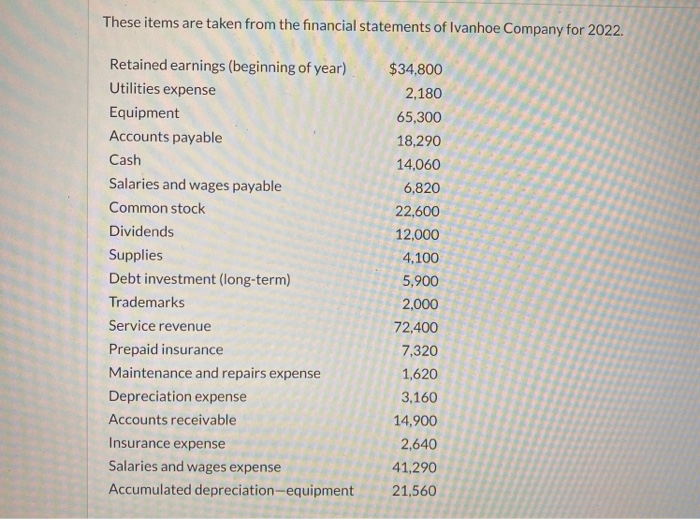

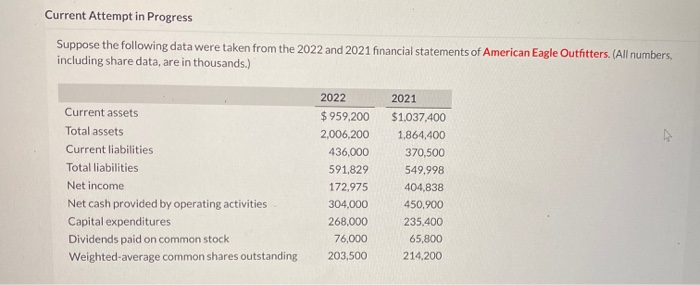

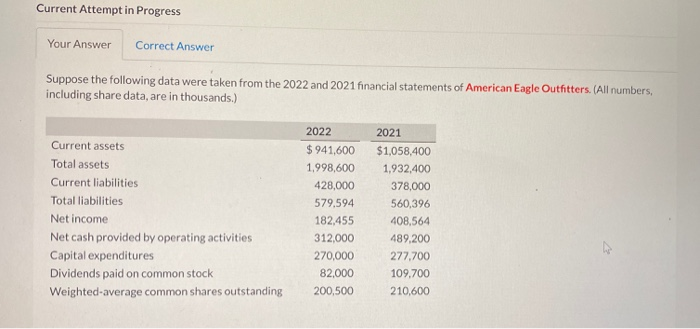

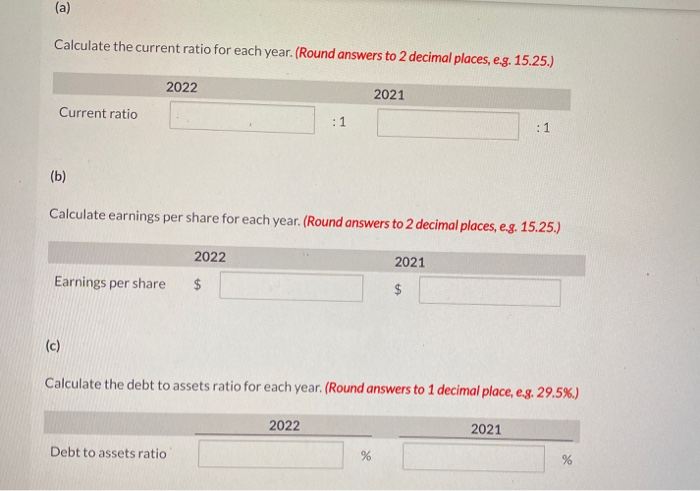

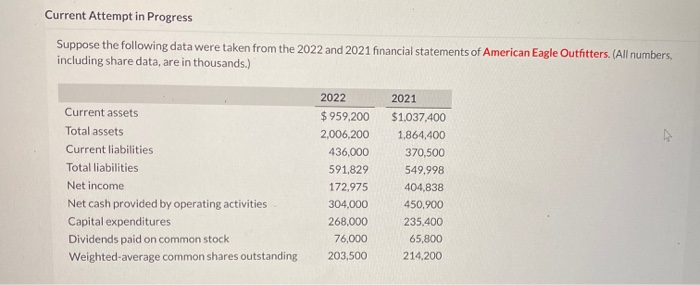

These items are taken from the financial statements of Ivanhoe Company for 2022. Retained earnings (beginning of year) Utilities expense Equipment Accounts payable Cash Salaries and wages payable Common stock Dividends Supplies Debt investment (long-term) Trademarks Service revenue Prepaid insurance Maintenance and repairs expense Depreciation expense Accounts receivable Insurance expense Salaries and wages expense Accumulated depreciation-equipment $34,800 2,180 65,300 18,290 14,060 6,820 22,600 12,000 4,100 5.900 2,000 72,400 7,320 1,620 3,160 14,900 2,640 41,290 21,560 Current Attempt in Progress Suppose the following data were taken from the 2022 and 2021 financial statements of American Eagle Outfitters. (All numbers, including share data, are in thousands.) Current assets Total assets Current liabilities Total liabilities Net income Net cash provided by operating activities Capital expenditures Dividends paid on common stock Weighted average common shares outstanding 2022 $959,200 2,006,200 436,000 591,829 172,975 304,000 268,000 76,000 203,500 2021 $1.037,400 1,864,400 370,500 549,998 404,838 450,900 235.400 65,800 214,200 Current Attempt in Progress Your Answer Correct Answer Suppose the following data were taken from the 2022 and 2021 financial statements of American Eagle Outfitters. (All numbers, including share data, are in thousands.) Current assets Total assets Current liabilities Total liabilities Net income Net cash provided by operating activities Capital expenditures Dividends paid on common stock Weighted average common shares outstanding 2022 $ 941,600 1.998,600 428,000 579.594 182,455 312,000 270,000 82.000 200,500 2021 $1,058,400 1,932.400 378,000 560.396 408,564 489,200 277,700 109.700 210,600 (a) Calculate the current ratio for each year. (Round answers to 2 decimal places, e.g. 15.25.) 2022 2021 Current ratio :1 (b) Calculate earnings per share for each year. (Round answers to 2 decimal places, e.g. 15.25.) 2022 2021 Earnings per share $ $ (c) Calculate the debt to assets ratio for each year. (Round answers to 1 decimal place, e.g. 29.5%) 2022 2021 Debt to assets ratio % (d) Calculate the free cash flow for each year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter amounts in thousands.) 2022 2021 Free cash flow $