these are the questions above that somwbody answered but he couldnt answer q19

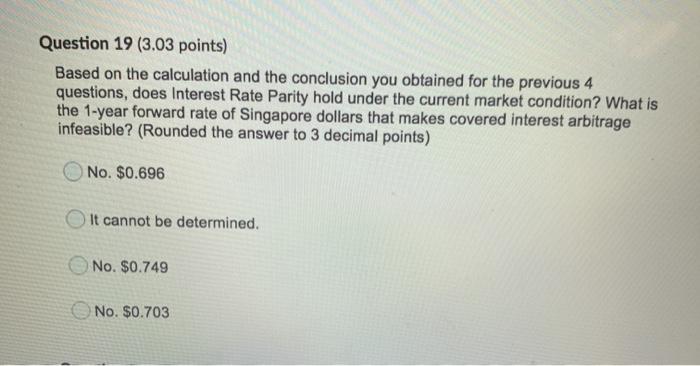

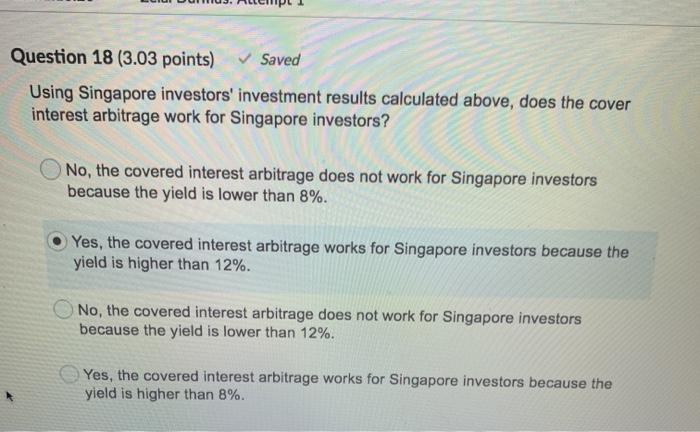

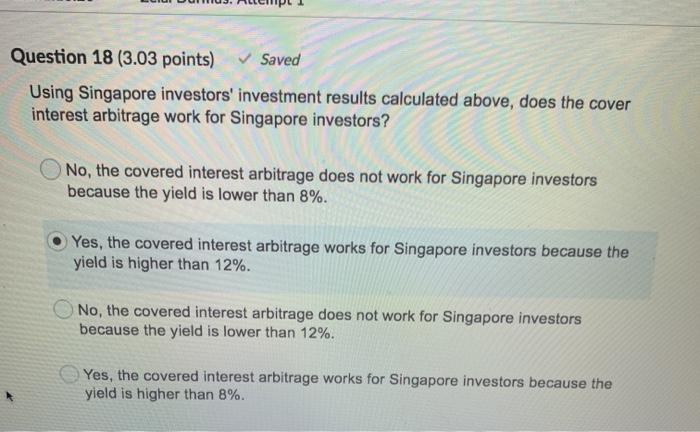

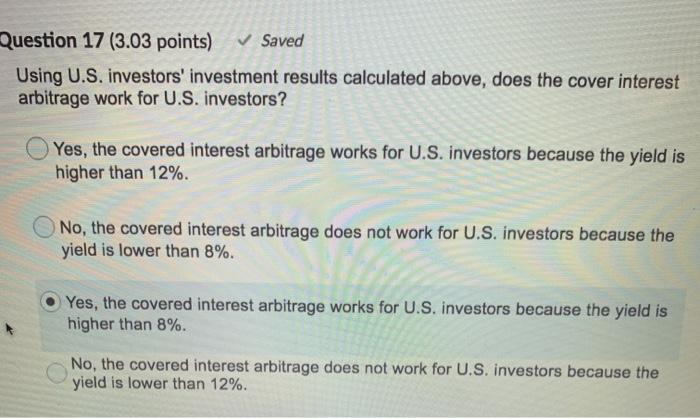

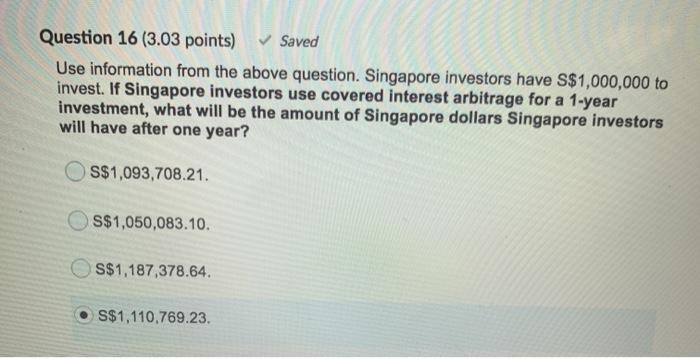

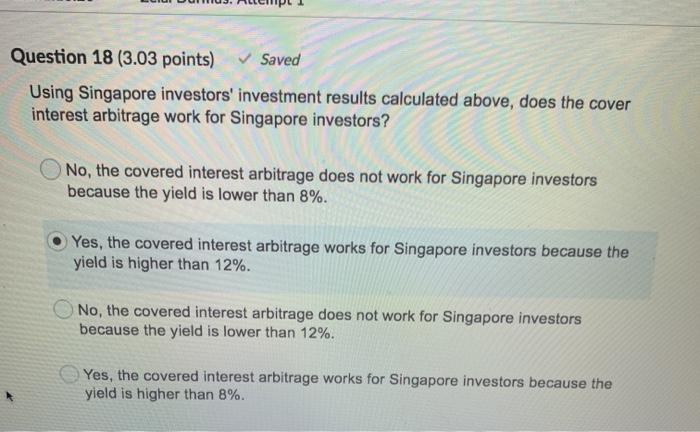

Question 19 (3.03 points) Based on the calculation and the conclusion you obtained for the previous 4 questions, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Singapore dollars that makes covered interest arbitrage infeasible? (Rounded the answer to 3 decimal points) No. $0.696 It cannot be determined. No. $0.749 No. $0.703 Question 18 (3.03 points) Saved Using Singapore investors' investment results calculated above, does the cover interest arbitrage work for Singapore investors? No, the covered interest arbitrage does not work for Singapore investors because the yield is lower than 8%. Yes, the covered interest arbitrage works for Singapore investors because the yield is higher than 12%. No, the covered interest arbitrage does not work for Singapore investors because the yield is lower than 12%. Yes, the covered interest arbitrage works for Singapore investors because the yield is higher than 8%. Question 17 (3.03 points) Saved Using U.S. investors' investment results calculated above, does the cover interest arbitrage work for U.S. investors? Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 12%. No, the covered interest arbitrage does not work for U.S. investors because the yield is lower than 8%. Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 8%. No, the covered interest arbitrage does not work for U.S. investors because the yield is lower than 12%. Question 16 (3.03 points) Saved Use information from the above question. Singapore investors have S$1,000,000 to invest. If Singapore investors use covered interest arbitrage for a 1-year investment, what will be the amount of Singapore dollars Singapore investors will have after one year? S$1,093,708.21. S$1,050,083.10. S$1,187,378.64. S$1,110,769.23 Question 19 (3.03 points) Based on the calculation and the conclusion you obtained for the previous 4 questions, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Singapore dollars that makes covered interest arbitrage infeasible? (Rounded the answer to 3 decimal points) No. $0.696 It cannot be determined. No. $0.749 No. $0.703 Question 18 (3.03 points) Saved Using Singapore investors' investment results calculated above, does the cover interest arbitrage work for Singapore investors? No, the covered interest arbitrage does not work for Singapore investors because the yield is lower than 8%. Yes, the covered interest arbitrage works for Singapore investors because the yield is higher than 12%. No, the covered interest arbitrage does not work for Singapore investors because the yield is lower than 12%. Yes, the covered interest arbitrage works for Singapore investors because the yield is higher than 8%. Question 17 (3.03 points) Saved Using U.S. investors' investment results calculated above, does the cover interest arbitrage work for U.S. investors? Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 12%. No, the covered interest arbitrage does not work for U.S. investors because the yield is lower than 8%. Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 8%. No, the covered interest arbitrage does not work for U.S. investors because the yield is lower than 12%. Question 16 (3.03 points) Saved Use information from the above question. Singapore investors have S$1,000,000 to invest. If Singapore investors use covered interest arbitrage for a 1-year investment, what will be the amount of Singapore dollars Singapore investors will have after one year? S$1,093,708.21. S$1,050,083.10. S$1,187,378.64. S$1,110,769.23