Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There was an issue with a number of students being unable to view the entire transaction line. I have re-uploaded an updated version circa

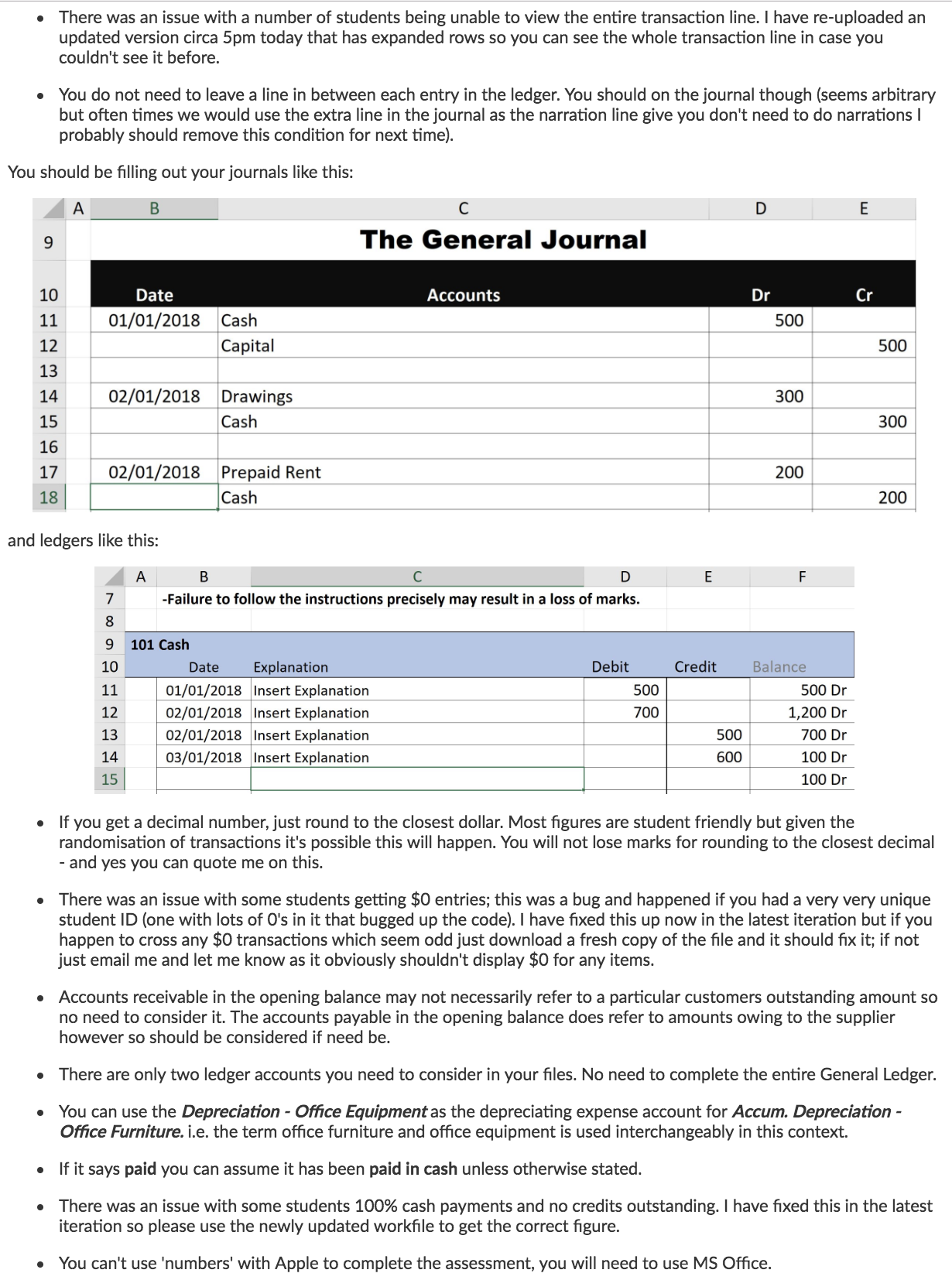

There was an issue with a number of students being unable to view the entire transaction line. I have re-uploaded an updated version circa 5pm today that has expanded rows so you can see the whole transaction line in case you couldn't see it before. You do not need to leave a line in between each entry in the ledger. You should on the journal though (seems arbitrary but often times we would use the extra line in the journal as the narration line give you don't need to do narrations I probably should remove this condition for next time). You should be filling out your journals like this: 9 A B 10 Date 11 01/01/2018 Cash 12 Capital 13 14 02/01/2018 Drawings 15 Cash 16 17 02/01/2018 Prepaid Rent 18 Cash and ledgers like this: C D E The General Journal Accounts Dr Cr 500 500 300 300 200 200 A B C D E F 7 -Failure to follow the instructions precisely may result in a loss of marks. 8 9 101 Cash 10 Date Explanation 11 01/01/2018 Insert Explanation 12 02/01/2018 Insert Explanation 13 02/01/2018 Insert Explanation 14 03/01/2018 Insert Explanation 15 Debit Credit Balance 500 700 500 Dr 1,200 Dr 500 700 Dr 600 100 Dr 100 Dr If you get a decimal number, just round to the closest dollar. Most figures are student friendly but given the randomisation of transactions it's possible this will happen. You will not lose marks for rounding to the closest decimal - and yes you can quote me on this. There was an issue with some students getting $0 entries; this was a bug and happened if you had a very very unique student ID (one with lots of O's in it that bugged up the code). I have fixed this up now in the latest iteration but if you happen to cross any $0 transactions which seem odd just download a fresh copy of the file and it should fix it; if not just email me and let me know as it obviously shouldn't display $0 for any items. Accounts receivable in the opening balance may not necessarily refer to a particular customers outstanding amount so no need to consider it. The accounts payable in the opening balance does refer to amounts owing to the supplier however so should be considered if need be. There are only two ledger accounts you need to consider in your files. No need to complete the entire General Ledger. You can use the Depreciation - Office Equipment as the depreciating expense account for Accum. Depreciation - Office Furniture. i.e. the term office furniture and office equipment is used interchangeably in this context. If it says paid you can assume it has been paid in cash unless otherwise stated. There was an issue with some students 100% cash payments and no credits outstanding. I have fixed this in the latest iteration so please use the newly updated workfile to get the correct figure. You can't use 'numbers' with Apple to complete the assessment, you will need to use MS Office.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started