Answered step by step

Verified Expert Solution

Question

1 Approved Answer

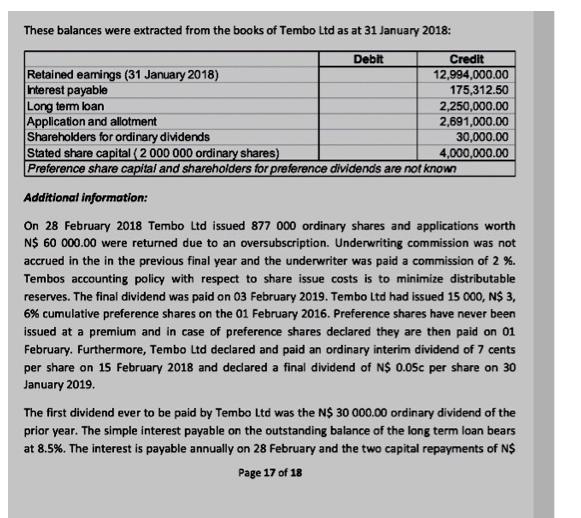

These balances were extracted from the books of Tembo Ltd as at 31 January 2018: Debit Credit 12,994,000.00 175,312.50 Retained eamings (31 January 2018)

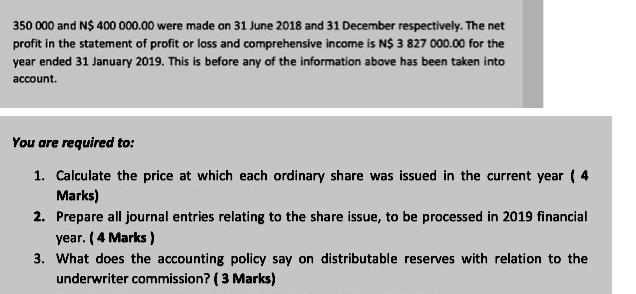

These balances were extracted from the books of Tembo Ltd as at 31 January 2018: Debit Credit 12,994,000.00 175,312.50 Retained eamings (31 January 2018) Interest payable Long term loan Application and allotment Shareholders for ordinary dividends Stated share capital (2 000 000 ordinary shares) Preference share capital and shareholders for preference dividends are not known Additional information: On 28 February 2018 Tembo Ltd issued 877 000 ordinary shares and applications worth N$ 60 000.00 were returned due to an oversubscription. Underwriting commission was not accrued in the in the previous final year and the underwriter was paid a commission of 2 %. Tembos accounting policy with respect to share issue costs is to minimize distributable reserves. The final dividend was paid on 03 February 2019. Tembo Ltd had issued 15 000, N$ 3, 6% cumulative preference shares on the 01 February 2016. Preference shares have never been issued at a premium and in case of preference shares declared they are then paid on 01 February. Furthermore, Tembo Ltd declared and paid an ordinary interim dividend of 7 cents per share on 15 February 2018 and declared a final dividend of N$ 0.05c per share on 30 January 2019. 2,250,000.00 2,691,000.00 30,000.00 4,000,000.00 The first dividend ever to be paid by Tembo Ltd was the N$ 30 000.00 ordinary dividend of the prior year. The simple interest payable on the outstanding balance of the long term loan bears at 8.5%. The interest is payable annually on 28 February and the two capital repayments of N$ Page 17 of 18 350 000 and N$ 400 000.00 were made on 31 June 2018 and 31 December respectively. The net profit in the statement of profit or loss and comprehensive income is N$ 3 827 000.00 for the year ended 31 January 2019. This is before any of the information above has been taken into account. You are required to: 1. Calculate the price at which each ordinary share was issued in the current year (4 Marks) 2. Prepare all journal entries relating to the share issue, to be processed in 2019 financial year. ( 4 Marks) 3. What does the accounting policy say on distributable reserves with relation to the underwriter commission? (3 Marks)

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started