These are the accounts to use. I have asked this question once before and it was wrong.

These are the accounts to use. I have asked this question once before and it was wrong.

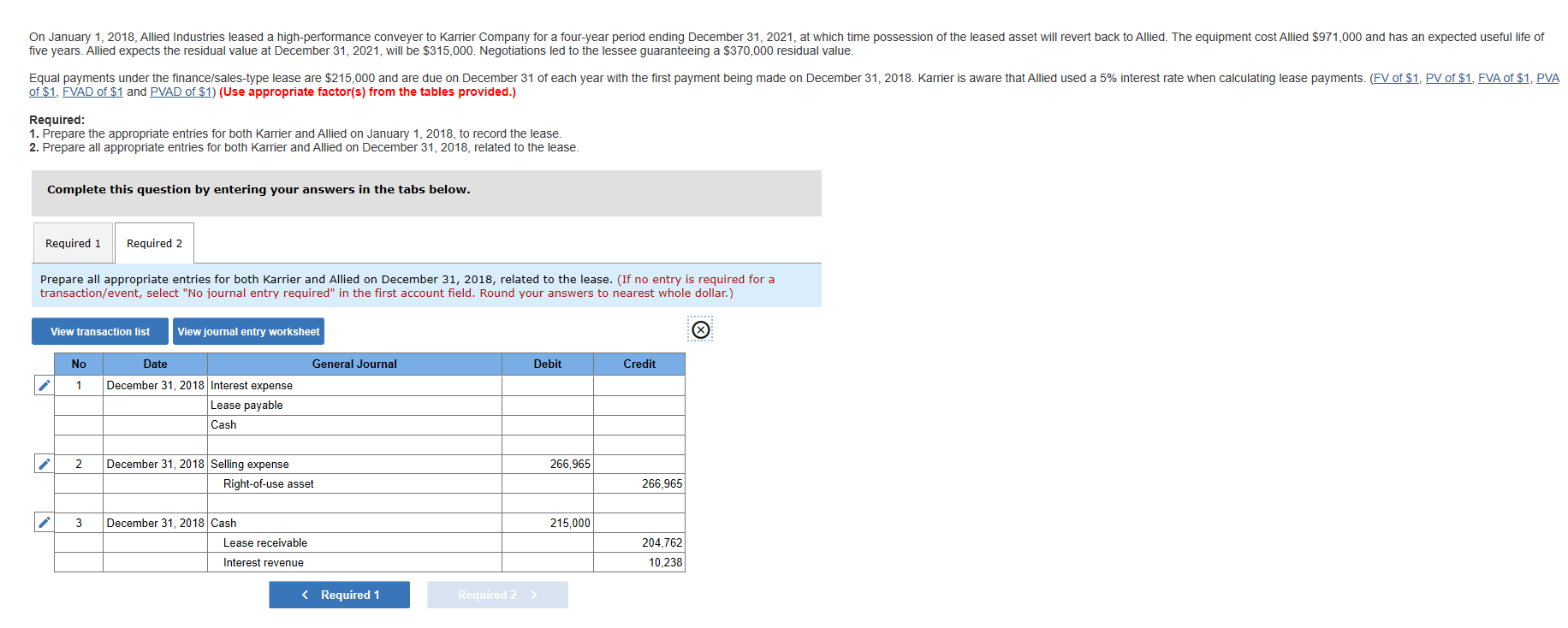

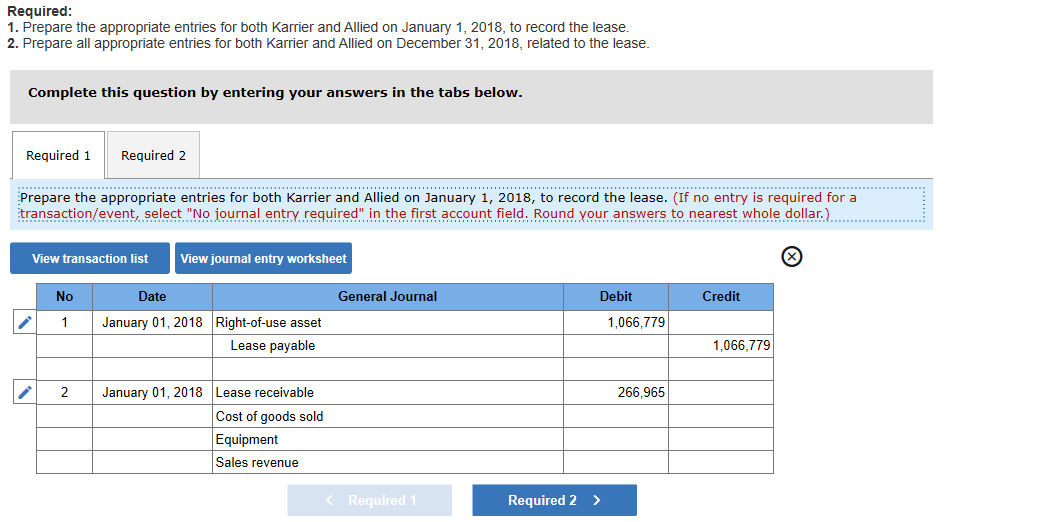

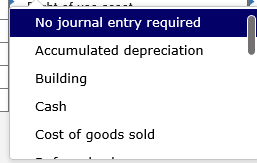

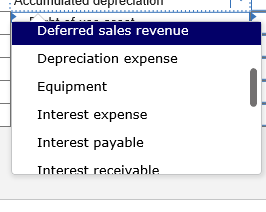

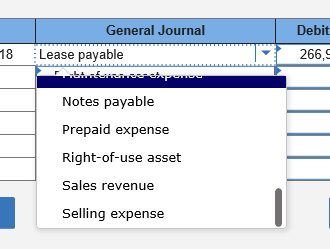

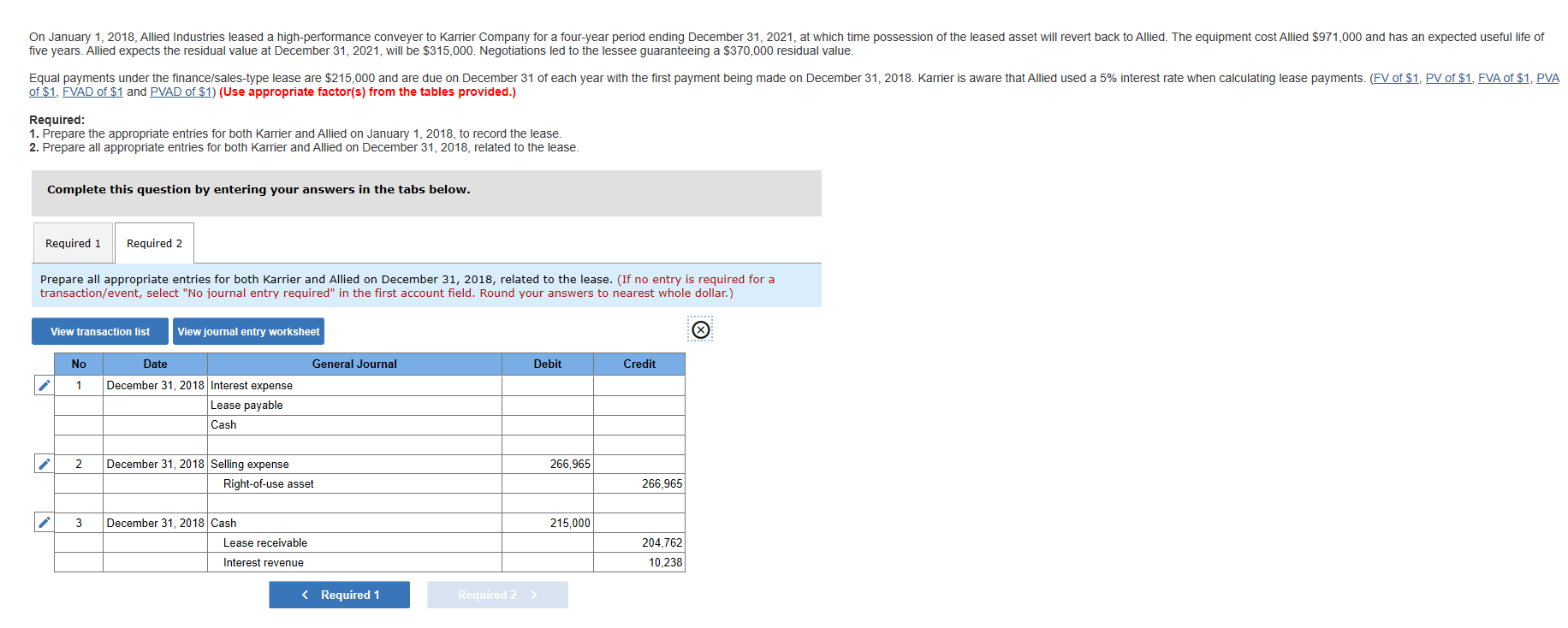

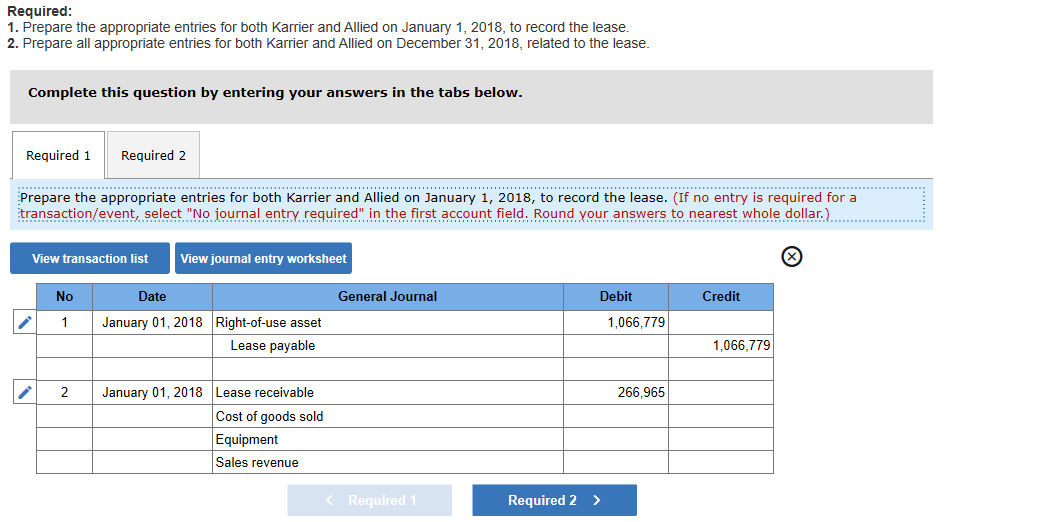

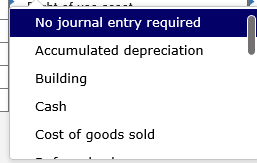

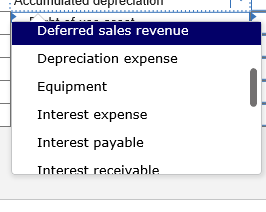

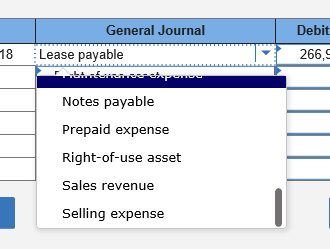

On January 1, 2018, Allied Industries leased a high-performance conveyer to Karrier Company for a four-year period ending December 31, 2021, at which time possession of the leased asset will revert back to Allied. The equipment cost Allied $971,000 and has an expected useful life of five years. Allied expects the residual value at December 31, 2021, will be $315,000. Negotiations led to the lessee guaranteeing a $370,000 residual value. Equal payments under the finance/sales-type lease are $215,000 and are due on December 31 of each year with the first payment being made on December 31, 2018. Karrier is aware that Allied used a 5% interest rate when calculating lease payments. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the appropriate entries for both Karrier and Allied on January 1, 2018, to record the lease. 2. Prepare all appropriate entries for both Karrier and Allied on December 31, 2018, related to the lease. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare all appropriate entries for both Karrier and Allied on December 31, 2018, related to the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar.) View transaction list View journal entry worksheet General Journal Debit Credit No 1 Date December 31, 2018 Interest expense Lease payable Cash 2 266,965 December 31, 2018 Selling expense Right-of-use asset 266,965 3 215,000 December 31, 2018 Cash Lease receivable Interest revenue 204,762 10,238 Required: 1. Prepare the appropriate entries for both Karrier and Allied on January 1, 2018, to record the lease. 2. Prepare all appropriate entries for both Karrier and Allied on December 31, 2018, related to the lease. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate entries for both Karrier and Allied on January 1, 2018, to record the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar.) View transaction list View journal entry worksheet No General Journal Credit Date January 01, 2018 Right-of-use asset Lease payable Debit 1,066,779 1 1,066,779 2 266,965 January 01, 2018 Lease receivable Cost of goods sold Equipment Sales revenue Required 1 Required 2 > No journal entry required Accumulated depreciation Building Cash Cost of goods sold Allurruidleu uepelldLIUI Deferred sales revenue Depreciation expense Equipment Interest expense Interest payable Interest receivable General Journal Lease payable Debit 266, 18 Amore Notes payable Prepaid expense Right-of-use asset Sales revenue Selling expense

These are the accounts to use. I have asked this question once before and it was wrong.

These are the accounts to use. I have asked this question once before and it was wrong.