Answered step by step

Verified Expert Solution

Question

1 Approved Answer

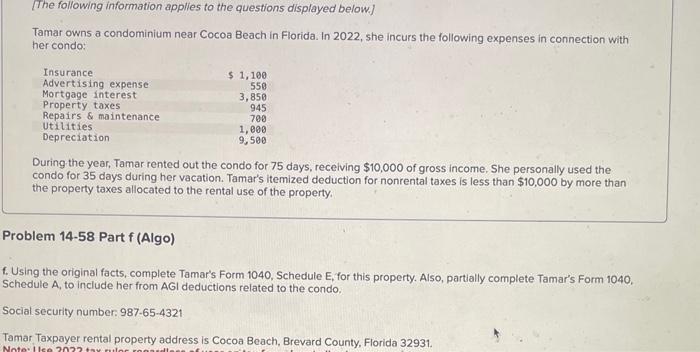

this all the information [The following information applies to the questions displayed below] Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she

this all the information

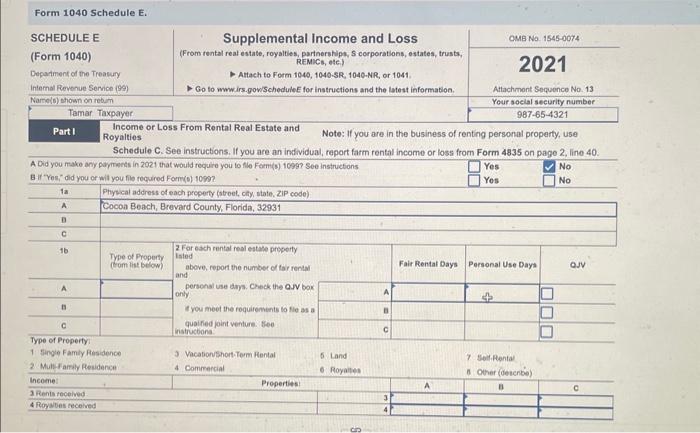

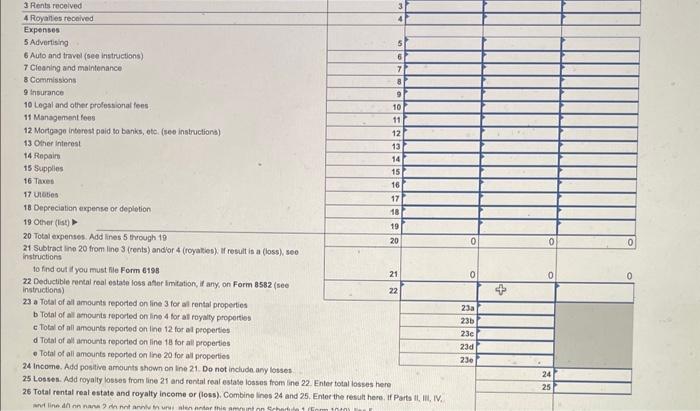

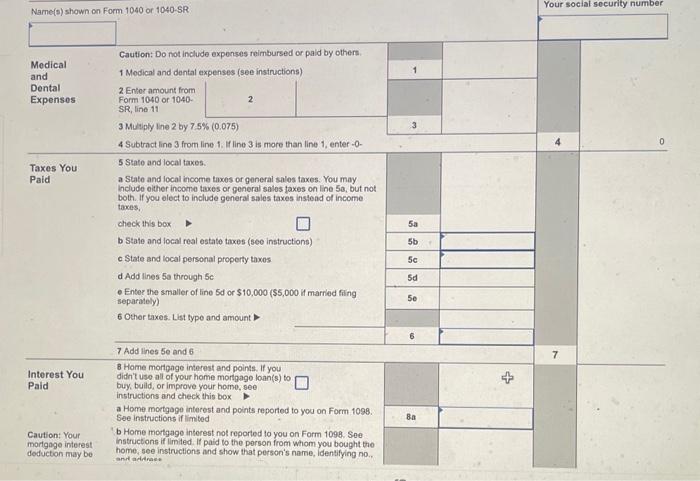

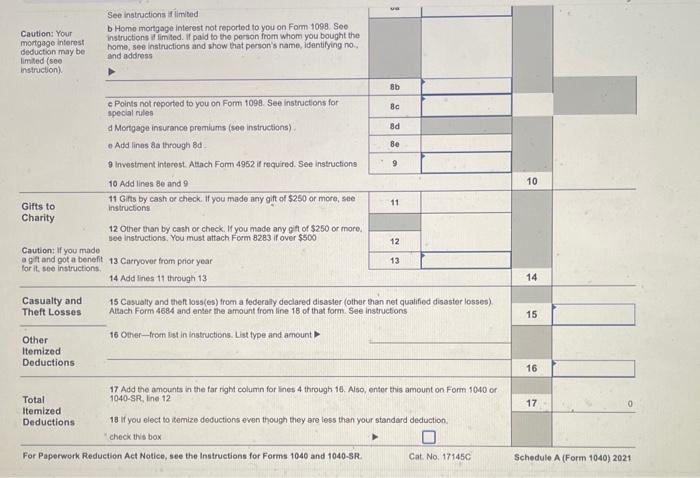

[The following information applies to the questions displayed below] Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo: During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. roblem 14-58 Part f( Algo) Using the original facts, complete Tamar's Form 1040, Schedule E, for this property. Also, partially complete Tamar's Form 1040, chedule A, to include her from AGI deductions related to the condo. ocial security number: 987654321 Form 1040 Schedule E. Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or losa from Form 4835 on page 2, line 40. A Did you make any payments in 2021 that would require you to flo Fem(s) 1099 ? See instructions I fients received 4 Royalies received Expenses 5 Advertising 6 Auto and travel (Gede instructions) 7 Cleaning and malntenance B Commissions 9 insurance 10 Legal and other profestional fees 11 Management fees 12. Mortgage interest paid to banks, eto. (see instructionb) 13 Cher interest 14 Ropain 15 supplies 16 Tiwes 17 viaties 18 Depreciabion expense or deplotion 19 Oiner (list) > 20 Total eupenses. Add lines 5 through 18 21. Subtract ine 20 from line 3 (rents) andlor 4 (royalies) a result is a (loss) seo instructions to find oul it you must file Form 6198 22 Deductible Fental roal estate loss athor Imitationy if any, on Form 8582 isee instrictions) 23 a Tocal of all amounts reported on line 3 for al rental propertios b Total of all amounts reported on line 4 for al royalty proportios c Tolal of all amounts roportod on line 12 for ol pecperties d Total of al amounts ropcrted on line 18 for all propertios - Total of ali amounts reported on line 20 for all properties 24 incoene. Add pesithe arnounts shown on Ine 21. Do not includa any lotset 25 Losses. Add royalty losses from line 21 and tental real estase lossos from line 22 . Enter total losses here 26 Total rental real estate and royalty income or (loss), Combino linos 24 and 25 . Enter the result here. If Parts It, Ill, IV, Name(s) shown on Form 1040 or 10405R See instrutions if limited Cavtion: Your b Homo mortgage interest not reported to you on Form 1098. See mortgage interest instructions at limled. If pald to the porson from whom you bought the deduction may be home, see instructions and thow that person's name, identilying no. limited (see and address instruction). \begin{tabular}{|l|l|} \hline ua & \\ \hline & \\ \hline & \\ \hline 8b & \\ \hline 8c & \\ \hline 8d & \\ \hline 8e & \\ \hline 9 & \\ \hline \end{tabular} 10 Add lines be and 9 Gifts to 11Gints by cash or check. If you made any gift of $250 or more, see instructions Charity 12 Other than by cash or check. If you made any git of $250 or more. bee instructions. You must attach Form 8283 if over $500 Caution: if you made a gil and got a benefit 13 Carryovor from prior yoar for it. see instructions. 14 Add lines 11 through 13 Casualty and 15 Casualty and thef loss(es) from a federaly declared disaster (other than net qualified disastor losses) Altach Form 4684 and enter the amount from line 18 of that form. See instructions Other 16 Oher-from list in instructions. Liat type and amount Itemized Deductions 17 Add the amounts in the far right column for lines 4 through 16. Aiso, enter this amount on Form 1040 or Total Itemlzed Deductions 18 if you elect to itemize deductions even though they are less than your standard deduction. "check this box For Paperwork Reduction Act Notice, see the Instruetions for Forms 1040 and 1040-SR. Cat No, 17145C Schedule A (Form 1040) 2021 [The following information applies to the questions displayed below] Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo: During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. roblem 14-58 Part f( Algo) Using the original facts, complete Tamar's Form 1040, Schedule E, for this property. Also, partially complete Tamar's Form 1040, chedule A, to include her from AGI deductions related to the condo. ocial security number: 987654321 Form 1040 Schedule E. Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or losa from Form 4835 on page 2, line 40. A Did you make any payments in 2021 that would require you to flo Fem(s) 1099 ? See instructions I fients received 4 Royalies received Expenses 5 Advertising 6 Auto and travel (Gede instructions) 7 Cleaning and malntenance B Commissions 9 insurance 10 Legal and other profestional fees 11 Management fees 12. Mortgage interest paid to banks, eto. (see instructionb) 13 Cher interest 14 Ropain 15 supplies 16 Tiwes 17 viaties 18 Depreciabion expense or deplotion 19 Oiner (list) > 20 Total eupenses. Add lines 5 through 18 21. Subtract ine 20 from line 3 (rents) andlor 4 (royalies) a result is a (loss) seo instructions to find oul it you must file Form 6198 22 Deductible Fental roal estate loss athor Imitationy if any, on Form 8582 isee instrictions) 23 a Tocal of all amounts reported on line 3 for al rental propertios b Total of all amounts reported on line 4 for al royalty proportios c Tolal of all amounts roportod on line 12 for ol pecperties d Total of al amounts ropcrted on line 18 for all propertios - Total of ali amounts reported on line 20 for all properties 24 incoene. Add pesithe arnounts shown on Ine 21. Do not includa any lotset 25 Losses. Add royalty losses from line 21 and tental real estase lossos from line 22 . Enter total losses here 26 Total rental real estate and royalty income or (loss), Combino linos 24 and 25 . Enter the result here. If Parts It, Ill, IV, Name(s) shown on Form 1040 or 10405R See instrutions if limited Cavtion: Your b Homo mortgage interest not reported to you on Form 1098. See mortgage interest instructions at limled. If pald to the porson from whom you bought the deduction may be home, see instructions and thow that person's name, identilying no. limited (see and address instruction). \begin{tabular}{|l|l|} \hline ua & \\ \hline & \\ \hline & \\ \hline 8b & \\ \hline 8c & \\ \hline 8d & \\ \hline 8e & \\ \hline 9 & \\ \hline \end{tabular} 10 Add lines be and 9 Gifts to 11Gints by cash or check. If you made any gift of $250 or more, see instructions Charity 12 Other than by cash or check. If you made any git of $250 or more. bee instructions. You must attach Form 8283 if over $500 Caution: if you made a gil and got a benefit 13 Carryovor from prior yoar for it. see instructions. 14 Add lines 11 through 13 Casualty and 15 Casualty and thef loss(es) from a federaly declared disaster (other than net qualified disastor losses) Altach Form 4684 and enter the amount from line 18 of that form. See instructions Other 16 Oher-from list in instructions. Liat type and amount Itemized Deductions 17 Add the amounts in the far right column for lines 4 through 16. Aiso, enter this amount on Form 1040 or Total Itemlzed Deductions 18 if you elect to itemize deductions even though they are less than your standard deduction. "check this box For Paperwork Reduction Act Notice, see the Instruetions for Forms 1040 and 1040-SR. Cat No, 17145C Schedule A (Form 1040) 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started