Answered step by step

Verified Expert Solution

Question

1 Approved Answer

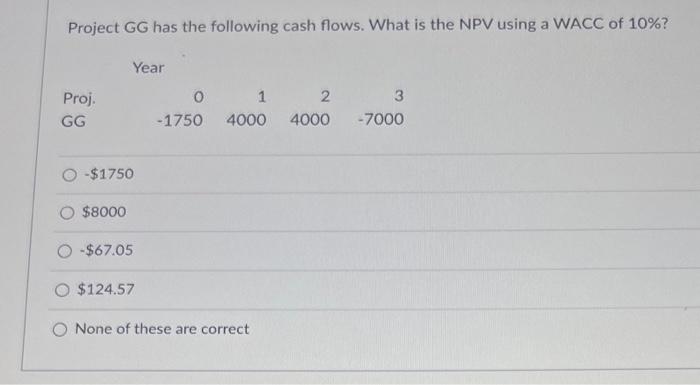

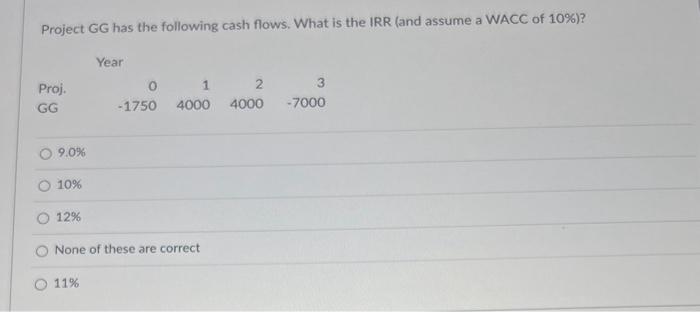

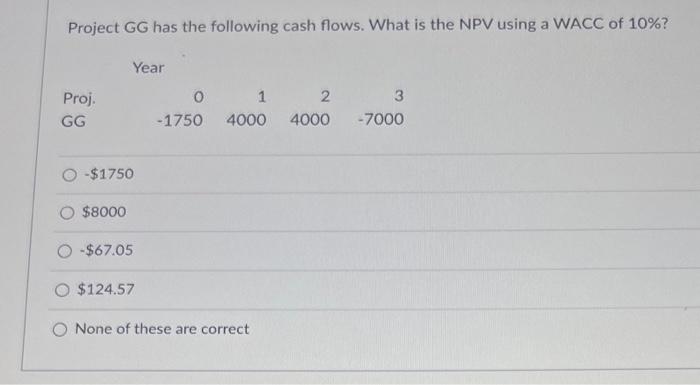

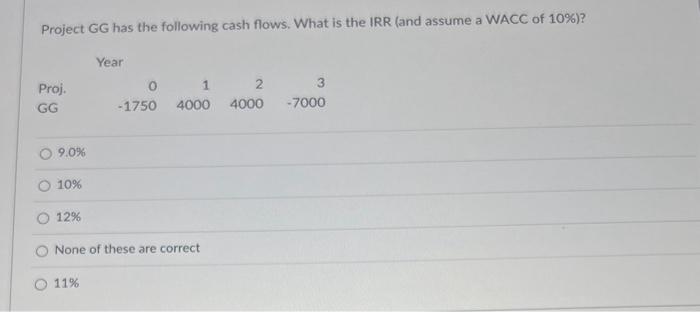

These questions are all related to each other so please answer all. 3-a. 3-b. 3-c. Project GG has the following cash flows. What is the

These questions are all related to each other so please answer all.

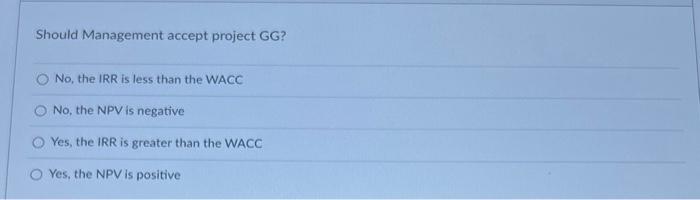

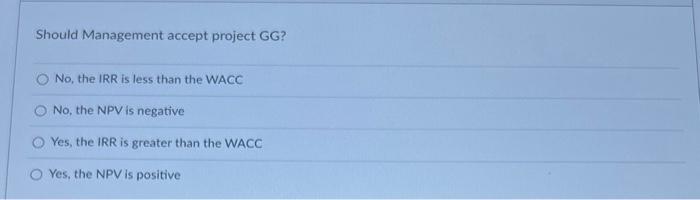

Project GG has the following cash flows. What is the NPV using a WACC of 10% ? $1750 $8000 $67.05 $124.57 None of these are correct Project GG has the following cash flows. What is the IRR (and assume a WACC of 10% )? 9.0% 10% 12% None of these are correct 11% Should Management accept project GG? No, the IRR is less than the WACC No, the NPV is negative Yes, the IRR is greater than the WACC Yes, the NPV is positive 3-a.

3-b.

3-c.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started