This Assignment will require you to dig deep into the structure and composition of Campbell Soups liabilities (debt) and equity. This will help you better understand the sources of funding in any business. Locate the Campbell Soup Cases 3-2 and 3-3 on pages 219 and 220 of your text. Be sure to submit thoughtful and substantial answers to the questions following each case. Response successfully answers Assignment questions for these cases. 3-2 Identity Liabilities and Interest Expense and reconcile long term borrowing activity. 10 3-3 Identify par value, the number of shares issued and the number of shares authorized. 10 Responses exhibit strong critical thinking and appropriate analysis. 3-2 Describe the composition of the long term liabilities. 10 3-3 Determine the book value per share of the common stock

CASE 32 Analyzing and Interpreting Liabilities

Refer to the annual report of Campbell Soup Company in Appendix A.

Campbell Soup

Required:

a. Identify Campbell Soups major categories of liabilities. Identify which of these liabilities require recognition of interest expense.

b. Reconcile activity in the long-term borrowing account for Year 11.

c. Describe the composition of Campbell Soups long-term liabilities account using its note 19.

Page 220CASE 33 Analyzing and Interpreting Equity

Refer to the annual report of Campbell Soup Company in Appendix A.

Campbell Soup

Required:

a. Determine the book value per share of Campbell Soups common stock for Year 11.

b. Identify the par value of Campbell Soups common shares. Determine the number of common shares authorized, issued, and outstanding at the end of Year 11.

c. Determine how many common shares Campbell Soup repurchased as treasury stock for Year 11. Determine the price at which Campbell Soup repurchased the shares.

CHECK (c) Year 11 repurchase price, $51.72

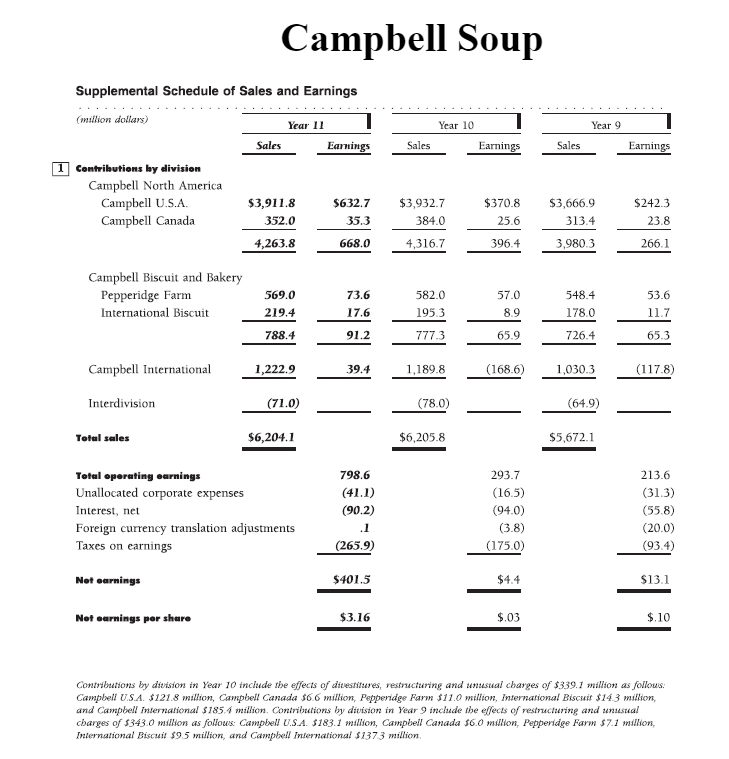

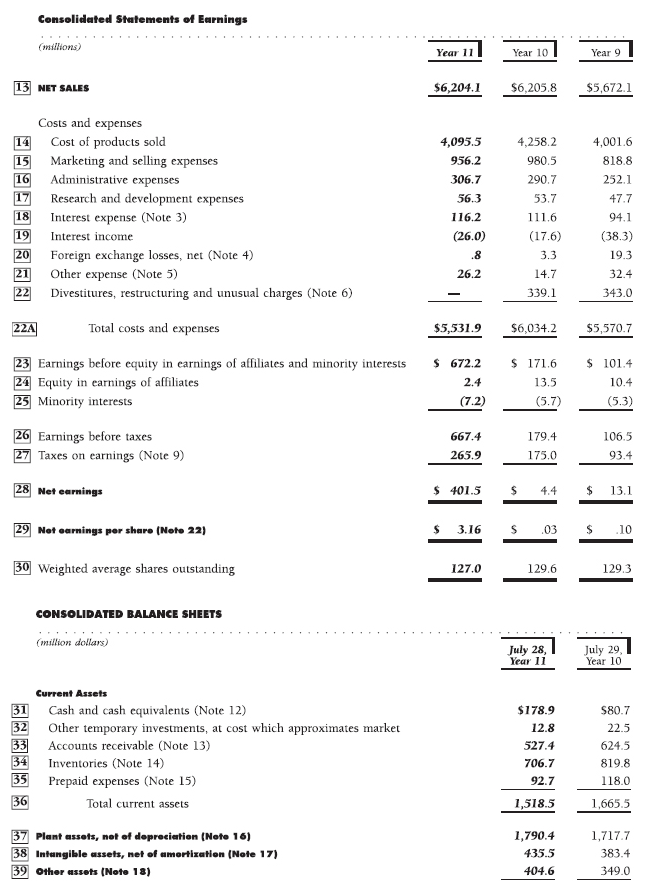

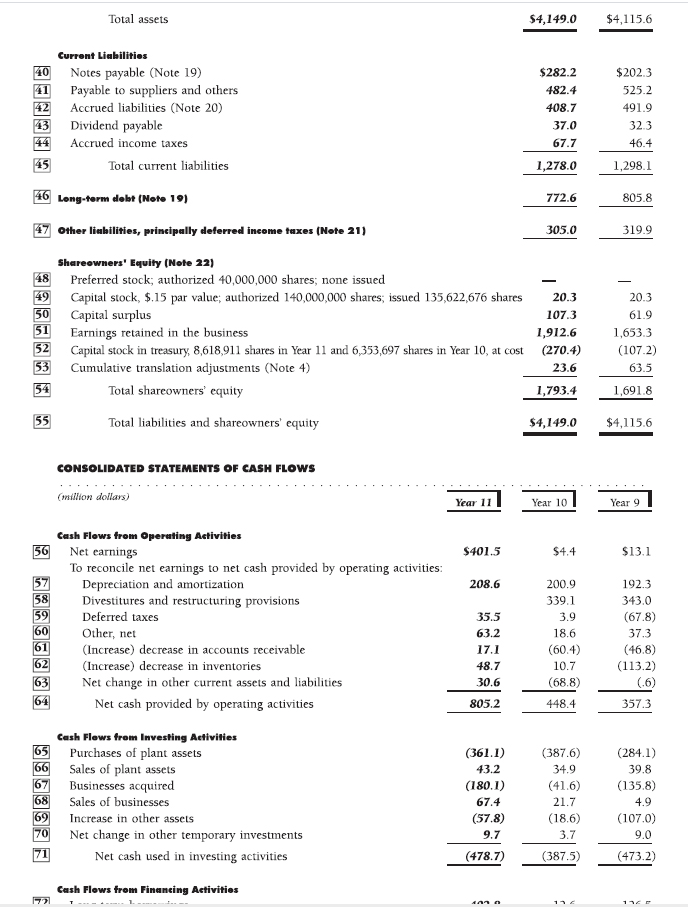

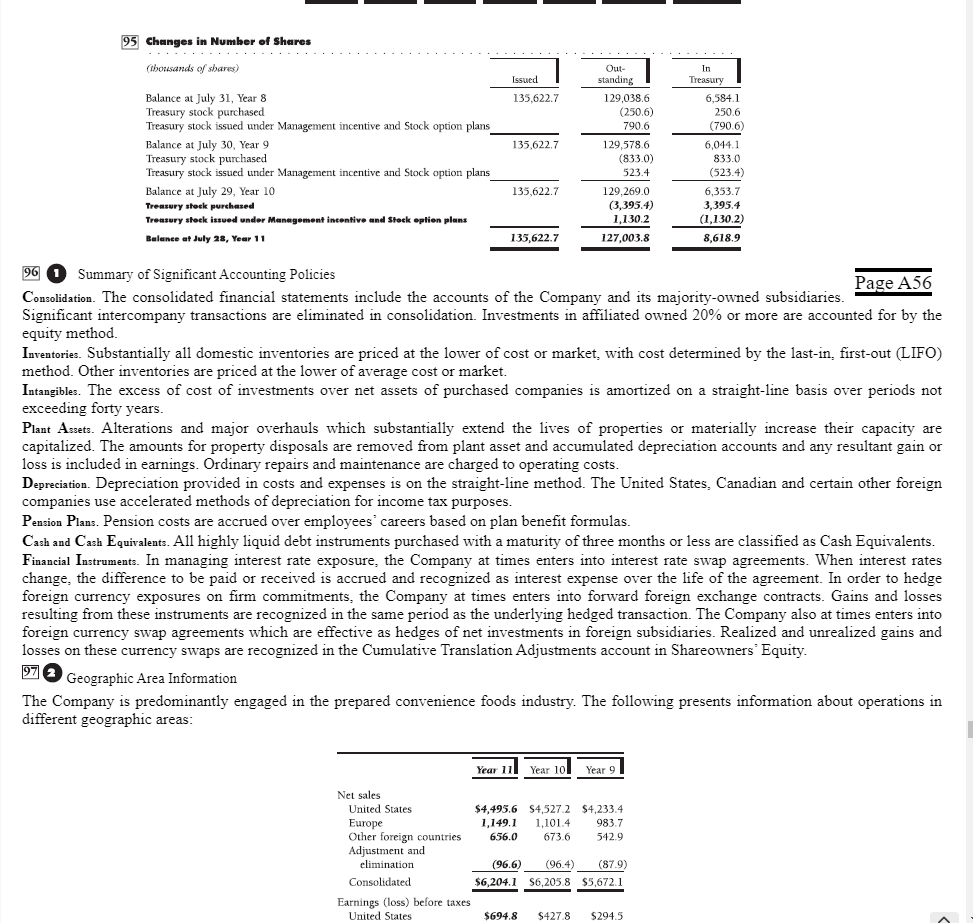

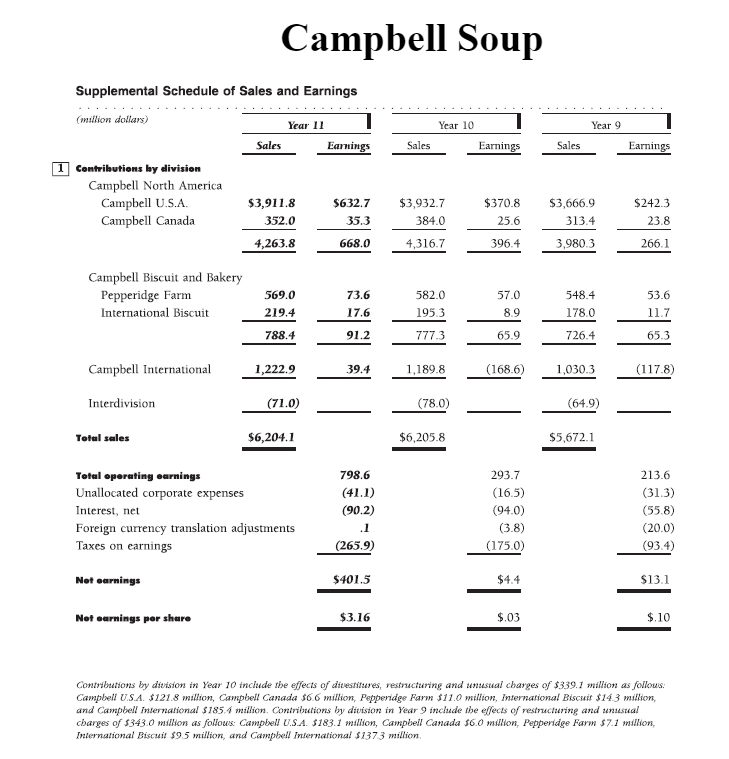

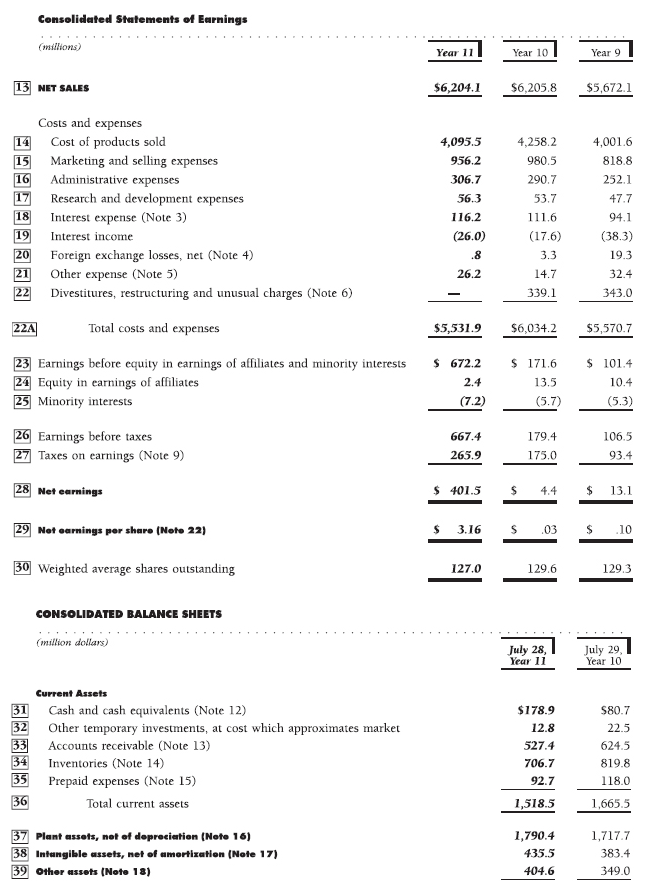

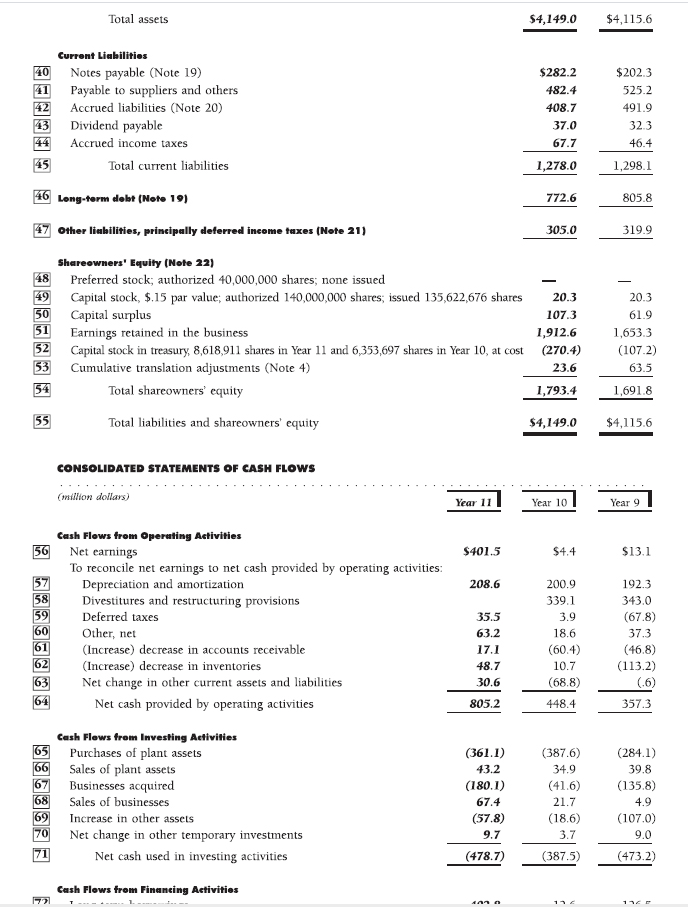

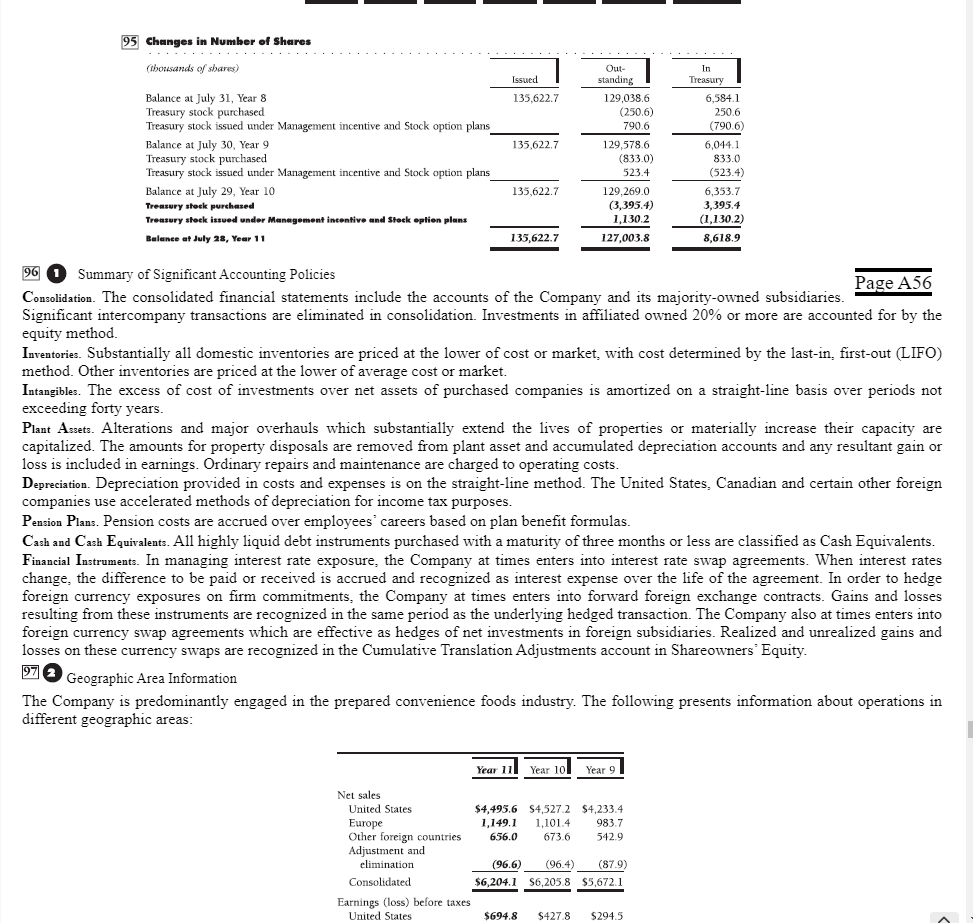

Campbell Soup Year 10 Year 9 Sales Earnings Sales Earnings Supplemental Schedule of Sales and Earnings (million dollars) Year 11 Sales Earnings 1 Contributions by division Campbell North America Campbell U.S.A. $3,911.8 $632.7 Campbell Canada 352.0 35.3 4,263.8 668.0 $3,932.7 384.0 $370.8 25.6 $3,666.9 313.4 $242.3 23.8 4,316.7 396.4 3.980.3 266.1 Campbell Biscuit and Bakery Pepperidge Farm International Biscuit 569.0 219.4 73.6 17.6 582.0 1953 57.0 8.9 548.4 178.0 53.6 11.7 788.4 91.2 777.3 65.9 726.4 65.3 Campbell International 1,222.9 39.4 1,189.8 (168.6) 1,030.3 (117.8) Interdivision (71.0) (78.0) (64.9) | Total sales $6,204.1 $6,205.8 $5,672.1 Total operating earnings Unallocated corporate expenses Interest, net Foreign currency translation adjustments Taxes on earnings 798.6 (41.1) (90.2) .1 (265.9) 293.7 (16.5) (94.0) (3.8) (175.0) 213.6 (31.3) (55.8) (20.0) (93.4) Net earnings $401.5 $4.4 $13.1 Net earnings per share $3.16 $.03 $.10 Contributions by diersion in Year 10 include the effects of divestitures, restructuring and unusual charges of $339.1 million as follows: Campbell U.S.A. $121.8 million, Campbell Canada $6.6 million, Pepperidge Farm $11.0 million, International Biscuit $14.3 million, and Campbell international $185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of $343.0 million as follous: Campbell U.S.A. $183.1 million, Campbell Canada $6.0 million, Pepperidge Farm $7.1 million, International Biscuit $9.5 million, and Campbell International $1373 million Consolidated Statements of Earnings (millions) Year 11 Year 10 Year 9 13 NET SALES $6,204.1 $6,205.8 $5,672.1 17 Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses 16 Administrative expenses Research and development expenses 18 Interest expense (Note 3) 19 Interest income Foreign exchange losses, net (Note 4) 21 Other expense (Note 5) 22 Divestitures, restructuring and unusual charges (Note 6) 4,095.5 956.2 306.7 56.3 116.2 (26.0) .8 26.2 4,258,2 980,5 290.7 53.7 111.6 (17.6) 3.3 14.7 339.1 4,001.6 818.8 252.1 47.7 94.1 (38.3) 19.3 32.4 20 343.0 22A Total costs and expenses $5,531.9 $6,034.2 $5,570.7 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests $ 672.2 2.4 (7.2) $ 171.6 13.5 (5.7) $ 101.4 10.4 (5.3) 179.4 106.5 26 Earnings before taxes 27 Taxes on earnings (Note 9) 667.4 265.9 175.0 93.4 28 Net earnings $ 401.5 $ 4.4 $ 13.1 29 Net earnings per share (Note 22) $ 3.16 $ 03 10 30 Weighted average shares outstanding 127.0 129.6 129.3 CONSOLIDATED BALANCE SHEETS (million dollars) July 28, Year 11 July 29, Year 10 31 32 33 34 35 36 Current Assets Cash and cash equivalents (Note 12) Other temporary investments, at cost which approximates market Accounts receivable (Note 13) Inventories (Note 14) Prepaid expenses (Note 15) Total current assets $178.9 12.8 527.4 706.7 92.7 $80.7 22.5 6245 819.8 118.0 1,518.5 1,665.5 37 Plant assets, net of depreciation (Note 16) 38 Intangible assets, met of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 Total assets $4,149.0 $4,115.6 40 42 43 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 $2023 525.2 491.9 323 46.4 45 1,278.0 1,298.1 46 Long-term debt (Note 19) 772.6 805.8 47 Other liabilities, principally deferred income taxes (Note 21) 305.0 319.9 48 49 50 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares, none issued Capital stock, $.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 20.3 Capital surplus 107.3 51 Earnings retained in the business 1,912.6 52 Capital stock in treasury, 8618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost (270.4) Cumulative translation adjustments (Note 4) Total shareowners' equity 1,793.4 Total liabilities and shareowners' equity $4,149.0 20.3 61.9 1,653.3 (107.2) 63.5 1,691.8 23.6 54 55 $4,115.6 CONSOLIDATED STATEMENTS OF CASH FLOWS (million dollars) Year 11 Year 10 Year 9 56 $401.5 $4.4 $13.1 208.6 57 58 Cash Flows from Operating Activities Net earnings To reconcile net earnings to net cash provided by operating activities: Depreciation and amortization Divestitures and restructuring provisions Deferred taxes Other, net (Increase) decrease in accounts receivable (Increase) decrease in inventories Net change in other current assets and liabilities Net cash provided by operating activities 60 61 62 63 64 35.5 63.2 17.1 48.7 30.6 805.2 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 448.4 192.3 343.0 (67.8) 37.3 (46.8) (113.2) (6) 357.3 65 66 67 68 69 70 Cash Flows from Investing Activities Purchases of plant assets Sales of plant assets Businesses acquired Sales of businesses Increase in other assets Net change in other temporary investments Net cash used in investing activities (361.1) 43.2 (180.1) 67.4 (57.8) 9.7 (387.6) 34.9 (41.6) 21.7 (186) 3.7 (387.5) (284.1) 39.8 (135.8) 4.9 (107.0) 9.0 (473.2) 71 (478.7) Cash Flows from Financing Activities T Cash Flows from Financing Activities 72 Long-term borrowings 173 Repayments of long-term borrowings 174 Increase (decrease) in borrowings with less than three month maturities Other short-term borrowings Repayments of other short-term borrowings 77 Dividends paid Treasury stock purchases Treasury stock issued Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) (101.8) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 78 79 80 (219.6) 163.1 (8.7) .7 (12.1) 98.2 80.7 (40.2) 120.9 35.1 85.8 $178.9 $80.7 $120.9 CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY (million dollars) Preferred Stock Capital Stock $20.3 Earnings Retained Capital in the Surplus Business $423 $1,879.1 Capital Stock Cumulative in Translation Treasuryl Adjustments S(75.2) $28.5 Total Shareowners Equity $1,895.0 13.1 13.1 (116.4) (8.1) (116.4) (8.1) 8.5 12.6 (26.4) 2.1 21.1 (26.4) 1,778.3 4.4 20.3 50.8 1,775.8 4.4 (707) (126.9) (41.1) (126.9) (41.1) 86 Balance at July 31, Year 8 Net earnings Cash dividends ($.90 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments 87 Balance at July 30, Year 9 Net earnings Cash dividends ($.98 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments Balance at July 29, Year 10 88 Net earnings 89 Cash dividends ($1.12 per share) 90 Treasury stock purchased 91 Treasury stock issued under Management Incentive and Stock option plans 92 Translation adjustments 93 Sale of foreign operations 94 Balance at July 28, Year 11 11.1 4.6 61.4 63.5 15.7 61.4 1,691.8 401.5 20.3 61.9 1,653.3 401.5 (1072) (142.2) (175.6) (142.2) (175.6) 45.4 12.4 (29.9) (10.0) $23.6 57.8 (29.9) (10.0) $1,793.4 $20.3 $107.3 $1,912.6 $(270.4) 95 Changes in Number of Shares (thousands of shares) Issued 135,622.7 135,622.7 Balance at July 31, Year 8 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 30, Year 9 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 29, Year 10 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance of July 28, Year 11 Out standing 129,038.6 (250.6) 790.6 129,578.6 (833.0) 523.4 129,269.0 (3,395.4) 1,130.2 127,003.8 In Treasury 6,584.1 2506 (790.6) 6,044,1 833.0 (523.4) 6,353.7 3,395.4 (1,130.2) 8,618.9 135,622.7 135,622.7 96 Summary of Significant Accounting Policies Page A56 Consolidation. The consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries. Significant intercompany transactions are eliminated in consolidation. Investments in affiliated owned 20% or more are accounted for by the equity method Inventories. Substantially all domestic inventories are priced at the lower of cost or market, with cost determined by the last-in, first-out (LIFO) method. Other inventories are priced at the lower of average cost or market. Intangibles. The excess of cost of investments over net assets of purchased companies is amortized on a straight-line basis over periods not exceeding forty years. Plant Assets. Alterations and major overhauls which substantially extend the lives of properties or materially increase their capacity are capitalized. The amounts for property disposals are removed from plant asset and accumulated depreciation accounts and any resultant gain or loss is included in earnings. Ordinary repairs and maintenance are charged to operating costs. Depreciation. Depreciation provided in costs and expenses is on the straight-line method. The United States, Canadian and certain other foreign companies use accelerated methods of depreciation for income tax purposes. Pension Plans. Pension costs are accrued over employees' careers based on plan benefit formulas. Cash and Cash Equivalents. All highly liquid debt instruments purchased with a maturity of three months or less are classified as Cash Equivalents. Financial Instruments. In managing interest rate exposure, the Company at times enters into interest rate swap agreements. When interest rates change, the difference to be paid or received is accrued and recognized as interest expense over the life of the agreement. In order to hedge foreign currency exposures on firm commitments, the Company at times enters into forward foreign exchange contracts. Gains and losses resulting from these instruments are recognized in the same period as the underlying hedged transaction. The Company also at times enters into foreign currency swap agreements which are effective as hedges of net investments in foreign subsidiaries. Realized and unrealized gains and losses on these currency swaps are recognized in the Cumulative Translation Adjustments account in Shareowners. Equity. 97 Geographic Area Information The Company is predominantly engaged in the prepared convenience foods industry. The following presents information about operations in different geographic areas: Year ul Year 10 Year Net sales United States $4,495.6 $4,5272 $4,233.4 Europe 1,149.1 1,101.4 983.7 Other foreign countries 656.0 6736 5429 Adjustment and elimination (966) (96.4) (87.9) Consolidated $6,204.1 S6,205.8 $5,672.1 Earnings (loss) before taxes United States $694.8 $427.8 $294.5 Campbell Soup Year 10 Year 9 Sales Earnings Sales Earnings Supplemental Schedule of Sales and Earnings (million dollars) Year 11 Sales Earnings 1 Contributions by division Campbell North America Campbell U.S.A. $3,911.8 $632.7 Campbell Canada 352.0 35.3 4,263.8 668.0 $3,932.7 384.0 $370.8 25.6 $3,666.9 313.4 $242.3 23.8 4,316.7 396.4 3.980.3 266.1 Campbell Biscuit and Bakery Pepperidge Farm International Biscuit 569.0 219.4 73.6 17.6 582.0 1953 57.0 8.9 548.4 178.0 53.6 11.7 788.4 91.2 777.3 65.9 726.4 65.3 Campbell International 1,222.9 39.4 1,189.8 (168.6) 1,030.3 (117.8) Interdivision (71.0) (78.0) (64.9) | Total sales $6,204.1 $6,205.8 $5,672.1 Total operating earnings Unallocated corporate expenses Interest, net Foreign currency translation adjustments Taxes on earnings 798.6 (41.1) (90.2) .1 (265.9) 293.7 (16.5) (94.0) (3.8) (175.0) 213.6 (31.3) (55.8) (20.0) (93.4) Net earnings $401.5 $4.4 $13.1 Net earnings per share $3.16 $.03 $.10 Contributions by diersion in Year 10 include the effects of divestitures, restructuring and unusual charges of $339.1 million as follows: Campbell U.S.A. $121.8 million, Campbell Canada $6.6 million, Pepperidge Farm $11.0 million, International Biscuit $14.3 million, and Campbell international $185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of $343.0 million as follous: Campbell U.S.A. $183.1 million, Campbell Canada $6.0 million, Pepperidge Farm $7.1 million, International Biscuit $9.5 million, and Campbell International $1373 million Consolidated Statements of Earnings (millions) Year 11 Year 10 Year 9 13 NET SALES $6,204.1 $6,205.8 $5,672.1 17 Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses 16 Administrative expenses Research and development expenses 18 Interest expense (Note 3) 19 Interest income Foreign exchange losses, net (Note 4) 21 Other expense (Note 5) 22 Divestitures, restructuring and unusual charges (Note 6) 4,095.5 956.2 306.7 56.3 116.2 (26.0) .8 26.2 4,258,2 980,5 290.7 53.7 111.6 (17.6) 3.3 14.7 339.1 4,001.6 818.8 252.1 47.7 94.1 (38.3) 19.3 32.4 20 343.0 22A Total costs and expenses $5,531.9 $6,034.2 $5,570.7 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests $ 672.2 2.4 (7.2) $ 171.6 13.5 (5.7) $ 101.4 10.4 (5.3) 179.4 106.5 26 Earnings before taxes 27 Taxes on earnings (Note 9) 667.4 265.9 175.0 93.4 28 Net earnings $ 401.5 $ 4.4 $ 13.1 29 Net earnings per share (Note 22) $ 3.16 $ 03 10 30 Weighted average shares outstanding 127.0 129.6 129.3 CONSOLIDATED BALANCE SHEETS (million dollars) July 28, Year 11 July 29, Year 10 31 32 33 34 35 36 Current Assets Cash and cash equivalents (Note 12) Other temporary investments, at cost which approximates market Accounts receivable (Note 13) Inventories (Note 14) Prepaid expenses (Note 15) Total current assets $178.9 12.8 527.4 706.7 92.7 $80.7 22.5 6245 819.8 118.0 1,518.5 1,665.5 37 Plant assets, net of depreciation (Note 16) 38 Intangible assets, met of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 Total assets $4,149.0 $4,115.6 40 42 43 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 $2023 525.2 491.9 323 46.4 45 1,278.0 1,298.1 46 Long-term debt (Note 19) 772.6 805.8 47 Other liabilities, principally deferred income taxes (Note 21) 305.0 319.9 48 49 50 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares, none issued Capital stock, $.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 20.3 Capital surplus 107.3 51 Earnings retained in the business 1,912.6 52 Capital stock in treasury, 8618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost (270.4) Cumulative translation adjustments (Note 4) Total shareowners' equity 1,793.4 Total liabilities and shareowners' equity $4,149.0 20.3 61.9 1,653.3 (107.2) 63.5 1,691.8 23.6 54 55 $4,115.6 CONSOLIDATED STATEMENTS OF CASH FLOWS (million dollars) Year 11 Year 10 Year 9 56 $401.5 $4.4 $13.1 208.6 57 58 Cash Flows from Operating Activities Net earnings To reconcile net earnings to net cash provided by operating activities: Depreciation and amortization Divestitures and restructuring provisions Deferred taxes Other, net (Increase) decrease in accounts receivable (Increase) decrease in inventories Net change in other current assets and liabilities Net cash provided by operating activities 60 61 62 63 64 35.5 63.2 17.1 48.7 30.6 805.2 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 448.4 192.3 343.0 (67.8) 37.3 (46.8) (113.2) (6) 357.3 65 66 67 68 69 70 Cash Flows from Investing Activities Purchases of plant assets Sales of plant assets Businesses acquired Sales of businesses Increase in other assets Net change in other temporary investments Net cash used in investing activities (361.1) 43.2 (180.1) 67.4 (57.8) 9.7 (387.6) 34.9 (41.6) 21.7 (186) 3.7 (387.5) (284.1) 39.8 (135.8) 4.9 (107.0) 9.0 (473.2) 71 (478.7) Cash Flows from Financing Activities T Cash Flows from Financing Activities 72 Long-term borrowings 173 Repayments of long-term borrowings 174 Increase (decrease) in borrowings with less than three month maturities Other short-term borrowings Repayments of other short-term borrowings 77 Dividends paid Treasury stock purchases Treasury stock issued Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) (101.8) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 78 79 80 (219.6) 163.1 (8.7) .7 (12.1) 98.2 80.7 (40.2) 120.9 35.1 85.8 $178.9 $80.7 $120.9 CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY (million dollars) Preferred Stock Capital Stock $20.3 Earnings Retained Capital in the Surplus Business $423 $1,879.1 Capital Stock Cumulative in Translation Treasuryl Adjustments S(75.2) $28.5 Total Shareowners Equity $1,895.0 13.1 13.1 (116.4) (8.1) (116.4) (8.1) 8.5 12.6 (26.4) 2.1 21.1 (26.4) 1,778.3 4.4 20.3 50.8 1,775.8 4.4 (707) (126.9) (41.1) (126.9) (41.1) 86 Balance at July 31, Year 8 Net earnings Cash dividends ($.90 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments 87 Balance at July 30, Year 9 Net earnings Cash dividends ($.98 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments Balance at July 29, Year 10 88 Net earnings 89 Cash dividends ($1.12 per share) 90 Treasury stock purchased 91 Treasury stock issued under Management Incentive and Stock option plans 92 Translation adjustments 93 Sale of foreign operations 94 Balance at July 28, Year 11 11.1 4.6 61.4 63.5 15.7 61.4 1,691.8 401.5 20.3 61.9 1,653.3 401.5 (1072) (142.2) (175.6) (142.2) (175.6) 45.4 12.4 (29.9) (10.0) $23.6 57.8 (29.9) (10.0) $1,793.4 $20.3 $107.3 $1,912.6 $(270.4) 95 Changes in Number of Shares (thousands of shares) Issued 135,622.7 135,622.7 Balance at July 31, Year 8 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 30, Year 9 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 29, Year 10 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance of July 28, Year 11 Out standing 129,038.6 (250.6) 790.6 129,578.6 (833.0) 523.4 129,269.0 (3,395.4) 1,130.2 127,003.8 In Treasury 6,584.1 2506 (790.6) 6,044,1 833.0 (523.4) 6,353.7 3,395.4 (1,130.2) 8,618.9 135,622.7 135,622.7 96 Summary of Significant Accounting Policies Page A56 Consolidation. The consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries. Significant intercompany transactions are eliminated in consolidation. Investments in affiliated owned 20% or more are accounted for by the equity method Inventories. Substantially all domestic inventories are priced at the lower of cost or market, with cost determined by the last-in, first-out (LIFO) method. Other inventories are priced at the lower of average cost or market. Intangibles. The excess of cost of investments over net assets of purchased companies is amortized on a straight-line basis over periods not exceeding forty years. Plant Assets. Alterations and major overhauls which substantially extend the lives of properties or materially increase their capacity are capitalized. The amounts for property disposals are removed from plant asset and accumulated depreciation accounts and any resultant gain or loss is included in earnings. Ordinary repairs and maintenance are charged to operating costs. Depreciation. Depreciation provided in costs and expenses is on the straight-line method. The United States, Canadian and certain other foreign companies use accelerated methods of depreciation for income tax purposes. Pension Plans. Pension costs are accrued over employees' careers based on plan benefit formulas. Cash and Cash Equivalents. All highly liquid debt instruments purchased with a maturity of three months or less are classified as Cash Equivalents. Financial Instruments. In managing interest rate exposure, the Company at times enters into interest rate swap agreements. When interest rates change, the difference to be paid or received is accrued and recognized as interest expense over the life of the agreement. In order to hedge foreign currency exposures on firm commitments, the Company at times enters into forward foreign exchange contracts. Gains and losses resulting from these instruments are recognized in the same period as the underlying hedged transaction. The Company also at times enters into foreign currency swap agreements which are effective as hedges of net investments in foreign subsidiaries. Realized and unrealized gains and losses on these currency swaps are recognized in the Cumulative Translation Adjustments account in Shareowners. Equity. 97 Geographic Area Information The Company is predominantly engaged in the prepared convenience foods industry. The following presents information about operations in different geographic areas: Year ul Year 10 Year Net sales United States $4,495.6 $4,5272 $4,233.4 Europe 1,149.1 1,101.4 983.7 Other foreign countries 656.0 6736 5429 Adjustment and elimination (966) (96.4) (87.9) Consolidated $6,204.1 S6,205.8 $5,672.1 Earnings (loss) before taxes United States $694.8 $427.8 $294.5