Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are audit simulations from the CPA exam. The AICPA has developed these to prepare candidates for professional certification. Task #1 Green, CPA, is

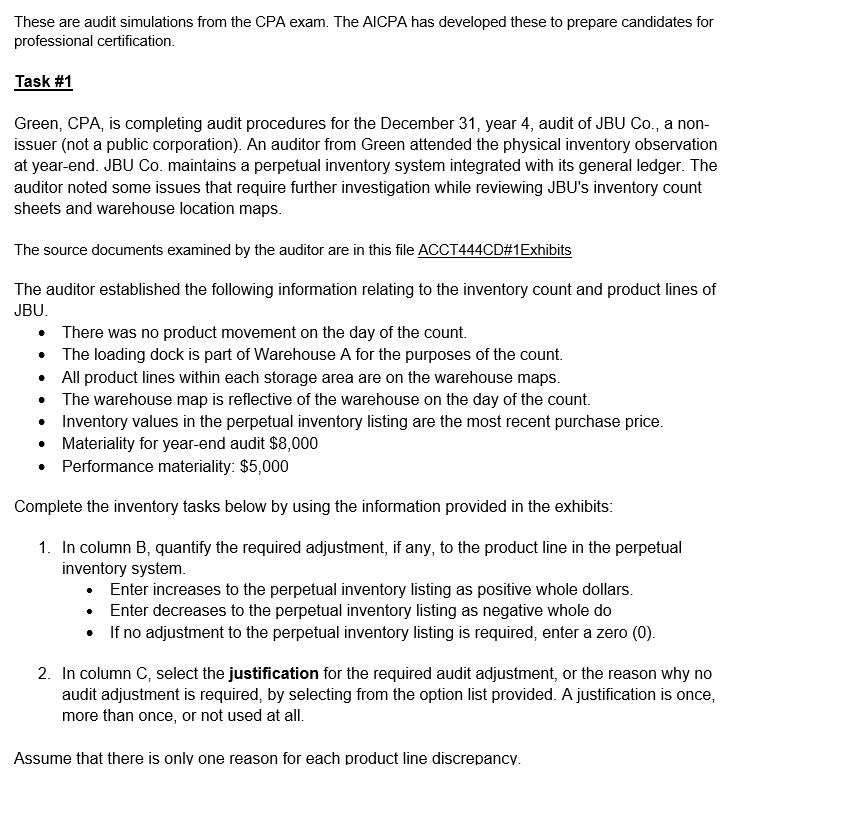

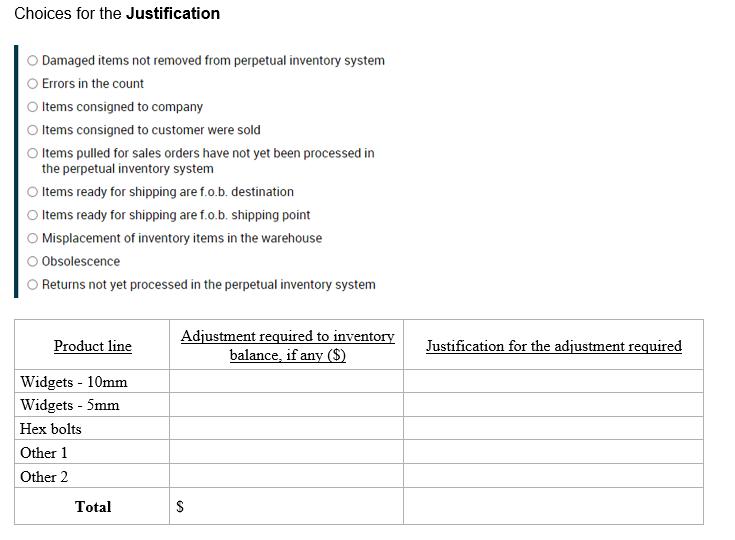

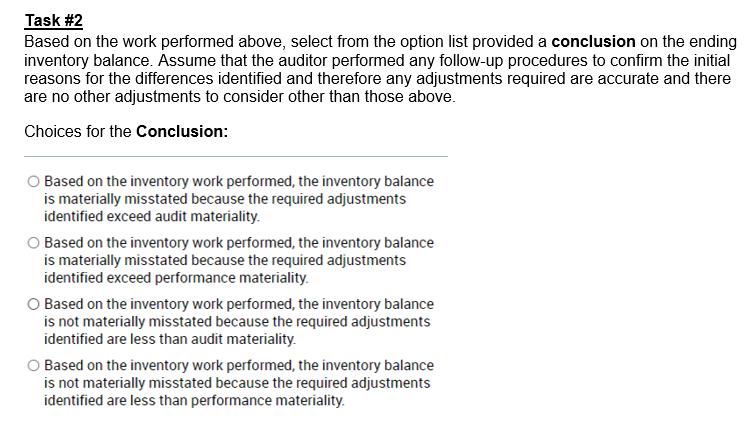

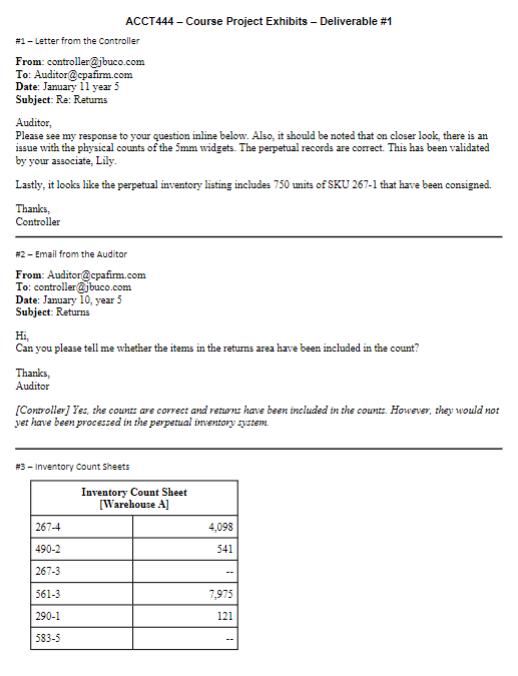

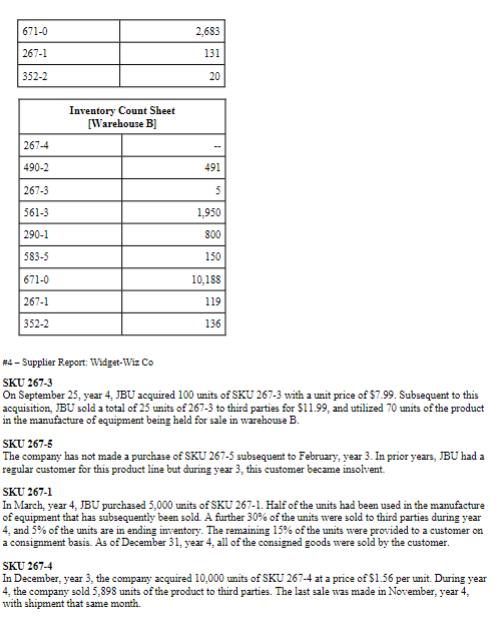

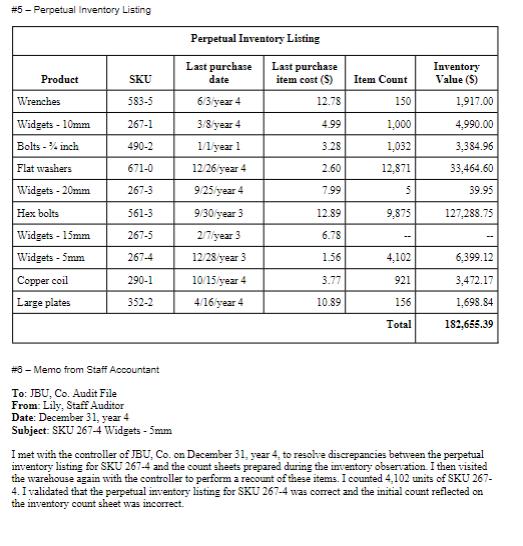

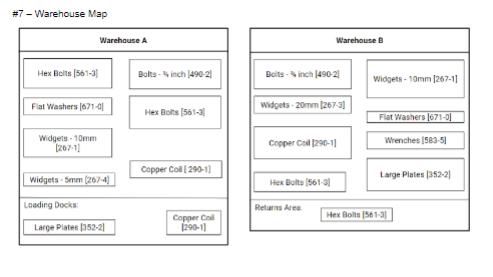

These are audit simulations from the CPA exam. The AICPA has developed these to prepare candidates for professional certification. Task #1 Green, CPA, is completing audit procedures for the December 31, year 4, audit of JBU Co., a non- issuer (not a public corporation). An auditor from Green attended the physical inventory observation at year-end. JBU Co. maintains a perpetual inventory system integrated with its general ledger. The auditor noted some issues that require further investigation while reviewing JBU's inventory count sheets and warehouse location maps. The source documents examined by the auditor are in this file ACCT444CD#1 Exhibits The auditor established the following information relating to the inventory count and product lines of JBU. There was no product movement on the day of the count. The loading dock is part of Warehouse A for the purposes of the count. All product lines within each storage area are on the warehouse maps. The warehouse map is reflective of the warehouse on the day of the count. Inventory values in the perpetual inventory listing are the most recent purchase price. Materiality for year-end audit $8,000 Performance materiality: $5,000 Complete the inventory tasks below by using the information provided in the exhibits: 1. In column B, quantify the required adjustment, if any, to the product line in the perpetual inventory system. Enter increases to the perpetual inventory listing as positive whole dollars. Enter decreases to the perpetual inventory listing as negative whole do If no adjustment to the perpetual inventory listing is required, enter a zero (0). 2. In column C, select the justification for the required audit adjustment, or the reason why no audit adjustment is required, by selecting from the option list provided. A justification is once, more than once, or not used at all. Assume that there is only one reason for each product line discrepancy. Choices for the Justification Damaged items not removed from perpetual inventory system Errors in the count O Items consigned to company Items consigned to customer were sold Items pulled for sales orders have not yet been processed in the perpetual inventory system Items ready for shipping are f.o.b. destination Items ready for shipping are f.o.b. shipping point Misplacement of inventory items in the warehouse Obsolescence Returns not yet processed in the perpetual inventory system Product line Widgets - 10mm Widgets - 5mm Hex bolts Other 1 Other 2 Total Adjustment required to inventory balance, if any ($) S Justification for the adjustment required Task #2 Based on the work performed above, select from the option list provided a conclusion on the ending inventory balance. Assume that the auditor performed any follow-up procedures to confirm the initial reasons for the differences identified and therefore any adjustments required are accurate and there are no other adjustments to consider other than those above. Choices for the Conclusion: Based on the inventory work performed, the inventory balance is materially misstated because the required adjustments identified exceed audit materiality. Based on the inventory work performed, the inventory balance is materially misstated because the required adjustments identified exceed performance materiality. O Based on the inventory work performed, the inventory balance is not materially misstated because the required adjustments identified are less than audit materiality. O Based on the inventory work performed, the inventory balance is not materially misstated because the required adjustments identified are less than performance materiality. #1 - Letter from the Controller From: controller@jbuco.com To: Auditor@cpafirm.com Date: January 11 year 5 Subject: Re: Returns ACCT444 - Course Project Exhibits - Deliverable #1 Auditor, Please see my response to your question inline below. Also, it should be noted that on closer look, there is an issue with the physical counts of the 5mm widgets. The perpetual records are correct. This has been validated by your associate, Lily. Lastly, it looks like the perpetual inventory listing includes 750 units of SKU 267-1 that have been consigned. Thanks, Controller #2 - Email from the Auditor From: Auditor@cpafirm.com To: controller@jbuco.com Date: January 10, year 5 Subject: Returns Can you please tell me whether the items in the returns area have been included in the count? Thanks, Auditor [Controller] Yes, the counts are correct and returns have been included in the counts. However, they would not yet have been processed in the perpetual inventory system. #3 - Inventory Count Sheets 267-4 490-2 267-3 561-3 290-1 583-5 Inventory Count Sheet [Warehouse A] 4,098 541 7,975 121 671-0 267-1 352-2 267-4 490-2 267-3 561-3 290-1 583-5 671-0 267-1 352-2 Inventory Count Sheet [Warehouse B] 2,683 131 20 491 5 1,950 800 150 10,188 119 136 #4- Supplier Report: Widget-Wiz Co SKU 267-3 On September 25, year 4, JBU acquired 100 units of SKU 267-3 with a unit price of $7.99. Subsequent to this acquisition, JBU sold a total of 25 units of 267-3 to third parties for $11.99, and utilized 70 units of the product in the manufacture of equipment being held for sale in warehouse B. SKU 267-5 The company has not made a purchase of SKU 267-5 subsequent to February, year 3. In prior years, JBU had a regular customer for this product line but during year 3, this customer became insolvent. SKU 267-1 In March, year 4, JBU purchased 5,000 units of SKU 267-1. Half of the units had been used in the manufacture of equipment that has subsequently been sold. A further 30% of the units were sold to third parties during year 4, and 5% of the units are in ending inventory. The remaining 15% of the units were provided to a customer on a consignment basis. As of December 31, year 4, all of the consigned goods were sold by the customer. SKU 267-4 In December, year 3, the company acquired 10,000 units of SKU 267-4 at a price of $1.56 per unit. During year 4, the company sold 5,898 units of the product to third parties. The last sale was made in November, year 4, with shipment that same month. # 5 - Perpetual Inventory Listing Product Wrenches Widgets - 10mm Bolts -% inch Flat washers Widgets - 20mm Hex bolts Widgets - 15mm Widgets - 5mm Copper coil Large plates SKU 583-5 267-1 490-2 671-0 267-3 561-3 267-5 267-4 290-1 352-2 #6 - Memo from Staff Accountant To: JBU, Co. Audit File From: Lily, Staff Auditor Date: December 31, year 4 Subject: SKU 267-4 Widgets - 5mm Perpetual Inventory Listing Last purchase Last purchase date item cost (S) 6/3 year 4 3/8/year 4 1/1/year 1 12/26/year 4 9/25/year 4 9/30/year 3 2/7/year 3 12/28/year 3 10/15/year 4 4/16/year 4 12.78 4.99 3.28 2.60 7.99 12.89 6.78 1.56 3.77 10.89 Item Count 150 1,000 1,032 12,871 5 9,875 4,102 921 156 Total Inventory Value (S) 1,917.00 4,990.00 3,384.96 33,464.60 39.95 127,288.75 6,399.12 3,472.17 1,698.84 182,655.39 I met with the controller of JBU, Co. on December 31, year 4, to resolve discrepancies between the perpetual inventory listing for SKU 267-4 and the count sheets prepared during the inventory observation. I then visited the warehouse again with the controller to perform a recount of these items. I counted 4,102 units of SKU 267- 4. I validated that the perpetual inventory listing for SKU 267-4 was correct and the initial count reflected on the inventory count sheet was incorrect. # 7 - Warehouse Map Warehouse A Hex Bolts [561-3) Flat Washers (671-01 Widgets-10mm [267-1] Widgets-5mm (267-4) Loading Docks Large Plates [152-2] Bolts-inch (490-21 Hex Bolts [561-3 Copper Coll (290-1) Copper Col [290-11 Boits-inch (490-21 Warehouse B widgets-20mm [267-3] Copper Coll1290-11 Hex Bolts (561-3 Returns Area Widgets-10mm 1267-1] Flat Washers (671-0] Wrenches (583-5] Large Plates (352-2) Hex Bolts [561-3

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

O Damaged items not removed from perpetual inventory system Errors in the count OItems con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started