Answered step by step

Verified Expert Solution

Question

1 Approved Answer

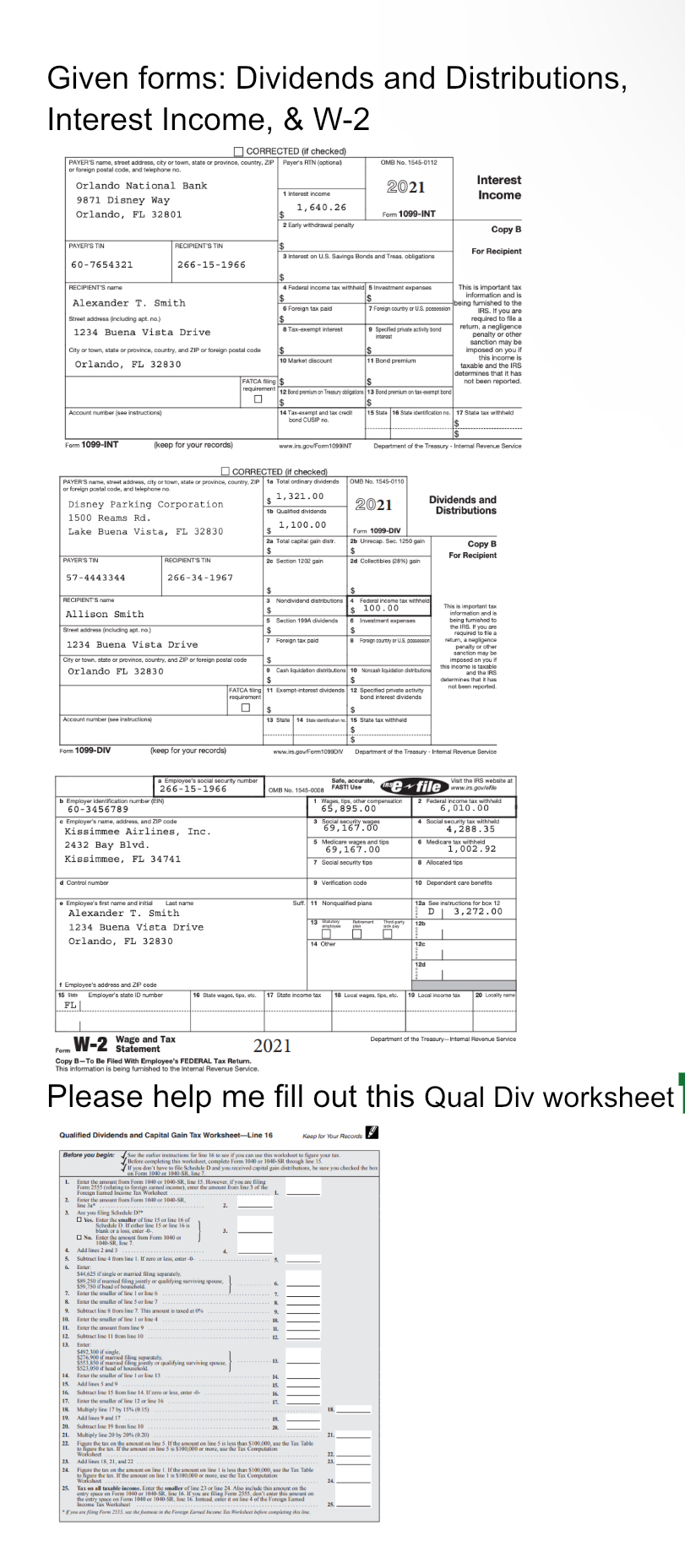

This assignment requires you to complete four tax forms ( Form 1 0 4 0 , Schedule 1 , Schedule B , and Qualified Dividends

This assignment requires you to complete four tax forms Form Schedule Schedule B and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayer information. The forms provided are for tax year please disregard date on WINT, and DIVAlexander Smith and his wife Allison are married and will file a joint tax return for The Smiths live at Buena Vista Drive, Orlando, FL Alexander is a commuter airline pilot but took months off from his job in to obtain a higherlevel pilots license. The Smiths have an yearold son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a yearold daughter, Angelina, who is a parttime firstyear student at Orange County Community College OCCC Angelina is married to Sean Shirker, who is years old and also a parttime student at OCCC. Sean and Angelina have a yearold child, Trask Social Security number All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work parttime for Seans wealthy grandfather as apprentices in his business. The Shirkers wages for the year were $ which allowed them to pay all the personal expenses for themselves and Trask.

Alexander SmithAllison Smith

Brad Smith

Angelina ShirkerSean Shirker

Trask Shirker

Five years ago, Alexander divorced Jennifer Amistad Social Security number Alexander pays Jennifer $ per month in alimony under the divorce decree.Not included with the Smiths tax forms was interest from State of Florida bonds of $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started