Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this all the information that's given. please recheck You are the chief financial officer of Big Foot Forestry (BFF), a New Zealand forestry investment company

this all the information that's given. please recheck

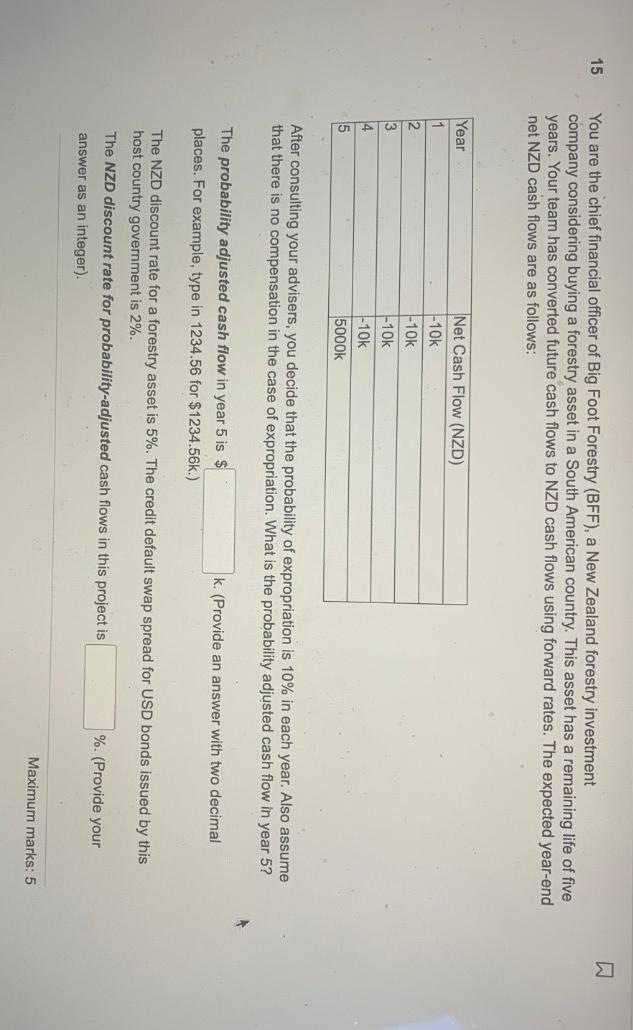

You are the chief financial officer of Big Foot Forestry (BFF), a New Zealand forestry investment company considering buying a forestry asset in a South American country. This asset has a remaining life of five years. Your team has converted future cash flows to NZD cash flows using forward rates. The expected year-end net NZD cash flows are as follows: After consulting your advisers, you decide that the probability of expropriation is 10% in each year. Also assume that there is no compensation in the case of expropriation. What is the probability adjusted cash flow in year 5 ? The probability adjusted cash flow in year 5 is $ places. For example, type in 1234.56 for $1234.56k.) k. (Provide an answer with two decimal The NZD discount rate for a forestry asset is 5%. The credit default swap spread for USD bonds issued by this host country government is 2%. The NZD discount rate for probability-adjusted cash flows in this project is answer as an integer). \%. (Provide yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started