Answered step by step

Verified Expert Solution

Question

1 Approved Answer

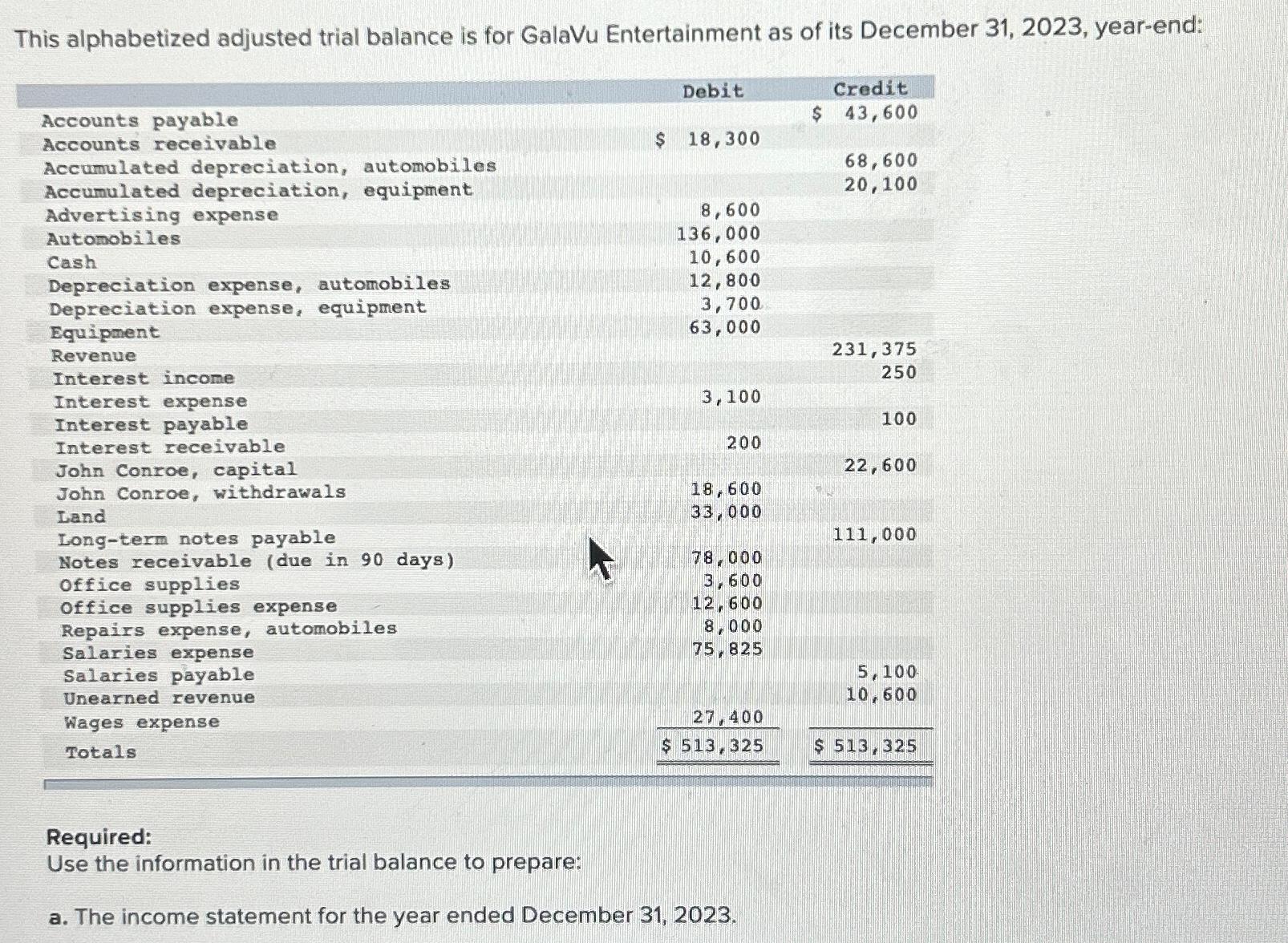

This alphabetized adjusted trial balance is for GalaVu Entertainment as of its December 3 1 , 2 0 2 3 , year - end:

This alphabetized adjusted trial balance is for GalaVu Entertainment as of its December yearend:

tableDebit,,CreditAccounts payable,,,$Accounts receivable,$Accumulated depreciation, automobiles,,,,Accumulated depreciation, equipment,,,,Advertising expense,,AutomobilesCashDepreciation expense, automobiles,,Depreciation expense, equipment,,EquipmentRevenueInterest income,,,,Interest expense,,Interest payable,,,,Interest receivable,,John Conroe, capital,,,,John Conroe, withdrawals,,LandLongterm notes payable,,,,Notes receivable due in daysOffice supplies,,office supplies expense,,Repairs expense, automobiles,,Salaries expense,,Salaries payable,,,,Unearned revenue,,,,Wages expense,,Totals$

Required:

Use the information in the trial balance to prepare:

a The income statement for the year ended December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started