,735 1.595 1,275 Debenture interest payable 200 100 Taxation 1,935 1,695 1,275 Total equity and liabilities 33,205 16,385 26,235 Additional Information: 143 (a) Gold Ltd acquired 70% of the ordinary shares of Silver Ltd and 80% of their 10% debentures on 15 July 2015 for 6,175,000. The retained earnings and share premium of Silver Lid were 2,500,000 and 800,000 respectively on the date of acquisition. (b) Gold Ltd acquired 15% of the ordinary shares of Bronze Ltd on 1" September 2015 when the retained camnings and share premium of Bronze Ltd were 2,600,000 and 1,500,000 respectively. (C) Non-controlling interests at 1July 2015 are measured at their proportionate share of net assets of Silver Ltd. (d) Silver Ltd approved an ordinary dividend for the year ended 31 July 2018 of 50,000, however, this has not been reflected in the above financial statements. Requirement: (i) Prepare the Consolidated Statement of Financial Position for Gold Group as at 31" July 2018, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves (45 Marks) . . Question 3 The following are the statements of financial position of Gold Ltd, Silver Ltd and Bronze Ltd as at 31* July 2018: Statement of Financial Position as at 31st July 2018 Silver Ltd Gold Ltd Bronze Ltd Assets '000 Non-current assets '000 '000 15,525 14,280 24,300 Property, plant and equipment Investment in Silver Ltd 6,175 Investment in Bronze Ltd 7.425 29.125 14,280 24,300 Current assets Inventories 2,400 1.130 1,170 Trade receivables 1,375 900 735 Debenture interest receivable 80 Bank 225 75 30 4,080 2,105 1,935 Total assets 33,205 16,385 26,235 Equity and Liabilities Equity Ordinary share capital 14,750 5,000 13,050 Share premium 1.500 800 2.250 Retained earnings 13,020 7,890 9,660 Total equity 29,270 13,690 24,960 Non-current liabilities 10% debenture 2,000 1,000 Current Liabilities Trade payables 1.735 1,595 Debenture interest payable 200 100 Taxation 1,935 1.695 1,275 Total equity and liabilities 33,205 16,385 26,235 Additional Information: 142 (a) Gold Ltd acquired 70% of the ordinary shares of Silver Ltd and 80% of their 10% debentures on 1 July 2015 for 6,175,000. The retained earnings and share premium of Silver Ltd were 2,500,000 and 800,000 respectively on the date of acquisition 1,275 () Gold Ltd acquired 15% of the ordinary shares of Bronze Ltd on 1 September 2015 when the retained carnings and share premium of Bronze Lid were 2,600,000 and 1,500,000 respectively. () Non-controlling interests at 1" July 2015 are measured at their proportionate share of net assets of Silver Ltd. (d) Silver Ltd approved an ordinary dividend for the year ended 31 July 2018 of 50,000, however, this has not been reflected in the above financial statements. Requirement: (i) Prepare the Consolidated Statement of Financial Position for Gold Group as at 31" July 2018, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves (45 Marks) . Question 3 Answer ONE from Iwo The following are the statements of financial position of Gold Lad, Silver Lad and Bronze Ltd as at 31* July 2018: Statement of Financial Position as at 31st July 2018 Assets Gold Ltd Silver Ltd Bronze Ltd Non-current assets E000 "000 '000 Property, plant and equipment 15,525 14,280 24,300 Investment in Silver Lid 6,175 Investment in Bronze Ltd 7,425 29,125 14.280 24,300 Current assets Inventories 2,400 1.130 1,170 Trade receivables 1,375 900 735 Debenture interest receivable 80 Bank 225 75 30 4,080 2,105 1.935 Total assets 33,205 16.385 26,235 Equity and Liabilities Equity Ordinary share capital el 14,750 5.000 13.050 Share premium 1,500 800 2,250 Retained earnings 13,020 7,890 9,660 Total equity 29,270 13,690 24,960 Non-current liabilities 10% debenture 2,000 1.000 Current Liabilities Trade payables 1,735 1.595 1,275 Debenture interest payable 200 100 Taxation 1,935 1,695 1,275 Total equity and liabilities 33,205 16,385 26,235 Additional Information: 143 (a) Gold Ltd acquired 70% of the ordinary shares of Silver Ltd and 80% of their 10% debentures on 15 July 2015 for 6,175,000. The retained earnings and share premium of Silver Lid were 2,500,000 and 800,000 respectively on the date of acquisition. (b) Gold Ltd acquired 15% of the ordinary shares of Bronze Ltd on 1" September 2015 when the retained camnings and share premium of Bronze Ltd were 2,600,000 and 1,500,000 respectively. (C) Non-controlling interests at 1July 2015 are measured at their proportionate share of net assets of Silver Ltd. (d) Silver Ltd approved an ordinary dividend for the year ended 31 July 2018 of 50,000, however, this has not been reflected in the above financial statements. Requirement: (i) Prepare the Consolidated Statement of Financial Position for Gold Group as at 31" July 2018, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves (45 Marks) . . Question 3 The following are the statements of financial position of Gold Ltd, Silver Ltd and Bronze Ltd as at 31* July 2018: Statement of Financial Position as at 31st July 2018 Silver Ltd Gold Ltd Bronze Ltd Assets '000 Non-current assets '000 '000 15,525 14,280 24,300 Property, plant and equipment Investment in Silver Ltd 6,175 Investment in Bronze Ltd 7.425 29.125 14,280 24,300 Current assets Inventories 2,400 1.130 1,170 Trade receivables 1,375 900 735 Debenture interest receivable 80 Bank 225 75 30 4,080 2,105 1,935 Total assets 33,205 16,385 26,235 Equity and Liabilities Equity Ordinary share capital 14,750 5,000 13,050 Share premium 1.500 800 2.250 Retained earnings 13,020 7,890 9,660 Total equity 29,270 13,690 24,960 Non-current liabilities 10% debenture 2,000 1,000 Current Liabilities Trade payables 1.735 1,595 Debenture interest payable 200 100 Taxation 1,935 1.695 1,275 Total equity and liabilities 33,205 16,385 26,235 Additional Information: 142 (a) Gold Ltd acquired 70% of the ordinary shares of Silver Ltd and 80% of their 10% debentures on 1 July 2015 for 6,175,000. The retained earnings and share premium of Silver Ltd were 2,500,000 and 800,000 respectively on the date of acquisition 1,275 () Gold Ltd acquired 15% of the ordinary shares of Bronze Ltd on 1 September 2015 when the retained carnings and share premium of Bronze Lid were 2,600,000 and 1,500,000 respectively. () Non-controlling interests at 1" July 2015 are measured at their proportionate share of net assets of Silver Ltd. (d) Silver Ltd approved an ordinary dividend for the year ended 31 July 2018 of 50,000, however, this has not been reflected in the above financial statements. Requirement: (i) Prepare the Consolidated Statement of Financial Position for Gold Group as at 31" July 2018, showing the following accounts: Cost of Control Non-Controlling Interests Consolidated Reserves (45 Marks)