Answered step by step

Verified Expert Solution

Question

1 Approved Answer

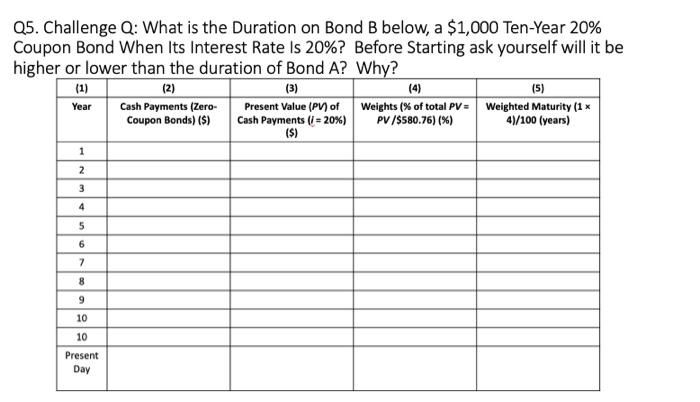

these are all three completely different questions Q5. Challenge Q: What is the Duration on Bond B below, a $1,000 Ten-Year 20% Coupon Bond When

these are all three completely different questions

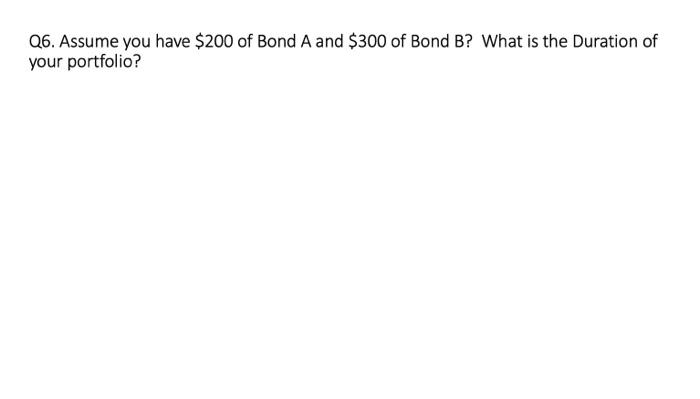

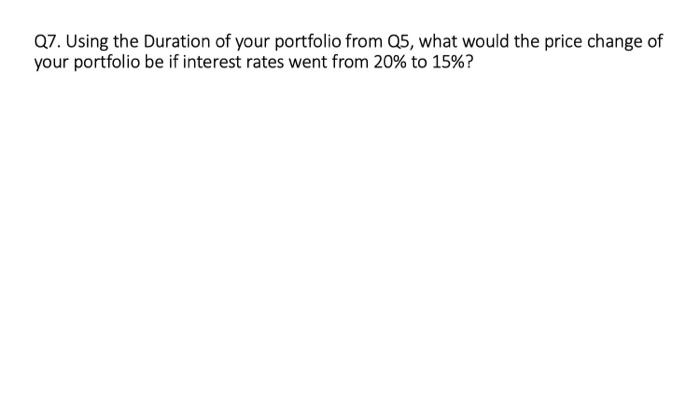

Q5. Challenge Q: What is the Duration on Bond B below, a $1,000 Ten-Year 20% Coupon Bond When Its Interest Rate Is 20% ? Before Starting ask yourself will it be higher or lower than the duration of Bond A? Why? Q6. Assume you have $200 of Bond A and $300 of Bond B? What is the Duration of your portfolio? Q7. Using the Duration of your portfolio from Q5, what would the price change of your portfolio be if interest rates went from 20% to 15% ? Q5. Challenge Q: What is the Duration on Bond B below, a $1,000 Ten-Year 20% Coupon Bond When Its Interest Rate Is 20% ? Before Starting ask yourself will it be higher or lower than the duration of Bond A? Why? Q6. Assume you have $200 of Bond A and $300 of Bond B? What is the Duration of your portfolio? Q7. Using the Duration of your portfolio from Q5, what would the price change of your portfolio be if interest rates went from 20% to 15% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started