Answered step by step

Verified Expert Solution

Question

1 Approved Answer

they are MC, answer all with work shown for full credit & thumbs up Casey transfers property with a tax basis of $3,0BO and a

they are MC, answer all with work shown for full credit & thumbs up

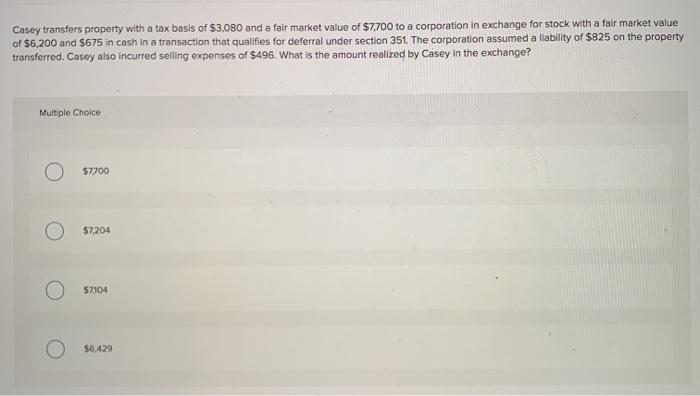

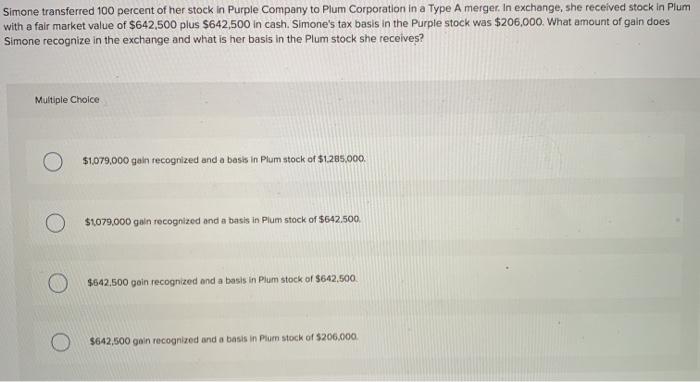

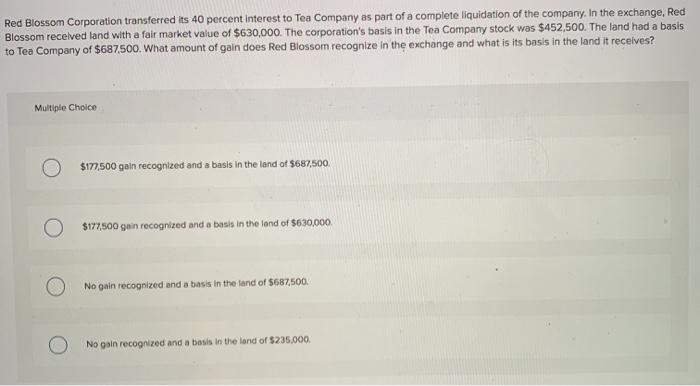

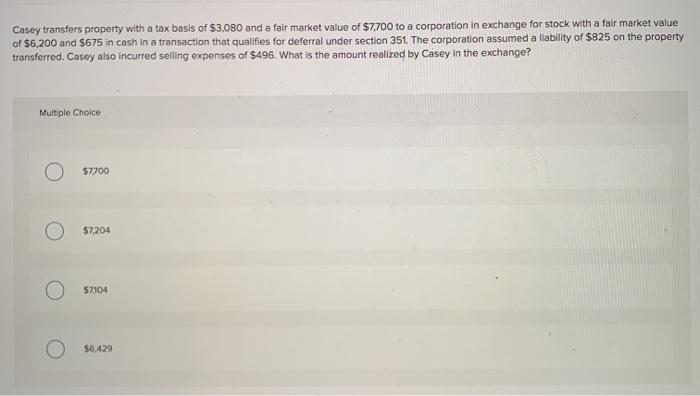

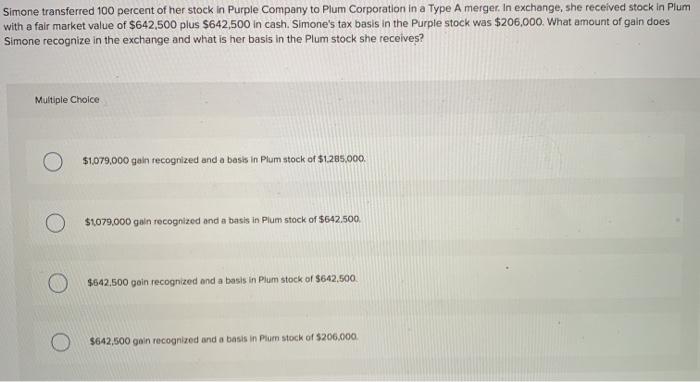

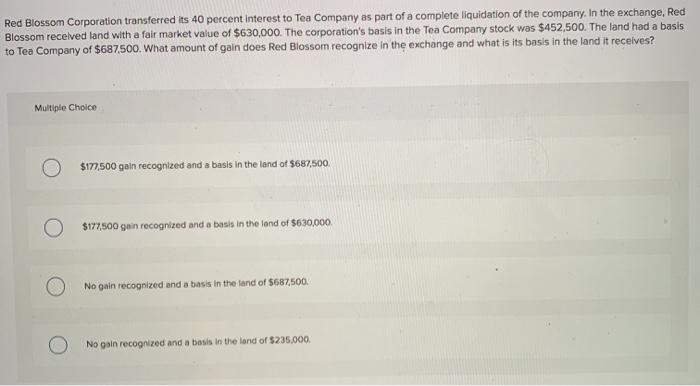

Casey transfers property with a tax basis of $3,0BO and a fair market value of $7.700 to a corporation in exchange for stock with a fair market value of $6,200 and $675 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $825 on the property transferred. Casey also incurred selling expenses of $496. What is the amount realized by Casey in the exchange? Multiple Choice $7700 $7,204 S7104 $6,429 Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a fair market value of $642,500 plus $642,500 in cash. Simone's tax basis in the Purple stock was $206,000. What amount of gain does Simone recognize in the exchange and what is her basis in the Plum stock she receives? Multiple Choice O $1079,000 guin recognized and a basis in Plum stock of $1205.000. O $1079,000 gain recognized and a basis in Plum stock of $642.500. $642,500 gain recognized and a basis in Plum stock of 5642,500. $642,500 gain recognized and a basis in Plum stock of $200,000 Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red Blossom recelved and with a fair market value of $630,000. The corporation's basis in the Tea Company stock was $452,500. The land had a basis to Tea Company of $687.500. What amount of gain does Red Blossom recognize in the exchange and what is its basis in the land it receives? Multiple Choice $177,500 gain recognized and a basis in the land of $687,500 O $177,500 gain recognized and a basis in the land of $630,000 No gain recognized and a basis in the land of $687,500 No gain recognized and a basis in the land of $235.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started