Answered step by step

Verified Expert Solution

Question

1 Approved Answer

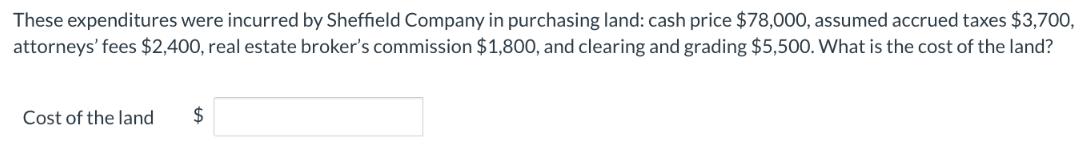

These expenditures were incurred by Sheffield Company in purchasing land: cash price $78,000, assumed accrued taxes $3,700, attorneys' fees $2,400, real estate broker's commission

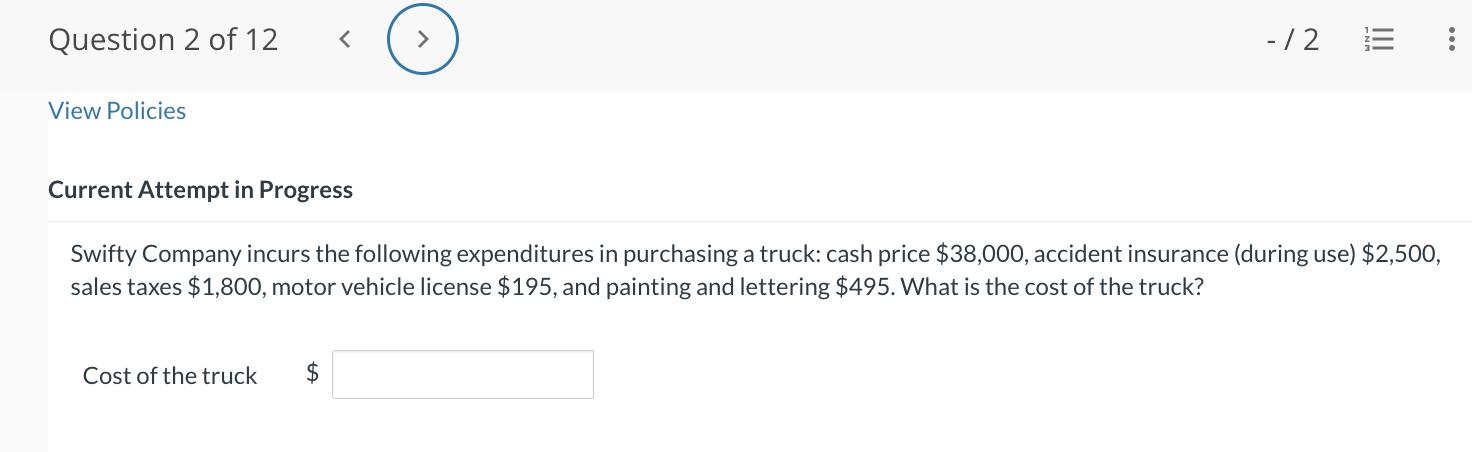

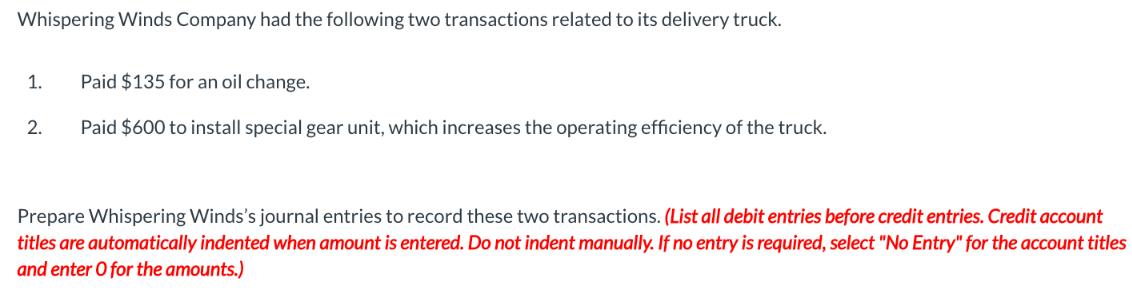

These expenditures were incurred by Sheffield Company in purchasing land: cash price $78,000, assumed accrued taxes $3,700, attorneys' fees $2,400, real estate broker's commission $1,800, and clearing and grading $5,500. What is the cost of the land? Cost of the land $ Question 2 of 12 View Policies Cost of the truck - 12 Current Attempt in Progress Swifty Company incurs the following expenditures in purchasing a truck: cash price $38,000, accident insurance (during use) $2,500, sales taxes $1,800, motor vehicle license $195, and painting and lettering $495. What is the cost of the truck? $ ||| Whispering Winds Company had the following two transactions related to its delivery truck. 1. 2. Paid $135 for an oil change. Paid $600 to install special gear unit, which increases the operating efficiency of the truck. Prepare Whispering Winds's journal entries to record these two transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

★★★★★

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 The cost of the land can be calculated by adding up all the expenditures incurred in purchasing th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started