Answered step by step

Verified Expert Solution

Question

1 Approved Answer

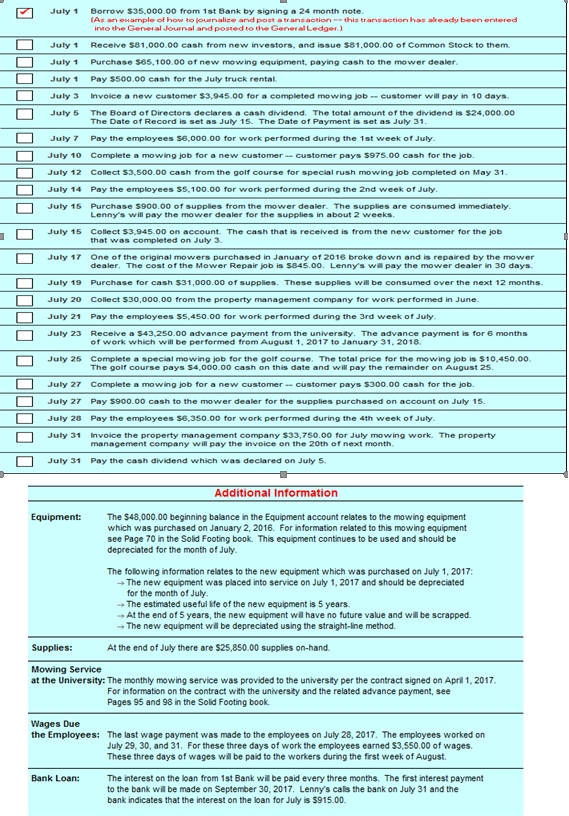

These are transactions for Lenny lawns service Inc. Can you make GENERAL JOURNAL for these transactions ASAP? July 1 Borrow $35,000.00 from 1st Bank by

These are transactions for Lenny lawns service Inc. Can you make GENERAL JOURNAL for these transactions ASAP?

July 1 Borrow $35,000.00 from 1st Bank by signing a 24 month note. ample of how to journalize and saction has already been orvtered into the General Journal and posted to the GeneralLedger. July 1 Receive $81.000.00 cash from new investors. and issue S81.000.00 of C Stock to them. July 1 Purchase S65.100.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental. July 3 Invoice a new customer S3,945.00 for a completed mowing job customer will pay in 10 days. July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $24.000,00 The Date of Record is set as July 15. The Date of Payment is set as July 31 July 7 Pay the employees $6,000.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer customer pays S97S 00 cash for the job. Collect $3.500.00 cash from the golf course for special rush mowing job completed on May 31. July 12 Pay the employees SS 100.00 for work performed during the 2nd week of July. July 14 July 15 Purchase $900.00 of supplies from the mo wer dealer. The s upplies are consumed immediately. Lenn will pay the mo wer dealer for the supplies in about 2 weeks. July 15 Collect $3.9 45.00 on account. The cash that is received is from the new customer for the job that was completed on July 3. July 17 One of the original mowers purchased in January of 2016 broke down and is repaired by the mower The cost of the Mower Repair job is S845.00. Lenny s wi pay the mower dealer in 30 days. July 19 Purchase for cash $31,000.00 of supplies. These supplies will be consumed over the next 12 months. July 20 Collect $30,000.00 from the property ement compan y for work performed July 21 Pay the employees SS 450.00 for work performed during the 3rd week of July. July 23 Receive a S43.250.00 advance payment from the university. The advance payment is for 6 months of work which will be performed from August 1. 2017 to January 31. 2018. July 25 Complet e a special mowing job for the golf course. The total price for the mowing job is S10.450.00. The golf course pays $4,000.00 cash on this date and will pay the remainder on August 2S. Complete a mowing job for a new customer July 27 customer pays S300.00 cash for the job. July 27 Pay $900.00 cash to the mower dealer for the supplies purchased on account on July 15. July 28 Pay the employees S6.3s0.00 for work performed during the 4th week of July. July 31 ement company $33,7S0.00 for July mowing work. The property invoice the property manage ny will pay the invoice on the 20th of next month management compa July 31 Pay the cash dividend which was declared on July 5. Additional Information The $48,000.00 beginning balance in the Equipment account relates to the mo equipment Equipment: which was purchased on January 2 2016. For information related to this mow ing equipment see Page 70 in the Solid Footing book. This equipment cont to be used and should be preciated for the month of July The following information relates to the new equipment which was purchased on July 1, 2017: The new equipment was placed in service on July 1, 2017 and should be depreciated for the month of July. The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and willbe scrapped. The new equipment wilbe depreciated using the straight-line method. Supplies: At the end of July there are $25.850.000 supplies o Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1, 2017. For information on the contract with the university and the related advance payment, see Pages 9s and 98in the sold Footing book Wages Due s on July 28, 2017. The employees worked on the Employees: The last wage payment was made to the July 29, 30, and 31. For these three days of work the employees earned S3,550.00 of wages. These three days of wages wil be paid to the workers during the first week of August The interest on the loan from 1st Bank wil be paid every three months. The first interest payment Bank Loan: to the bank wil be made on September 30, 2017. Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $915.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started