This answer was already partially answered prior. I only need the answer to part 6!!

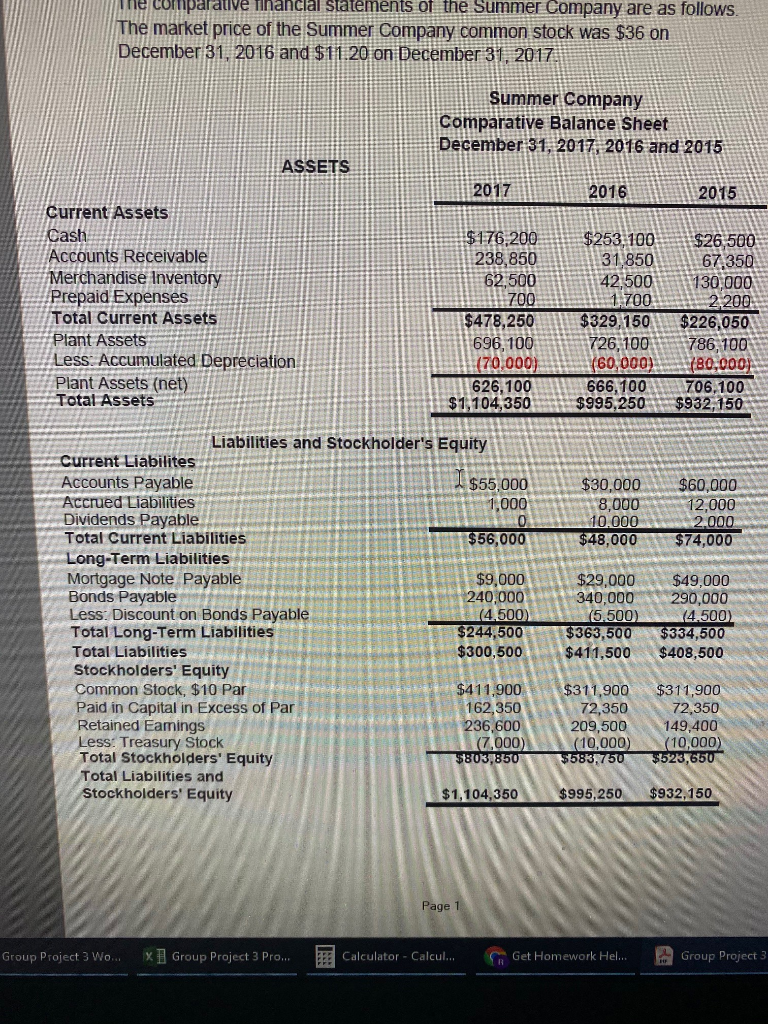

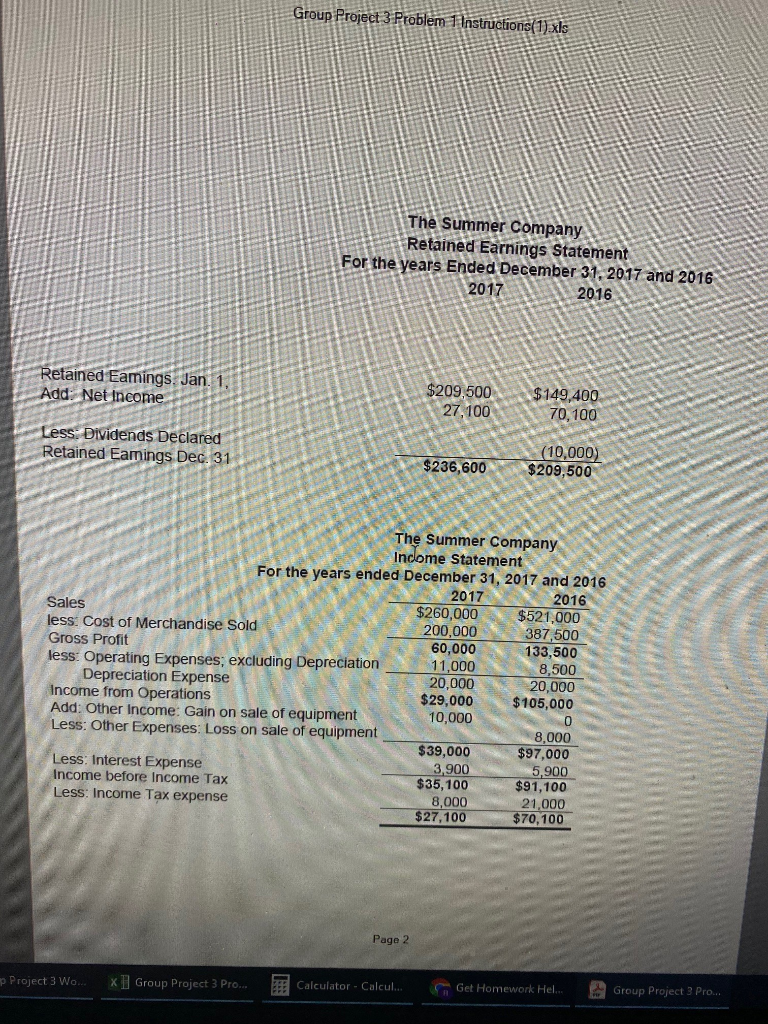

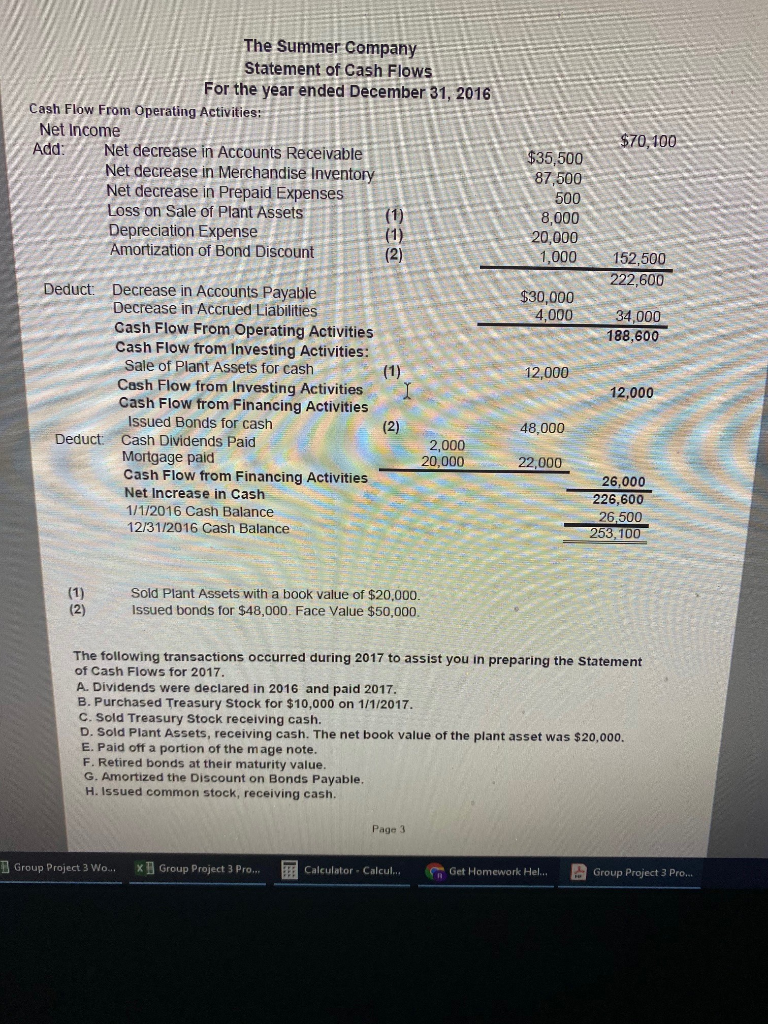

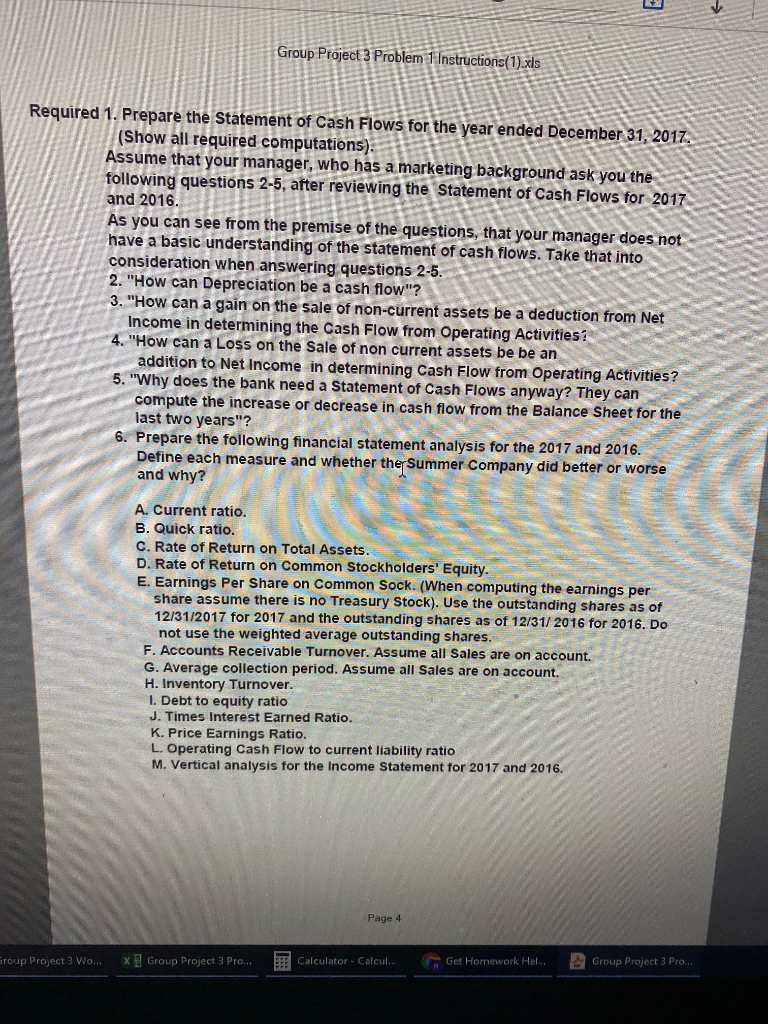

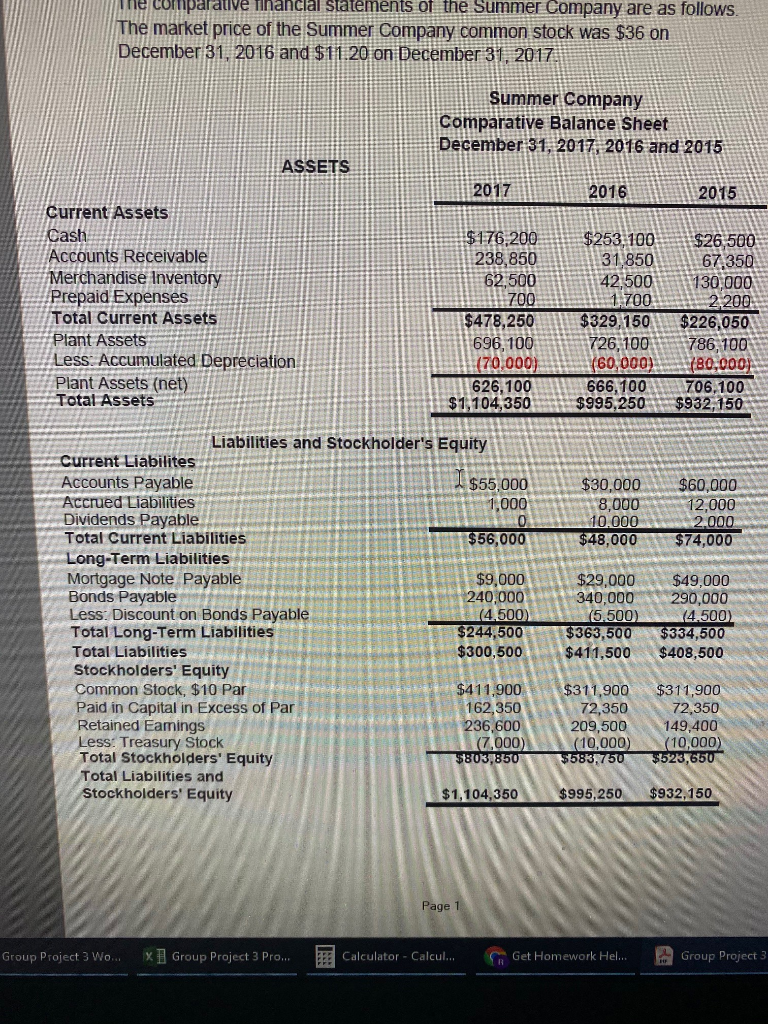

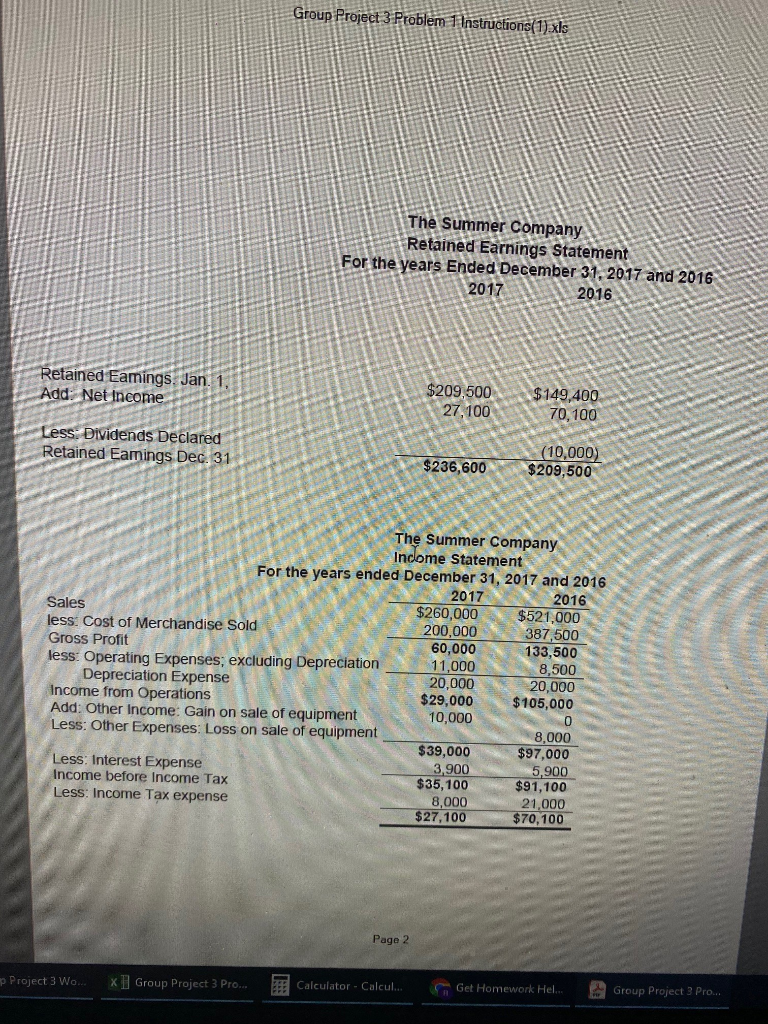

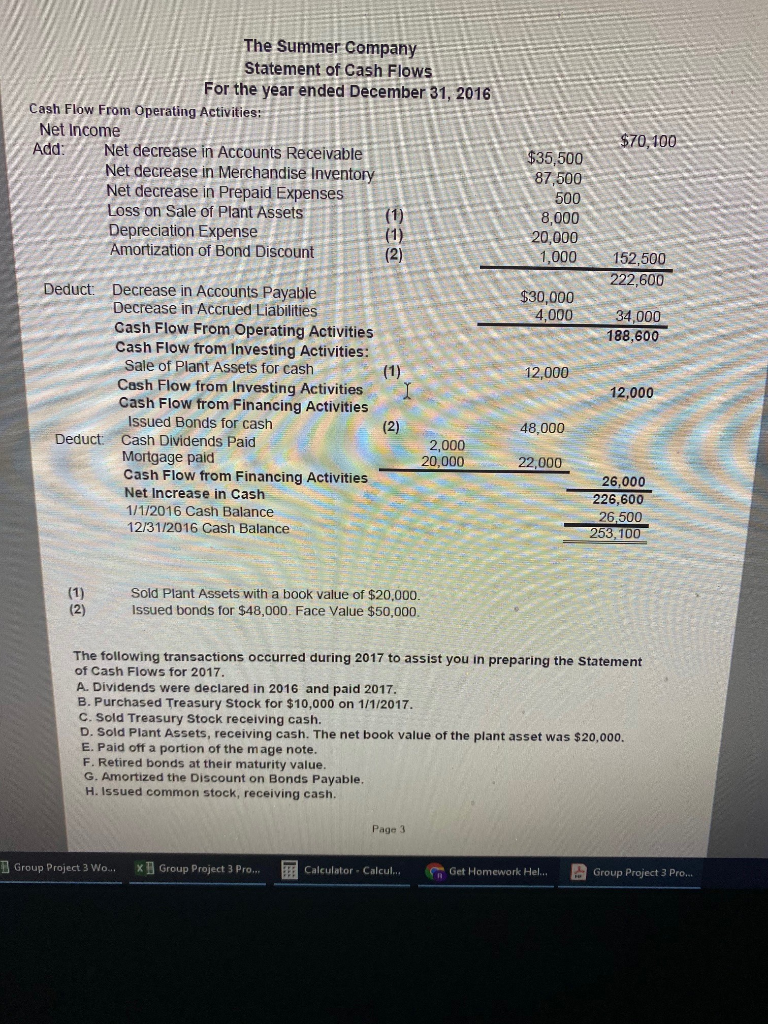

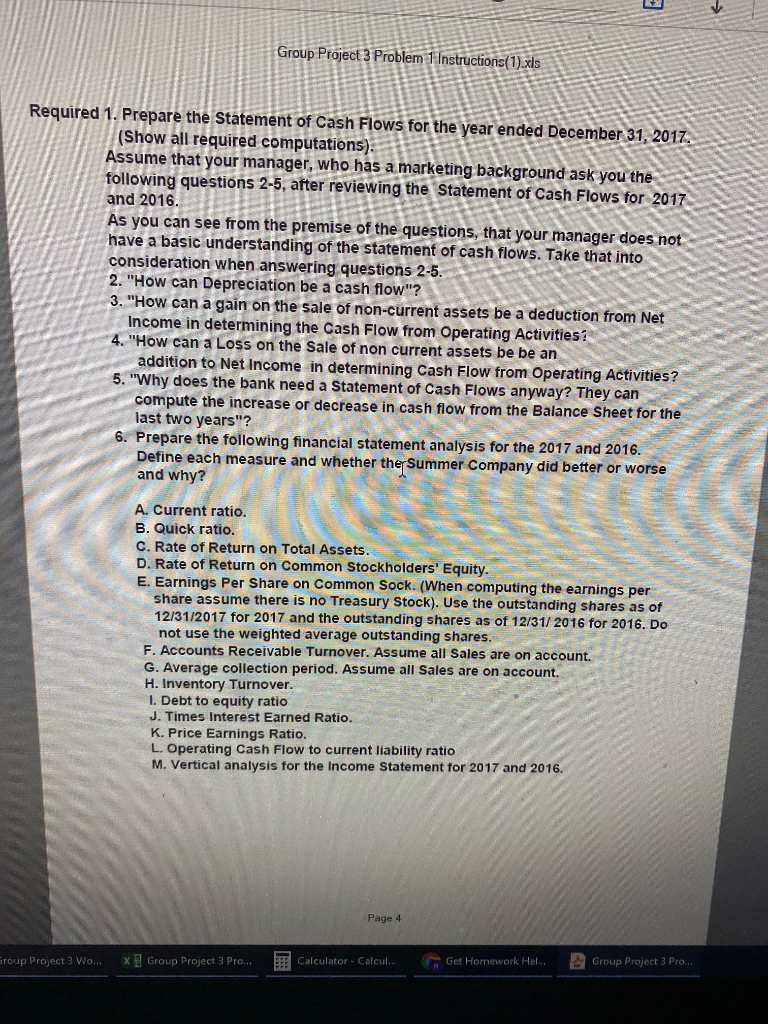

une comparative financial statements of the Summer Company are as follows The market price of the Summer Company common stock was $36 on December 31, 2016 and $11.20 on December 31, 2017 Summer Company Comparative Balance Sheet December 31, 2017, 2016 and 2015 ASSETS 2017 2016 2015 Current Assets Cash Accounts Receivable Merchandise Inventory Prepaid Expenses Total Current Assets Plant Assets Less: Accumulated Depreciation Plant Assets (net) Total Assets $176,200 238,850 62,500 700 $478,250 | 696,100 (70,000) 626,100 $1,104,350 $253, 100 31,850 42,500 1,700 $329,150 726,100 (60,000) 666,100 $995,250 $26,500 67,350 130,000 2.200 $226,050 786,100 (80,000) 706.100 $932,150 $30,000 8,000 10.000 $48,000 $60,000 12,000 2.000 $74,000 Liabilities and Stockholder's Equity Current Liabilites Accounts Payable | $55,000 Accrued Liabilities 1,000 Dividends Payable 0 Total Current Liabilities $56,000 Long-Term Liabilities Mortgage Note Payable $9,000 Bonds Payable 240,000 Less: Discount on Bonds Payable (4,500) Total Long-Term Liabilities $244,500 Total Liabilities $300,500 Stockholders' Equity Common Stock, $10 Par $411,900 Paid in Capital in Excess of Par 162,350 Retained Eamings 236,600 Less: Treasury Stock (7,000) Total Stockholders' Equity $803,850 Total Liabilities and Stockholders' Equity $1,104,350 $29,000 340,000 (5500) $363,500 $411,500 $49,000 290,000 4.500) $334,500 $408,500 $311,900 72,350 209,500 (10,000) $583,750 $311,900 72,350 149,400 (10,000) $523,650 $995,250 $932,150 Page 1 Group Project 3 Wo... x Group Project 3 Pro... F Calculator - Calcul... Get Homework Hel... Group Project 3 Group Project 3 Problem 1 Instructions(1).xls The Summer Company Retained Earnings Statement For the years Ended December 31, 2017 and 2016 2017 2016 Retained Eamings. Jan. 1, Add: Net Income $209,500 27,100 $149,400 70,100 Less Dividends Declared Retained Eamings Dec. 31 $236,600 (10,000) $209,500 The Summer Company Income Statement For the years ended December 31, 2017 and 2016 2017 2016 Sales $260,000 $521,000 less. Cost of Merchandise Sold 200,000 387,500 Gross Profit 60,000 133,500 less: Operating Expenses, excluding Depreciation 11,000 Depreciation Expense 20,000 20,000 Income from Operations $29,000 $105,000 Add: Other Income: Gain on sale of equipment 10,000 0 Less: Other Expenses. Loss on sale of equipment 8,000 $39,000 $97.000 Less: Interest Expense 3,900 5,900 Income before Income Tax $35,100 $91,100 Less: Income Tax expense 8,000 21,000 $27,100 $70, 100 8,500 Page 2 p Project 3 Wo. x Group Project 3 Pro... Calculator - Calcul.. Get Homework Hel... Group Project 3 Pro... The Summer Company Statement of Cash Flows For the year ended December 31, 2016 Cash Flow From Operating Activities: Net Income Add: Net decrease in Accounts Receivable Net decrease in Merchandise Inventory Net decrease in Prepaid Expenses Loss on Sale of Plant Assets Depreciation Expense (1) Amortization of Bond Discount (2) $70,100 $35,500 87,500 500 8,000 20,000 1,000 152,500 222,600 $30,000 4,000 34,000 188,600 (1) 12,000 I 12,000 Deduct Decrease in Accounts Payable Decrease in Accrued Liabilities Cash Flow From Operating Activities Cash Flow from Investing Activities: Sale of Plant Assets for cash Cash Flow from Investing Activities Cash Flow from Financing Activities Issued Bonds for cash Deduct: Cash Dividends Paid Mortgage paid Cash Flow from Financing Activities Net Increase in Cash 1/1/2016 Cash Balance 12/31/2016 Cash Balance (2) 48,000 2,000 20,000 22,000 26,000 226,600 26,500 253,100 (1) (2) Sold Plant Assets with a book value of $20,000. Issued bonds for $48,000. Face Value $50,000 The following transactions occurred during 2017 to assist you in preparing the Statement of Cash Flows for 2017. A. Dividends were declared in 2016 and paid 2017. B. Purchased Treasury Stock for $10,000 on 1/1/2017 C. Sold Treasury Stock receiving cash. D. Sold Plant Assets, receiving cash. The net book value of the plant asset was $20,000. E. Paid off a portion of the mage note. F. Retired bonds at their maturity value. G. Amortized the Discount on Bonds Payable. H. Issued common stock, receiving cash. Page 3 Group Project 3 Wo... x Group Project 3 Pro... Calculator. Calcul... Go Get Homework Hel... Group Project 3 Pro... Group Project 3 Problem 1 Instructions(1).xls Required 1. Prepare the Statement of Cash Flows for the year ended December 31, 2017. (Show all required computations). Assume that your manager, who has a marketing background ask you the following questions 2-5, after reviewing the Statement of Cash Flows for 2017 and 2016. As you can see from the premise of the questions, that your manager does not have a basic understanding of the statement of cash flows. Take that into consideration when answering questions 2-5. 2. "How can Depreciation be a cash flow"? 3. "How can a gain on the sale of non-current assets be a deduction from Net Income in determining the Cash Flow from Operating Activities 4. "How can a Loss on the sale of non current assets be be an addition to Net Income in determining Cash Flow from Operating Activities? 5. "Why does the bank need a Statement of Cash Flows anyway? They can compute the increase or decrease in cash flow from the Balance Sheet for the last two years"? 6. Prepare the following financial statement analysis for the 2017 and 2016. Define each measure and whether the Summer Company did better or worse and why? A. Current ratio. B. Quick ratio. C. Rate of Return on Total Assets D. Rate of Return on Common Stockholders' Equity. E. Earnings Per Share on Common Sock. (When computing the earnings per share assume there is no Treasury Stock). Use the outstanding shares as of 12/31/2017 for 2017 and the outstanding shares as of 12/31/2016 for 2016. Do not use the weighted average outstanding shares. F. Accounts Receivable Turnover. Assume all Sales are on account. G. Average collection period. Assume all Sales are on account. H. Inventory Turnover. 1. Debt to equity ratio J. Times Interest Earned Ratio. K. Price Earnings Ratio. L. Operating Cash Flow to current liability ratio M. Vertical analysis for the income Statement for 2017 and 2016. Page 4 sroup Project 3 Wo... x Group Project 3 Pro... Calculator - Calcul... Get Homework Hel.. Group Project 3 Pro