Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these are to pictures for part d and c i need just part e and f answered please C) Bank can safely land the amount

these are to pictures for part d and c i need just part e and f answered please

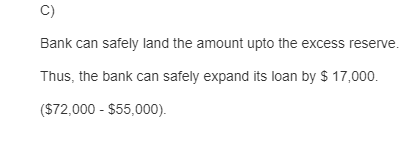

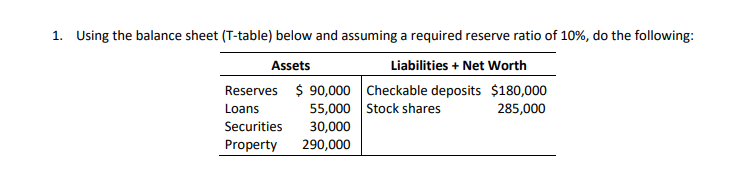

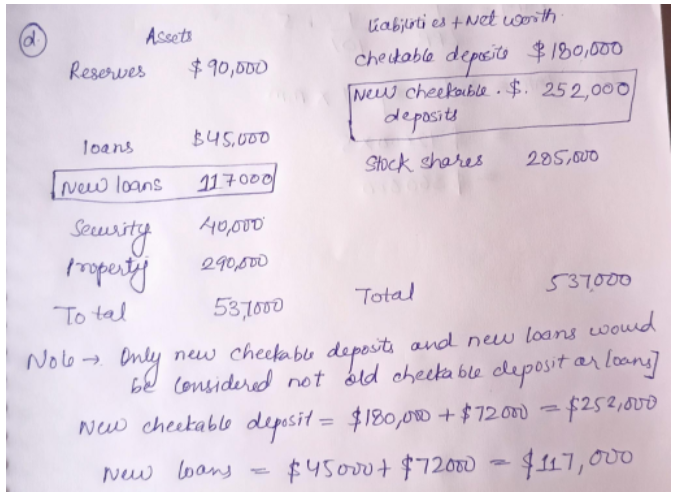

C) Bank can safely land the amount upto the excess reserve. Thus, the bank can safely expand its loan by $ 17,000. ($72,000 - $55,000). 1. Using the balance sheet (T-table) below and assuming a required reserve ratio of 10%, do the following: Assets Liabilities + Net Worth Reserves $ 90,000 Checkable deposits $180,000 Loans 55,000 Stock shares 285,000 Securities 30,000 Property 290,000 e. Use the following table to show what the balance sheet looks like after the check(s) clear from part d. Enter in numbers in all of the boxes. The outcome will be the final balance sheet after the checks clear in part d. Also show that the table balances in the last row. Assets Liabilities + Net Worth Checkable deposits Reserves Loans Stock shares Securities IN Property Total Total f. For the reserve ratio of 10%, how much can the money supply be increased at the most) when the bank expands its loans in part (c)? Write down the formulas you use and show your work. d - loans Assets liabilities net worth Reserves $90,000 cheddable deposito $180,000 new cheekable. $. 252,000 deposits $45.000 Stock shares 295.000 I New loans 117000 Security 40,000 property 290,000 537000 Total 53,7000 Nole Only be considered not old chectable deposit or loans] new Checka ble deposits and new loans woud ar ] www cheekable deposit = $180,000 + $72.000 = $252,000 New loans $45000+ $72000 = $117, OUD Total C) Bank can safely land the amount upto the excess reserve. Thus, the bank can safely expand its loan by $ 17,000. ($72,000 - $55,000). 1. Using the balance sheet (T-table) below and assuming a required reserve ratio of 10%, do the following: Assets Liabilities + Net Worth Reserves $ 90,000 Checkable deposits $180,000 Loans 55,000 Stock shares 285,000 Securities 30,000 Property 290,000 e. Use the following table to show what the balance sheet looks like after the check(s) clear from part d. Enter in numbers in all of the boxes. The outcome will be the final balance sheet after the checks clear in part d. Also show that the table balances in the last row. Assets Liabilities + Net Worth Checkable deposits Reserves Loans Stock shares Securities IN Property Total Total f. For the reserve ratio of 10%, how much can the money supply be increased at the most) when the bank expands its loans in part (c)? Write down the formulas you use and show your work. d - loans Assets liabilities net worth Reserves $90,000 cheddable deposito $180,000 new cheekable. $. 252,000 deposits $45.000 Stock shares 295.000 I New loans 117000 Security 40,000 property 290,000 537000 Total 53,7000 Nole Only be considered not old chectable deposit or loans] new Checka ble deposits and new loans woud ar ] www cheekable deposit = $180,000 + $72.000 = $252,000 New loans $45000+ $72000 = $117, OUD TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started