these are background information for part 1. heres part 2 question i need answered

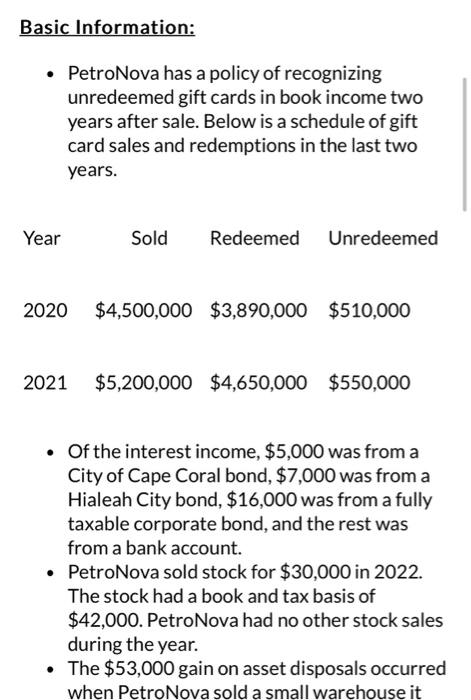

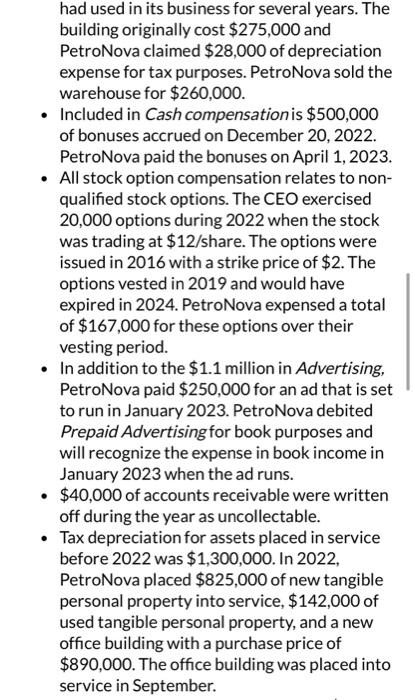

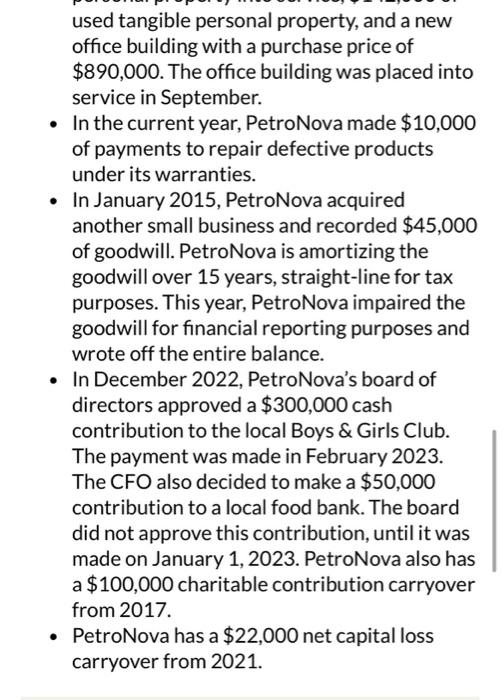

Basic Information: - PetroNova has a policy of recognizing unredeemed gift cards in book income two years after sale. Below is a schedule of gift card sales and redemptions in the last two years. - Of the interest income, $5,000 was from a City of Cape Coral bond, $7,000 was from a Hialeah City bond, $16,000 was from a fully taxable corporate bond, and the rest was from a bank account. - PetroNova sold stock for $30,000 in 2022. The stock had a book and tax basis of $42,000. PetroNova had no other stock sales during the year. - The $53,000 gain on asset disposals occurred when PetroNova sold a small warehouse it had used in its business for several years. The building originally cost $275,000 and PetroNova claimed $28,000 of depreciation expense for tax purposes. PetroNova sold the warehouse for $260,000. - Included in Cash compensation is $500,000 of bonuses accrued on December 20, 2022. PetroNova paid the bonuses on April 1, 2023. - All stock option compensation relates to nonqualified stock options. The CEO exercised 20,000 options during 2022 when the stock was trading at $12/ share. The options were issued in 2016 with a strike price of \$2. The options vested in 2019 and would have expired in 2024. PetroNova expensed a total of $167,000 for these options over their vesting period. - In addition to the $1.1 million in Advertising, PetroNova paid $250,000 for an ad that is set to run in January 2023. PetroNova debited Prepaid Advertising for book purposes and will recognize the expense in book income in January 2023 when the ad runs. - $40,000 of accounts receivable were written off during the year as uncollectable. - Tax depreciation for assets placed in service before 2022 was $1,300,000. In 2022, PetroNova placed $825,000 of new tangible personal property into service, $142,000 of used tangible personal property, and a new office building with a purchase price of $890,000. The office building was placed into service in September. used tangible personal property, and a new office building with a purchase price of $890,000. The office building was placed into service in September. - In the current year, PetroNova made $10,000 of payments to repair defective products under its warranties. - In January 2015, PetroNova acquired another small business and recorded $45,000 of goodwill. PetroNova is amortizing the goodwill over 15 years, straight-line for tax purposes. This year, PetroNova impaired the goodwill for financial reporting purposes and wrote off the entire balance. - In December 2022, PetroNova's board of directors approved a $300,000 cash contribution to the local Boys \& Girls Club. The payment was made in February 2023. The CFO also decided to make a $50,000 contribution to a local food bank. The board did not approve this contribution, until it was made on January 1,2023. PetroNova also has a $100,000 charitable contribution carryover from 2017. - PetroNova has a $22,000 net capital loss carryover from 2021. Part III, Planning Email (20 points) - Provide tax advice in a brief (maximum 1 page). planning email addressed to the PetroNova CEO, Kyle Schwarber, from you, their tax accountant. Be sure to use professional, client-ready formatting and language for your document and include your firm's branding and your professional signature. PetroNova has two questions it would like you to address about its 2023 tax position: 1) How can PetroNova reduce its tax liability in 2023 based on the fact pattern in Part 1? Provide at least two specific ways. Cite evidence (i.e., code, rules) to support your advice and be sure to include dollar value impact as well as conceptual impact. You are welcome to include tax credits or business in your advice, keeping in mind that PetroNova is a C Corporation