Answered step by step

Verified Expert Solution

Question

1 Approved Answer

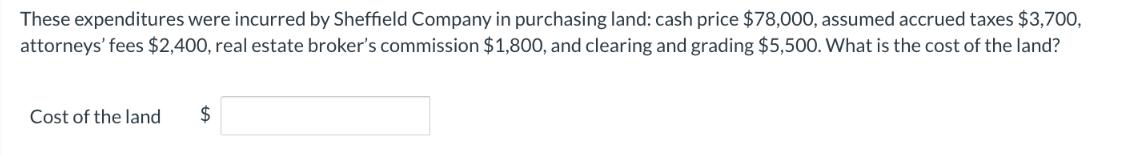

These expenditures were incurred by Sheffield Company in purchasing land: cash price $78,000, assumed accrued taxes $3,700, attorneys' fees $2,400, real estate broker's commission

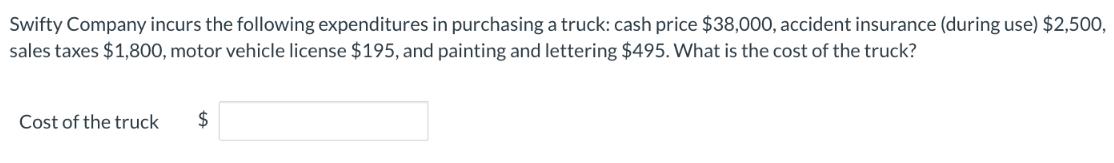

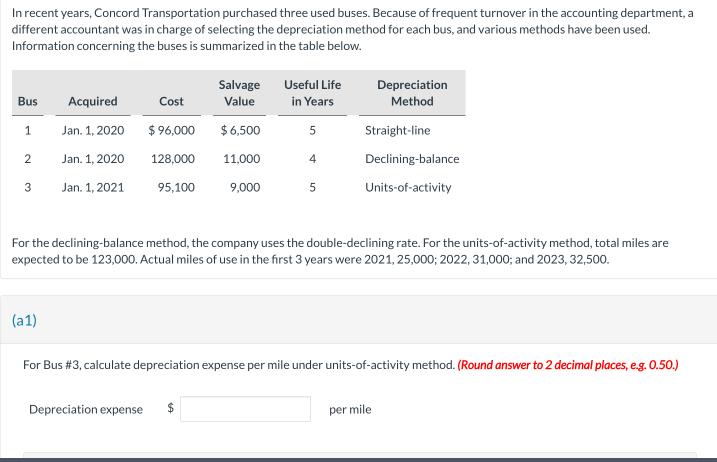

These expenditures were incurred by Sheffield Company in purchasing land: cash price $78,000, assumed accrued taxes $3,700, attorneys' fees $2,400, real estate broker's commission $1,800, and clearing and grading $5,500. What is the cost of the land? Cost of the land $ Swifty Company incurs the following expenditures in purchasing a truck: cash price $38,000, accident insurance (during use) $2,500, sales taxes $1,800, motor vehicle license $195, and painting and lettering $495. What is the cost of the truck? Cost of the truck $ In recent years, Concord Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each bus, and various methods have been used. Information concerning the buses is summarized in the table below. Bus 1 2 3 Acquired Jan. 1, 2020 Jan. 1, 2020 Jan. 1, 2021 (a1) Cost $ 96,000 128,000 95,100 Salvage Value $6,500 11,000 9,000 Useful Life in Years Depreciation expense $ 5 4 5 For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 123,000. Actual miles of use in the first 3 years were 2021, 25,000; 2022, 31,000; and 2023, 32,500. Depreciation Method Straight-line Declining-balance Units-of-activity For Bus #3, calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) per mile

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started