Answered step by step

Verified Expert Solution

Question

1 Approved Answer

These are the tax forms needed: 2020 Form 1040 (irs.gov) 2020 Schedule 1 (Form 1040) (irs.gov) 2020 Schedule B (Form 1040) (irs.gov) Please complete the

These are the tax forms needed:

These are the tax forms needed:

2020 Form 1040 (irs.gov)

2020 Schedule 1 (Form 1040) (irs.gov)

2020 Schedule B (Form 1040) (irs.gov)

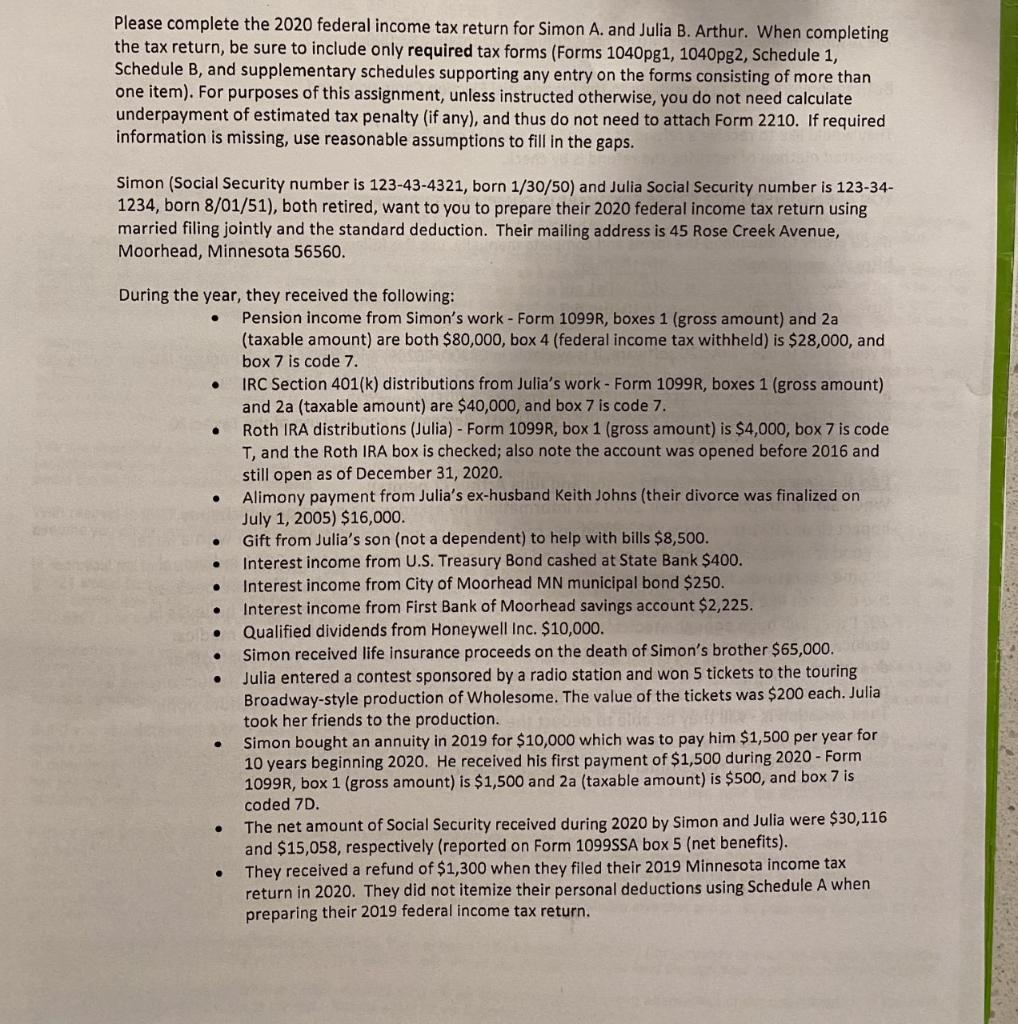

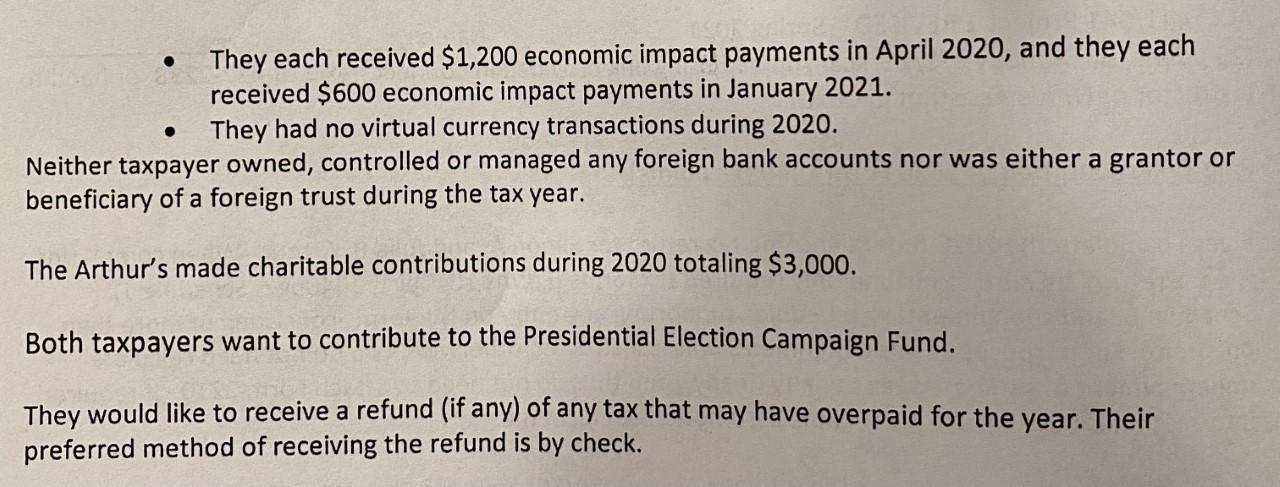

Please complete the 2020 federal income tax return for Simon A. and Julia B. Arthur. When completing the tax return, be sure to include only required tax forms (Forms 1040pg1, 1040pg2, Schedule 1, Schedule B, and supplementary schedules supporting any entry on the forms consisting of more than one item). For purposes of this assignment, unless instructed otherwise, you do not need calculate underpayment of estimated tax penalty (if any), and thus do not need to attach Form 2210. If required information is missing, use reasonable assumptions to fill in the gaps. Simon (Social Security number is 123-43-4321, born 1/30/50) and Julia Social Security number is 123-34- 1234, born 8/01/51), both retired, want to you to prepare their 2020 federal income tax return using married filing jointly and the standard deduction. Their mailing address is 45 Rose Creek Avenue, Moorhead, Minnesota 56560. . . . . During the year, they received the following: Pension income from Simon's work - Form 1099R, boxes 1 (gross amount) and 2a (taxable amount) are both $80,000, box 4 (federal income tax withheld) is $28,000, and box 7 is code 7. IRC Section 401(k) distributions from Julia's work - Form 1099R, boxes 1 (gross amount) and 2a (taxable amount) are $40,000, and box 7 is code 7. Roth IRA distributions (Julia) - Form 1099R, box 1 (gross amount) is $4,000, box 7 is code T, and the Roth IRA box is checked; also note the account was opened before 2016 and still open as of December 31, 2020. Alimony payment from Julia's ex-husband Keith Johns (their divorce was finalized on July 1, 2005) $16,000. Gift from Julia's son (not a dependent) to help with bills $8,500. Interest income from U.S. Treasury Bond cashed at State Bank $400. Interest income from City of Moorhead MN municipal bond $250. Interest income from First Bank of Moorhead savings account $2,225. Qualified dividends from Honeywell Inc. $10,000. Simon received life insurance proceeds on the death of Simon's brother $65,000. Julia entered a contest sponsored by a radio station and won 5 tickets to the touring Broadway-style production of Wholesome. The value of the tickets was $200 each. Julia took her friends to the production. Simon bought an annuity in 2019 for $10,000 which was to pay him $1,500 per year for 10 years beginning 2020. He received his first payment of $1,500 during 2020 - Form 1099R, box 1 (gross amount) is $1,500 and 2a (taxable amount) is $500, and box 7 is coded 7D. The net amount of Social Security received during 2020 by Simon and Julia were $30,116 and $15,058, respectively (reported on Form 1099SSA box 5 (net benefits). They received a refund of $1,300 when they filed their 2019 Minnesota income tax return in 2020. They did not itemize their personal deductions using Schedule A when preparing their 2019 federal income tax return. . . . . They each received $1,200 economic impact payments in April 2020, and they each received $600 economic impact payments in January 2021. They had no virtual currency transactions during 2020. Neither taxpayer owned, controlled or managed any foreign bank accounts nor was either a grantor or beneficiary of a foreign trust during the tax year. The Arthur's made charitable contributions during 2020 totaling $3,000. Both taxpayers want to contribute to the Presidential Election Campaign Fund. They would like to receive a refund (if any) of any tax that may have overpaid for the year. Their preferred method of receiving the refund is by check. Please complete the 2020 federal income tax return for Simon A. and Julia B. Arthur. When completing the tax return, be sure to include only required tax forms (Forms 1040pg1, 1040pg2, Schedule 1, Schedule B, and supplementary schedules supporting any entry on the forms consisting of more than one item). For purposes of this assignment, unless instructed otherwise, you do not need calculate underpayment of estimated tax penalty (if any), and thus do not need to attach Form 2210. If required information is missing, use reasonable assumptions to fill in the gaps. Simon (Social Security number is 123-43-4321, born 1/30/50) and Julia Social Security number is 123-34- 1234, born 8/01/51), both retired, want to you to prepare their 2020 federal income tax return using married filing jointly and the standard deduction. Their mailing address is 45 Rose Creek Avenue, Moorhead, Minnesota 56560. . . . . During the year, they received the following: Pension income from Simon's work - Form 1099R, boxes 1 (gross amount) and 2a (taxable amount) are both $80,000, box 4 (federal income tax withheld) is $28,000, and box 7 is code 7. IRC Section 401(k) distributions from Julia's work - Form 1099R, boxes 1 (gross amount) and 2a (taxable amount) are $40,000, and box 7 is code 7. Roth IRA distributions (Julia) - Form 1099R, box 1 (gross amount) is $4,000, box 7 is code T, and the Roth IRA box is checked; also note the account was opened before 2016 and still open as of December 31, 2020. Alimony payment from Julia's ex-husband Keith Johns (their divorce was finalized on July 1, 2005) $16,000. Gift from Julia's son (not a dependent) to help with bills $8,500. Interest income from U.S. Treasury Bond cashed at State Bank $400. Interest income from City of Moorhead MN municipal bond $250. Interest income from First Bank of Moorhead savings account $2,225. Qualified dividends from Honeywell Inc. $10,000. Simon received life insurance proceeds on the death of Simon's brother $65,000. Julia entered a contest sponsored by a radio station and won 5 tickets to the touring Broadway-style production of Wholesome. The value of the tickets was $200 each. Julia took her friends to the production. Simon bought an annuity in 2019 for $10,000 which was to pay him $1,500 per year for 10 years beginning 2020. He received his first payment of $1,500 during 2020 - Form 1099R, box 1 (gross amount) is $1,500 and 2a (taxable amount) is $500, and box 7 is coded 7D. The net amount of Social Security received during 2020 by Simon and Julia were $30,116 and $15,058, respectively (reported on Form 1099SSA box 5 (net benefits). They received a refund of $1,300 when they filed their 2019 Minnesota income tax return in 2020. They did not itemize their personal deductions using Schedule A when preparing their 2019 federal income tax return. . . . . They each received $1,200 economic impact payments in April 2020, and they each received $600 economic impact payments in January 2021. They had no virtual currency transactions during 2020. Neither taxpayer owned, controlled or managed any foreign bank accounts nor was either a grantor or beneficiary of a foreign trust during the tax year. The Arthur's made charitable contributions during 2020 totaling $3,000. Both taxpayers want to contribute to the Presidential Election Campaign Fund. They would like to receive a refund (if any) of any tax that may have overpaid for the year. Their preferred method of receiving the refund is by checkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started