These are the steps I need help with.

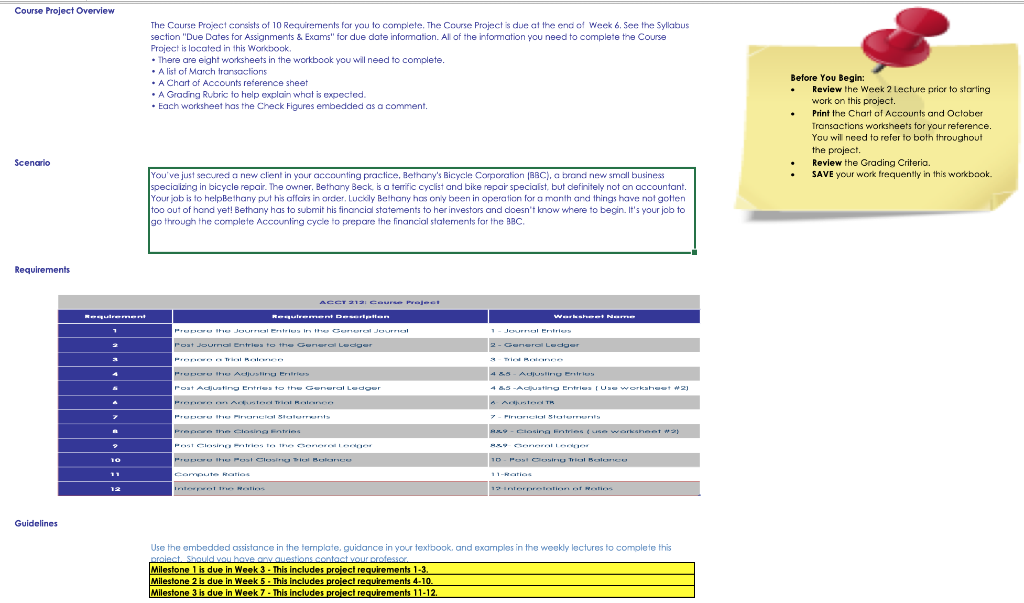

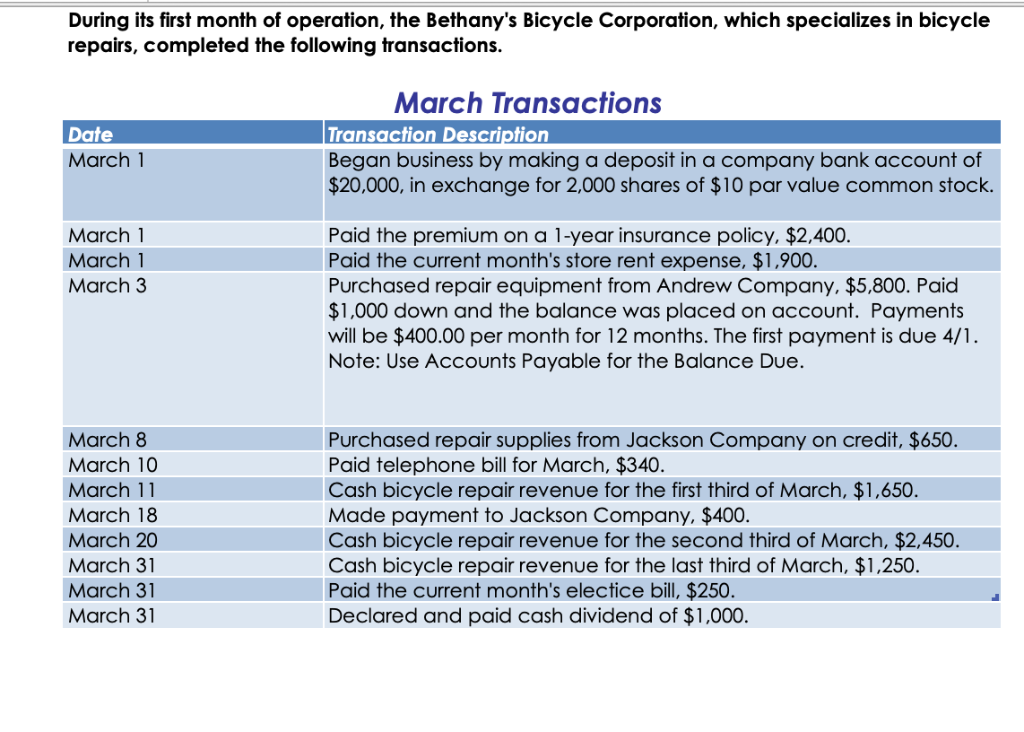

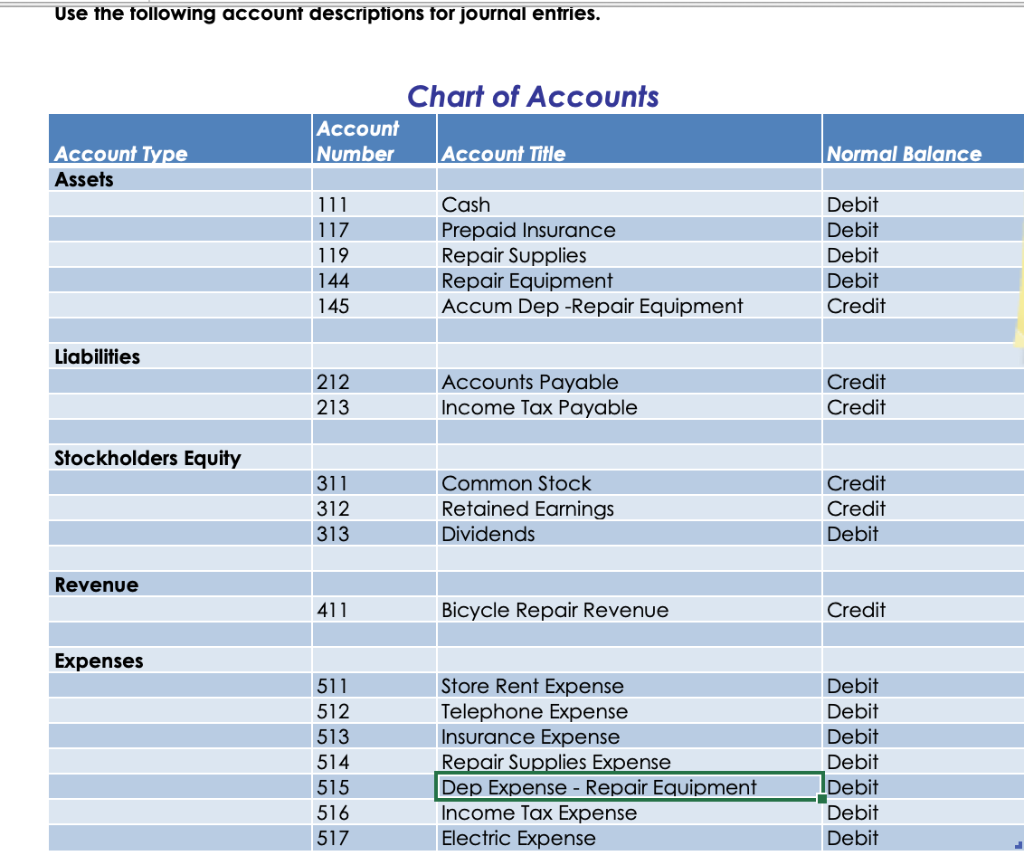

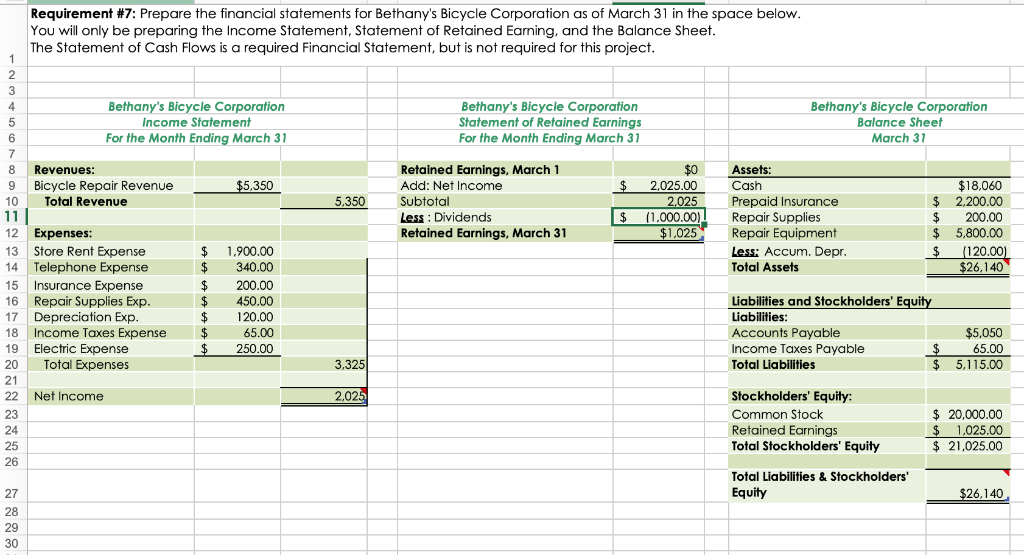

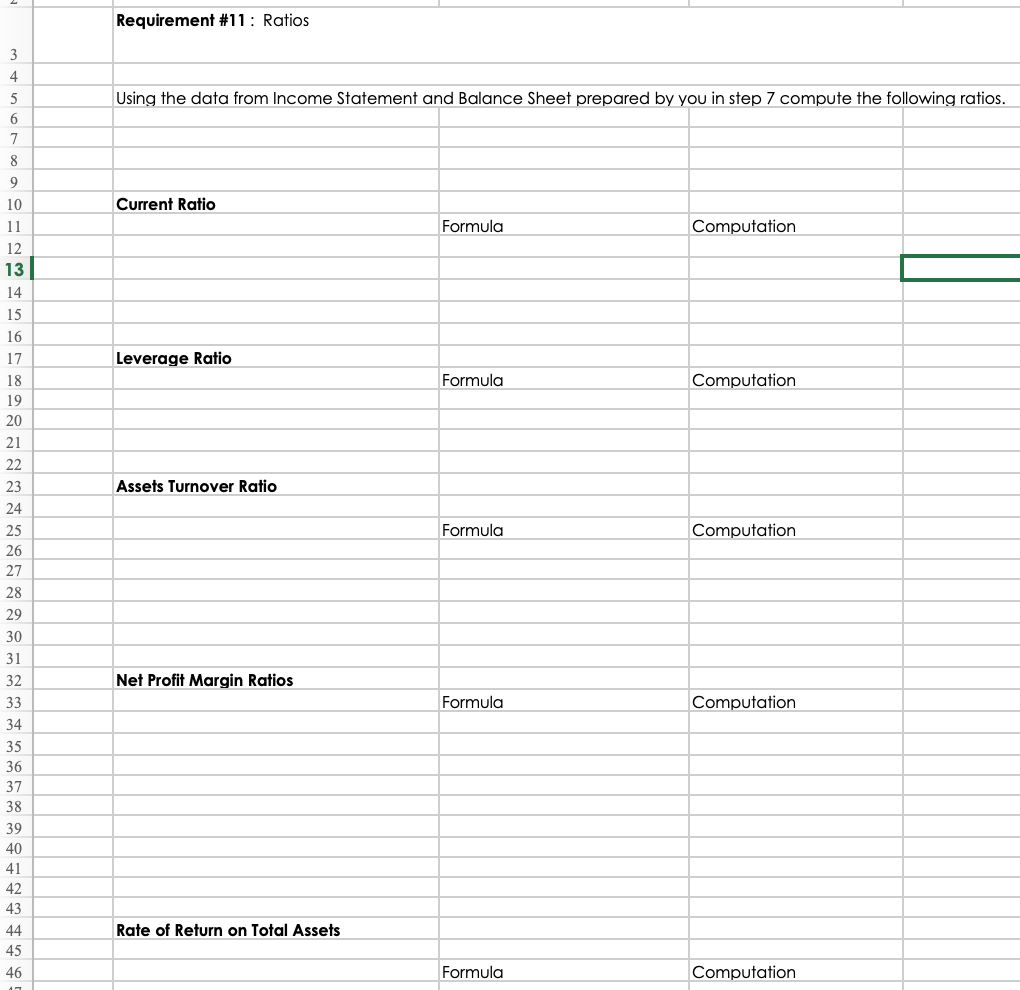

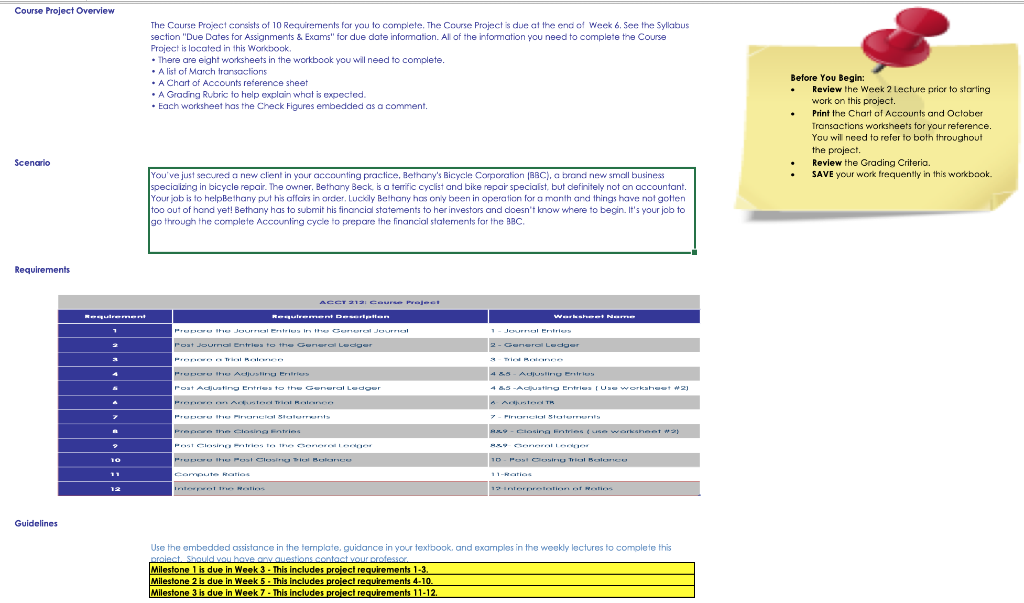

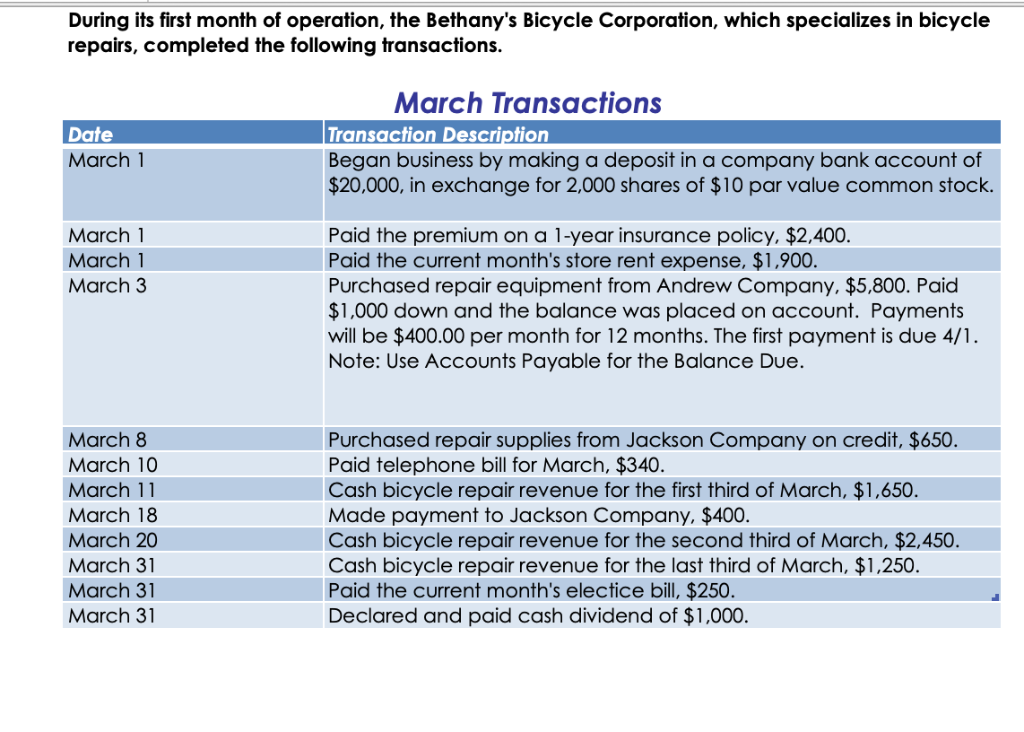

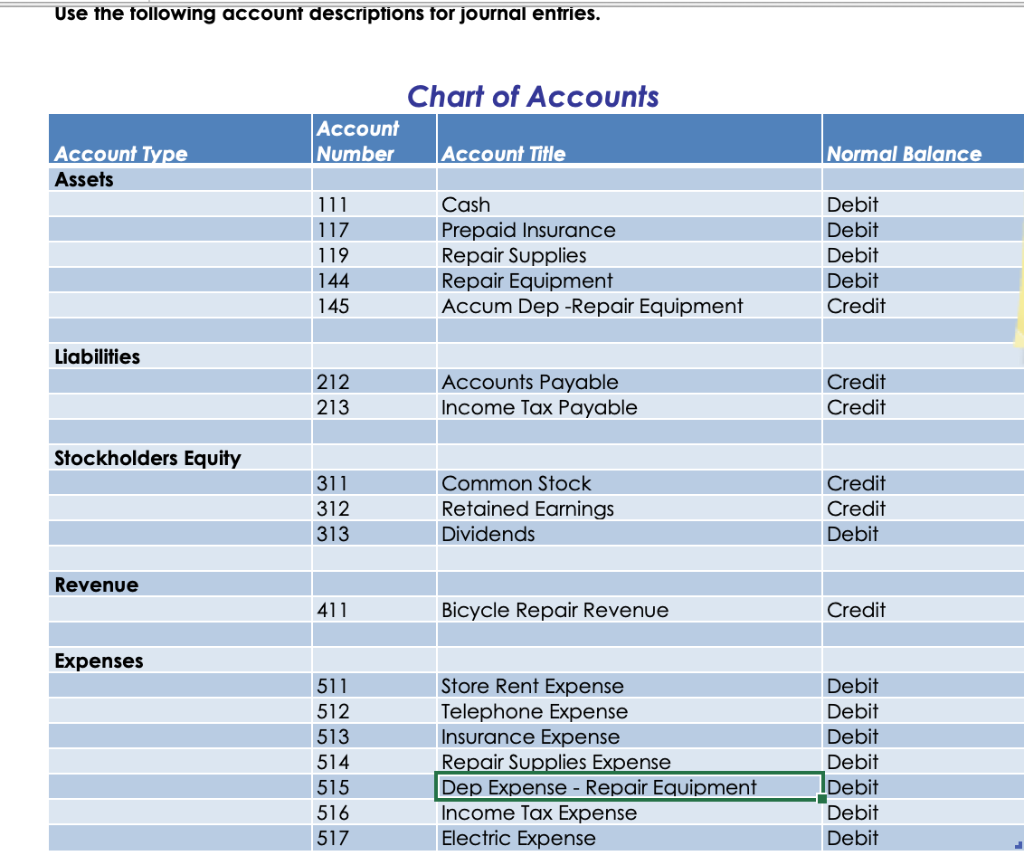

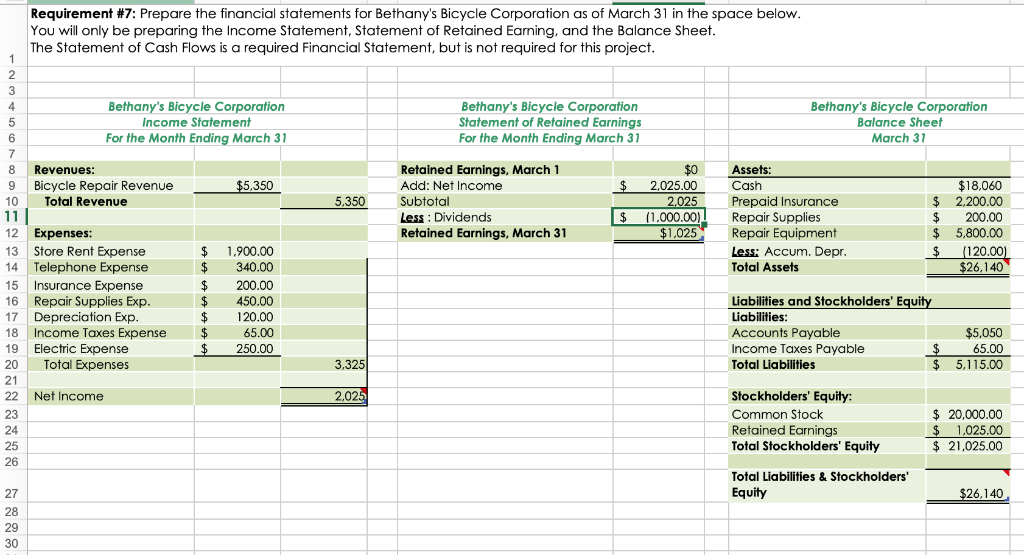

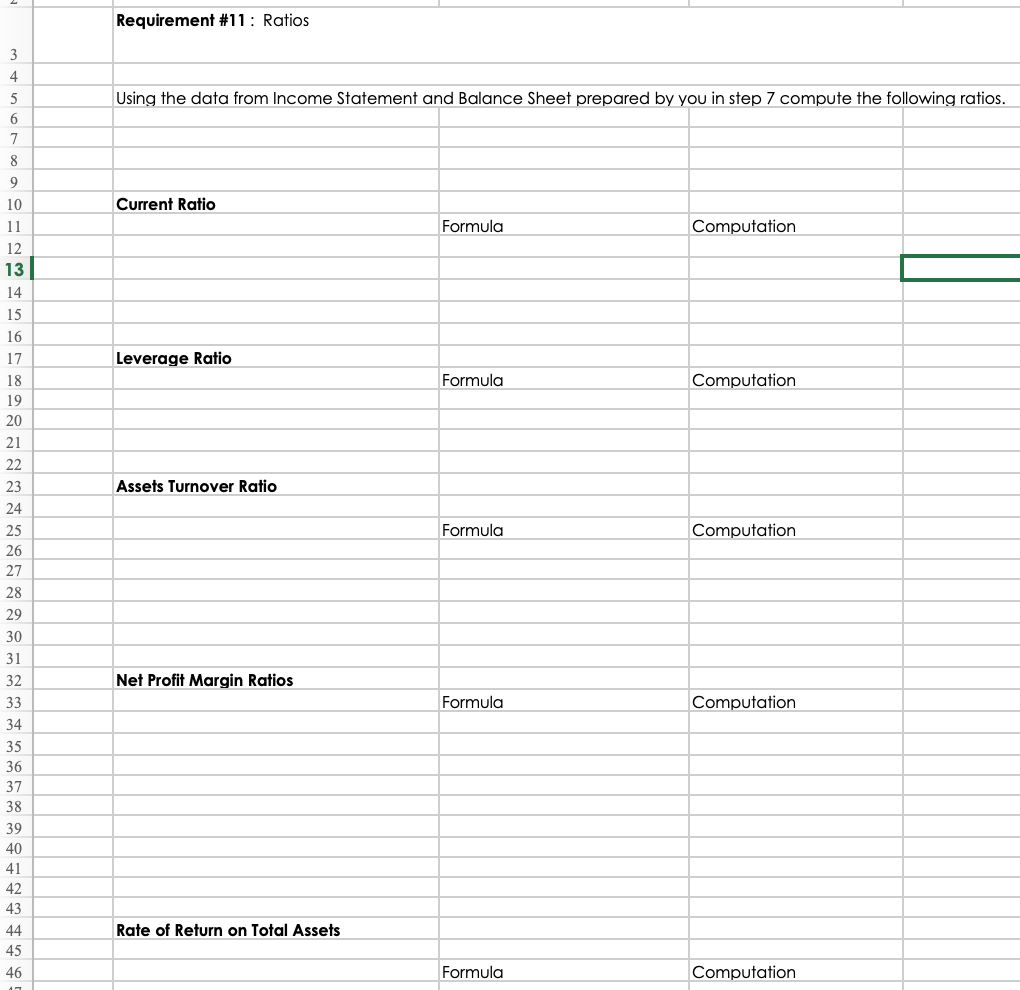

Course Project Overview The Course Project corsists of 10 Requiremenls far you to complele. The Corse Project s due at the end of Week 6. See the Syllabus section "Due Dates for Assignments & Exams" for due date infomation. Al of the infomation you need to complete the Course Project is localed in this Workbook There are eight worksheets in the workbook you will need to complete A list of March trarsoctions A Chart of Accounts reference sheet A Gradng Rubric to help oxplain what is expecied. Each worksheet has the Check Figures embedded as a comment. Before You Begin: .Review the Week 2 Lecture prier to starling work on this project. . Print the Chart of Accouris and October Transactions worksheets for your Yau will need to refer to both throughout the project. reference Scenarko . Review the Grading Criteria. SAVE your work frequently in this workbaok. You've just secured a new client in your accounting praclice, Betharry's Bicycle Corporation (BBC), abrand new smell business speciaiing in bicycle repair. The owner. Bethany Beck is a temfic cyclist and bike repair speciaist, but clefinitely not an accountant Your job is to helpBethany put his affairs in order, Lucily Bethany has ony been in operation for a manth and things have not golten too out of hand yet! Bethany has to submit his financial statements to her investors and doesn't know where to begin. It's your job to go through the complete Acccunting cycle to prepare the financial stalements for the BBC Post Adjuating Entries to t Use the embedded assistance in the femplate, guidance in your textbook, and examples in the weekly lectures to complete this ilestone 2 is due in Week During its first month of operation, the Bethany's Bicycle Corporation, which specializes in bicycle repairs, completed the following transactions. March Transactions Date March1 Transaction Description Began business by making a deposit in a company bank account of $20,000, in exchange for 2,000 shares of $10 par value common stock. Paid the premium on a 1-year insurance policy, $2,400 Paid the current month's store rent expense, $1,900. Purchased repair equipment from Andrew Company, $5,800. Paid $1,000 down and the balance was placed on account. Payments will be $400.00 per month for 12 months. The first payment is due 4/1 Note: Use Accounts Payable for the Balance Due. March1 March 1 March3 March 8 March 10 March 11 March 18 Purchased repair supplies from Jackson Company on credit, $650 Paid telephone bill for March, $340 Cash bicycle repair revenue for the first third of March, $1,650 Made payment to Jackson Company, $400 Cash bicycle repair revenue for the second third of March, $2,450 Cash bicycle repair revenue for the last third of March, $1,250. Paid the current month's electice bill, $250. Declared and paid cash dividend of $1,000 March 31 March 31 March 31 Use the tollowing account descriptions tor journal entries. Chart of Accounts Account NumberACCOunt Title Normal Balance Account Type Assets Cash Prepaid Insurance Repair Supplies Repair Equipment Accum Dep -Repair Equipment Debit Debit Debit Debit Credit 119 144 145 Liabilities 212 213 Credit Credit Accounts Payable Income Tax Payable Stockholders Equity 311 312 313 Credit Credit Debit Common Stock Retained Earnings Dividends Revenue 411 Bicycle Repair Revenue Credit Expenses 511 512 513 514 515 516 517 Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income lax Expense Electric Expense Debit Debit Debit Debit Debit Debit Debit Requirement #7: Prepare the financial statements for Bethany's Bicycle Corporation as of March 31 in the space below You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet The Statement of Cash Flows is a required Financial Statement, but is not required for this project 2 4 Bethany's Bicycle Corporation ncome Statement For the Month Ending March 3 Bethany's Bicycle Corporation Statement of Retained Earnings For the Month Ending March 3 Bethany's Bicycle Corporation Balance Sheet March 31 $0 2,025.00 2025 8 Revenues: 9 Bicycle Repair Revenue 10 Total Revenue Retained Earnings, March 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, March 31 Assets: Cash Prepaid Insurance 5,350 $18,060 $ 2,200.00 $ 200.00 $ 5,800.00 120.00 $26,140 5,350 $ (1.000.00 Repair Supplies 12 13 14 15 16 17 18 19 20 Expenses: Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Exp Depreciation Exp Income Taxes Expense Electric Expense $1,025 Repair Equipment Less: Accum. Depr Total Assets $ 1.900.00 $ 340.00 $ 200.00 $450.00 $120.00 $65.00 250.00 Liabilities and Stockholders' Equi Liabilities Accounts Payable Income Taxes Payable Total Liabilities 65.00 $ 5,115.00 Total Expenses 3,325 22 Net Income 23 24 25 26 2,02 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity $ 20,000.00 1,025.00 $21,025.00 Total Liabilities &Stockholders' 27 28 29 30 26,140 Requirement #11 : Ratios Using the data from Income Statement and Balance Sheet prepared by you in step 7 compute the following ratios. Current Ratio 10 Formula Computation 12 14 16 17 18 19 20 21 Leverage Ratio Formula Computation Assets Turnover Ratio 24 25 26 27 28 29 30 Formula Computation Net Profit Margin Ratios 32 Formula Computation 34 35 36 37 39 41 42 43 Rate of Return on Total Assets 45 Formula Computation Requirement #12Interpret the ratios computed in step i company Your interpretation should include the definition of the ratio ts managerial use and how does t reflec the operating performance and financial health of the Liquidity Ratios 10 12 16 17 20 21 23 24 26 27 28 30 31 34 35 37 38 39 40 41 Solvency Ratios 43 45 46 47 48 50 52 53 54 58 Profitability Ratios