Question

These fair value adjustments were not recorded in the separate financial records of Third Ltd. 3. First Ltd sold machinery to Second Ltd on 1

These fair value adjustments were not recorded in the separate financial records of Third Ltd. 3. First Ltd sold machinery to Second Ltd on 1 January 20.21 for R45 000. The sale was made at cost plus 20%. Second Ltd depreciates machinery at 20% per annum on the straight line method. This is the same policy as used by SA revenue authority. 4. At 30 June 20.21 the directors of First Ltd decided that the goodwill that arose on the acquisition of Second Ltd had been impaired by R6 000.

5. First Ltd and Second Ltd measure their investments in subsidiaries in their separate accounting records at cost price in accordance with IAS 27, separate financial statements. 6. The SA normal tax rate is 28% and capital gains tax is calculated at 80% thereof. You may assume that both the tax rates have remained unchanged since 1 January 20.20. 7. Each share carries one vote and the issued share capital of all the entities in the group remained unchanged since 1 January 20.20.

Prepare the pro-forma consolidation journal entries of First Ltd Group for the year ended 30 June 20.21

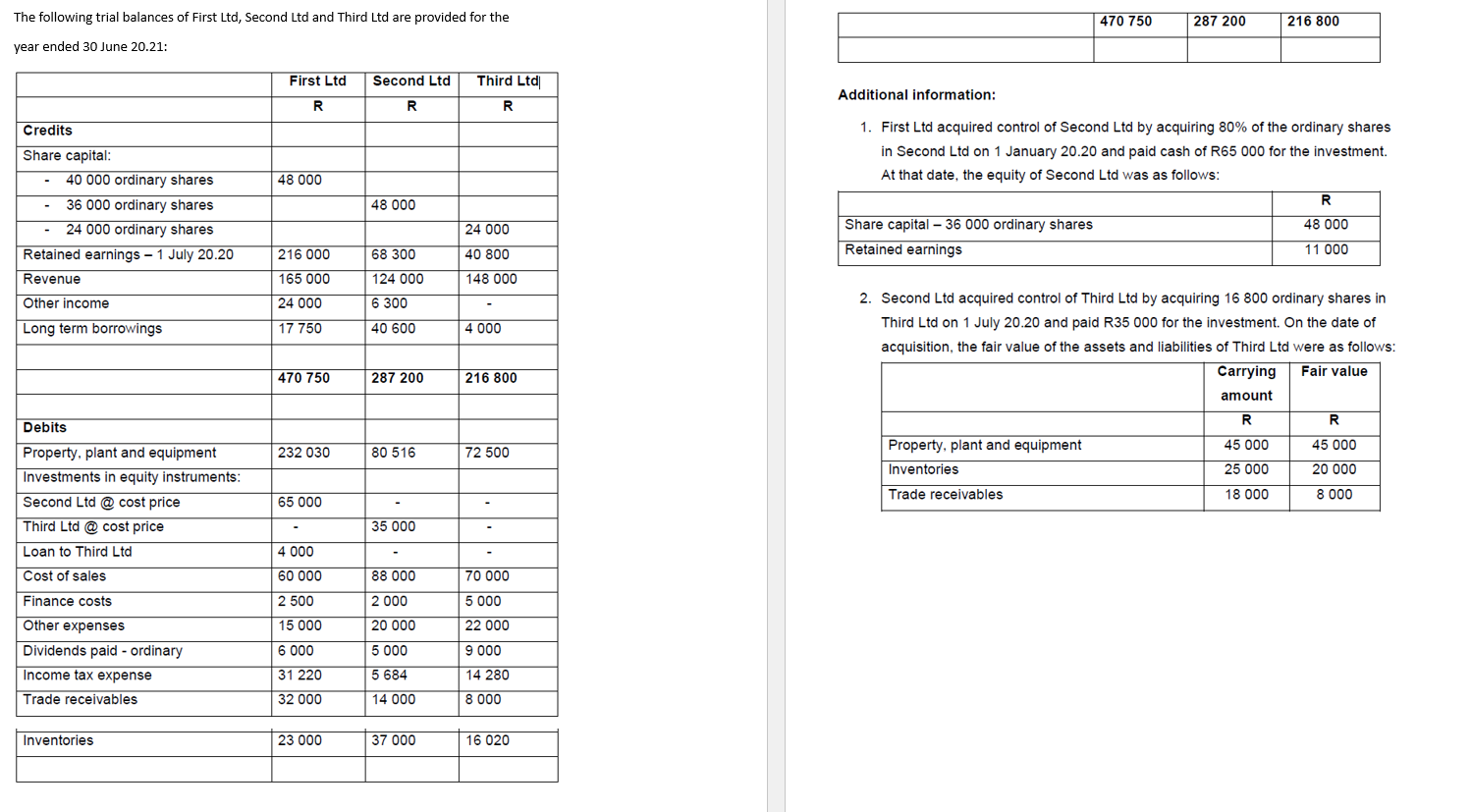

The following trial balances of First Ltd, Second Ltd and Third Ltd are provided for the year ended 30 June 20.21: Additional information: 1. First Ltd acquired control of Second Ltd by acquiring 80% of the ordinary shares in Second Ltd on 1 January 20.20 and paid cash of R65 000 for the investment. At that date, the equity of Second Ltd was as follows: 2. Second Ltd acquired control of Third Ltd by acquiring 16800 ordinary shares in Third Ltd on 1 July 20.20 and paid R35 000 for the investment. On the date of acquisition, the fair value of the assets and liabilities of Third Ltd were as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started