these are all the questions I need help with thank you

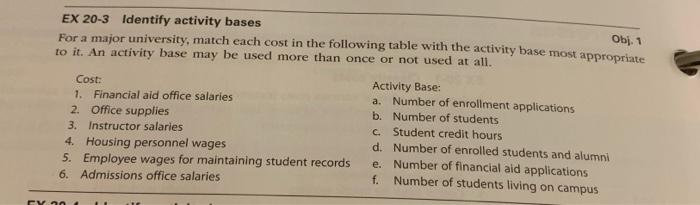

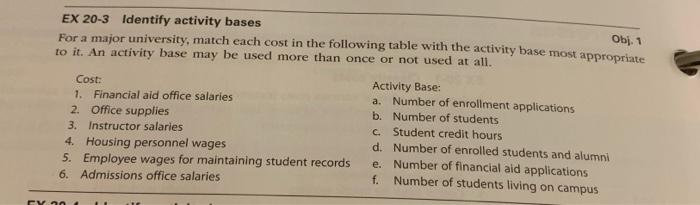

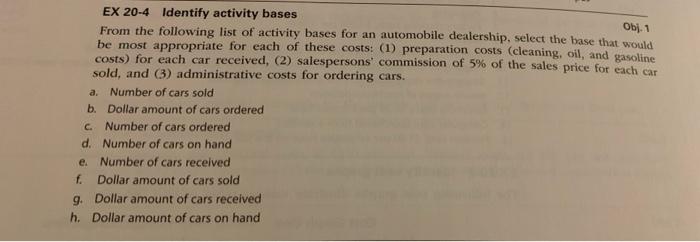

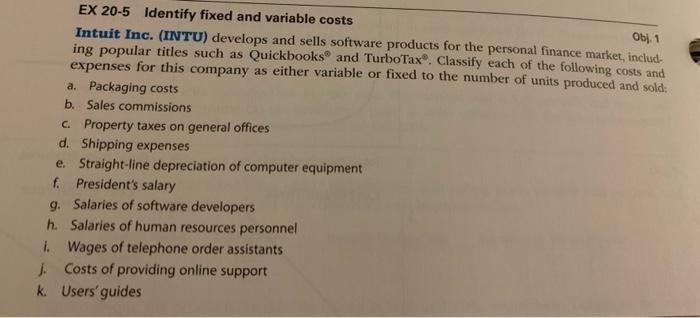

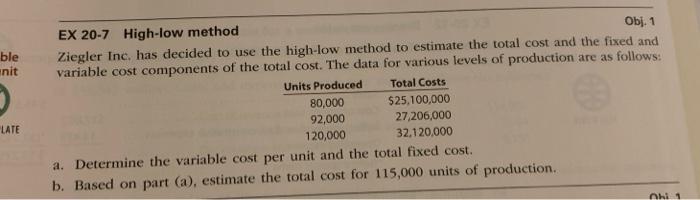

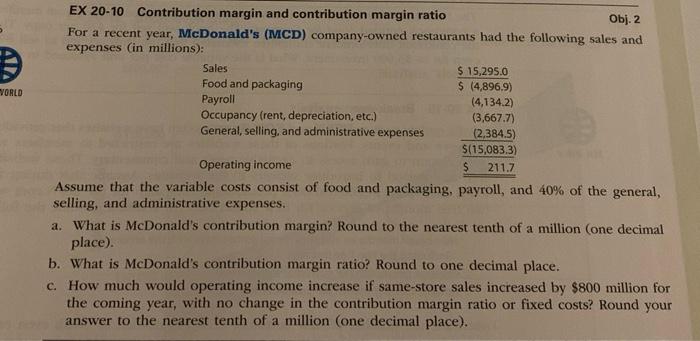

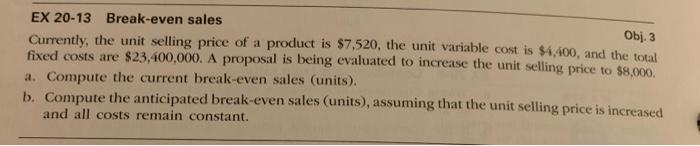

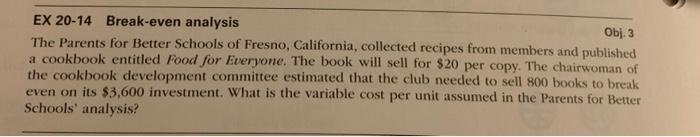

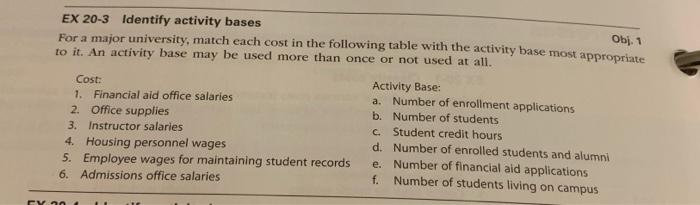

EX 20-3 Identify activity bases Obj. 1 For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all. Cost: Activity Base: 1. Financial aid office salaries Number of enrollment applications 2. Office supplies b. Number of students 3. Instructor salaries c. Student credit hours 4. Housing personnel wages d. Number of enrolled students and alumni 5. Employee wages for maintaining student records e. Number of financial aid applications 6. Admissions office salaries f. Number of students living on campus a. FY EX 20-4 Identify activity bases Obj. 1 From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs cleaning, oil, and gasoline costs) for each car received, (2) salespersons' commission of 5% of the sales price for each car sold, and (3) administrative costs for ordering cars. a. Number of cars sold b. Dollar amount of cars ordered c. Number of cars ordered d. Number of cars on hand e Number of cars received f Dollar amount of cars sold 9. Dollar amount of cars received h. Dollar amount of cars on hand EX 20-5 Identify fixed and variable costs Obj. 1 Intuit Inc. (INTU) develops and sells software products for the personal finance market, includ- ing popular titles such as Quickbooks and TurboTax Classify each of the following costs and expenses for this company as either variable or fixed to the number of units produced and sold: a. Packaging costs b. Sales commissions c Property taxes on general offices d. Shipping expenses e Straight-line depreciation of computer equipment f. President's salary 9. Salaries of software developers h. Salaries of human resources personnel 1. Wages of telephone order assistants J. Costs of providing online support k Users' guides ble nit EX 20-7 High-low method Obj. 1 Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 80,000 $25,100,000 92,000 27,206,000 120,000 32.120,000 a. Determine the variable cost per unit and the total fixed cost. b. Based on part (a), estimate the total cost for 115,000 units of production. LATE . 1 YORLD EX 20-10 Contribution margin and contribution margin ratio Obj. 2 For a recent year, McDonald's (MCD) company-owned restaurants had the following sales and expenses (in millions): Sales $ 15,295.0 Food and packaging $ (4,896.9) Payroll (4,134.2) Occupancy (rent, depreciation, etc.) (3,667.7) General, selling, and administrative expenses (2.384.5) $(15,083.3) Operating income $ 211.7 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place). b. What is McDonald's contribution margin ratio? Round to one decimal place. c. How much would operating income increase if same-store sales increased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place). EX 20-13 Break-even sales Obj.3 Currently, the unit selling price of a product is $7,520, the unit variable cost is $4,400, and the total fixed costs are $23,400,000. A proposal is being evaluated to increase the unit selling price to $8,000, a. Compute the current break-even sales (units). b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant. EX 20-14 Break-even analysis Obj. 3 The Parents for Better Schools of Fresno, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $20 per copy. The chairwoman of the cookbook development committee estimated that the club needed to sell 800 books to break even on its $3,600 investment. What is the variable cost per unit assumed in the Parents for Better Schools' analysis