these are for the same quistion A and B and please i need the answer to be quickly thank you

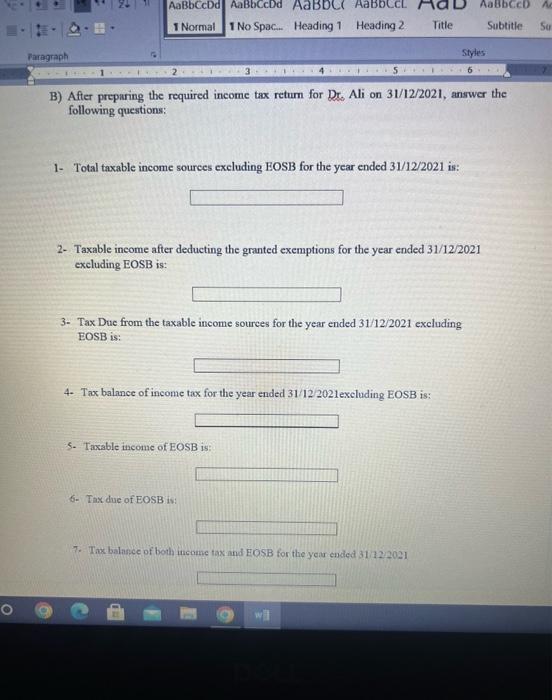

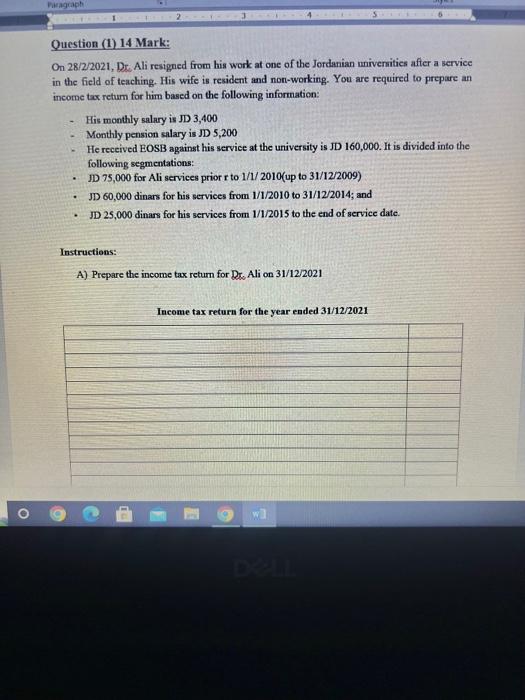

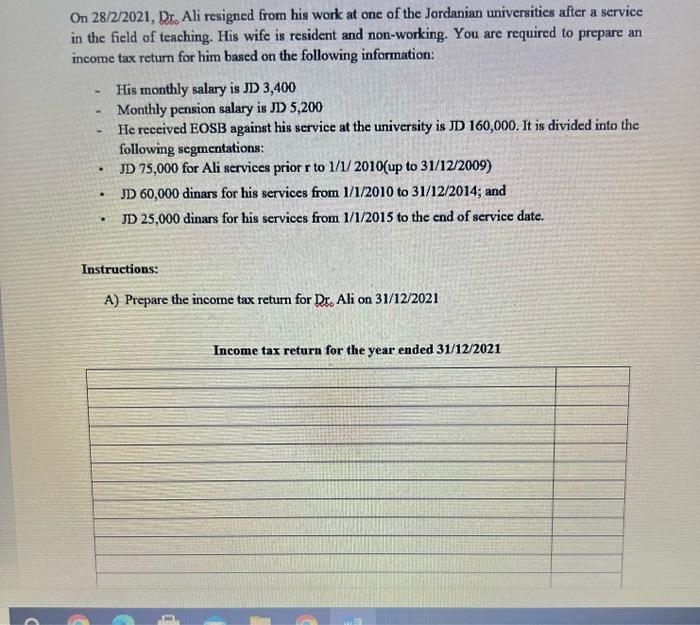

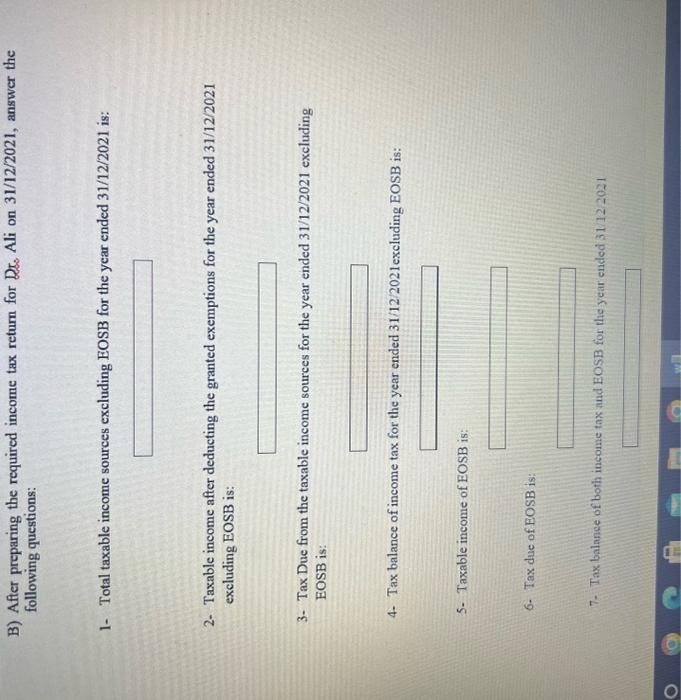

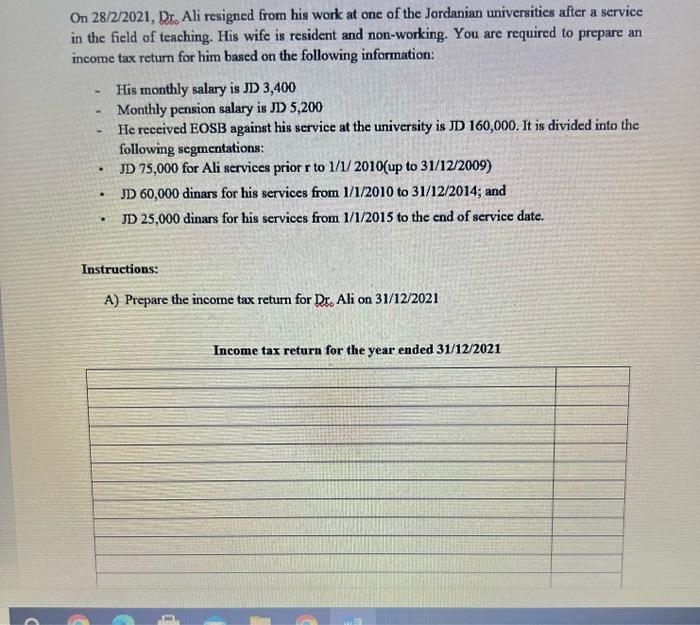

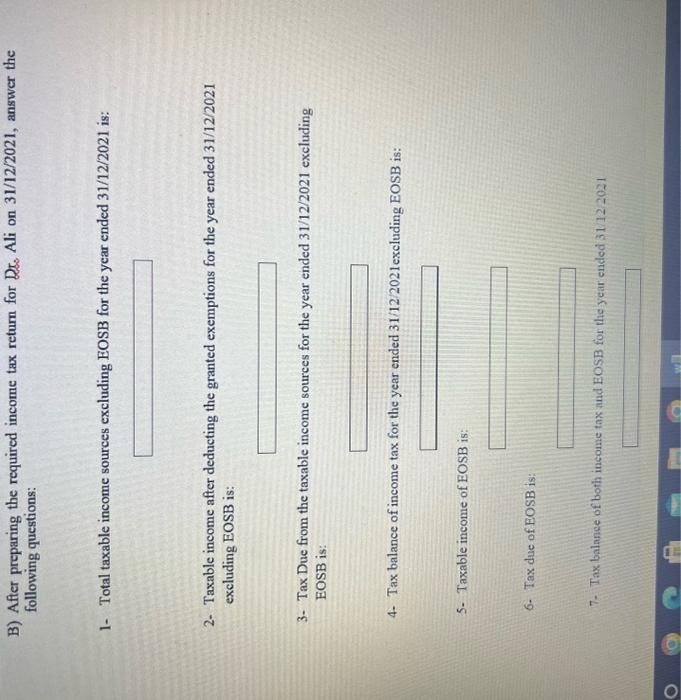

Texsthon Acignancat i Li (20 Marts) Question (t) 14 Mierth Aldowite questions Niceta proine watsy a 70:3760 foterntal wemaravixes nachaling fosi in: lastractions: LOsil in teroen Gai rotere fer the year ended 3112 cona - Twath ixime affoster: 6 Takitar of ioin " Question (1) 14 Mark: On 28/2/2021, D. Ali resigned from his work at one of the Jordanian universitics after a service in the field of teaching. His wife is resident and non-working. You are required to prepare an income tax return for him based on the following information: - His monthly salary is D3,400 - Monthly pension salary is D5,200 - He received EOSB against his service at the university is J 160,000. It is divided into the following segmentations: - JD 75,000 for Ali services prior r to 1/1/2010 (up to 31/12/2009 ) - JD 60,000 dinars for his services from 1/1/2010 to 31/12/2014; and - D 25,000 dinars for his services from 1/1/2015 to the end of service date. Instructions: A) Prepare the income tax return for Dr. Ali on 31/12/2021 Income tax return for the year ended 31/12/2021 B) After preparing the required income tax retum for Dr. Ali on 31/12/2021, answer the following questions: 1- Total taxable income sources cxcluding EOSB for the year ended 31/12/2021 is: 2- Taxable ineome after deducting the granted exemptions for the year ended 31/12/2021 excluding EOSB is: 3- Tax Due from the taxable income sources for the year ended 31/12/2021 excluding EOSB is: 4. Tax balance of income tax for the year ended 31/12/2021 excluding EOSB is: 5. Taxable income of EOSB is: 6. Tax due of EOSB is: 7. Tax balance of both inconce tax and EOSB for the year ended 31122021 Question (1) 14 Mark: On 28/2/2021, De. Ali resigned from his work at one of the Jordanian mivenitics after a service in the field of teaching. His wife is resident and non-working. You are required to prepare an income tox retum for him based on the following information: - His monthly salary is R3,400 - Monthly pension salary is JD,200 - He received EOSB against his service at the university is JD160,000. It is divided into the following segmentations: - ID 75,000 for Ali services prior r to 1/1/2010 (up to 31/12/2009) - JD 60,000 dinars for his services from 1/1/2010 to 31/12/2014; and - ID 25,000 dinars for his services from 1/1/2015 to the end of service date. Instructions: A) Prepare the income tax return for Dr. Ali on 31/12/2021 On 28/2/2021, Dr. Ali resigned from his work at one of the Jordanian universities after a service in the field of teaching. His wife is resident and non-working. You are required to prepare an income tax return for him based on the following information: - His monthly salary is JD 3,400 - Monthly pension salary is JD 5,200 - He received EOSB against his service at the university is JD 160,000 . It is divided into the following segmentations: - JD 75,000 for Ali services prior r to 1/1/2010 (up to 31/12/2009) - JD 60,000 dinars for his services from 1/1/2010 to 31/12/2014; and - JD 25,000 dinars for his services from 1/1/2015 to the end of service date. Instructions: A) Prepare the income tax return for Dr. Ali on 31/12/2021 Income tax return for the year ended 31/12/2021 B) After preparing the required income tax return for Dr. Ali on 31/12/2021, answer the following questions: 1- Total taxable income sources excluding EOSB for the year ended 31/12/2021 is: 2- Taxable income after deducting the granted exemptions for the year ended 31/12/2021 excluding EOSB is: 3. Tax Due from the taxable income sources for the year ended 31/12/2021 excluding EOSB is: 4. Tax balance of income tax for the year ended 31/12/2021 excluding EOSB is: 5. Taxable income of EOSB is: 6. Tax due of EOSB is: 7. Tax balance of both income tax and EOSB for the year ended 31122021 On 28/2/2021, Dr. Ali resigned from his work at one of the Jordanian universities after a service in the field of teaching. His wife is resident and non-working. You are required to prepare an income tax return for him based on the following information: - His monthly salary is JD 3,400 - Monthly pension salary is JD 5,200 - He received EOSB against his service at the university is JD 160,000. It is divided into the following segmentations: - JD 75,000 for Ali services prior r to 1/1/2010 (up to 31/12/2009) - JD 60,000 dinars for his services from 1/1/2010 to 31/12/2014; and - JD 25,000 dinars for his services from 1/1/2015 to the end of service date. Instructions: A) Prepare the income tax return for Dr. Ali on 31/12/2021 Income tax return for the year ended 31/12/2021

these are for the same quistion A and B and please i need the answer to be quickly thank you

these are for the same quistion A and B and please i need the answer to be quickly thank you