Answered step by step

Verified Expert Solution

Question

1 Approved Answer

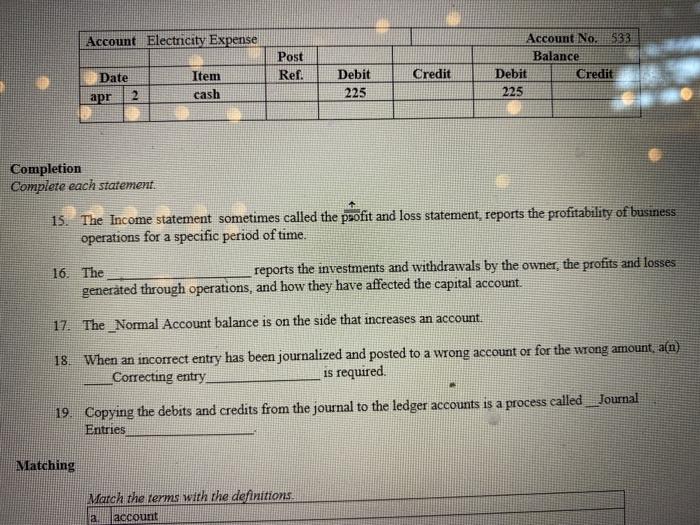

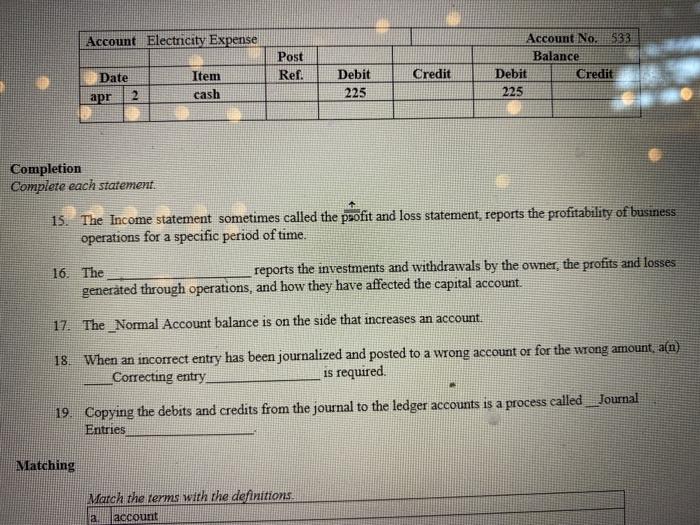

these right? Account Electricity Expense Post Ref. Account No. 533 Balance Debit Credit 225 Credit Date apr 2 Item cash Debit 225 Completion Complete each

these right?

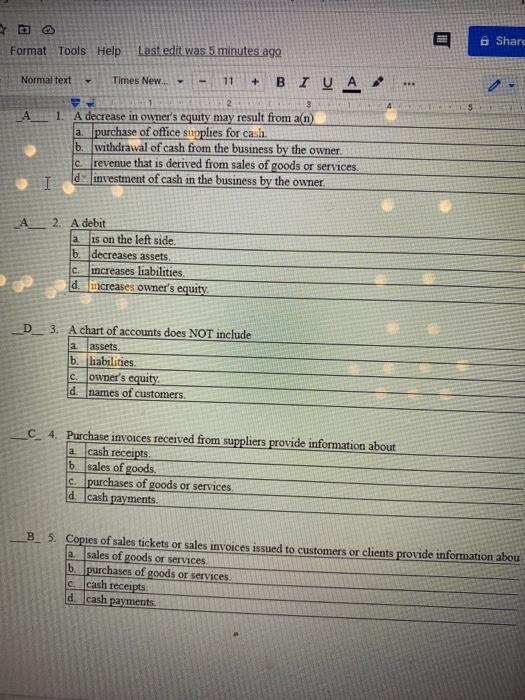

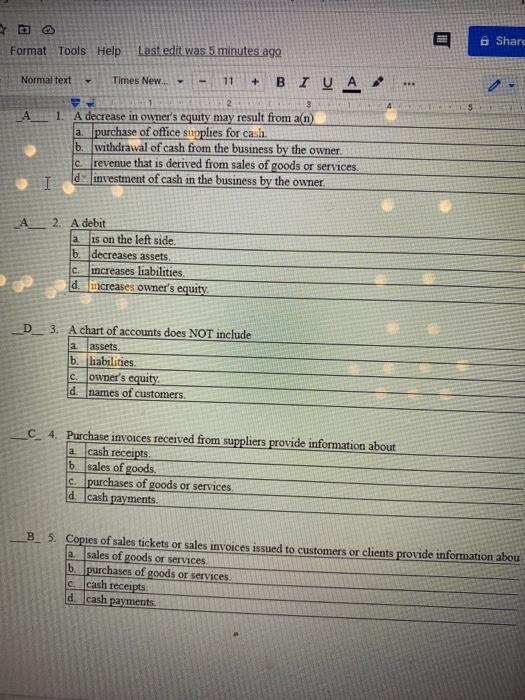

Account Electricity Expense Post Ref. Account No. 533 Balance Debit Credit 225 Credit Date apr 2 Item cash Debit 225 Completion Complete each statement. 15. The Income statement sometimes called the profit and loss statement, reports the profitability of business operations for a specific period of time. 16. The reports the investments and withdrawals by the owner, the profits and losses generated through operations, and how they have affected the capital account. 17. The_Normal Account balance is on the side that increases an account. 18. When an incorrect entry has been journalized and posted to a wrong account or for the wrong arnount, a[n) Correcting entry is required 19. Copying the debits and credits from the journal to the ledger accounts is a process called_Journal Entries Matching March the terms with the definitions. account a 6 Share Format Tools Help Last edit was 5 minutes ago + 3 S Normal text Times New... 11 2 1. A decrease in owner's equity may result from an a purchase of office supplies for cash. b. withdrawal of cash from the business by the owner revenue that is derived from sales of goods or services. I d investment of cash in the business by the owner a A 2. A debit is on the left side b. decreases assets. Cincreases liabilities, d. increases owner's equity. D__ 3. A chart of accounts does NOT include a. assets b. liabilities. c. owner's equity d. names of customers C_4. Purchase invoices received from suppliers provide information about 2. cash receipts. b. sales of goods. c. purchases of goods or services d cash payments. B 5. Copies of sales tickets or sales invoices issued to customers or clients provide information abou a. sales of goods or services b. purchases of goods or services. cash receipts. d. cash payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started