Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these questions are also with the first one, so can you please give me the answer of these ones too. thank you you can just

these questions are also with the first one, so can you please give me the answer of these ones too. thank you

you can just give the answer of the first question

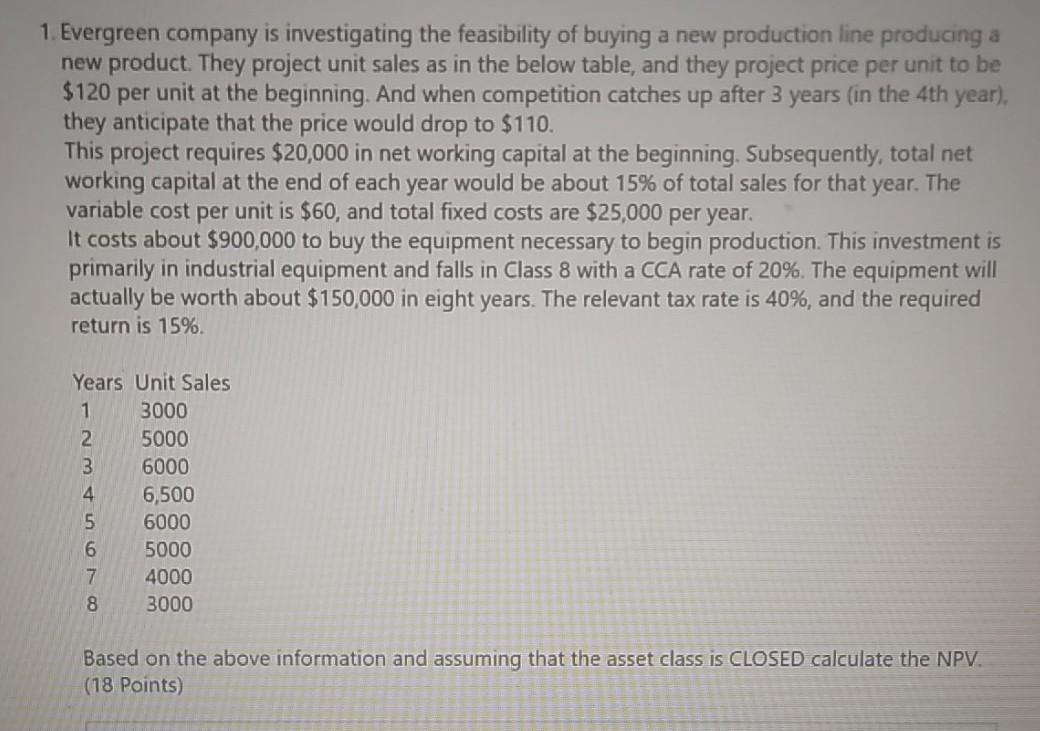

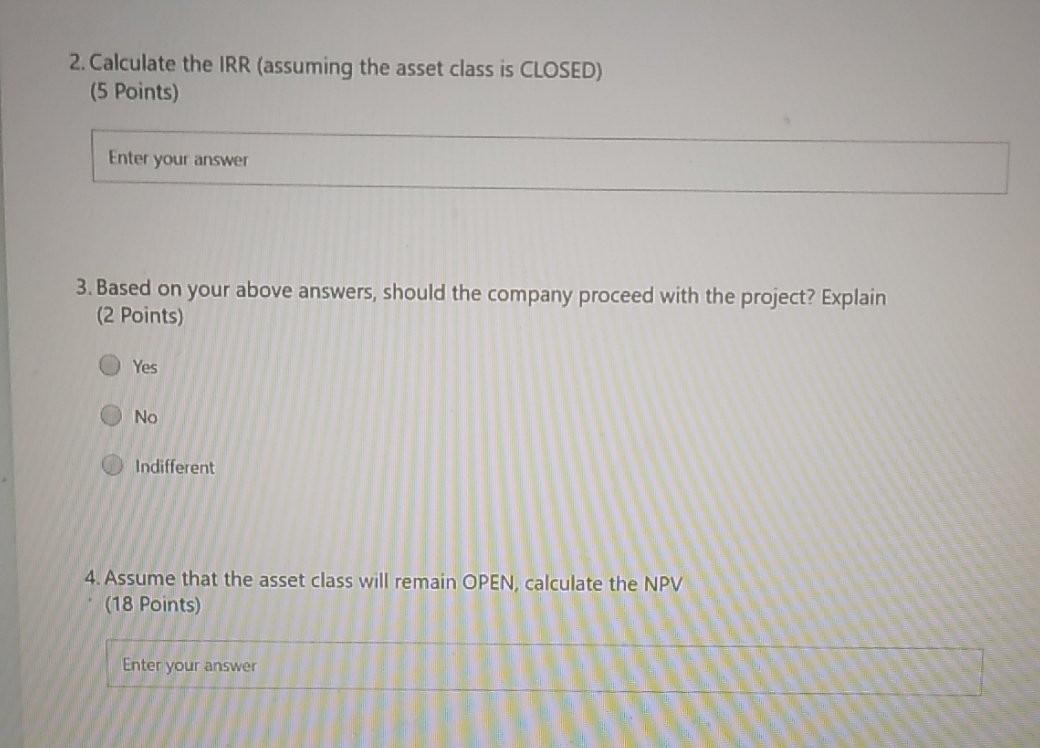

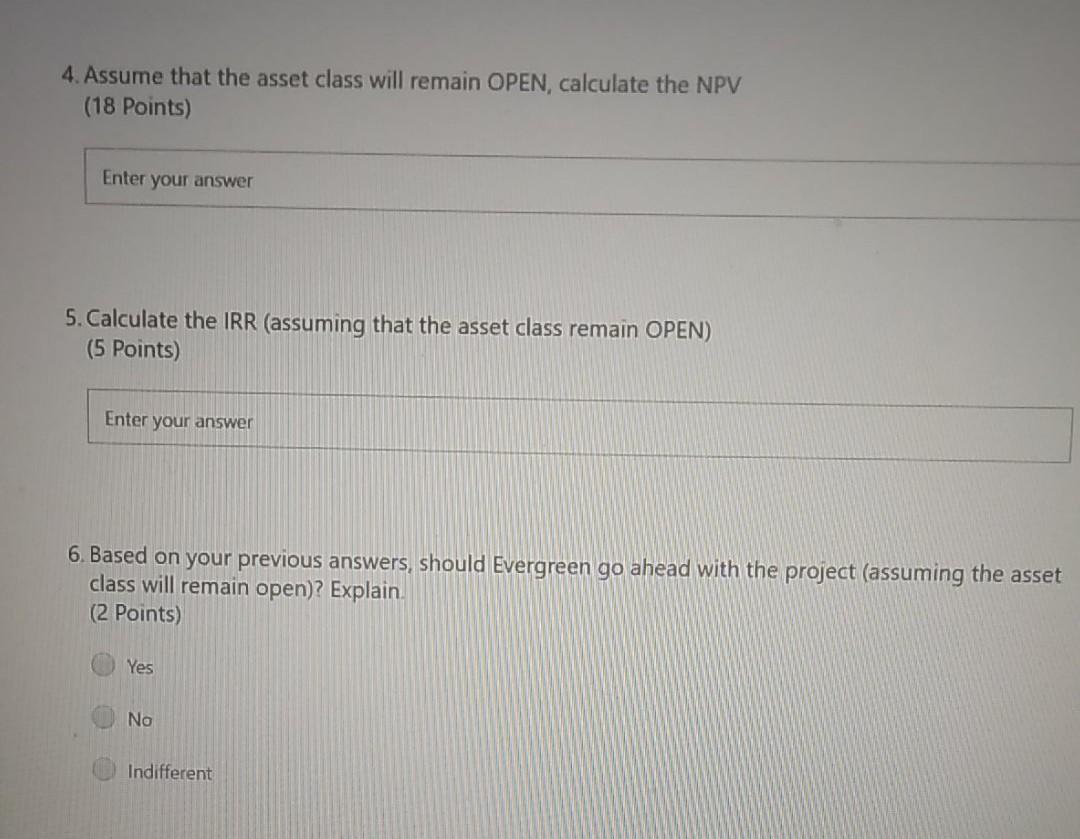

1. Evergreen company is investigating the feasibility of buying a new production line producing a new product. They project unit sales as in the below table, and they project price per unit to be $120 per unit at the beginning. And when competition catches up after 3 years in the 4th year), they anticipate that the price would drop to $110. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. The variable cost per unit is $60, and total fixed costs are $25,000 per year. It costs about $900,000 to buy the equipment necessary to begin production. This investment is primarily in industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will actually be worth about $150,000 in eight years. The relevant tax rate is 40%, and the required return is 15%. Years Unit Sales 1 3000 2 5000 3 6000 4 6,500 5 6000 6 5000 7 4000 8 3000 Based on the above information and assuming that the asset class is CLOSED calculate the NPV. (18 Points) 2. Calculate the IRR (assuming the asset class is CLOSED) (5 Points) Enter your answer 3. Based on your above answers, should the company proceed with the project? Explain (2 Points) Yes No Indifferent 4. Assume that the asset class will remain OPEN, calculate the NPV (18 Points) Enter your answer 4. Assume that the asset class will remain OPEN, calculate the NPV (18 Points) Enter your answer 5. Calculate the IRR (assuming that the asset class remain OPEN) (5 Points) Enter your answer 6. Based on your previous answers, should Evergreen go ahead with the project (assuming the asset class will remain open)? Explain. (2 Points) Yes No Indifferent 1. Evergreen company is investigating the feasibility of buying a new production line producing a new product. They project unit sales as in the below table, and they project price per unit to be $120 per unit at the beginning. And when competition catches up after 3 years in the 4th year), they anticipate that the price would drop to $110. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. The variable cost per unit is $60, and total fixed costs are $25,000 per year. It costs about $900,000 to buy the equipment necessary to begin production. This investment is primarily in industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will actually be worth about $150,000 in eight years. The relevant tax rate is 40%, and the required return is 15%. Years Unit Sales 1 3000 2 5000 3 6000 4 6,500 5 6000 6 5000 7 4000 8 3000 Based on the above information and assuming that the asset class is CLOSED calculate the NPV. (18 Points) 2. Calculate the IRR (assuming the asset class is CLOSED) (5 Points) Enter your answer 3. Based on your above answers, should the company proceed with the project? Explain (2 Points) Yes No Indifferent 4. Assume that the asset class will remain OPEN, calculate the NPV (18 Points) Enter your answer 4. Assume that the asset class will remain OPEN, calculate the NPV (18 Points) Enter your answer 5. Calculate the IRR (assuming that the asset class remain OPEN) (5 Points) Enter your answer 6. Based on your previous answers, should Evergreen go ahead with the project (assuming the asset class will remain open)? Explain. (2 Points) Yes No IndifferentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started