Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these two questions i find to be very tough 4-21 adopted, the company's average sales will fall by 15%. What will be the level of

these two questions i find to be very tough

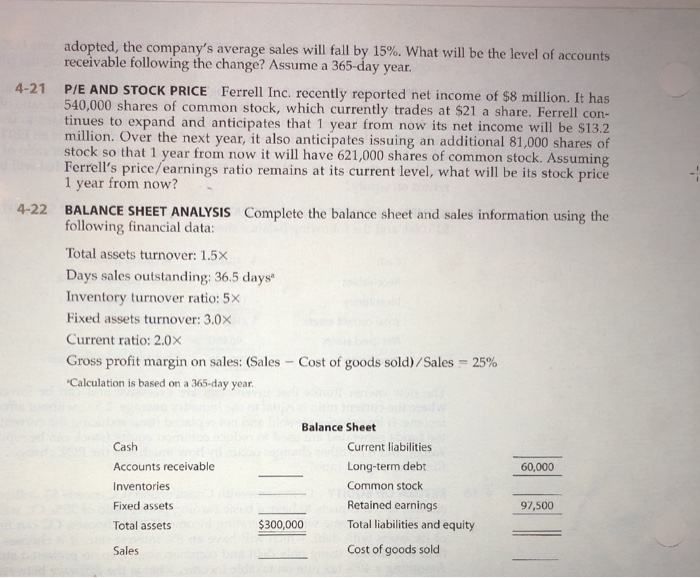

4-21 adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year. P/E AND STOCK PRICE Ferrell Inc. recently reported net income of $8 million. It has 540,000 shares of common stock, which currently trades at $21 a share. Ferrell con- tinues to expand and anticipates that 1 year from now its net income will be $13.2 million. Over the next year, it also anticipates issuing an additional 81,000 shares of stock so that 1 year from now it will have 621,000 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? 4-22 BALANCE SHEET ANALYSIS Complete the balance sheet and sales information using the following financial data: Total assets turnover: 1.5X Days sales outstanding 365 days Inventory turnover ratio: 5X Fixed assets turnover: 3.0X Current ratio: 2.0x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales - 25% Calculation is based on a 365-day year. 60,000 Cash Accounts receivable Inventories Fixed assets Total assets Balance Sheet Current liabilities Long-term debt Common stock Retained earnings $300,000 Total liabilities and equity 97,500 Sales Cost of goods sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started