Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This assignment is individual. The stock data used in the analysis must be download individually. Use Excel to solve the assignment and show all

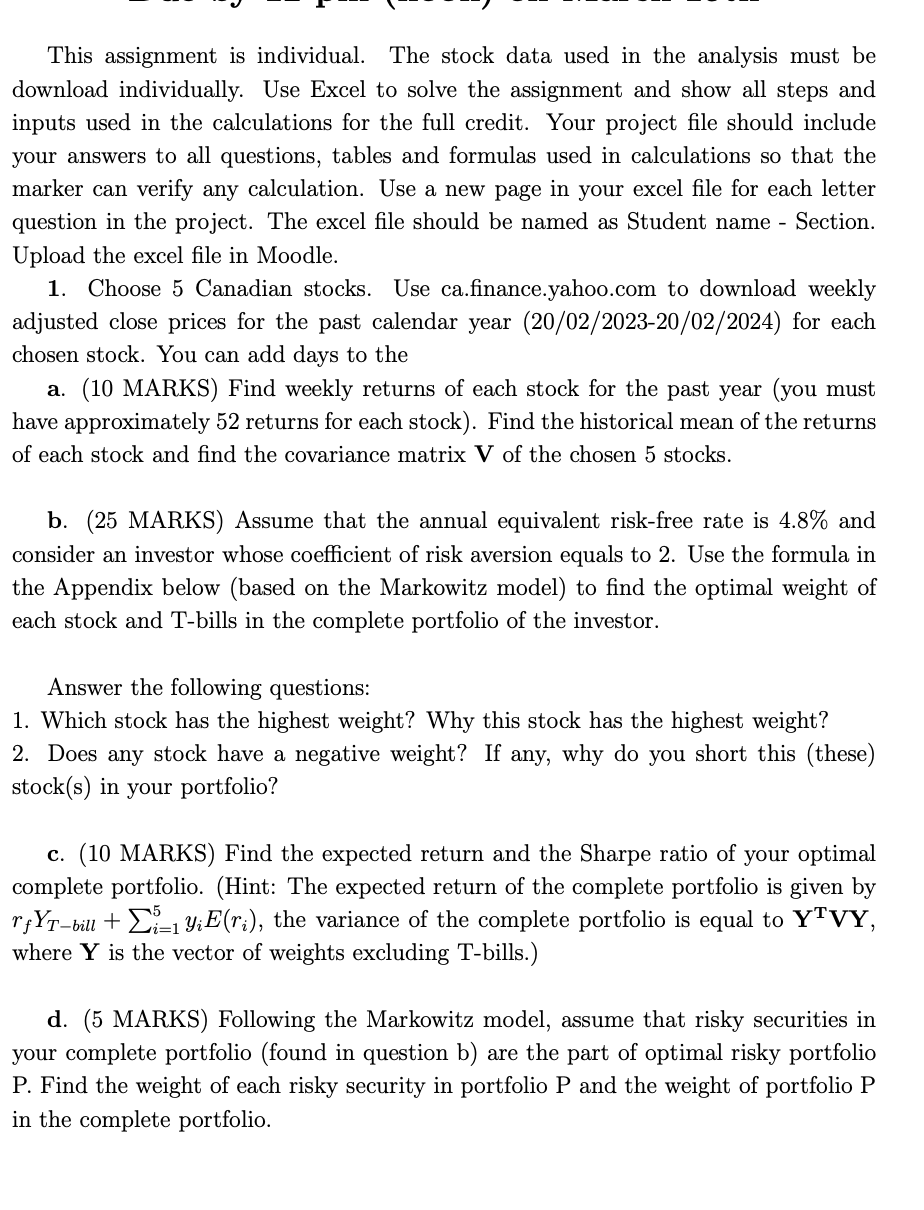

This assignment is individual. The stock data used in the analysis must be download individually. Use Excel to solve the assignment and show all steps and inputs used in the calculations for the full credit. Your project file should include your answers to all questions, tables and formulas used in calculations so that the marker can verify any calculation. Use a new page in your excel file for each letter question in the project. The excel file should be named as Student name - Section. Upload the excel file in Moodle. 1. Choose 5 Canadian stocks. Use ca.finance.yahoo.com to download weekly adjusted close prices for the past calendar year (20/02/2023-20/02/2024) for each chosen stock. You can add days to the a. (10 MARKS) Find weekly returns of each stock for the past year (you must have approximately 52 returns for each stock). Find the historical mean of the returns of each stock and find the covariance matrix V of the chosen 5 stocks. b. (25 MARKS) Assume that the annual equivalent risk-free rate is 4.8% and consider an investor whose coefficient of risk aversion equals to 2. Use the formula in the Appendix below (based on the Markowitz model) to find the optimal weight of each stock and T-bills in the complete portfolio of the investor. Answer the following questions: 1. Which stock has the highest weight? Why this stock has the highest weight? 2. Does any stock have a negative weight? If any, why do you short this (these) stock(s) in your portfolio? c. (10 MARKS) Find the expected return and the Sharpe ratio of your optimal complete portfolio. (Hint: The expected return of the complete portfolio is given by r f YT-bill +i1 YiE(r;), the variance of the complete portfolio is equal to YTVY, where Y is the vector of weights excluding T-bills.) d. (5 MARKS) Following the Markowitz model, assume that risky securities in your complete portfolio (found in question b) are the part of optimal risky portfolio P. Find the weight of each risky security in portfolio P and the weight of portfolio P in the complete portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started