There should be 27 journal entries. If correct, I will leave good feedback for you!

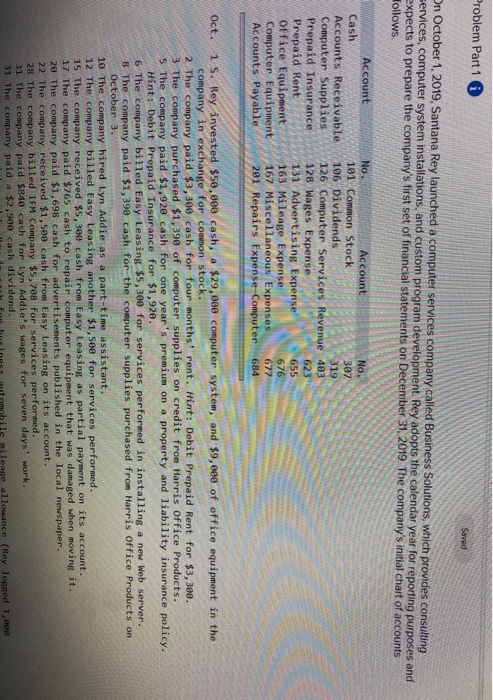

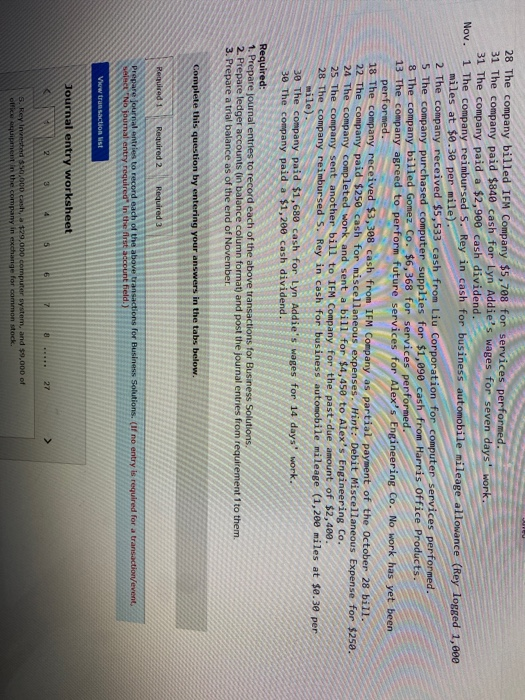

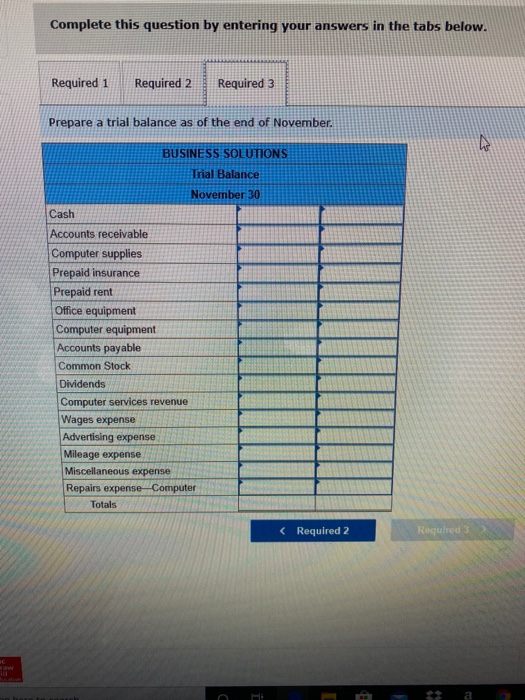

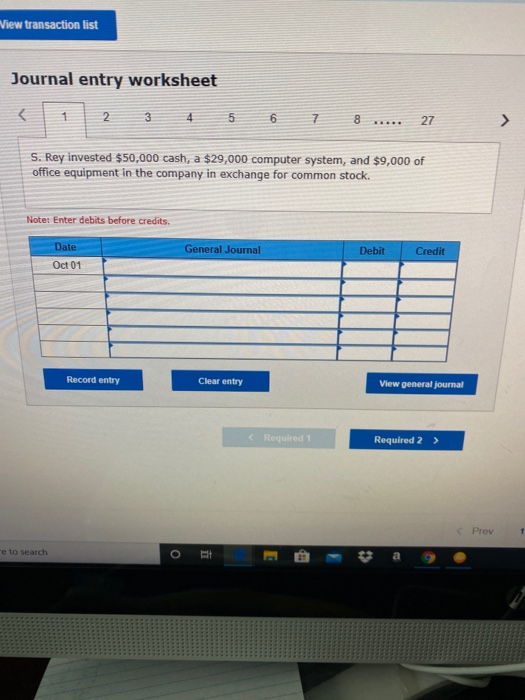

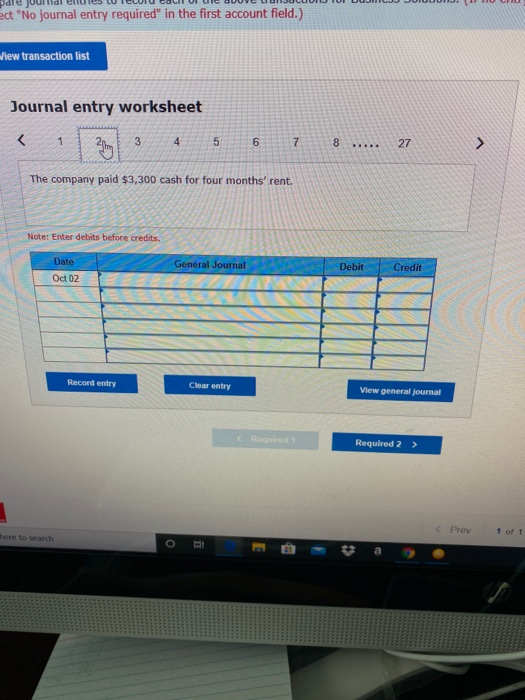

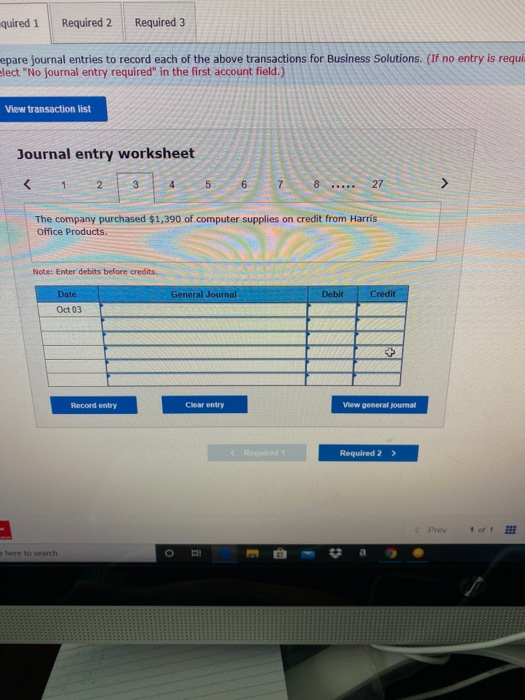

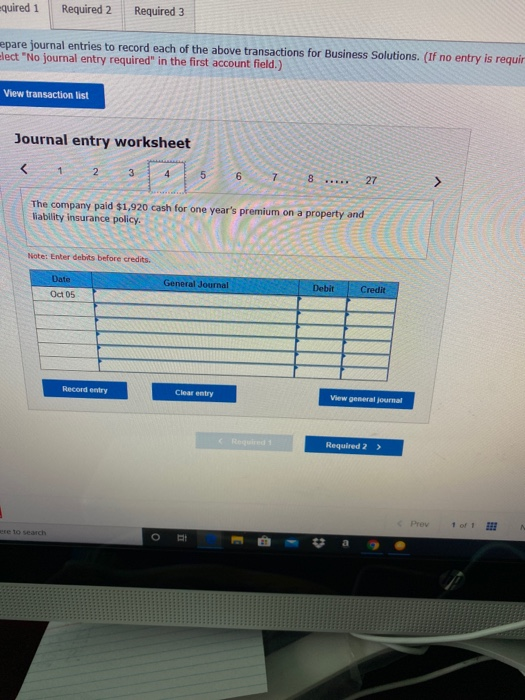

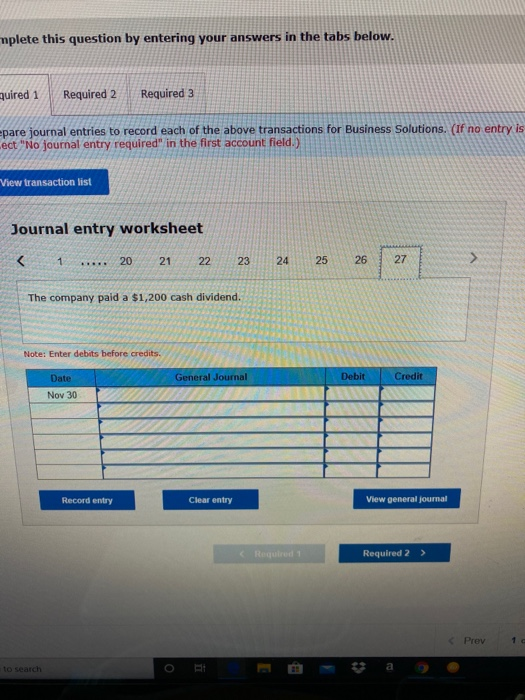

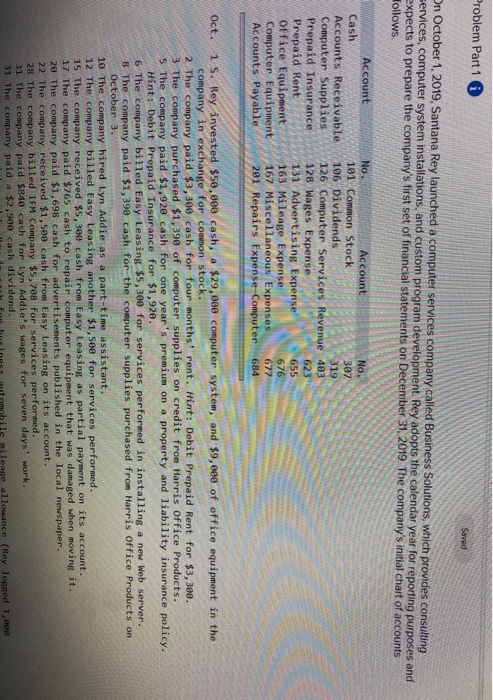

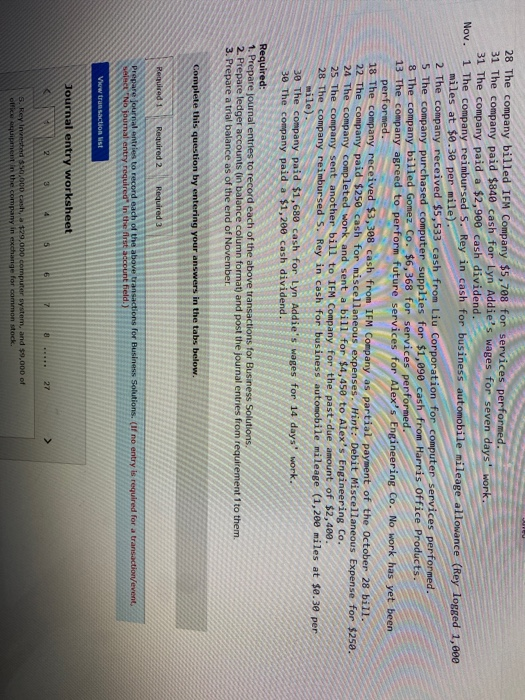

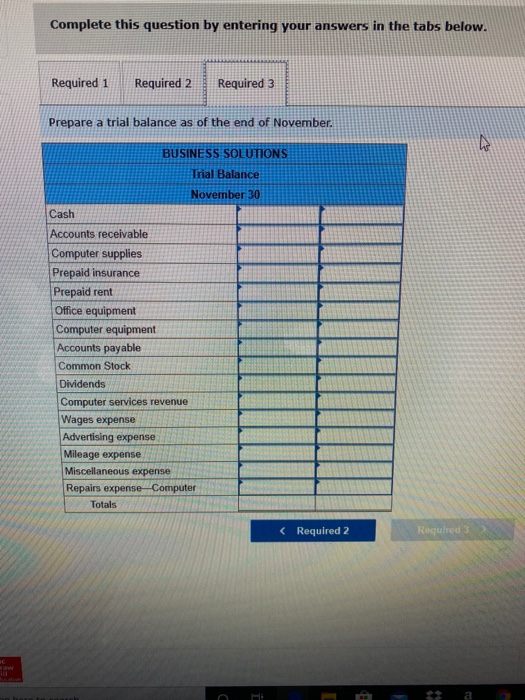

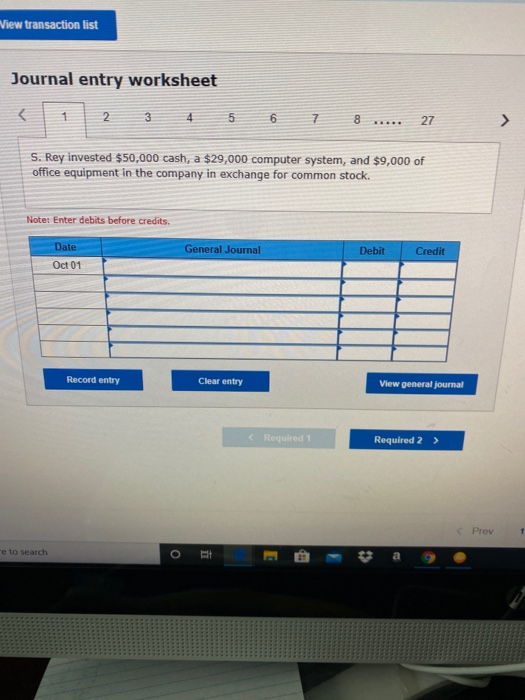

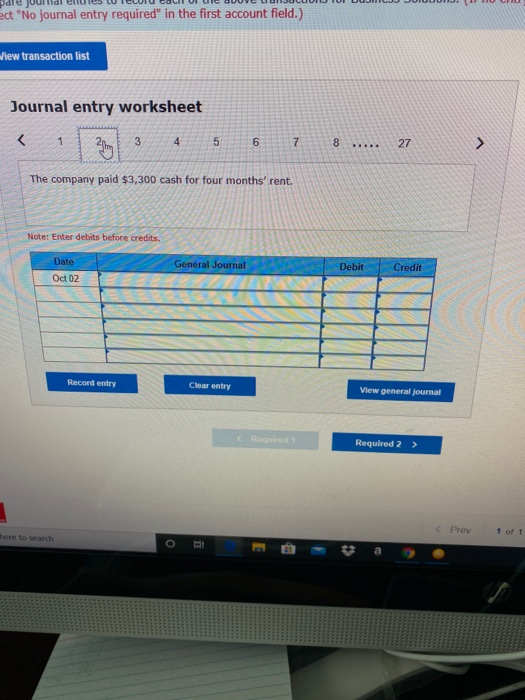

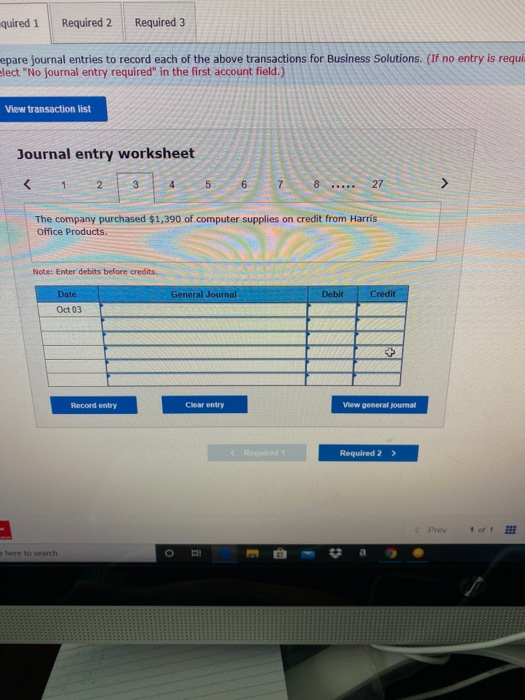

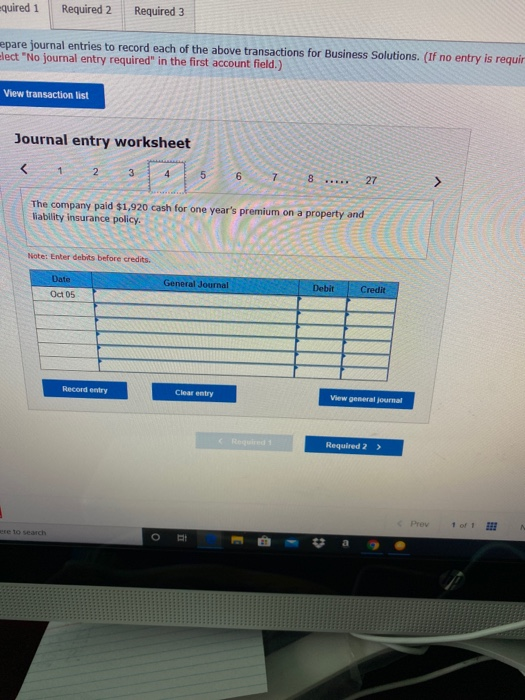

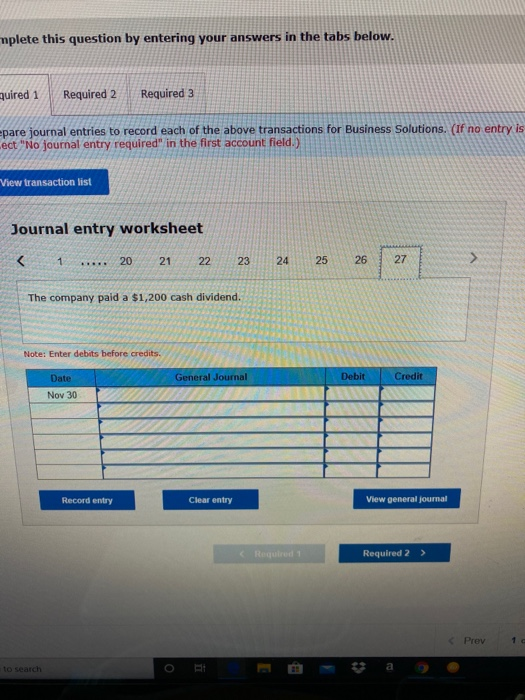

Problem Part 1 On October 1, 2019, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. Rey adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on December 31, 2019 The company's initial chart of accounts follows Account Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accounts Payable No. Account No 101 Common Stock 106 Dividends 126 Computer Services Revenue 483 128 Wages Expense 623 131 Advertising Expense 655 163 Mileage Expense 676 167 Miscellaneous Expenses 677 2 01 Repairs Expense Computer 684 Oct. 1 5. Rey invested $50,000 cash, a $29,000 computer system, and $9,000 of office equipment in the company in exchange for common stock. 2 The company paid $3,300 cash for four months' rent. Hint: Debit Prepaid Rent for $3,300. 3 The company purchased $1,390 of computer supplies on credit from Harris Office Products. 5 The company paid $1,920 cash for one year's premium on a property and liability insurance policy. Hint: Debit Prepaid Insurance for $1,920. 6 The company billed Easy Leasing $5,300 for services performed in installing a new Web server. 8 The company paid $1,390 cash for the computer supplies purchased from Harris Office Products on October 3. 10 The company hired Lyn Addie as a part-time assistant. 12 The company billed Easy Leasing another $1,500 for services performed. 15 The company received $5,300 cash from Easy Leasing as partial payment on its account. 17 The company paid $765 cash to repair computer equipment that was damaged when moving it. 20 The company paid $1,698 cash for advertisements published in the local newspaper 22 The company received $1,500 cash from Easy Leasing on its account. 28 The company billed IFM Company $5,788 for services performed. 31 The company paid $840 cash for Lyn Addie's wages for seven days' work. 31 The company paid a $2,900 cash dividend. N i nach fon business automobile mileage allowance (Rey logged 1,000 28 The company billed IFM Company $5,708 for services performed. 31 The company paid $840 cash for Lyn Addie's wages for seven days' work. 31 The company paid a $2,900 cash dividend. Nov. 1 The company reimbursed 5. Rey in cash for business automobile mileage allowance (Rey logged 1,000 miles at $0.30 per mile). 2 The company received $5,533 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1,090 cash from Harris Office Products. 8 The company billed Gomez Co. $6,368 for services performed. 13 The company agreed to perform tuture services for Alex's Engineering Co. No work has yet been performed. 18 The company received $3,308 cash from IFM Company as partial payment of the October 28 bill. 22 The company paid $250 cash for miscellaneous expenses. Wint: Debit Miscellaneous Expense for $250. 24 The company completed work and sent a bill for $4,450 to Alex's Engineering Co. 25 The company sent another bill to IFM Company for the past due amount of $2,489. 28 The company reimbursed 5. Rey in cash for business automobile mileage (1,200 miles at se. 30 per wile). 30 The company paid $1,680 cash for Lyn Addie's wages for 14 days wo 30 The company paid a $1,200 cash dividend. Required: 1. Prepare journal entries to record each of the above transactions for Business Solutions 2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement to them. 3. Prepare a trial balance as of the end of November Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record each of the above transactions for Business Solutions. (If no entry is required for a transaction/event Select No journal entry required in the first account field.) Viw transaction list Journal entry worksheet 27 s. Key into 3.cash, 129,000 computer system, and $9,000 of oliquipment the company in exchange for common stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a trial balance as of the end of November. BUSINESS SOLUTIONS Trial Balance November 30 Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Computer equipment Accounts payable Common Stock Dividends Computer services revenue Wages expense Advertising expense SRBEEL Mileage expense Miscellaneous expense Repairs expense Computer Totals S. Rey invested $50,000 cash, a $29,000 computer system, and $9,000 of office equipment in the company in exchange for common stock. Note: Enter debits before credits. General Journal Debit Credit Date Oct 01 Record entry Clear entry View general journal S Prov to search JUU YOU OUwJUI t"No journal entry required" in the first account field.) wew transaction list Journal entry worksheet [ 12/13 3 45 ..... 27 The company paid $3,300 cash for four months' rent. Note: Enter debits before credits General Journal Debit Credit Date Oct 02 Record entry Clear entry View general journal Required Required 2 > Provor ere to search quired 1 Required 2 Required 3 epare journal entries to record each of the above transactions for Business Solutions. (If no entry is requi elect "No journal entry required in the first account field.) View transaction list Journal entry worksheet Prev 1 of 1 here to search Tired 1 Required 2 Required 3 are journal entries to record each of the above transactions for Business Solutions. (If no entry is requir ct "No journal entry required" in the first account field.) lew transaction list Journal entry worksheet The company paid $1,920 cash for one year's premium on a property and liability insurance policy. Note: Enter debits before credits. General Journal Debit Credit Date Od 05 Recorder Clear entry View general journal Required 2 > - Provo 29 to each nplete this question by entering your answers in the tabs below. juired 1 Required 2 Required 3 pare journal entries to record each of the above transactions for Business Solutions. (If no entry is ect "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 ..... 20 21 22 23 24 25 26 27 The company paid a $1,200 cash dividend. Note: Enter debits before credits General Journal Debit Credit Date Nov 30 Record entry Clear entry View general journal - Required to Required 2 > Prev to search