Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there should be more than one answer for the first and third question, someone please help i have asked multiple people on here and dont

there should be more than one answer for the first and third question, someone please help i have asked multiple people on here and dont think anyone is giving me the correct answers because there should be more than one correct answer since the questions lets me pick multiple answers.

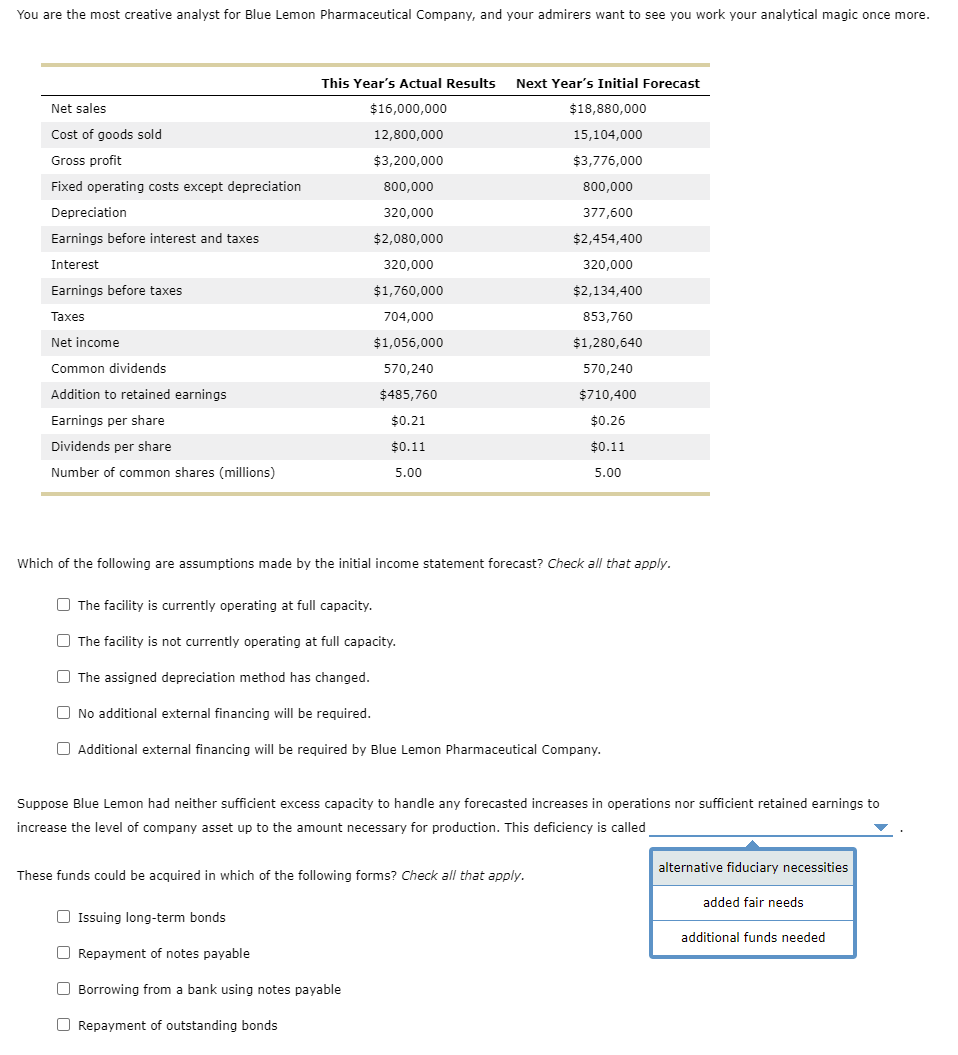

You are the most creative analyst for Blue Lemon Pharmaceutical Company, and your admirers want to see you work your analytical magic once more. This Year's Actual Results Next Year's Initial Forecast Net sales $16,000,000 $18,880,000 12,800,000 15,104,000 Cost of goods sold Gross profit Fixed operating costs except depreciation $3,200,000 $3,776,000 800,000 800,000 Depreciation 320,000 377,600 Earnings before interest and taxes $2,080,000 $2,454,400 Interest 320,000 320,000 $1,760,000 Earnings before taxes $2,134,400 Taxes 704,000 853,760 Net income $1,056,000 $1,280,640 570,240 570,240 $485,760 $710,400 Common dividends Addition to retained earnings Earnings per share Dividends per share Number of common shares (millions) $0.21 $0.26 $0.11 $0.11 5.00 5.00 Which of the following are assumptions made by the initial income statement forecast? Check all that apply. The facility is currently operating at full capacity. The facility is not currently operating at full capacity. The assigned depreciation method has changed. No additional external financing will be required. Additional external financing will be required by Blue Lemon Pharmaceutical Company. Suppose Blue Lemon had neither sufficient excess capacity to handle any forecasted increases in operations nor sufficient retained earnings to increase the level of company asset up to the amount necessary for production. This deficiency is called These funds could acquired in which of the following forms? Check all that apply. alternative fiduciary necessities added fair needs Issuing long-term bonds additional funds needed Repayment of notes payable Borrowing from a bank using notes payable Repayment of outstanding bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started