Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Therefore, please use PW amounts here. ** Please do not express the work in a table, but rather written out with formulas and their calculations.

Therefore, please use PW amounts here.

Therefore, please use PW amounts here.

** Please do not express the work in a table, but rather written out with formulas and their calculations.

Please and thank you!

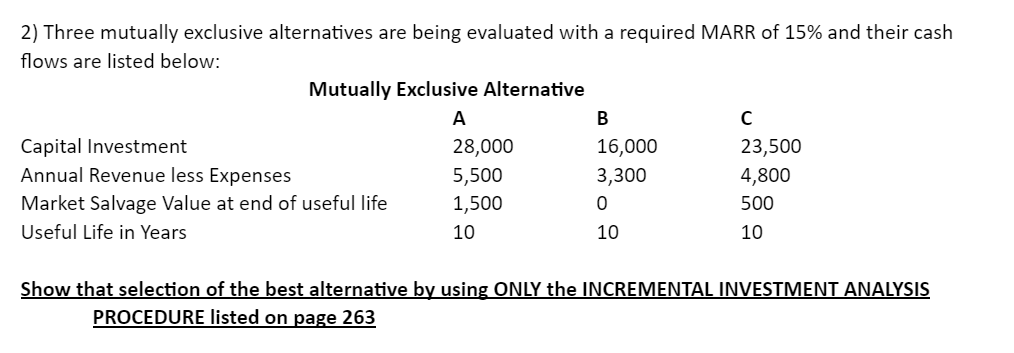

2) Three mutually exclusive alternatives are being evaluated with a required MARR of 15% and their cash flows are listed below: Mutually Exclusive Alternative 16,000 3,300 Capital Investment Annual Revenue less Expenses Market Salvage Value at end of useful life Useful Life in Years 28,000 5,500 1,500 10 23,500 4,800 500 10 10 Show that selection of the best alternative by using ONLY the INCREMENTAL INVESTMENT ANALYSIS PROCEDURE listed on page 263Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started