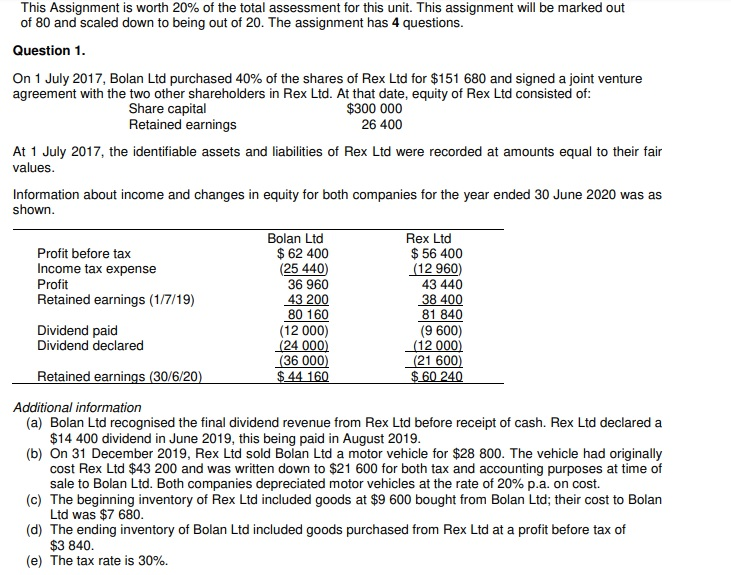

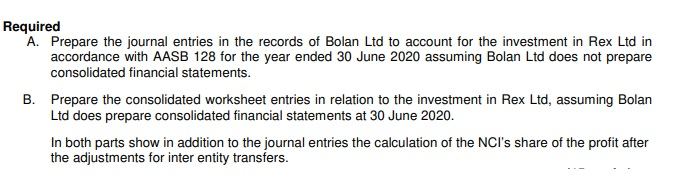

This Assignment is worth 20% of the total assessment for this unit. This assignment will be marked out of 80 and scaled down to being out of 20. The assignment has 4 questions. Question 1. On 1 July 2017, Bolan Ltd purchased 40% of the shares of Rex Ltd for $151 680 and signed a joint venture agreement with the two other shareholders in Rex Ltd. At that date, equity of Rex Ltd consisted of: Share capital $300 000 Retained earnings 26 400 At 1 July 2017, the identifiable assets and liabilities of Rex Ltd were recorded at amounts equal to their fair values. Information about income and changes in equity for both companies for the year ended 30 June 2020 was as shown. Profit before tax Income tax expense Profit Retained earnings (1/7/19) Bolan Ltd $ 62 400 25 440 36 960 43 200 80 160 (12 000) (24 000) (36 000) $.44 160 Rex Ltd $ 56 400 (12 960) 43 440 38 400 81 840 (9600) (12 000) (21 600) $ 60 240 Dividend paid Dividend declared Retained earnings (30/6/20 Additional information (a) Bolan Ltd recognised the final dividend revenue from Rex Ltd before receipt of cash. Rex Ltd declared a $14 400 dividend in June 2019, this being paid in August 2019. (b) On 31 December 2019, Rex Ltd sold Bolan Ltd a motor vehicle for $28 800. The vehicle had originally cost Rex Ltd $43 200 and was written down to $21 600 for both tax and accounting purposes at time of sale to Bolan Ltd. Both companies depreciated motor vehicles at the rate of 20% p.a. on cost. (c) The beginning inventory of Rex Ltd included goods at $9 600 bought from Bolan Ltd; their cost to Bolan Ltd was $7 680. (d) The ending inventory of Bolan Ltd included goods purchased from Rex Ltd at a profit before tax of $3 840. (e) The tax rate is 30%. Required A. Prepare the journal entries in the records of Bolan Ltd to account for the investment in Rex Ltd in accordance with AASB 128 for the year ended 30 June 2020 assuming Bolan Ltd does not prepare consolidated financial statements. B. Prepare the consolidated worksheet entries in relation to the investment in Rex Ltd, assuming Bolan Ltd does prepare consolidated financial statements at 30 June 2020. In both parts show in addition to the journal entries the calculation of the NCI's share of the profit after the adjustments for inter entity transfers. This Assignment is worth 20% of the total assessment for this unit. This assignment will be marked out of 80 and scaled down to being out of 20. The assignment has 4 questions. Question 1. On 1 July 2017, Bolan Ltd purchased 40% of the shares of Rex Ltd for $151 680 and signed a joint venture agreement with the two other shareholders in Rex Ltd. At that date, equity of Rex Ltd consisted of: Share capital $300 000 Retained earnings 26 400 At 1 July 2017, the identifiable assets and liabilities of Rex Ltd were recorded at amounts equal to their fair values. Information about income and changes in equity for both companies for the year ended 30 June 2020 was as shown. Profit before tax Income tax expense Profit Retained earnings (1/7/19) Bolan Ltd $ 62 400 25 440 36 960 43 200 80 160 (12 000) (24 000) (36 000) $.44 160 Rex Ltd $ 56 400 (12 960) 43 440 38 400 81 840 (9600) (12 000) (21 600) $ 60 240 Dividend paid Dividend declared Retained earnings (30/6/20 Additional information (a) Bolan Ltd recognised the final dividend revenue from Rex Ltd before receipt of cash. Rex Ltd declared a $14 400 dividend in June 2019, this being paid in August 2019. (b) On 31 December 2019, Rex Ltd sold Bolan Ltd a motor vehicle for $28 800. The vehicle had originally cost Rex Ltd $43 200 and was written down to $21 600 for both tax and accounting purposes at time of sale to Bolan Ltd. Both companies depreciated motor vehicles at the rate of 20% p.a. on cost. (c) The beginning inventory of Rex Ltd included goods at $9 600 bought from Bolan Ltd; their cost to Bolan Ltd was $7 680. (d) The ending inventory of Bolan Ltd included goods purchased from Rex Ltd at a profit before tax of $3 840. (e) The tax rate is 30%. Required A. Prepare the journal entries in the records of Bolan Ltd to account for the investment in Rex Ltd in accordance with AASB 128 for the year ended 30 June 2020 assuming Bolan Ltd does not prepare consolidated financial statements. B. Prepare the consolidated worksheet entries in relation to the investment in Rex Ltd, assuming Bolan Ltd does prepare consolidated financial statements at 30 June 2020. In both parts show in addition to the journal entries the calculation of the NCI's share of the profit after the adjustments for inter entity transfers