Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*These images are just to show the questions type and needs* I want requirement 1 and 2 both fully completed and accurate please. My question

*These images are just to show the questions type and needs*

I want requirement 1 and 2 both fully completed and accurate please.

My question numbers are below the images.

vvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvv

vvvvvvvvvvvv ((( Now here's my question numbers ))) vvvvvvvvvvvv

thank you:)

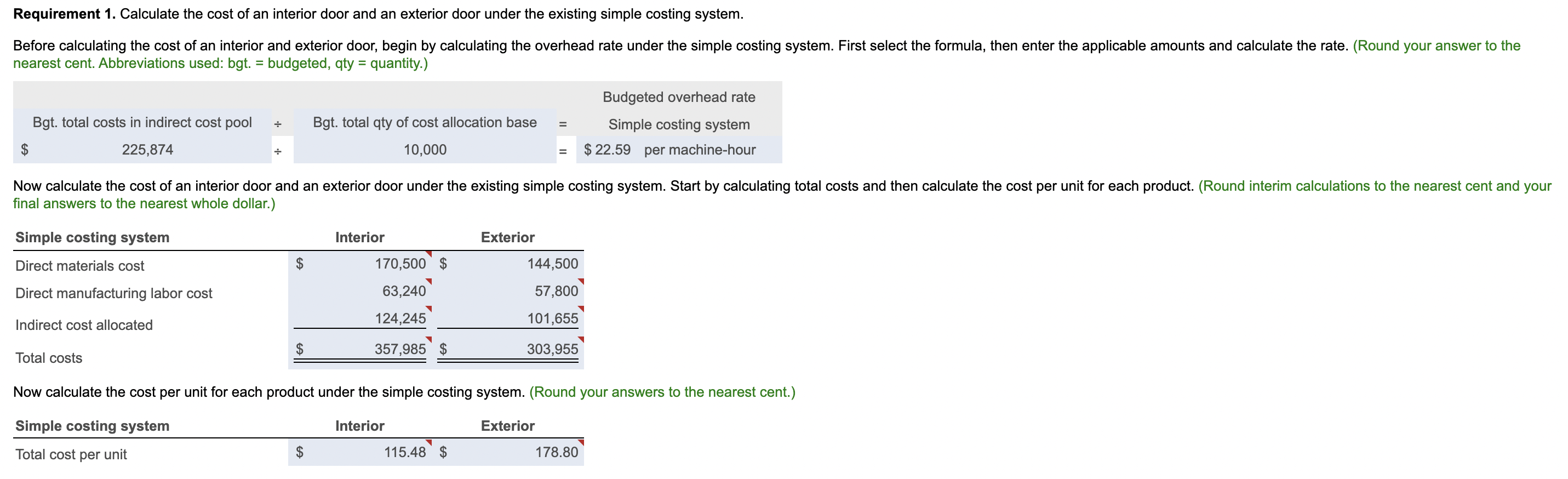

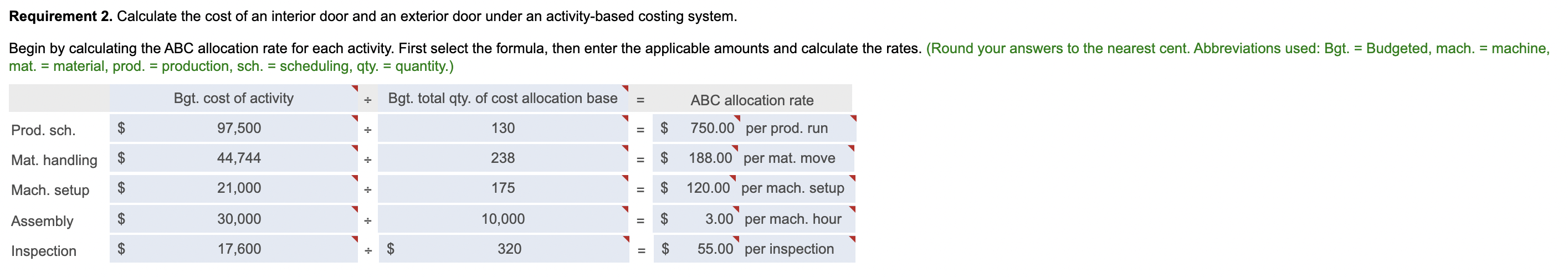

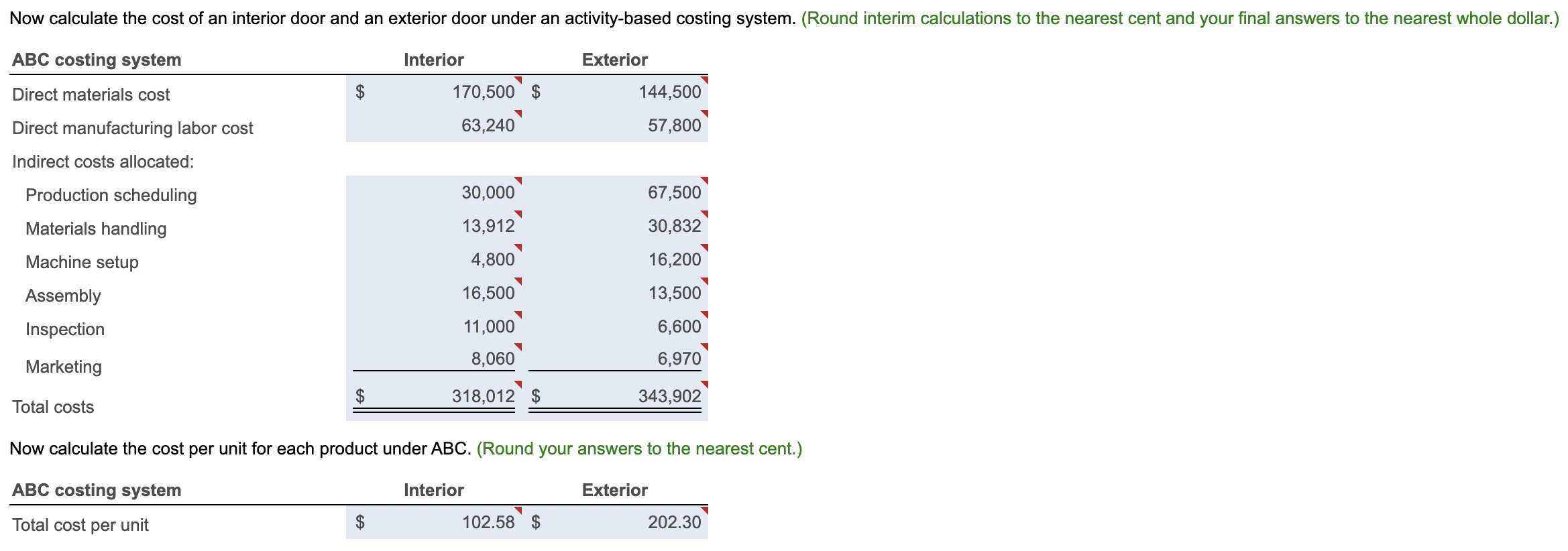

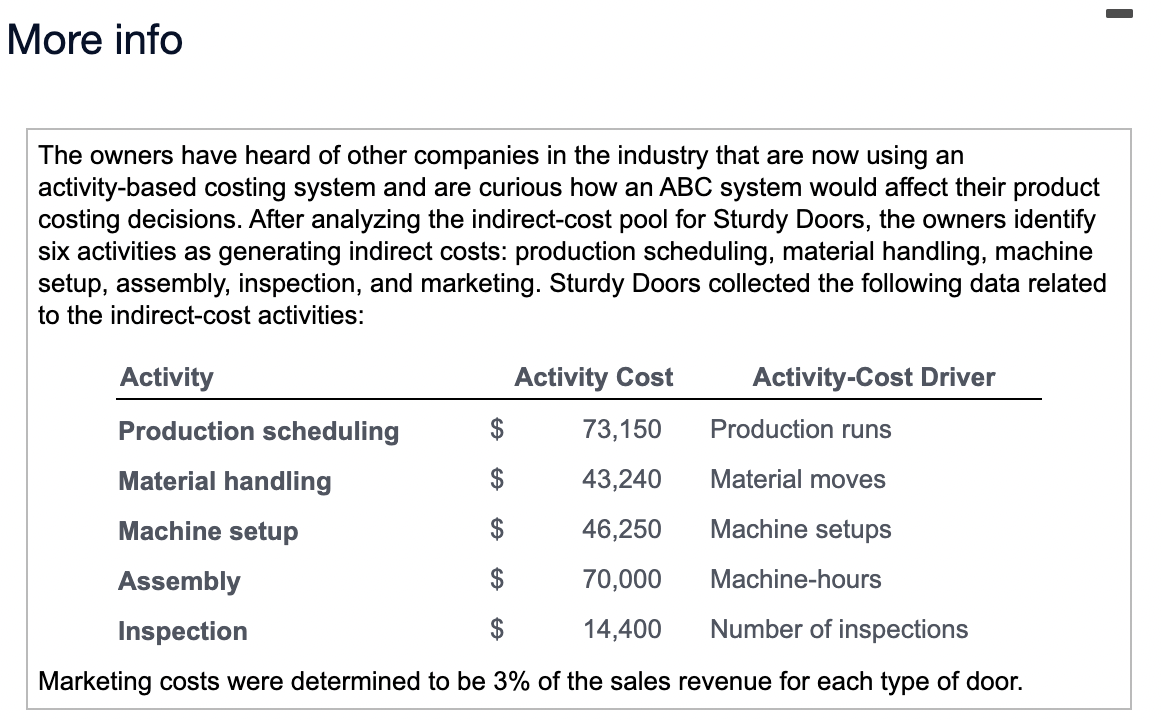

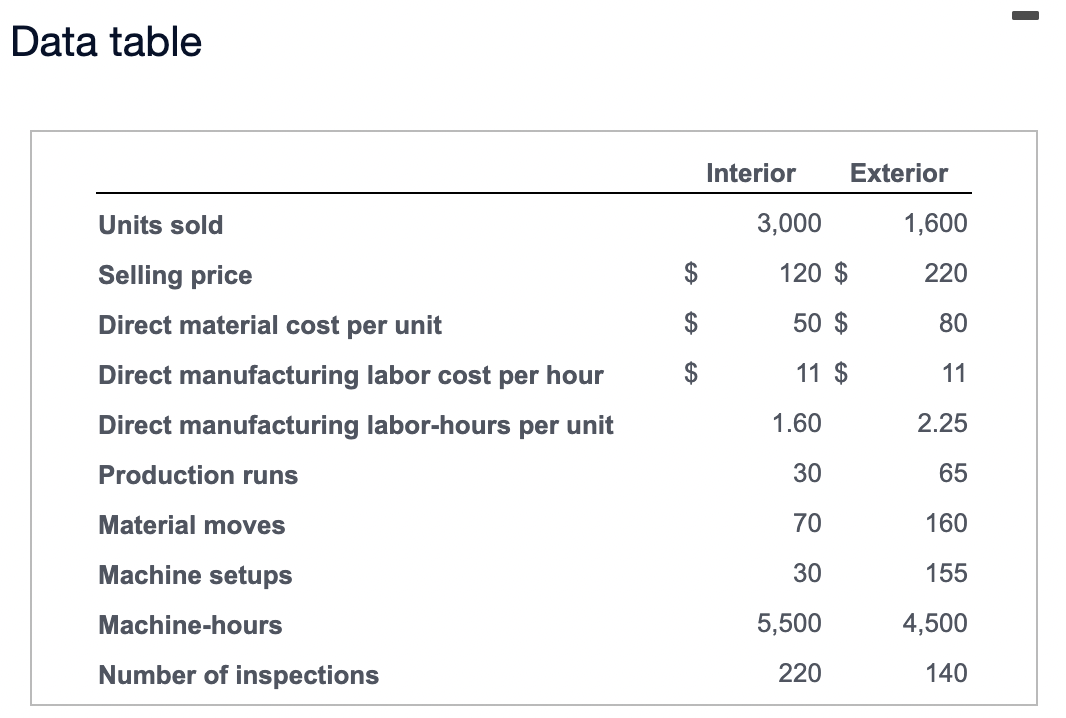

Requirement 1. Calculate the cost of an interior door and an exterior door under the existing simple costing system. Before calculating the cost of an interior and exterior door, begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate the rate. (Round your answer to the nearest cent. Abbreviations used: bgt. = budgeted, qty = quantity.) = = Budgeted overhead rate + Bgt. total qty of cost allocation base = Bgt. total costs in indirect cost pool $ 225,874 Simple costing system $ 22.59 per machine-hour 10,000 = Now calculate the cost of an interior door and an exterior door under the existing simple costing system. Start by calculating total costs and then calculate the cost per unit for each product. (Round interim calculations to the nearest cent and your final answers to the nearest whole dollar.) Simple costing system Interior Exterior Direct materials cost 144,500 170,500 63,240 Direct manufacturing labor cost 57,800 101,655 Indirect cost allocated 124,245 357,985 $ 303,955 Total costs Now calculate the cost per unit for each product under the simple costing system. (Round your answers to the nearest cent.) Simple costing system Interior Exterior Total cost per unit $ 115.48 $ 178.80 Requirement 2. Calculate the cost of an interior door and an exterior door under an activity-based costing system. = Budgeted, mach. = machine, Begin by calculating the ABC allocation rate for each activity. First select the formula, then enter the applicable amounts and calculate the rates. (Round your answers to the nearest cent. Abbreviations used: Bgt. mat. = material, prod. = production, sch. = scheduling, qty = quantity.) = Bgt. cost of activity Bgt. total qty. of cost allocation base = ABC allocation rate Prod. sch. 97,500 130 750.00 per prod. run II $ $ Mat. handling $ 44,744 238 $ 188.00 per mat. move . Mach. setup $ 21,000 . 175 = Il 120.00 per mach. setup Assembly $ 30,000 10,000 3.00 per mach. hour $ $ Inspection $ 17,600 ; $ 320 55.00 per inspection Now calculate the cost of an interior door and an exterior door under an activity-based costing system. (Round interim calculations to the nearest cent and your final answers to the nearest whole dollar.) ABC costing system Interior Exterior Direct materials cost 144,500 170,500 $ 63,240 57,800 Direct manufacturing labor cost Indirect costs allocated: Production scheduling Materials handling Machine setup Assembly Inspection 30,000 13,912 67,500 30,832 16,200 4,800 16,500 13,500 11,000 6,600 8,060 Marketing 6,970 $ 318,012 $ 343,902 Total costs Now calculate the cost per unit for each product under ABC. (Round your answers to the nearest cent.) ABC costing system Interior Exterior Total cost per unit $ 102.58 $ 202.30 Requirements 1. Calculate the cost of an interior door and an exterior door under the existing simple costing system. 2. Calculate the cost of an interior door and an exterior door under an activity-based costing system. More info The owners have heard of other companies in the industry that are now using an activity-based costing system and are curious how an ABC system would affect their product costing decisions. After analyzing the indirect-cost pool for Sturdy Doors, the owners identify six activities as generating indirect costs: production scheduling, material handling, machine setup, assembly, inspection, and marketing. Sturdy Doors collected the following data related to the indirect-cost activities: Activity Activity Cost Activity-Cost Driver Production scheduling 73,150 Production runs Material handling 43,240 Material moves Machine setup $ 46,250 Machine setups Assembly 70,000 Machine-hours Inspection 14,400 Number of inspections Marketing costs were determined to be 3% of the sales revenue for each type of door. - Data table Interior Exterior 3,000 1,600 $ 120 $ 220 Units sold Selling price Direct material cost per unit Direct manufacturing labor cost per hour Direct manufacturing labor-hours per unit $ 50 $ 80 $ 11 $ 11 1.60 2.25 Production runs 30 65 70 160 Material moves Machine setups 30 155 Machine-hours 5,500 4,500 Number of inspections 220 140Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started