There were no other non-current assets acquisitions or disposals. A dividend of 150m was paid on ordinary shares during the year. Required a) Prepare a

There were no other non-current assets acquisitions or disposals. A dividend of £150m was paid on ordinary shares during the year.

Required

a) Prepare a cash flow statement for Blackheath plc for the year ended 31st December 2021.

b) Make any relevant comments about Blackheath's plc's cash flow statement which you feel should be drawn to the attention of its management.

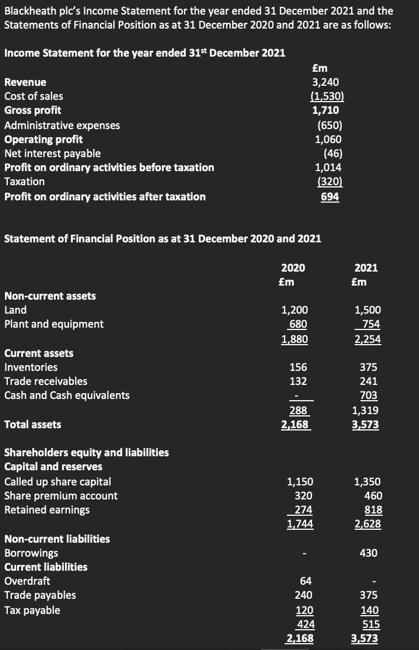

Blackheath plc's Income Statement for the year ended 31 December 2021 and the Statements of Financial Position as at 31 December 2020 and 2021 are as follows: Income Statement for the year ended 31st December 2021 Revenue Cost of sales Gross profit Administrative expenses Operating profit Net interest payable Profit on ordinary activities before taxation Taxation Profit on ordinary activities after taxation Non-current assets Land Plant and equipment Current assets Inventories Statement of Financial Position as at 31 December 2020 and 2021 2020 m Trade receivables Cash and Cash equivalents Total assets Shareholders equity and liabilities Capital and reserves Called up share capital Share premium account Retained earnings Non-current liabilities Borrowings Current liabilities Overdraft Trade payables Tax payable 1,200 680 1,880 156 132 m 3,240 (1,530) 1,710 288 2,168 1,150 320 274 1,744 64 240 120 (650) 1,060 (46) 1,014 (320) 694 2,168 424 2021 m 1,500 754 2,254 375 241 703 1,319 3,573 1,350 460 818 2,628 430 375 140 515 3,573

Step by Step Solution

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started