Answered step by step

Verified Expert Solution

Question

1 Approved Answer

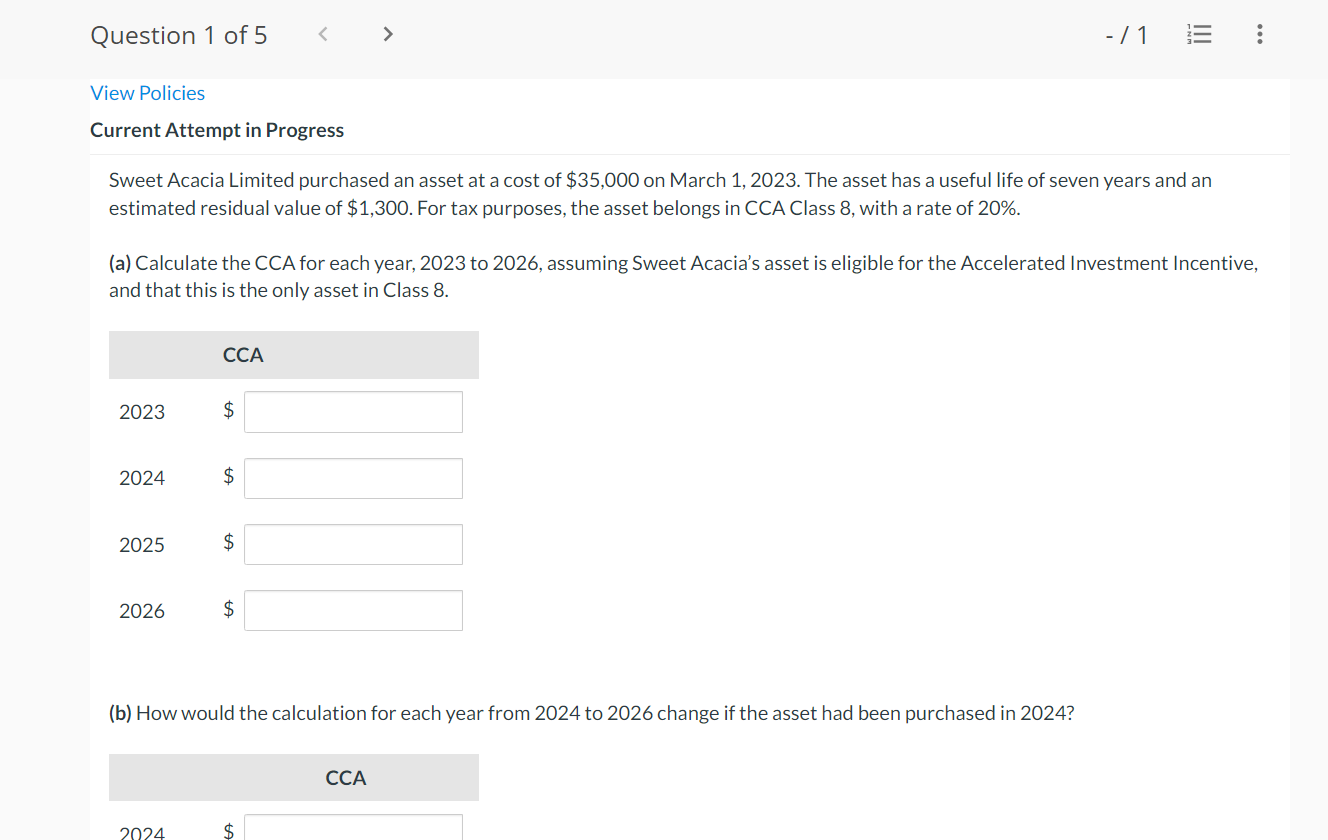

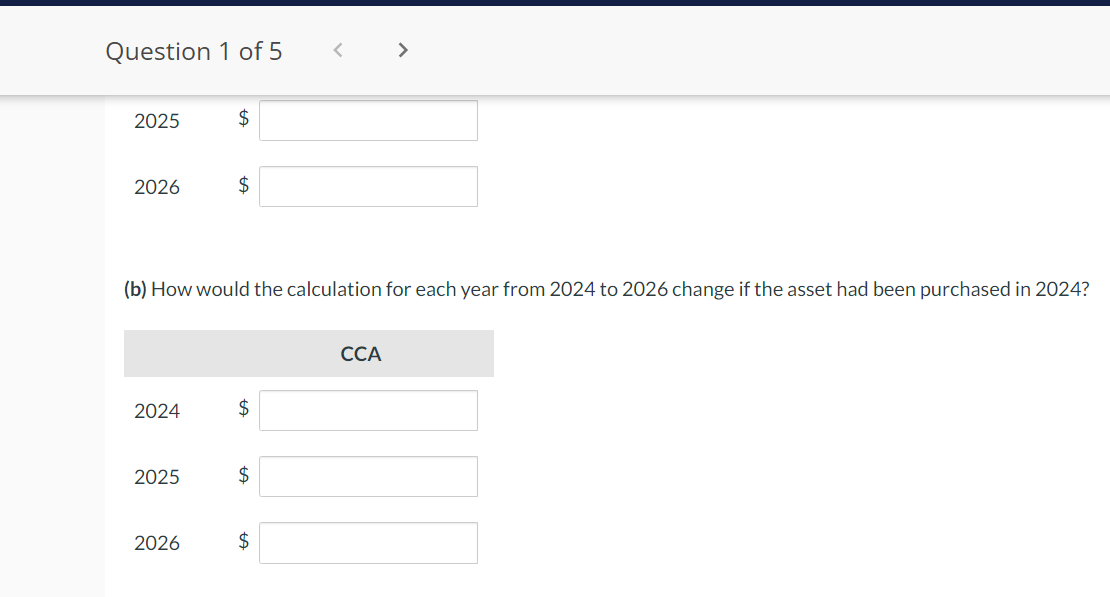

These are two photos of Same question . Question 1 part a in First photo and part b in second photo.But this is one question.

These are two photos of Same question . Question 1 part a in First photo and part b in second photo.But this is one question. Please solution of Both parts

Sweet Acacia Limited purchased an asset at a cost of $35,000 on March 1,2023 . The asset has a useful life of seven years and an estimated residual value of $1,300. For tax purposes, the asset belongs in CCA Class 8 , with a rate of 20%. (a) Calculate the CCA for each year, 2023 to 2026 , assuming Sweet Acacia's asset is eligible for the Accelerated Investment Incentive, and that this is the only asset in Class 8. (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024 ? (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started